Twitter (X Holdings I, Inc.) Solvency

Exploring the issuance of a solvency opinion for the October 2022 acquisition of Twitter, Inc. by Elon Musk’s X Holdings I, Inc.

This short presentation is intended to discuss the concept of corporate solvency, solvency opinions and provide perspective on what issues a solvency opinion might address regarding the October 27, 2022, acquisition of Twitter, Inc. (“Twitter”) by Elon Musk’s X Holding I, Inc. (“XHI”). Since then, the entities have been renamed X Holdings Corp., which in turn wholly owns X Corp. that operates “X” previously known as Twitter.

In addition, the presentation makes observations about the financial performance of Twitter and the financing structure employed by XHI.

This Interest Rate Environment Done Got Old

One of BankWatch’s favorite blues artists is Junior Kimbrough. In “Done Got Old,” Junior sings:

Well, I done got old

Well, I done got old

I cain’t do the thangs I used to do1

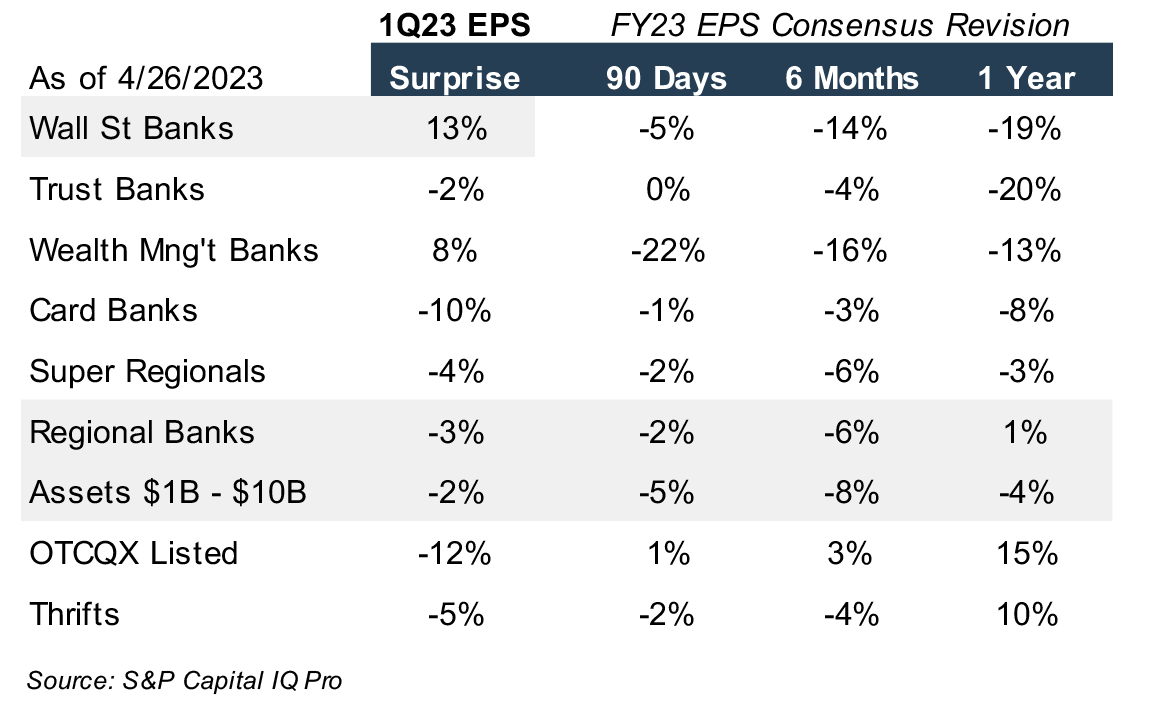

You could say the same about this interest rate environment. Earlier in 2023, markets were expecting Fed rate cuts by late 2023; alas, this expectation missed the mark. Now though, as a higher-for-longer rate environment descends on the industry, perhaps banks cain’t do the thangs they used to do in a lower rate environment.

We had the good fortune to speak at Bank Director’s Bank Board Training Forum in Nashville earlier in September. Our presentation, Valuation Issues Post-SVB, focused on issues emerging from a higher-for-longer environment. Right on cue, the Wall Street Journal published an article entitled, “Higher Interest Rates Not Just for Longer, but Maybe Forever” arguing that the “neutral” interest rate that balances inflation and unemployment has risen.2

This article covers some implications of a higher-for-longer rate environment included in our conference presentation:

- Funding Costs and Net Interest Margins

- Growth & Capital Planning

- Securities Portfolio Management

- Credit Quality Risks

- Mergers & Acquisitions Impact

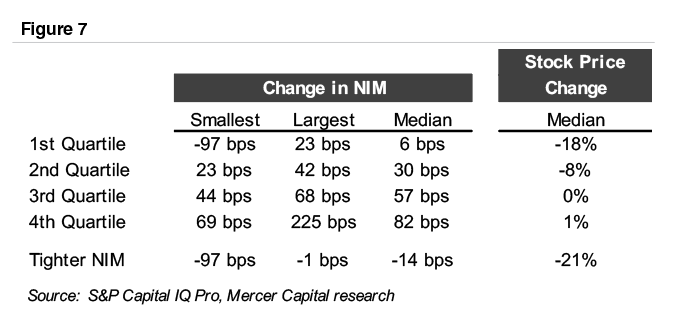

Funding Costs & Net Interest Margins

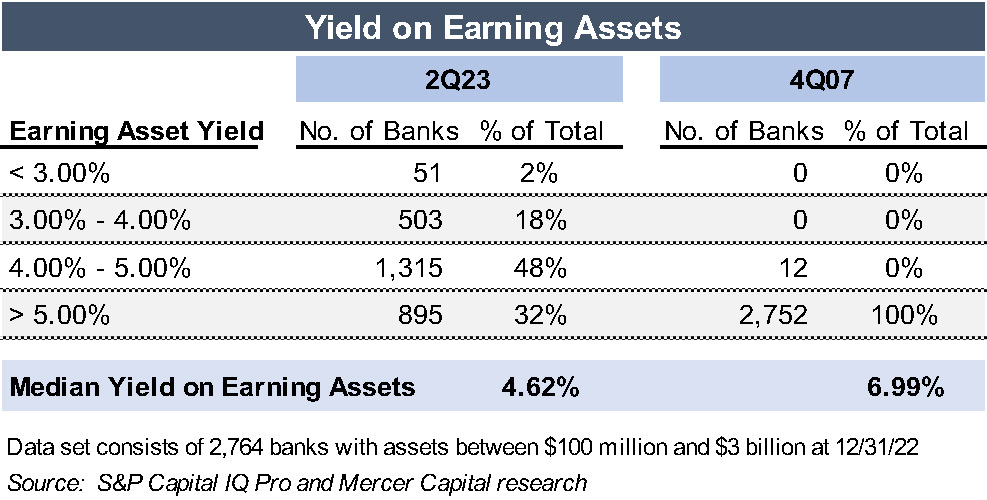

For many banks, a higher-for-longer rate environment is quite favorable, though sometimes media reports dwell on banks squeezed by rising rates. Figure 1 compares net interest margins between the first quarter of 2022 and the second quarter of 2023. We included the first quarter of 2022 as the impact of rising rates was minimal, PPP fee income had largely been recognized in prior quarters, and balance sheet composition reflected the changes that occurred during the pandemic. Our research indicates that 68% of the 2,764 banks included in the analysis reported a wider net interest margin in the second quarter of 2023. Many banks, in fact, face greater exposure to a long-term low rate environment than the current rate environment.

