What Is the Market Approach and How Is It Utilized for Auto Dealer Valuations?

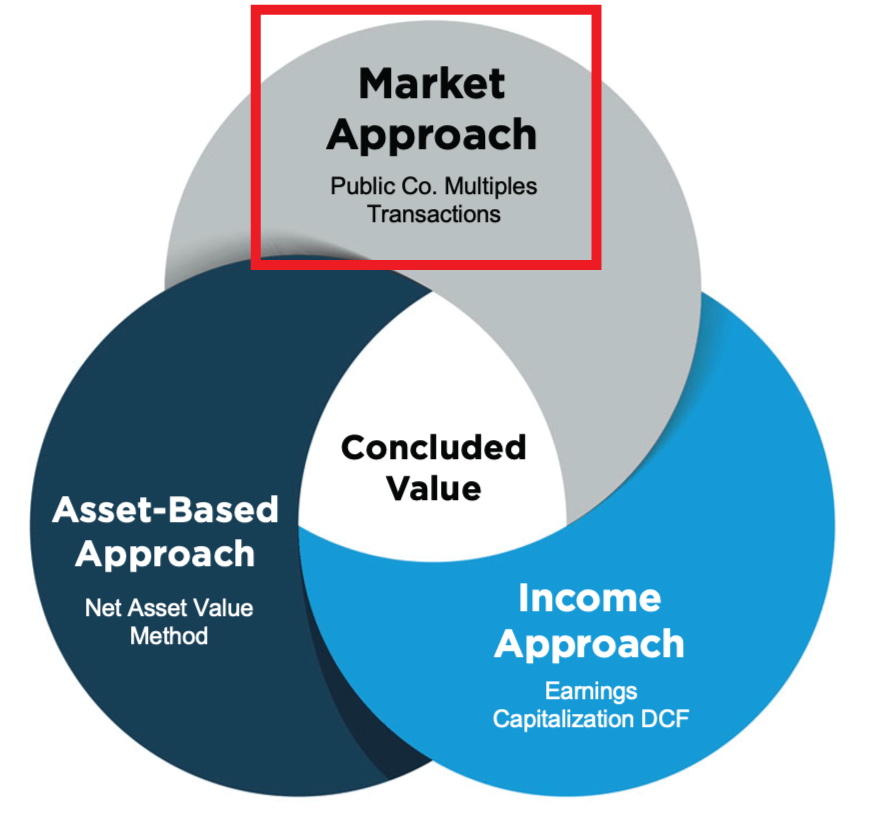

A thoughtful business valuation of an auto dealership will likely rely on multiple approaches to derive an indication of value. While each approach should be considered, the approach(es) ultimately relied upon will depend on the unique facts and circumstances of the dealership and its operating conditions. We recently focused on the asset approach and the income approach for valuing auto dealerships. This post presents a broad overview of the market approach, the last of the three approaches considered in all business valuations.

The market approach enables analysts to determine a value indication by comparing the subject auto dealership to other similar dealerships. These comparable dealerships could be similar in size, geographic location, or, most importantly, franchise. For example, a Toyota dealership in Missouri should be very comparable to other Toyota dealerships in the Midwest but less comparable to Ford dealers in Texas.

For a business valuation of any type of company, there are three primary valuation methods under the market approach:

Guideline Public Company Method

The Guideline Public Company Method considers valuation multiples from comparable public companies in the subject company’s industry. For auto dealers specifically, there are six publicly traded franchised auto dealers in the United States (not including used-only companies like Carvana). These large, public players may be in the same industry as a single, private dealership. However, the six public auto dealers are diversified over many franchises and a large geographic area. Due to these differences, the Guideline Public Company method is rarely used to value standalone auto dealerships. This method is more relevant to larger private auto groups that may at least have brand diversification, even if they are concentrated in one metro area.

Guideline Transactions Method

The Guideline Transactions Method considers valuation multiples from other privately held companies in which interests are bought and sold. For auto dealerships, data on private transactions from traditional sources exists, but there is generally not a large enough sample size of the subject dealership’s particular franchise to provide meaningful comparisons. Later, we will discuss Blue Sky multiples, an industry-specific version of this method.