Figure 1

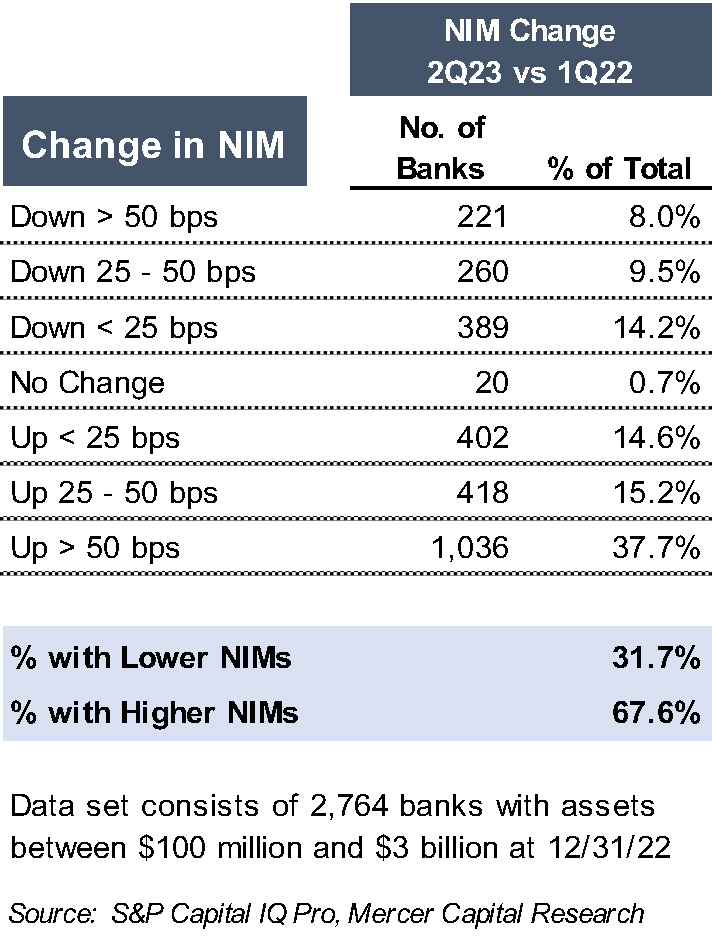

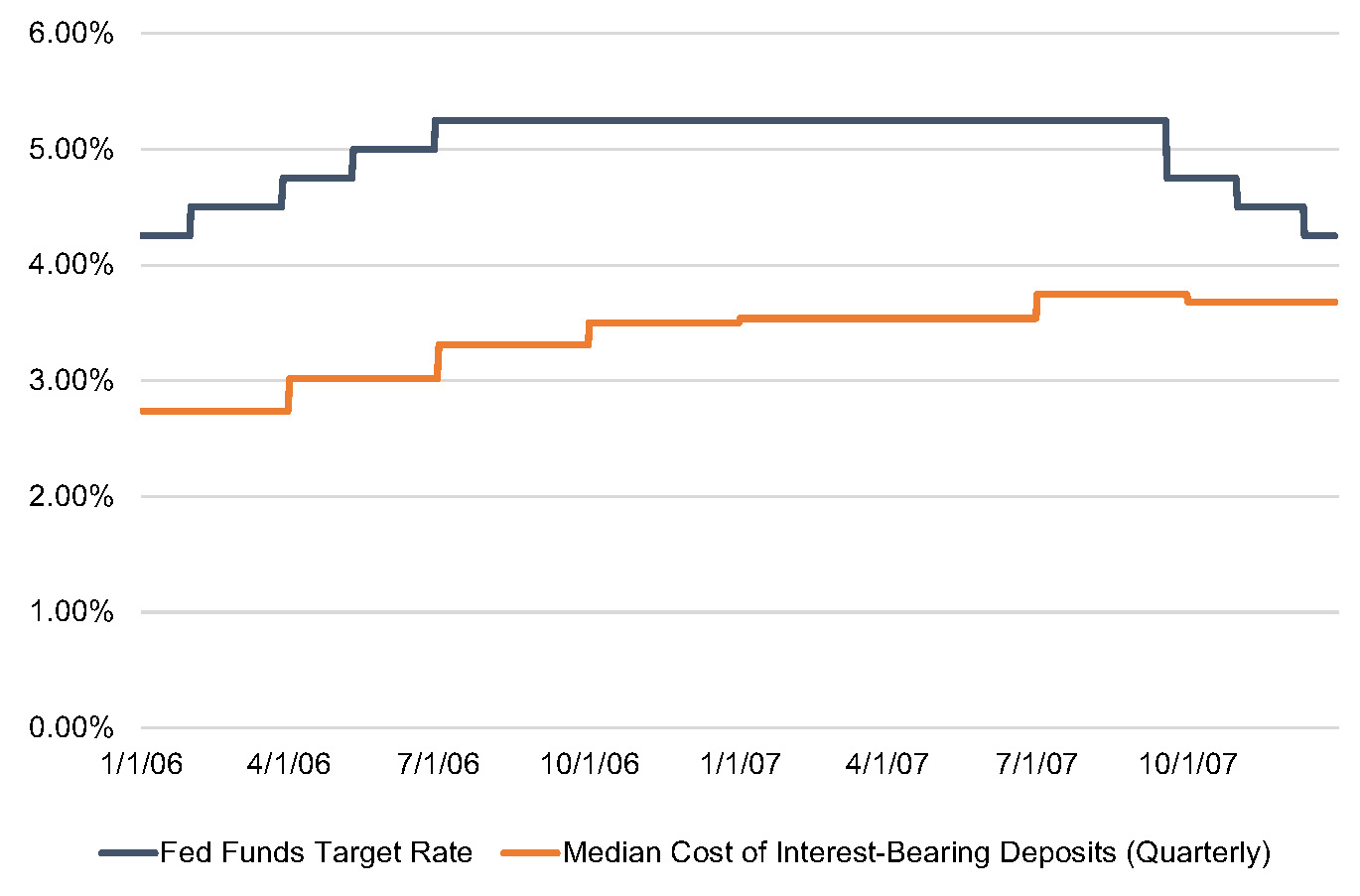

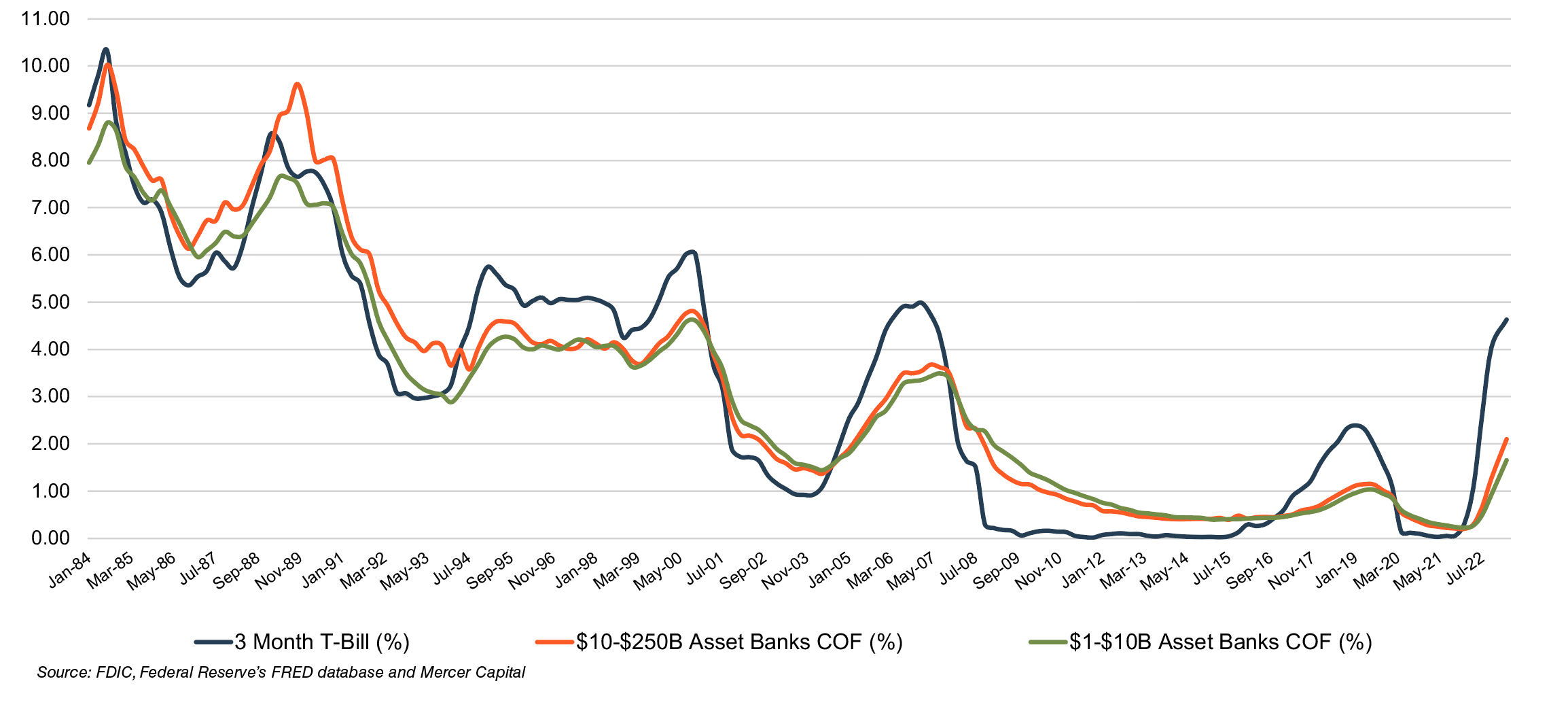

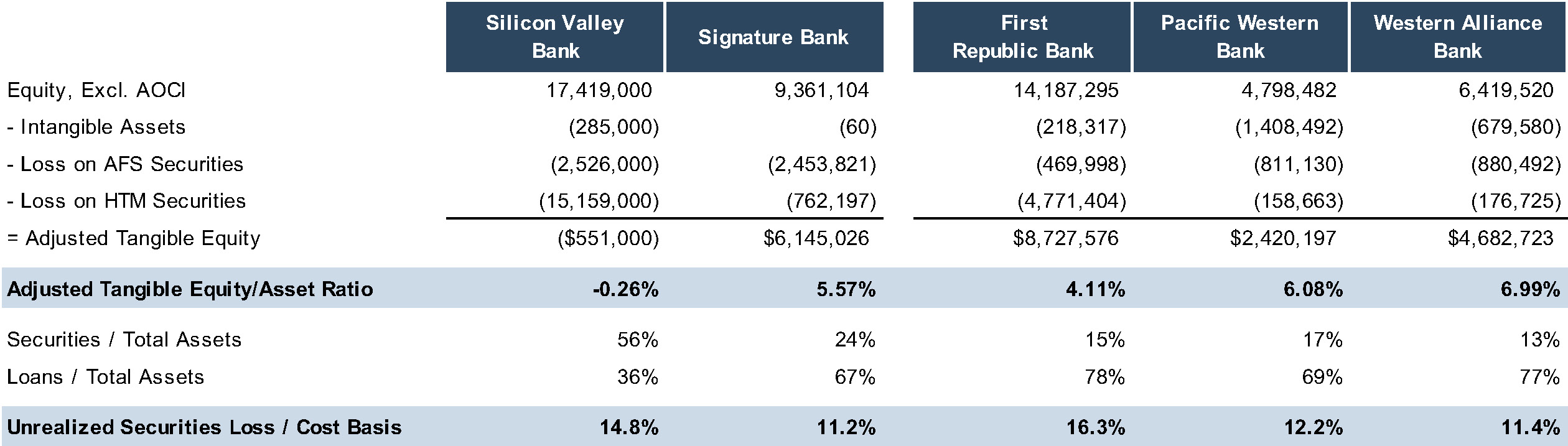

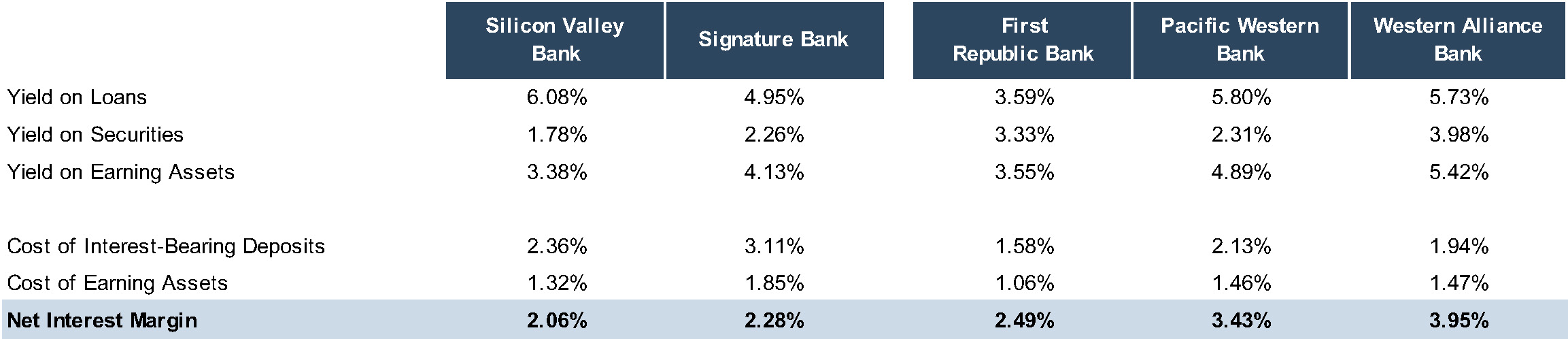

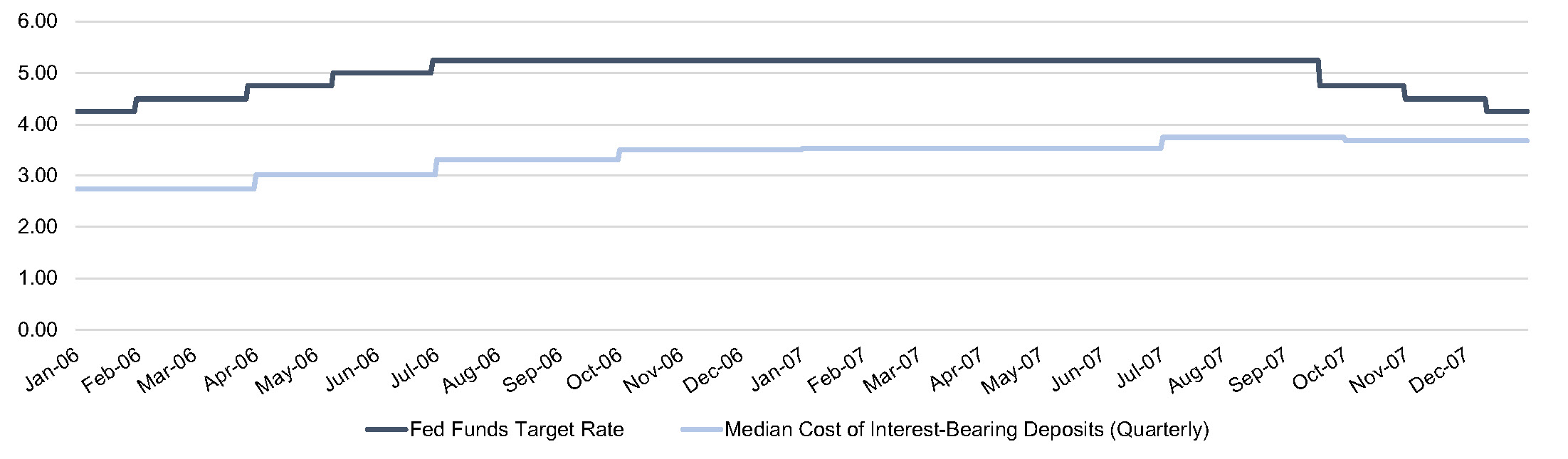

The most recent period in which the Fed Funds target rate exceeded 5% occurred from 2006 to 2007. As shown in Figure 2, the median cost of interest-bearing deposits for the same group of banks included in Figure 1 reached 3.75% in the third quarter of 2007. For the second quarter of 2023, however, this group’s cost of interest-bearing deposits was only 1.59% (see Figure 3).

Figure 2 :: 2006-2007 Cycle

Figure 3 :: 2022-2023

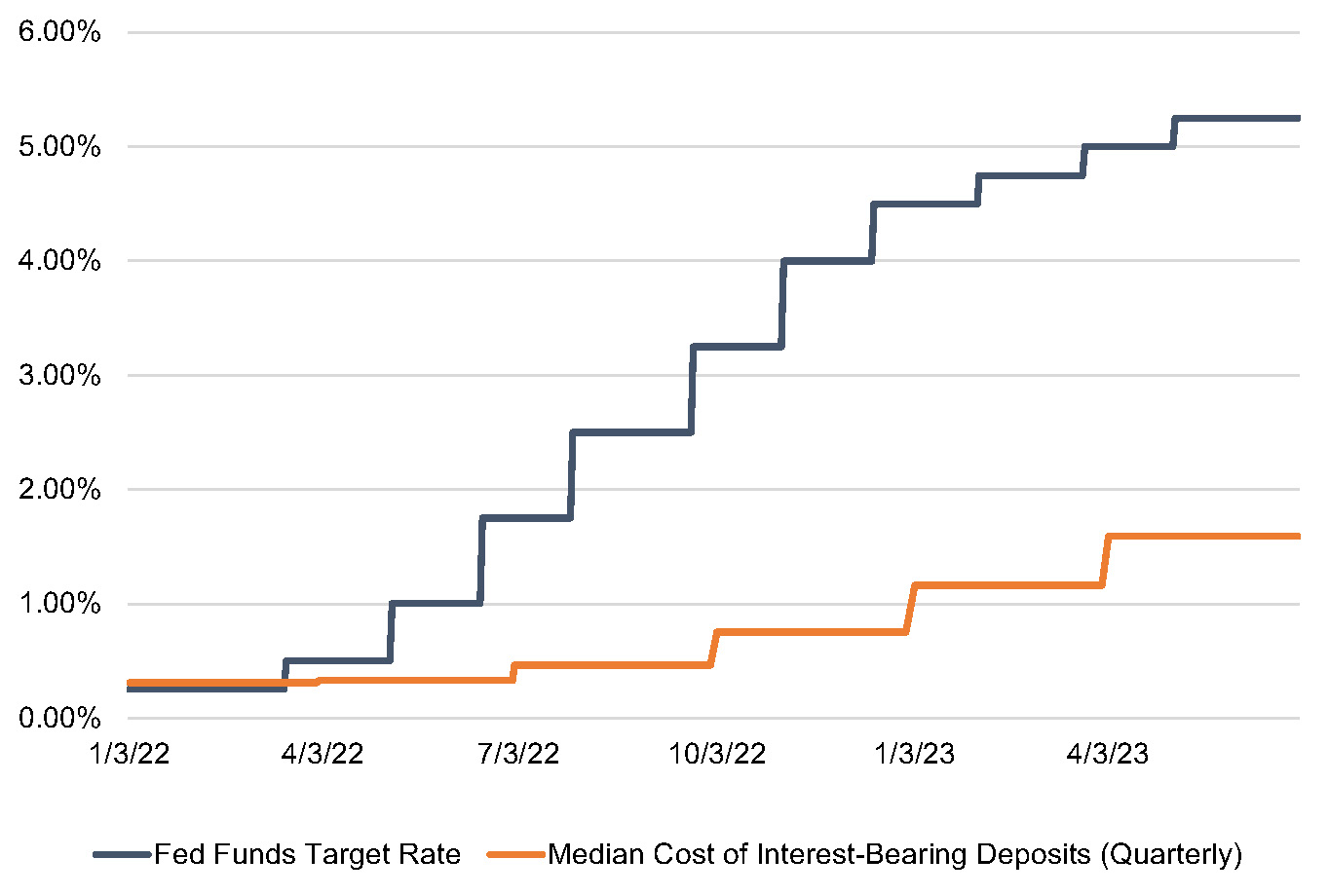

Deposit rates presumably will grind higher, and an extrapolation of recent deposit cost changes suggests that the median cost of interest-bearing deposits will reach 2.00% to 2.50% from 1.59% in the second quarter of 2023. Nevertheless, deposits cost for most banks likely will remain well below the level reported in 2006 and 2007. This is desirable for several reasons, but most importantly because earning asset yields are well below the level reported in 2006 and 2007. In the fourth quarter of 2007, the median yield on earning assets was 6.99%, which is 237 basis points higher than in the second quarter of 2023 (per Figure 4).

From an investment standpoint, current conditions somewhat mirror the late 1970s when most thrifts and some banks were caught with long(er) duration assets as funding costs rose. We believe the “asset duration issue” has weighed on bank stocks this year though institutional investors’ focus may now be shifting to credit risks.

Figure 4

Growth & Capital Planning

During periods marked by low rates, banks’ strategic plans often were oriented around loan growth, especially during the pandemic when banks were flush with deposits. This strategic direction, in turn, often was implemented by hiring loan officers or entering new markets. In a higher-for-longer rate environment, do these strategies remain appropriate?

A loan-oriented growth strategy certainly remains defensible for those banks that still hold substantial liquidity at the Federal Reserve. For other banks, though, the question becomes more complex. To measure the profitability of loan growth, banks should use their marginal cost of funds, not their current average cost of funds. Hiring an investor commercial real estate lender may be difficult to justify when the marginal cost of funding is 5%, as every loan originated by the new lender may compress the net interest margin. Other financial or strategic motivations could support such loan growth strategies—like obtaining long-term customer relationships or locking in an attractive loan yield supported by prepayment penalties–but bank directors should be aware of the return on capital implications of more aggressive loan growth.

During a higher-for-longer rate environment, balance sheet growth will be governed mostly by a bank’s ability to obtain funding at a reasonable cost. And we know that building core deposits takes time. Given these constraints, bank directors should temper their expectations regarding balance sheet growth. Individuals possessing strong deposit customer relationships or access to specific deposit niches will become more valuable traits in new hires (or more subject to poaching by other banks).

If the return on capital from more aggressive loan growth strategies is diminished in a higher-for-longer rate environment, what should banks do with internally-generated capital?

If the bank’s stock is trading at 8x to 10x earnings, share repurchases seem attractive (subject to one’s outlook regarding the probability of credit deterioration).

A more controversial strategy would entail using some excess capital to effectuate a partial restructuring of the bond portfolio. Rather than tying up capital with loans earning a relatively low spread over marginal funding costs, a bank could exit some low yielding investments at a loss that could be replaced with investments at current market rates (or used to pay down costly borrowings).

Banks could analyze which strategy produces a better return on capital. We will explore this issue in a future article, but suffice to say as the spread over marginal funding costs for new loans declines, enhancing earnings by “investing” some capital in a bond portfolio restructuring looks financially more appealing.

Issuers of subordinated debt may wish to accumulate funds to repay these instruments when the current rate resets after five years, rather than face an interest rate hundreds of basis points higher than the current fixed rate.

Securities Portfolio Management

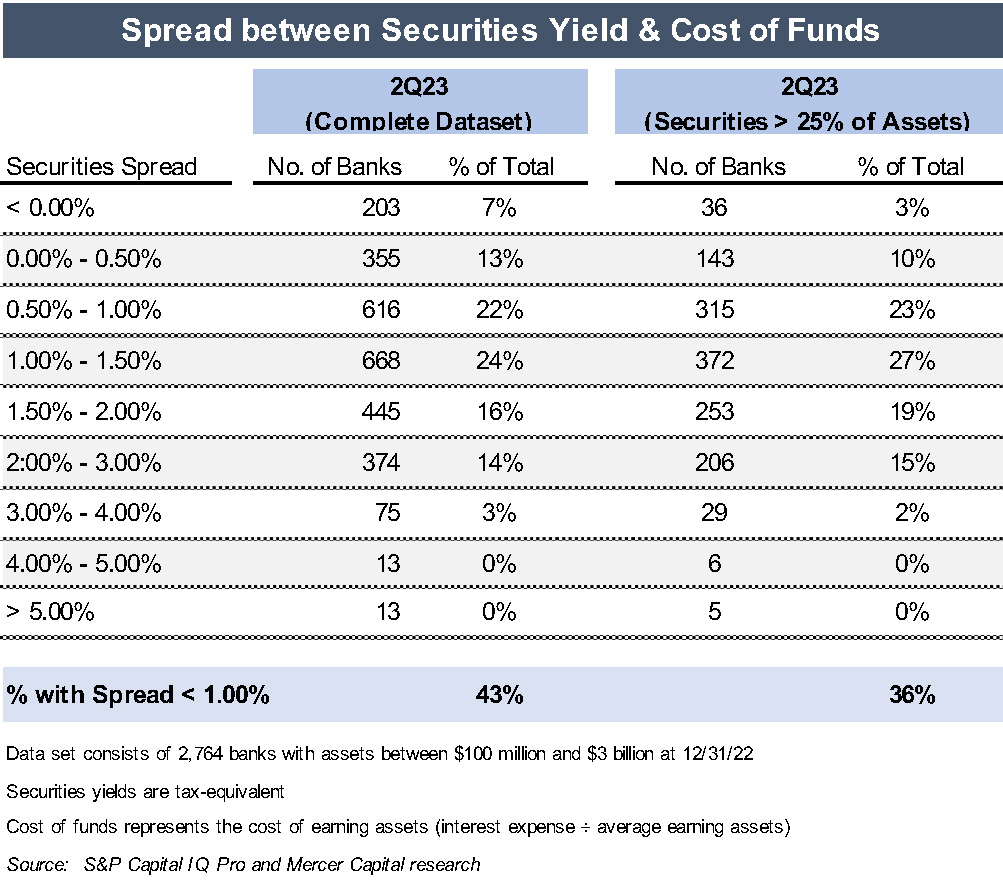

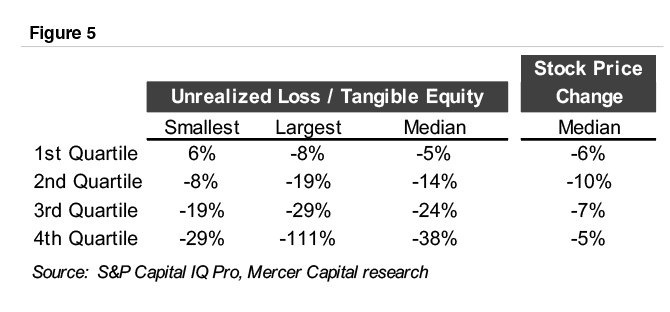

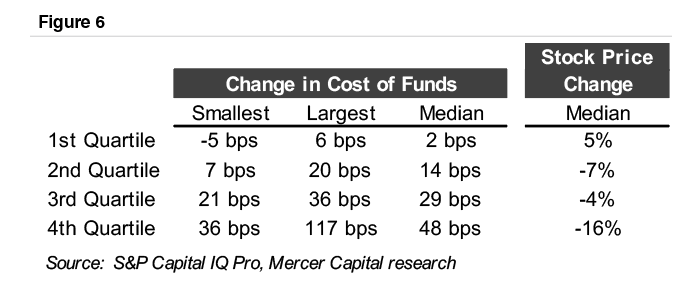

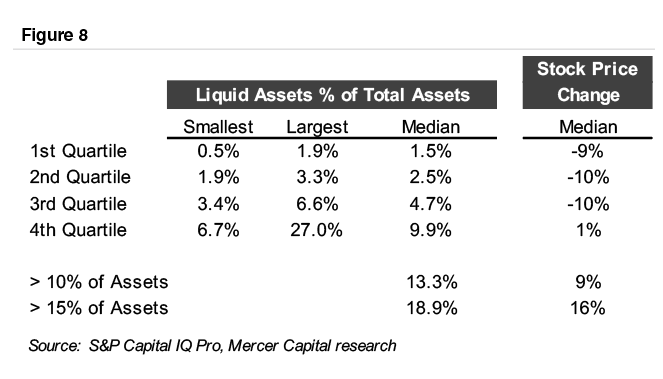

As rates linger at a higher level, more banks will experience a low or negative spread on their securities portfolios, which we measure as (a) the yield on securities minus (b) the cost of earning assets (interest expense divided by average earning assets). Figure 5 presents a stratification of banks’ securities spreads based on data for 2,764 banks with assets between $100 million and $3 billion.

The number of banks with low or negative securities portfolio spreads has steadily increased. The proportion of banks with spreads of less than 1% increased from 8% in the fourth quarter of 2019 to 36% in the fourth quarter of 2022 to 43% in the second quarter of 2023. Similarly, banks with negative spreads increased from 2% in the fourth quarter of 2019 to 3% in the fourth quarter of 2022 to 7% in the second quarter of 2023.

Figure 5

As hope diminishes that the unrealized securities losses will quickly reverse and the earnings drag from securities with low (or negative) spreads continues unabated, banks will face a reckoning. The currently unrealized losses will be recognized in one of two ways: immediately through sale of securities or over time through lower earnings. Choosing between those two options, whether consciously or not, becomes unavoidable in a higher-for-longer rate environment.

Credit Quality Risks

Credit quality has remained remarkedly strong, except for some sectors for which most community banks have limited exposure like lower credit score consumer lending and central business district office properties. Our research found that 61% of publicly traded banks with assets between $1 and $10 billion reported lower criticized loans (i.e., loans rated special mention or worse) at June 30, 2023 than at year-end 2022. Nevertheless, some issues may arise in a prolonged environment of higher rates:

- Vintage Migration. The risk of higher interest payments affecting borrower performance as repricing or maturing fixed rate loans adjust to current loan rates has been cited as a risk, albeit an unrealized one so far for most of our clients. However, a higher-for-longer rate environment means that more lower rate loans in banks’ portfolios eventually will be ensnared by higher rates. The 2020 and 2021 vintage originations, when loan rate competition was most aggressive, would be subject to the greatest payment shock upon maturity or repricing. A large portion of the 2020 and 2021 vintages will not begin repricing until at least 2024 or 2025—time will tell how these vintages perform with higher loan rates.

- Problem Asset Carrying Costs. During the Great Financial Crisis, the cost of carrying nonperforming assets—the foregone yield on nonaccrual loans or the interest cost associated with carrying other real estate owned—exacerbated loan loss provisions and OREO write-downs. The erosion of operating income as nonperforming assets increased often tipped banks into a position of needing to raise capital (or worse). However, these carrying costs occurred in a low rate environment.