Transactions in the Stock of the Subject Company

Transactions in the Stock of the Subject Company is the final method under the market approach. An important requirement for applying the transactions method is that the transaction was “arm’s length,” meaning that it took place between independent parties acting in their own self-interests. Transfers among family members or grants to employees are not necessarily representative of fair market value as there may be other motivations, such as gifting or pseudo compensation. Timing is also important. How much time has passed since the transaction? In what condition is the business and industry at the valuation date relative to the time of said transaction?

So, how does a valuation expert typically value a standalone auto dealership under the market approach? The answer is a hybrid method utilizing published Blue Sky multiples from transactions of various franchise dealership locations and the subject dealership’s most appropriate earnings indication. Two primary national sources, Haig Partners and Kerrigan Advisors, publish Blue Sky multiples quarterly by franchise.

Blue Sky Multiples and the Market Approach

The auto dealership industry as a whole communicates value in terms of Blue Sky values and Blue Sky multiples. Blue Sky is any intangible/goodwill value of the auto dealership above the book value of its tangible assets. Typically, Blue Sky value is measured as a multiple of pre-tax earnings, referred to as a Blue Sky multiple. Blue Sky multiples vary by franchise/brand and fluctuate year to year. Furthermore, Blue Sky multiples are typically expressed as a range, recognizing that dealerships within the same brand can have differing circumstances that can result in a higher or lower Blue Sky multiple.

In practice, the Blue Sky method uses the subject dealership’s most appropriate pre-tax earnings indication, whether that be the latest twelve months’ pre-tax earnings or a weighted average of multiple periods’ pre-tax earnings, to determine value. Once the valuation expert determines this indication of pre-tax income through discussions with management and analysis of historical data, the published range of Blue Sky multiples is considered, and an appropriate multiple is applied to the earnings indication, which results in a range of values for a dealership. For example, if the Blue Sky range for a dealership is 4.0x – 5.0x pre-tax earnings, a dealership with $1 million in pre-tax income might be worth $4 million or could be closer to $5 million depending on different facts and circumstances.

Whether a dealership is at the top of the Blue Sky range or the bottom (or above or below) is typically determined using qualitative factors. Some of the factors that we consider are listed below:

- Financial Performance Dealerships underperforming their peers may perversely receive higher multiples on historical earnings as buyers anticipate an ability to increase earnings. Conversely, outperforming dealerships can receive lower multiples as a buyer may anticipate mean regression.

- Competition Dealerships in “over-dealered” markets (numerous dealerships carrying the same brand in one geographical market) tend to be less desirable. In markets where it is likely another dealership would be added as competition also reduces the desirability of the dealership. It is important not to double count this risk, as certain brands with significantly larger dealer networks already effectively price in this intra-brand competition in their published multiples.

- Geographical Market Dealerships located in high-growth and/or metro markets tend to be more desirable, and buyers typically are willing to pay more for such dealerships.

- Taxes Blue Sky multiples are applied to pre-tax earnings. Dealerships in high-tax states are viewed as less desirable, as pre-tax earnings result in lower net income levels in such states.

- Real Estate Dealerships with high real estate costs tend to be less desirable. There also may be uncertainties related to the transferability of dealerships whose real estate is not compliant with current factory specifications.

- Brand Fit in Market Certain brands are more aligned with their geographic market. For example, in rural areas where trucks are sold more than cars, brands with appropriate light-truck offerings would benefit.

Conclusion

A competent valuation expert is needed to thoroughly review a company’s dealer financial statements, assess the necessary adjustments to reflect the appropriate level of ongoing pre-tax earnings, determine which end of the Blue Sky range is most appropriate, and determine if the approach best represents the value of the business at hand. Mercer Capital has extensive experience performing this type of analysis and is qualified and ready to perform any auto dealer valuations for a variety of purposes.

Auto Dealer Valuation Insights

Auto Dealer Valuation Insights