In a high rate environment, these costs would be amplified. OREO of $1 million may have incurred an interest charge of $10,000 during the Great Financial Crisis; now that charge could be $50,000. Stated differently, it would require fewer nonperforming assets in the current rate environment to produce the same erosion of earning power as experienced in the Great Financial Crisis. - Cap Rates. CBRE’s quarterly commercial real estate cap rate study indicates that cap rates, while rising from 2021 levels, are not much different from levels reported between 2012 and 2019.3 This implies, of course, a tighter spread between cap rates and 10-year Treasuries. A higher-for-longer rate environment, particularly if the 10-year Treasury continues its recent rising trend, portends higher cap rates that could pressure valuations for commercial real estate properties serving as loan collateral.

- Capital Augmentation through Securities Sales. In the Great Financial Crisis, banks had a sort of “Fed put” where falling rates created gains on securities, which in turn plugged capital holes created by credit losses. That cushion protecting banks from dilutive capital raises or forced M&A transactions is unlikely to exist, even if rates decline to some extent from current levels given the low coupons on bonds purchased in 2020 and 2021.

Mergers & Acquisitions Impact

Bank M&A activity improved in August 2023, although from a low base in prior months. Several factors likely prompted this, including more visibility into the extent of deposit attrition and the trend in deposit interest rates. Additionally, the balance sheet marks that are necessary to complete a transaction are becoming more accepted by both buyers and sellers.

Beyond credit, several other considerations exist for M&A transactions in a higher-for-longer rate environment:

- Deposit due diligence. Due diligence in the past often has focused on credit risk and compliance. The current environment suggests a greater need for diligence around the deposit portfolio, such as regarding accounts with larger balances, accounts held by larger shareholders, and the volatility in balances over different periods.

A merger and the related conversion process often trigger customers to reassess long-term relationships. A buyer should assess the sensitivity of the deal valuation to deposit attrition that differs from the target’s historical norm. In low rate environments, an unexpected loss of deposits usually could be replaced by wholesale borrowings without materially affecting anticipated earnings. In a higher rate environment, though, this cushion does not exist. The unexpected attrition of low cost deposits could materially erode the target’s expected earnings contribution, given the current variance between core deposit and wholesale funding costs.

- Merging banks with divergent deposit costs, particularly if the target’s deposit costs exceed the buyer’s deposit rates. Will the market penalize the buyer for a transaction that materially increases the buyer’s cost of funds? If the buyer attempts to migrate the target’s (higher) deposit rates to the buyer’s (lower) deposit rate structure, the buyer risks losing deposits and facing the need to replace them with even costlier wholesale funds. If the buyer leaves the target’s deposit rates alone, though, will it cannibalize its own deposits? That is, will the buyer’s existing low cost deposits migrate to the higher rates offered to the target’s depositors? This risk may be easier to manage in out-of-market transactions than in-market transactions.

Conclusion

As indicated in Figure 1 at the beginning of this article, many banks continue to perform quite well in this rate environment despite occasional expressions of doom in some media reports. Hopefully, not too many banks will be singing the blues like Junior Kimbrough as this high rate environment persists.

1 Junior Kimbrough, First Recordings, Fat Possum Records, recorded in 1966 (released in 2009).

2 Ip, Greg, “Higher Interest Rates Not Just for Longer, but Maybe Forever, Wall Street Journal, September 21, 2023.

3 CBRE, U.S. Cap Rate Survey H1 2023, July 26, 2023.

Fairness Considerations in Going Private and Other Squeeze-Out Transactions

Going Private 2023 presentation by Mercer Capitals’, Jeff K. Davis, CFA, that provides an overview of issues surrounding a decision to take an SEC-registrant private.

- Pros and Cons of Going Private

- Structuring a Transaction

- Valuation Analysis

- Fairness Considerations

2023 Core Deposit Intangibles Update

Since Mercer Capital’s most recently published article on core deposit trends in September 2022, the banking industry has faced abysmal deal activity. The scarcity of transactions can largely be blamed on unfavorable deal math due to required balance sheet marks on underwater securities and loan portfolios. Compressed P/E ratios, credit quality concerns (especially for commercial real estate portfolios), regulatory headwinds, pressures on profitability, and uncertainty in the wake of several bank failures earlier in 2023, have also contributed to a quiet year from an M&A perspective. Although deal activity has been slow, we have seen an obvious uptick in core deposit intangible values relative to this time last year.

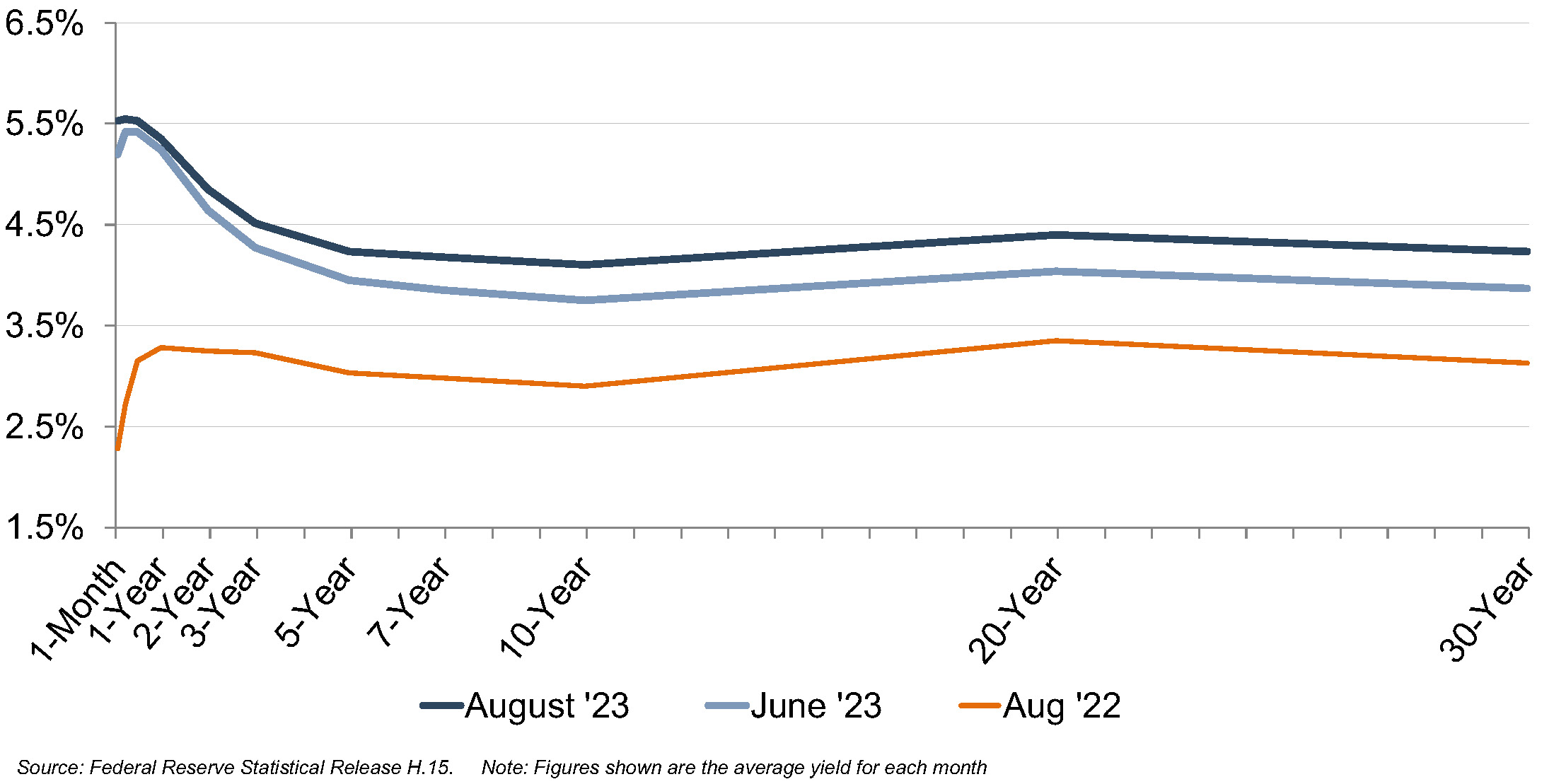

On July 26, 2023, the Federal Reserve increased the target federal funds rate by 25 basis points, capping off a collective increase of 100 basis points year-to-date and 525 basis points since March 2022. While many factors are pertinent to analyzing a deposit base, a significant driver of value is market interest rates.

Figure 1: U.S. Treasury Yield Curve

Trends In CDI Values

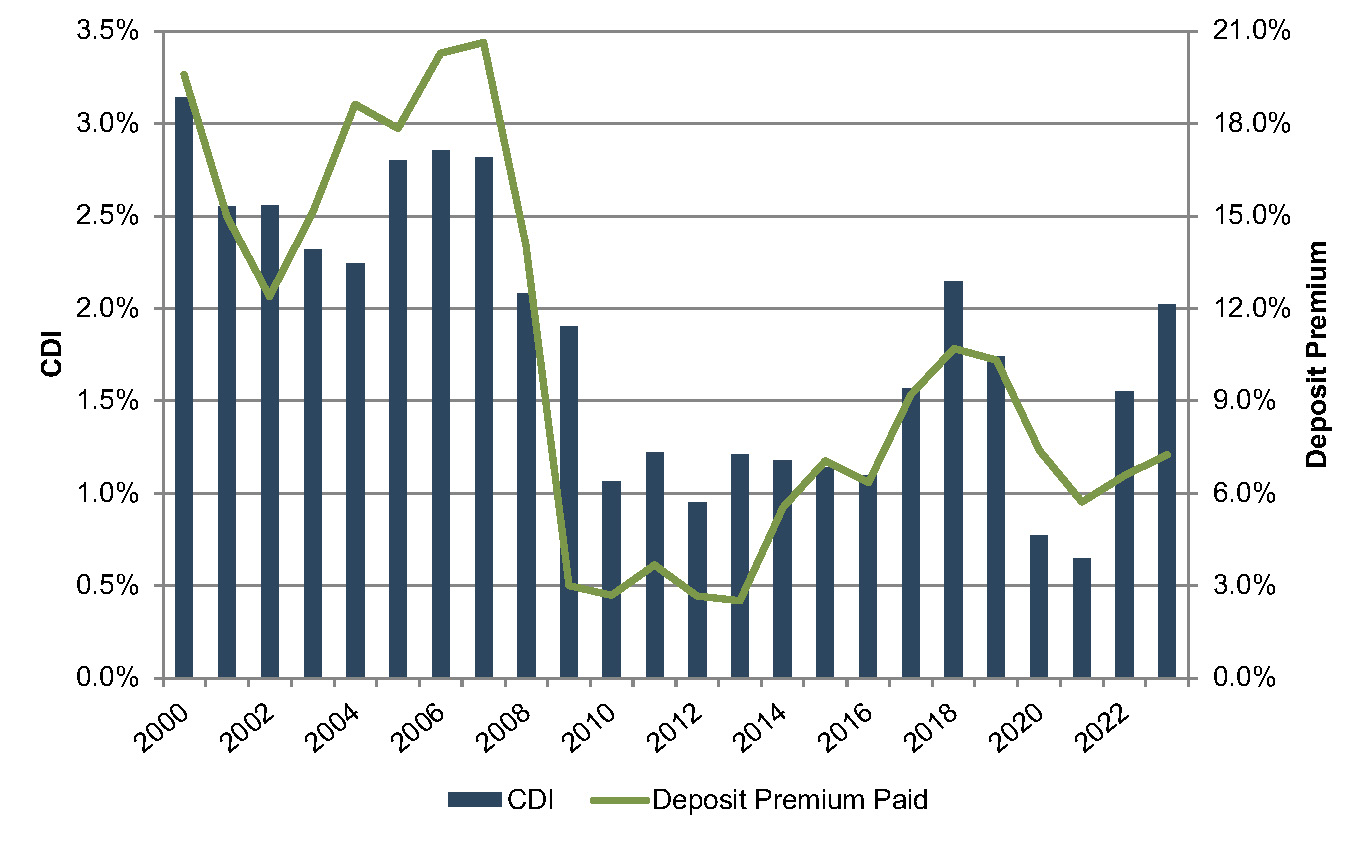

Using data compiled by S&P Capital IQ Pro, we analyzed trends in core deposit intangible (CDI) assets recorded in whole bank acquisitions completed from 2000 through mid-August 2023. CDI values represent the value of the depository customer relationships obtained in a bank acquisition. CDI values are driven by many factors, including the “stickiness” of a customer base, the types of deposit accounts assumed, the level of noninterest income generated, and the cost of the acquired deposit base compared to alternative sources of funding. For our analysis of industry trends in CDI values, we relied on S&P Capital IQ Pro’s definition of core deposits.1

In analyzing core deposit intangible assets for individual acquisitions, however, a more detailed analysis of the deposit base would consider the relative stability of various account types. In general, CDI assets derive most of their value from lower-cost demand deposit accounts, while often significantly less (if not zero) value is ascribed to more rate-sensitive time deposits and public funds. Non-retail funding sources such as listing service or brokered deposits are excluded from core deposits when determining the value of a CDI.

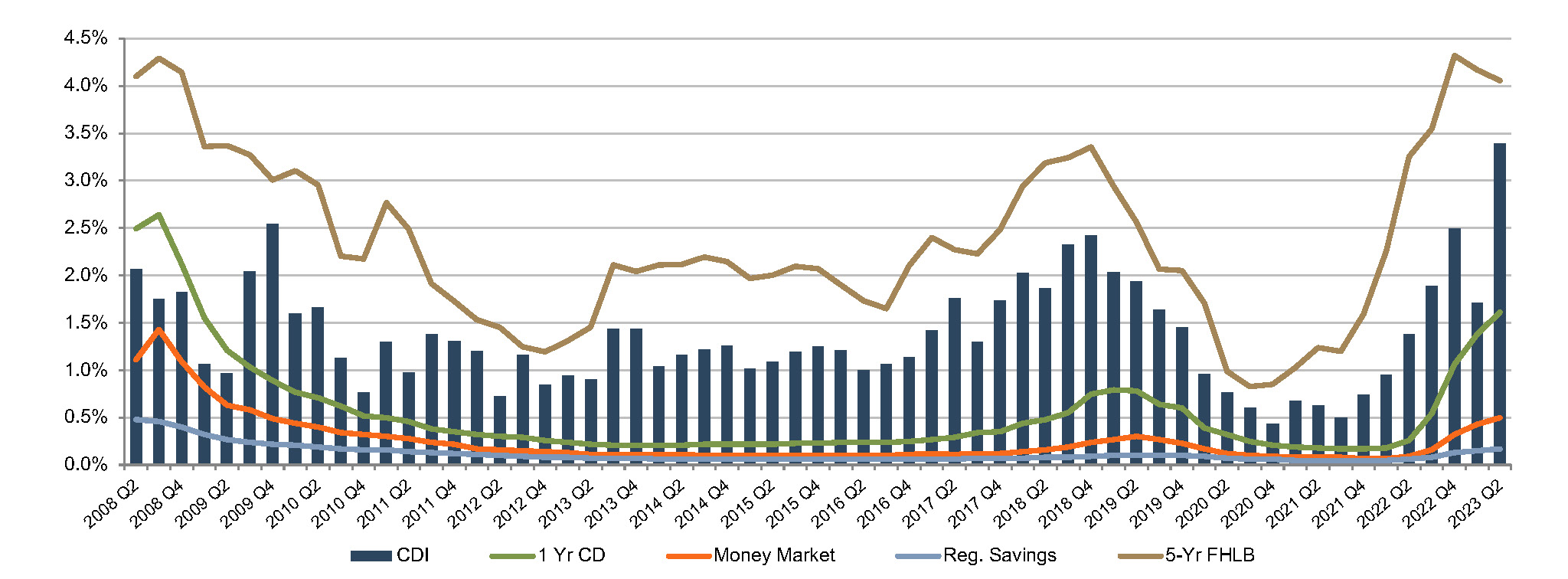

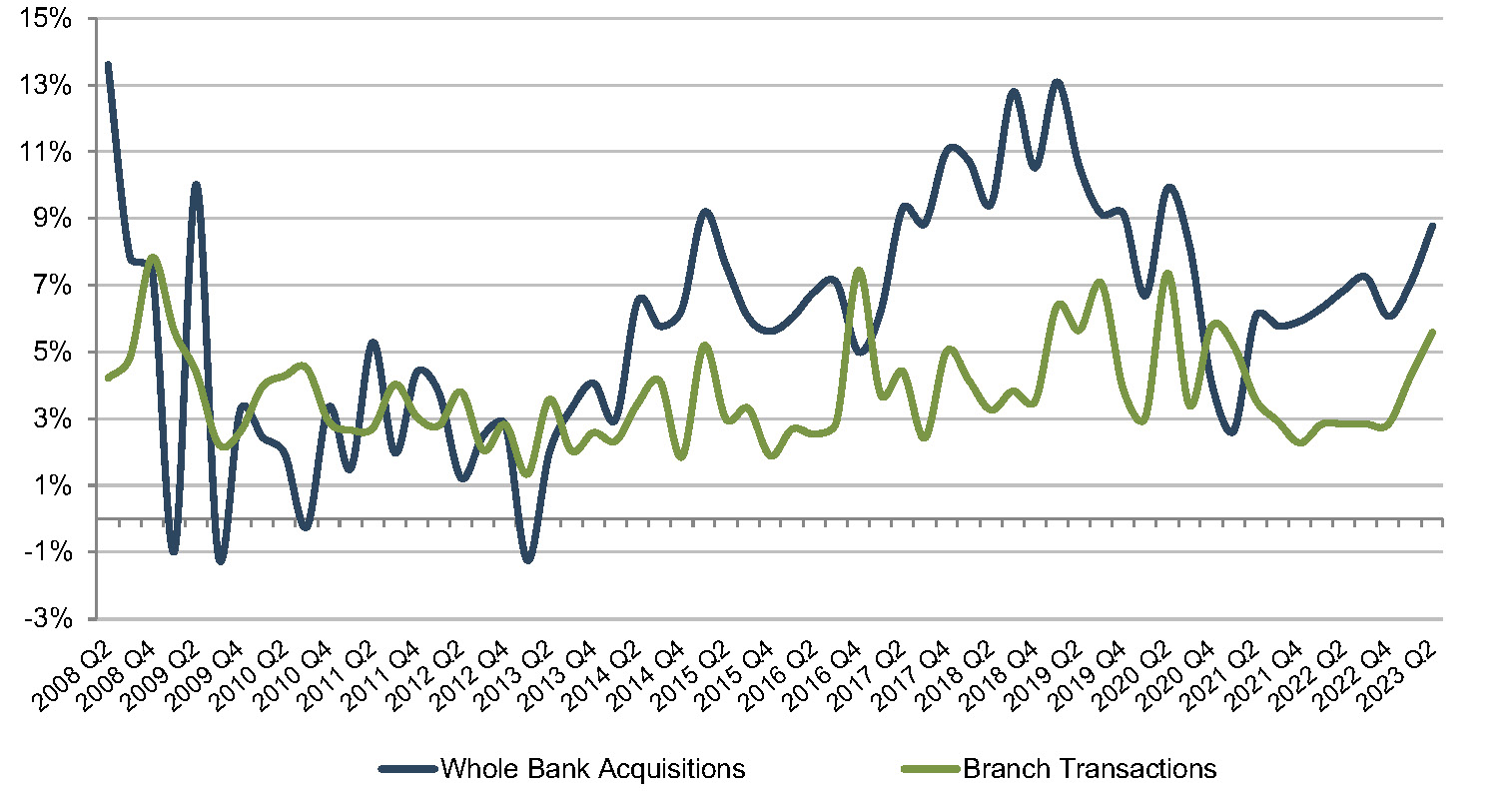

Figure 2, summarizes the trend in CDI values since the start of the 2008 recession, compared with rates on 5-year FHLB advances. Over the post-recession period, CDI values have largely followed the general trend in interest rates—as alternative funding became more costly in 2017 and 2018, CDI values generally ticked up as well, relative to post-recession average levels. Throughout 2019, CDI values exhibited a declining trend in light of yield curve inversion and Fed cuts to the target federal funds rate during the back half of 2019. This trend accelerated in March 2020 when rates were effectively cut to zero.

Figure 2: CDI as % of Acquired Core Deposits

CDI values have increased meaningfully in the past few quarters (with an average CDI value of 171 and 339 basis points for the first and second quarters of 2023, respectively). This compares to 155 basis points for all of 2022 and 64 basis points for all of 2021. Recent values are above the post-recession average of 1.39%, and on par with longer-term historical levels which averaged closer to 2.5% to 3.0% in the early 2000’s.

As shown in Figure 2, reported CDI values have followed the general trend of the increase in FHLB rates. However, the averages from 2023 should be taken with a grain of salt. The chart is provided to illustrate the general directional trend in value as opposed to being predictive of specific indications of CDI value due to the following reasons:

- The second quarter average of 3.39% represents the average of just three transactions with somewhat disparate indications of value (5.20%, 2.17%, and 2.81%). Although 24 deals were completed in the second quarter, 21 did not publicly report a core deposit intangible asset value at the time of closing.

- For all three second quarter transactions where the CDI value was reported at closing, the value was not updated from the amount estimated by the buyer at the time of the deal’s announcement. Due to the timing lag necessary for completion of independent valuation work, the estimated core deposit intangible value is based on interest rates, deposit cost of funds, and market conditions effective at the time of the announcement of the deals in the fourth quarter of 2022. Since that time, forward interest rates and cost of funds have increased.

- Even in times of more robust deal activity, CDI values should be calculated to reflect the individual characteristics of the subject deposit base as opposed to being defined by market averages.

Eleven deals were announced in July and the first half of August, and three of those deals provided either investor presentations or earnings calls containing CDI estimates. These CDI estimates ranged from 3.6% to 4.0%, which is in line with the numbers we have observed in our valuation analyses. We expect CDI values to continue rising in concert with market interest rates. However, market interest rates are not the only driver of CDI value, and there are some potentially mitigating factors to CDI values in the near term.

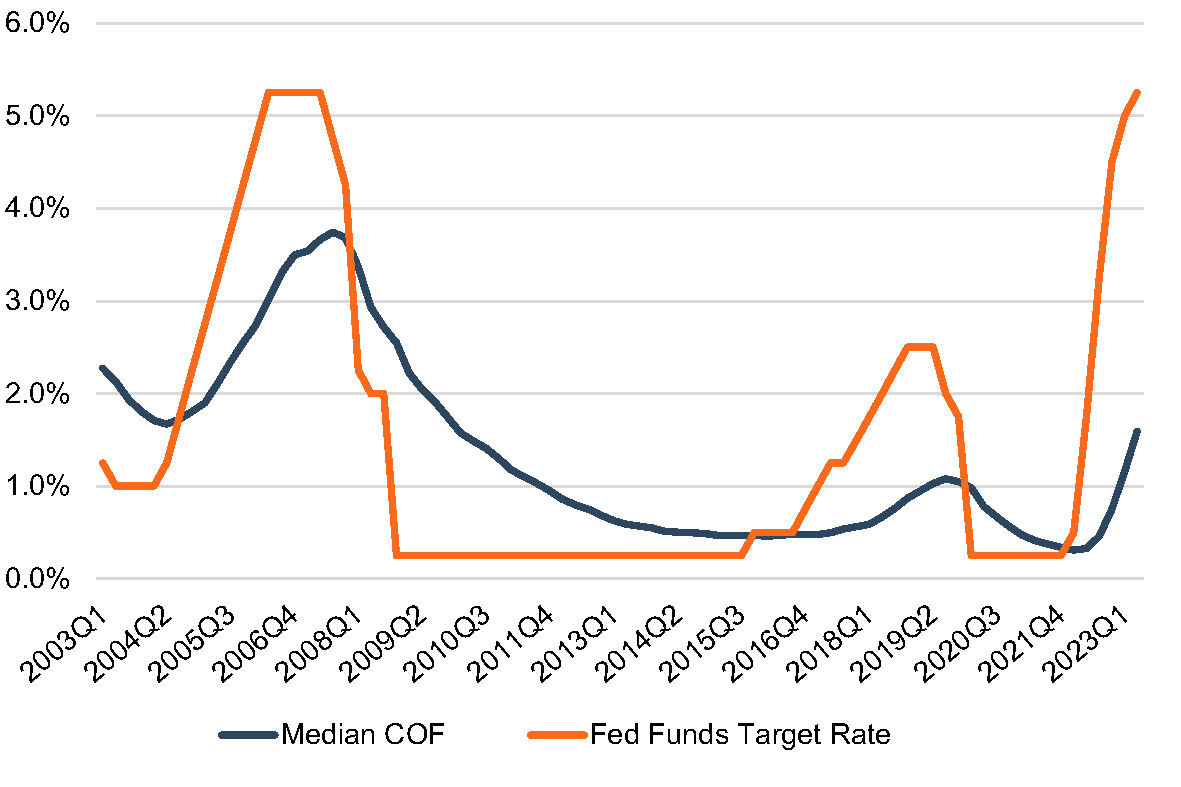

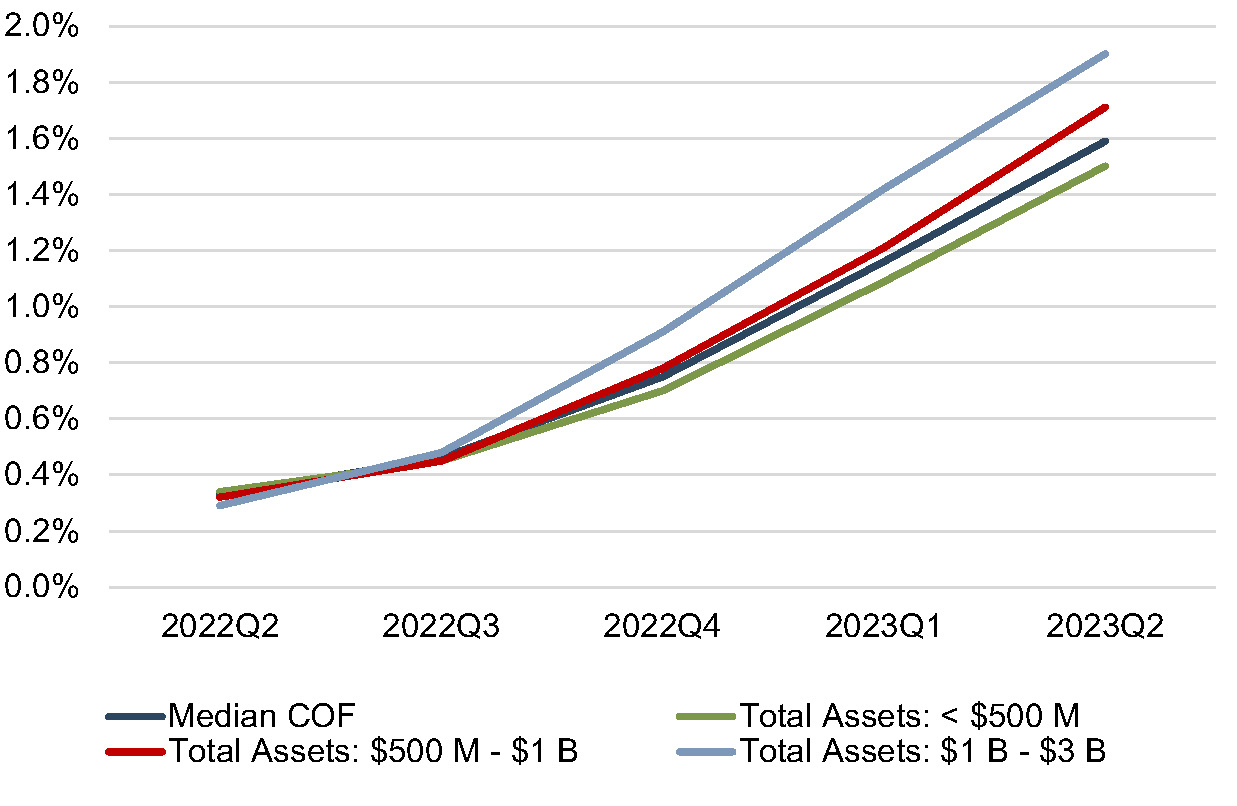

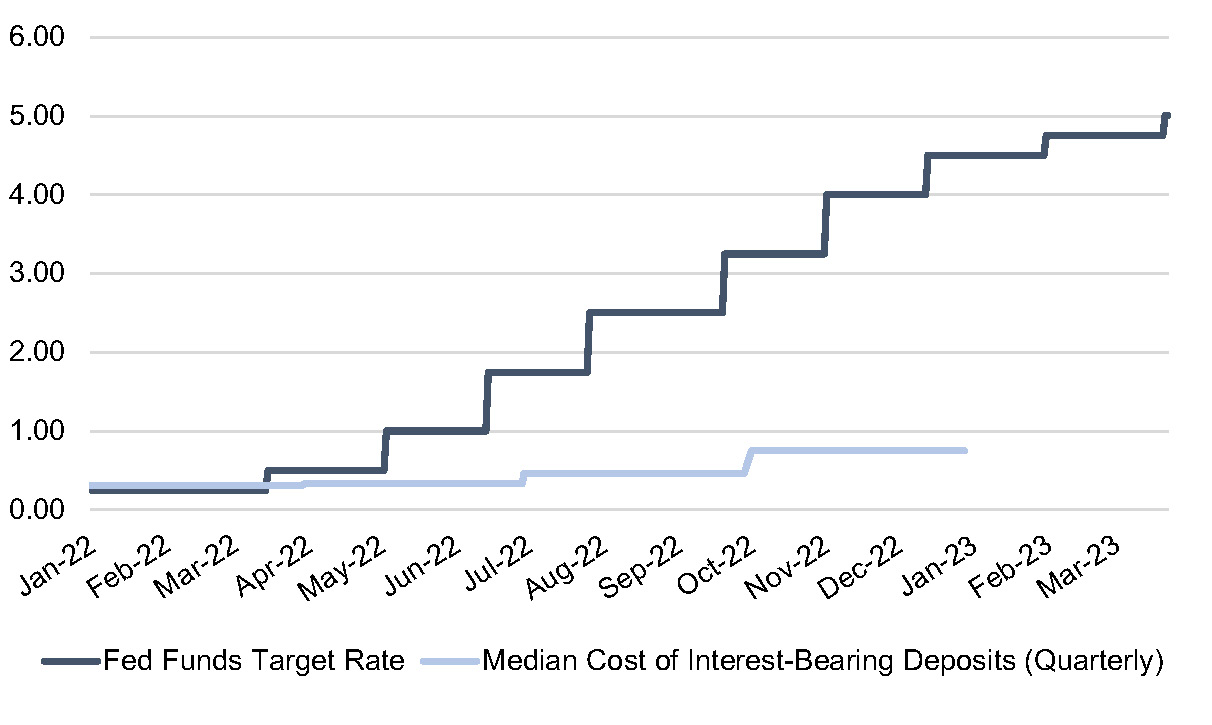

Figure 3: Median Cost of Funds as Compared to Target Federal Funds Rate

Figure 4: Cost of Funds by Asset Size – 2Q22 to 2Q23

- Rising Cost of Funds. Despite increases over the past several quarters, the median industry cost of funds remains well below the averages seen in 2006 and 2007 when the target Federal Funds rate was approximately equal to its current level (Figure 3). Rising deposit interest rates would lead to lower indications of CDI value. Larger banks have had a relatively higher deposit interest rate beta, as evidenced by Figure 4.

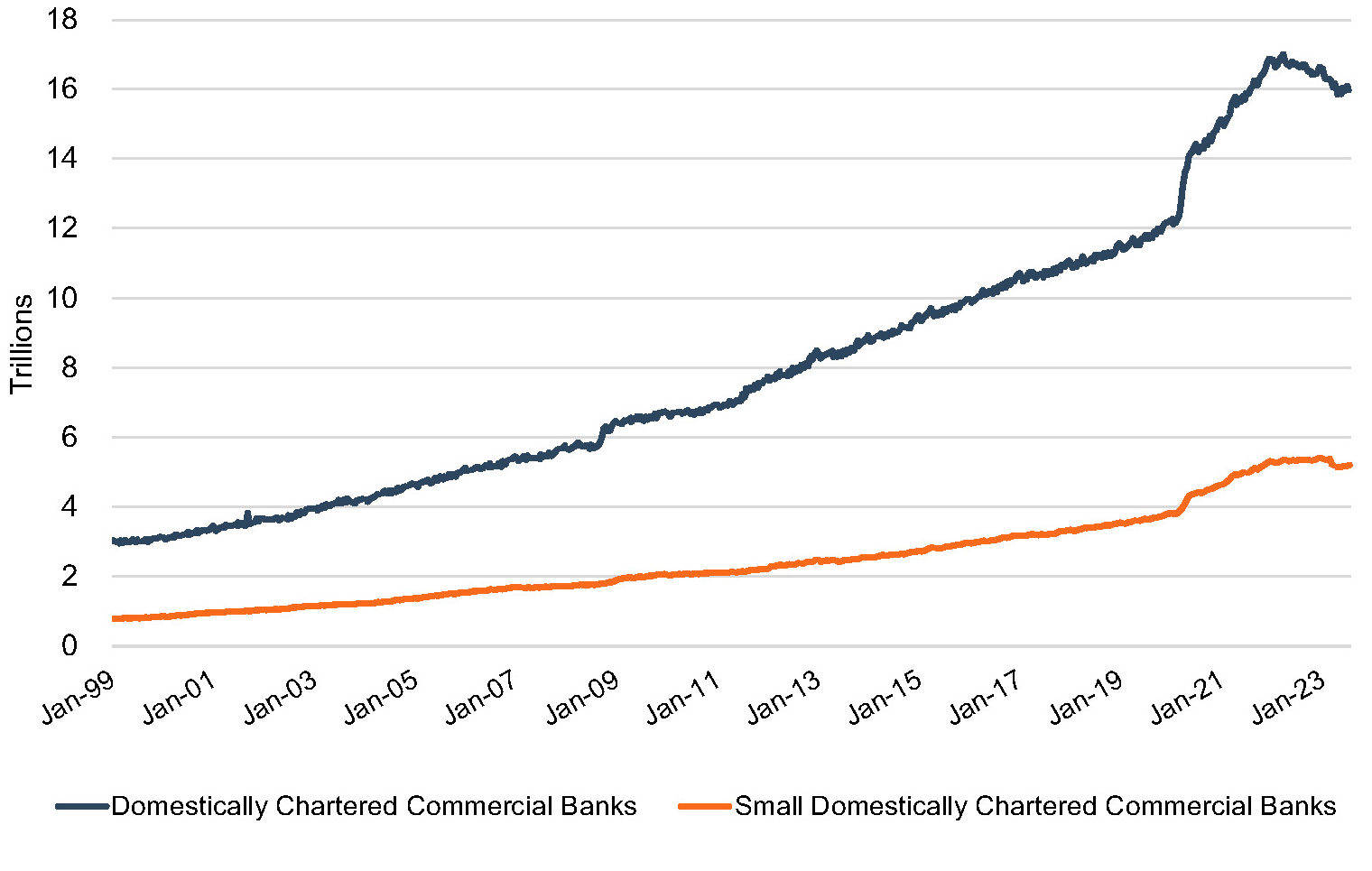

- Deposit Levels. Since the beginning of the pandemic, banks have been inundated with deposits. It was initially expected that the increase in deposits would be transient in nature as the economy re-opened, PPP funds were spent or invested, and consumer confidence improved. However, deposit growth continued through 2021 for nearly all banks and into 2022 for some banks. As alternatives to deposit accounts like money market accounts at brokerage firms became more attractive, total industry deposits have finally begun to drop. In 2022, total industry deposits fell 1.1%, the largest annual decline on record.2 Industry deposits at the end of the second quarter of 2023 declined for the fifth consecutive quarter with deposit balances falling by approximately 3.0% and 0.9% in the first and second quarters, respectively. According to S&P Capital IQ Pro’s recent U.S. Bank Outlook Survey, less than half of respondents expect deposits to increase at their organization in the next 12 months.It is perhaps important to note that smaller banks (defined by the Federal Reserve as all banks outside of the top 25 banks in terms of asset size) have not lost deposits at the same rate as the overall banking industry. It remains to be seen whether deposit bases of community banks will be “stickier” long-term than industry averages. All else equal, higher deposit runoff assumptions lead to lower indications of CDI value.

Figure 5: Total Industry Deposits Per Federal Reserve H.8 Release

- Uninsured Industry Deposits. One of my favorite Warren Buffet quotes is, “Only when the tide goes out do you discover who’s been swimming naked.” The deposit run on Silicon Valley Bank and its subsequent failure put a spotlight on the unprotected nature of many depositors. With 94% of its deposits uninsured, SVB appeared shockingly naked. According to the FDIC, uninsured deposits increased from approximately 18% of deposits in 1991 to approximately 47% of deposits in 2021. At the end of 2022, less than one percent of all deposit accounts had balances above the $250,000 deposit-limit threshold, but these deposit accounts comprised over 40% of banking industry deposits.While we haven’t historically placed explicit emphasis on the level of uninsured deposits as a detriment in evaluating CDI value, we have considered the magnitude of depositor concentrations and attempted to factor such concentrations into CDI value. Buyers are becoming more cognizant of who’s swimming naked, and from a valuation perspective, it is worth considering the risk inherent in a deposit base from a high ratio of uninsured deposits or other significant deposit concentrations. Whether the risk is accounted for with a higher runoff assumption, a higher discount rate, or even removing some concentrations of deposits from the analysis as “non-core” is arguable, but an analysis that ignores this entirely could be considered deficient.

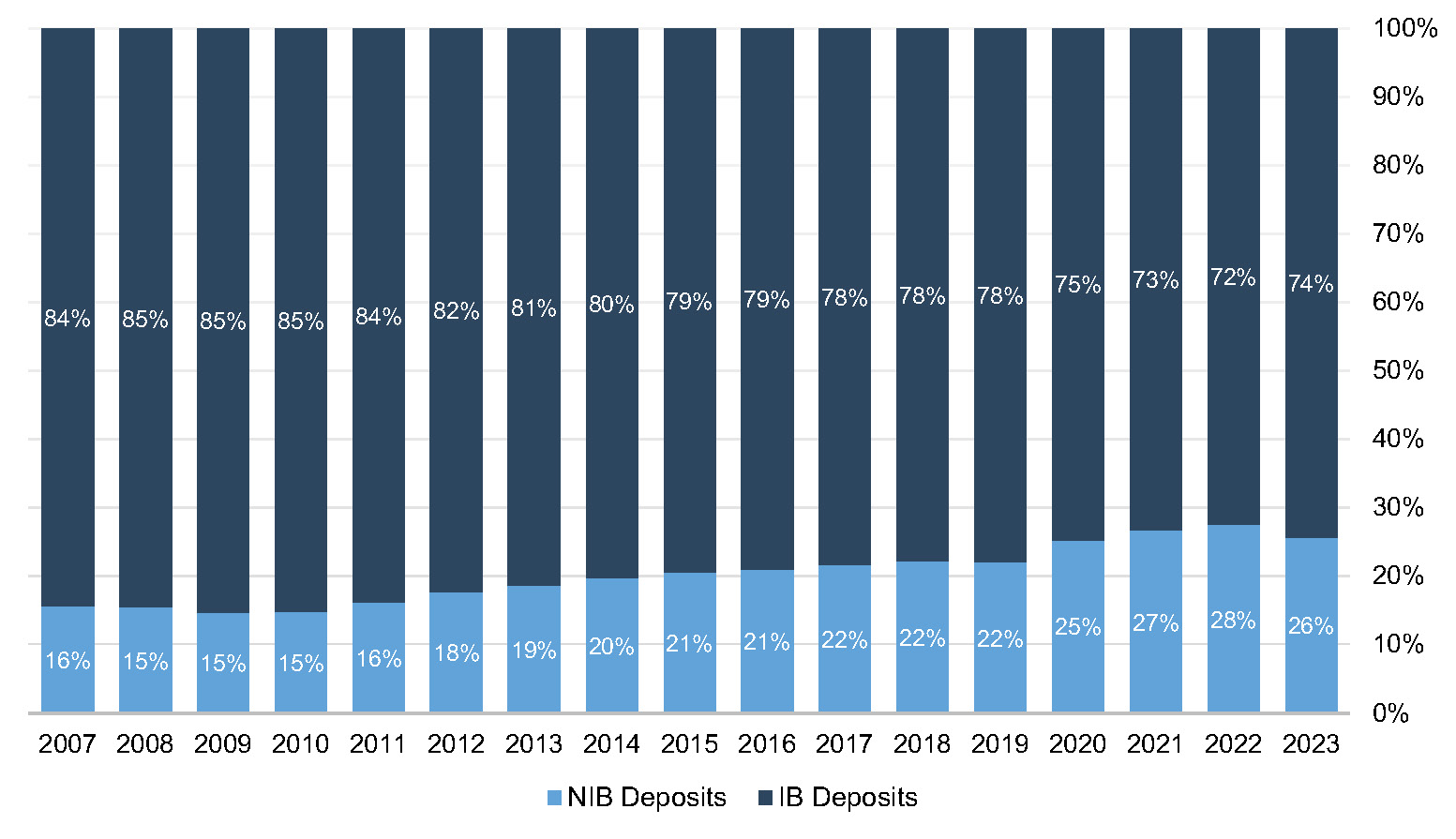

- Deposit Mix and Deposit Beta. Over the past decade, nationwide average deposit mix has shifted in favor of noninterest bearing deposits. In 2023, we see this trend beginning to reverse. The deposit mix is likely to continue shifting in favor of interest-bearing deposits that have lower CDI values. Theoretically, noninterest-bearing deposits have an interest rate beta of zero. While that’s true, an evaluation of a deposit base must consider the likelihood that a dollar of noninterest bearing demand deposits will remain a dollar of deposits that does not demand interest income. It isn’t enough to consider that interest rates will rise only for interest-bearing accounts. One must also factor in the likelihood that balances will shift into interest-bearing accounts. A remixing of deposit balances to historical norms is likely to intensify the effect of rising rates.

Figure 6: Deposit Mix Over Time

- Uncertain Rate Outlook. While rates have risen substantially over the past 18 months, and may continue rising in the near-term, some market participants remain concerned that a zero rate environment will persist as the long-term norm. If this view is correct, which implicitly assumes that the Federal Reserve can choke inflation, CDI values may level off or decline.

- Other Factors. More details within the deposit trial balance tend to provide more meaningful indications of depositor value – and this is especially important to consider on the front end of a deal. When possible, we like to see a customer relationship identifier, information on industry concentrations, more granular detail on account types, several years of deposit history, demographic details surrounding customer age and location, and average account balances over time. Admittedly, this level of detail is not always feasible due to data limitations, but more detail contributes to a more comprehensive “story” of the deposit base. Before you can value the core deposit intangible asset, you need to begin by ascertaining which accounts and balances are “core”. Furthermore, sometimes a particular relationship might be core, but some or most of its balances at a particular point in time might not be. In an environment where rising interest rates are yielding record-high CDI values, it is more important than ever to understand the underlying deposit base.

- Service Charge Income and FDIC Assessments. Given push back from regulators and the public, the industry is facing pressure to reduce overdraft charges and other fees. Lower service charge income produces lower CDI values, all else equal. FDIC assessments related to an increased burden from bailouts would increase the expense burden of a deposit base and produce lower CDI values, all else equal. However, it appears that the burden of covering the Deposit Insurance Fund’s losses from the 2023 bank failures will fall upon the largest banks.

Trends In Deposit Premiums Relative To CDI Asset Values

Core deposit intangible assets are related to, but not identical to, deposit premiums paid in acquisitions. While CDI assets are an intangible asset recorded in acquisitions to capture the value of the customer relationships the deposits represent, deposit premiums paid are a function of the purchase price of an acquisition. Deposit premiums in whole bank acquisitions are computed based on the excess of the purchase price over the target’s tangible book value, as a percentage of the core deposit base. While deposit premiums often capture the value to the acquirer of assuming the established funding source of the core deposit base (that is, the value of the deposit franchise), the purchase price also reflects factors unrelated to the deposit base, such as the quality of the acquired loan portfolio, unique synergy opportunities anticipated by the acquirer, etc. As shown in Figure 7, deposit premiums paid in whole bank acquisitions have shown more volatility than CDI values. Deposit premiums in the range of 6% to 10% remain well below the pre-Great Recession levels when premiums for whole bank acquisitions averaged closer to 20%.

Figure 7: CDI Recorded vs. Deposit Premium

Additional factors may influence the purchase price to an extent that the calculated deposit premium doesn’t necessarily bear a strong relationship to the value of the core deposit base to the acquirer. This influence is often less relevant in branch transactions where the deposit base is the primary driver of the transaction and the relationship between the purchase price and the deposit base is more direct. Figure 8 presents deposit premiums paid in whole bank acquisitions as compared to premiums paid in branch transactions.

Figure 8: Average Deposit Premiums Paid

Deposit premiums paid in branch transactions have generally been less volatile than tangible book value premiums paid in whole bank acquisitions. Only four branch transactions with reported premium data have occurred year-to-date in 2023. For those transactions, the deposit premiums ranged from 2.0% to 6.0%. The lack of branch transactions, though, is indicative of their value. With high short-term funding costs and tight liquidity, few banks are willing to part with stable, low cost core deposits.

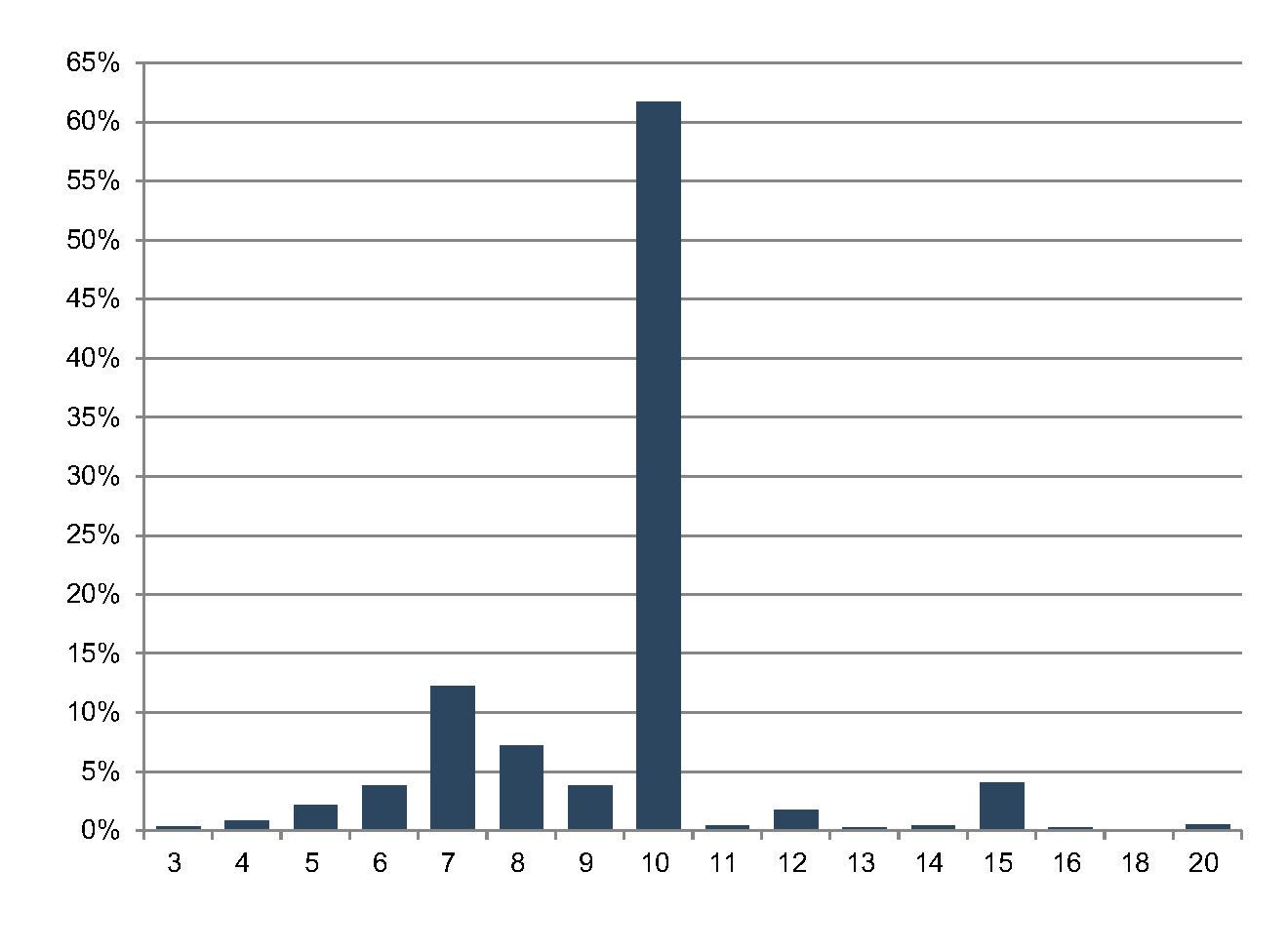

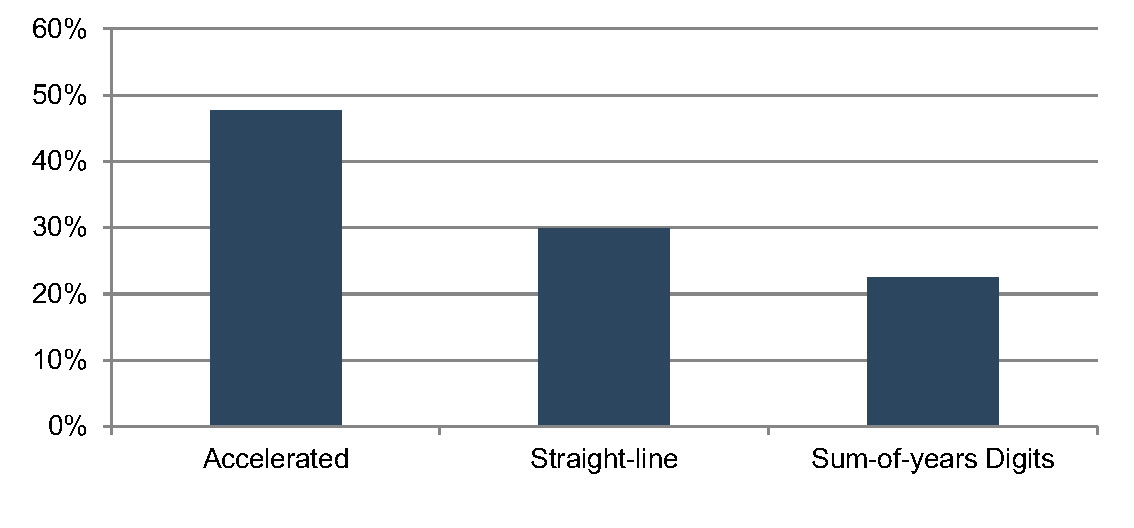

Accounting For CDI Assets

Based on the data for acquisitions for which core deposit intangible detail was reported, a majority of banks selected a ten-year amortization term for the CDI values booked. Less than 10% of transactions for which data was available selected amortization terms longer than ten years. Amortization methods were somewhat more varied, but an accelerated amortization method was selected in approximately half of these transactions.

Figure 9: Selected Amortization Term (Years)

Figure 10: Selected Amortization Method

For more information about Mercer Capital’s core deposit valuation services, please contact us.

1 S&P Capital IQ Pro defines core deposits as, “Deposits in U.S. offices excluding time deposits over $250,000 and brokered deposits of $250,000 or less.”

2 Defined by the Federal Reserve as domestically chartered commercial banks.

Potential Forensic Services Resulting from Valuation Normalizing Adjustments

In the sometimes contentious realm of divorce proceedings, the role of forensic services becomes increasingly vital. Last month’s article, “Valuation of a Business for Divorce: Overview of Valuation Approaches and Normalizing Adjustments,” shed light on the complexities of valuing a business, describing the three approaches: the asset-based approach, the income approach, and the market approach. The article also emphasized the importance of “normalizing adjustments” which act as a corrective lens, adjusting the income statement to portray the financial results from the ordinary operations of a business, as well as ongoing earnings capacity of the business.

Valuations of a closely held business in the context of a contentious divorce can be especially multifaceted and may require additional forensic investigative scrutiny for any irregularities in the financials in anticipation of the divorce and valuation. In valuations for divorce, certain adjustments may impact and/or require further forensic services such as income determination, tracing services, lifestyle analyses, marital vs. separate analyses, and more.

Examples of such adjustments may include, but are not limited to:

- Owner Compensation. Owners may reduce earnings in anticipation of divorce to appear to have lower earnings capacity. Owners or executives with ownership interest may have made arrangements within the business to receive a post-divorce pay-out. A financial expert, through review of historical financial statements and tax returns, as well as an analysis of the lifestyle of the family, may gather support of the true earnings.

- Rent expense. Owners of a company may also own the land and/or building to which the business’ rent expense is paid, otherwise referred to as a related party. If the rent has increased in anticipation of the divorce, the related party may be taking on pre-paid rent or higher than market rent rates to reduce income. A financial expert may review historical expenses and assess the reasonableness of the rent expense.

- Discretionary expenses. Owners may use business funds to pay for personal, non-business related expenses such as vacations, lavish cars, boats, meals & entertainment, among others. A financial expert can review historical transactions to assess if such items are non-business related and if normalization adjustments are necessary for valuation purposes.

It is important to consider these types of situations if only one spouse is involved with the operations and management of the company, otherwise referred to as the “in-spouse.” That spouse may, or may not, have been altering the financial position of the business in anticipation of divorce and a potential independent business valuation. The services of a financial expert can be vital to you and your client in such matters, as the accuracy of the valuation may impact the equitable distribution of the marital assets.

Check out these additional resources:

Active vs. Passive Appreciation of Closely Held Companies

Determining the value of financial assets in a divorce case can often be the most complicated aspect of the case.

The value of certain assets, such as a retirement account or a bank account, can be determined by a brokerage or bank statement/balance as close to the date of trial or settlement as possible.

An asset such as a closely held business may be the most valuable asset in the marital estate and can require a business appraiser to determine its fair market value since no market indication of value is generally available (unlike a publicly traded company).

The valuation date is also important. In addition to the value of the business or business interest (%) at the current date, other indications of value, such as the value at the date of marriage, may also be required. This varies depending on the facts and circumstances of ownership as well as state statutes.

Net asset division in divorce proceedings are further complicated because they are governed by laws that differ by state. The majority of states are referred to as Equitable Division (“ED”) states as opposed to Community Property states. In ED states, courts determine the equitable or fair distribution of the marital assets based on the characteristics of each case. Further, a majority of ED states are referred to as Dual Property ED states, meaning that assets are categorized as either marital or separate.

While definitions vary by state, some states define marital assets as those acquired or earned during the marriage. Those states then define separate assets as those consisting of property owned by a spouse prior to marriage or property received by gift or inheritance that has not been commingled or transmuted during the marriage. Generally, marital assets are subject to division in a divorce proceeding whereas separate assets, as the name implies, are held separately and not factored into the equitable division of marital assets.

Can a separate asset ever become a marital asset? Yes. In many states, the increase in value of a separate asset during the course of the marriage can potentially be considered a marital asset. Using the example of a closely held business, the increase in value, or appreciation, is often measured by the fair market value of that asset at the date of marriage and some other date as defined by the individual state law or statutes. Other measurement dates are the date of trial, date of separation, or date of filing, among others. In an article published in Family Lawyer magazine, we discussed the importance of the valuation date and its impact on the value of a closely held business.

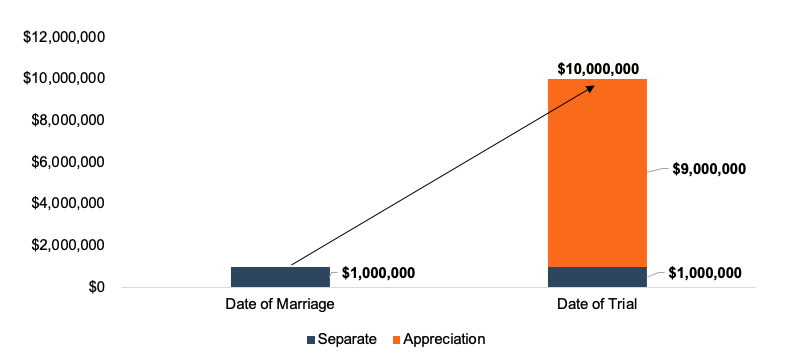

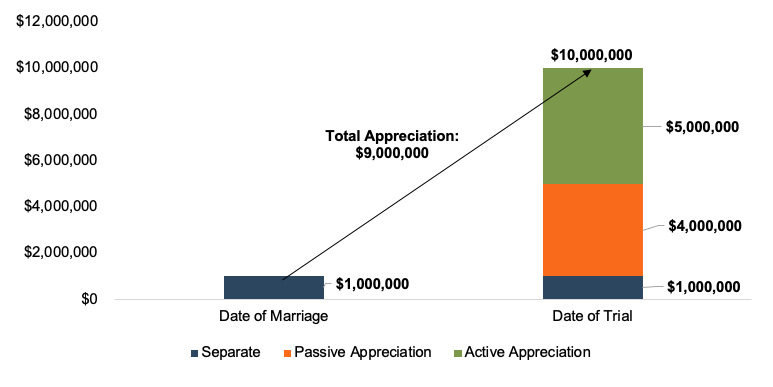

Active vs. Passive Appreciation

Consider a simple example of a closely held business that one spouse owned at the time of marriage. Let’s assume that the fair market value of the business at the date of marriage is $1 million and the fair market value of the business at the date of trial is $10 million. The simple calculation of the appreciation, or increase in value, is $9 million. Is the entire difference of $9 million considered marital property in this example? The answer may be “it depends,” because it may not be that simple depending on the state or jurisdiction of the case.

In many states, the entire portion of appreciation is not treated as marital property, though, valuation experts must confirm state statute and precedent with the attorneys.

Many states make the distinction between “active” and “passive” appreciation. Active appreciation refers to the increase in value, due to the active, direct and indirect, efforts of one or both spouses. Passive appreciation refers to the increase in value, due to external factors such as market forces, or efforts of other individuals other than the spouses in the divorce.

Depending on the state, courts may then classify active appreciation as marital property, while passive appreciation generally remains separate property.

Active and passive appreciation can also be illustrated by looking at certain assets, such as retirement accounts or real estate. Assuming no contributions during the marriage, the growth in value of a retirement account as a result of the increase in the market values of the underlying investments since the date of marriage would be an example of passive appreciation. The rise in value of a piece of real estate or property due to general market conditions and absent any additional investment, improvement, or management of that real estate during the marriage would also constitute passive appreciation.

Appreciation in retirement accounts and real estate can be simply illustrated and defined through reasonable methodologies. Determining active and passive appreciation in the value of a closely held business can be much more complex. The assumptions used in the overall valuation of the business requires the business appraiser to use qualitative and quantitative analyses. Active appreciation can be supported through direct efforts of one or both spouses such as financial investment in the business, ownership and labor hours contributed to the business, management, marketing strategy, etc. Passive appreciation can consist of economic or market conditions and/or the efforts of non-divorcing individuals.

Examples of Passive Appreciation Factors and Techniques to Quantify

Market forces refer to the economic or market conditions that affect the price, demand, or value of an asset. Market forces happen naturally and are outside of the control or direct efforts of the owners of the company or spouses involved in a divorce. For a closely held business, market forces that can affect value include changes in interest rates, discount/capitalization rates, tax rates, pricing of products or billing rates, legislation that causes an increase in demand for a company’s products or services, etc. Value appreciation attributable to market forces would generally be classified as passive appreciation and as a result, would not be included in the marital estate in those states that recognize active/passive appreciation as marital/separate.

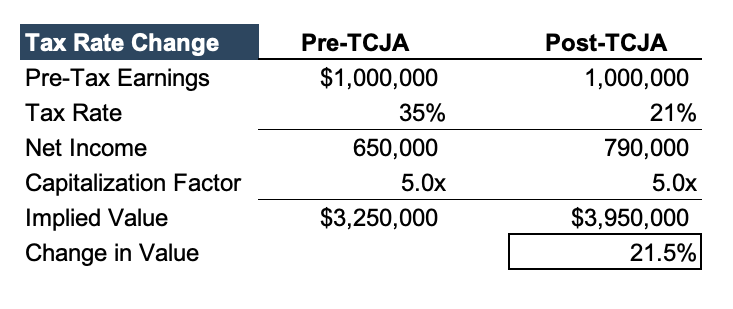

Consider a simple example of a company before and after the tax rate changes brought on by the 2017 Tax Cuts and Jobs Act (“TCJA”). Let’s assume the Company has $1 million in earnings, and the capitalization factor to determine value is 5x. Let’s also assume the tax rate changed from 35% to 21% after TCJA with no state income tax. In this example, all else being equal and not changed, the change in tax rate caused a 21.5% increase in value of the company.

Efforts from individuals other than the spouses could be another area where passive appreciation is present. Business appraisers can perform analyses of these third-party efforts through several techniques. When considering ownership, the following questions are addressed. What is the overall ownership of the company? Is the divorcing spouse the only owner or is he/she one of several owners? The presence of other owners could indicate efforts of other individuals. Management of the Company is also a consideration. Who are the key members of management and how are decisions made? Is the company controlled by a board of directors, and if so, how many individuals serve on the board? In terms of the the role of the spouse, appraisers can analyze these roles and the roles of other key individuals and determine what impact those duties have on the company’s strategy and performance overall. Finally, business appraisers can perform an analysis of the revenue contribution of each owner or key member of management to the overall revenue of the company. Does the company have multiple locations? If so, is the divorcing spouse active and participating at all locations?

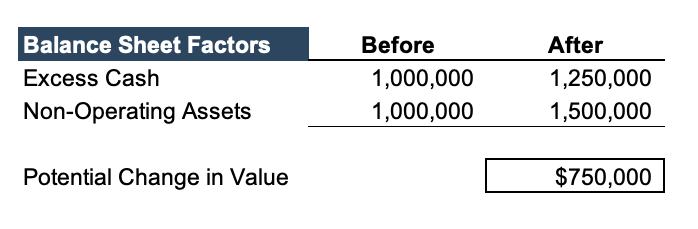

Balance sheet factors can also impact the overall value of a company. The presence of excess cash or non-operating assets can add to the value determined under an income or capitalization method (used in the tax rate example above). The Company may have experienced an increase in these items from the date of marriage to the current date of measurement. From our experience, it is not uncommon to see companies in certain industries with more cash on the balance sheet in the last two years as a result of remaining funds obtained from PPP loans or elevated profits. Non-operating assets can consist of real estate not used in the core operations of the business or an investment account. We discussed both of these assets earlier and illustrated how their values can increase due to passive appreciation factors.

Consider a company with the following changes to its balance sheet: excess cash increased by $250,000 and non-operating assets increased by $500,000. In this example, the change in potential value to the company could be $750,000 and may be characterized as passive appreciation depending on the specific factors. While these are assets and liabilities of the business, they may be categorized as “non-core” assets that have different considerations for separate or marital appreciation from those of the core business operations.

Allocating Active/Passive Appreciation

Once the appraiser identifies and quantifies the areas of passive appreciation, the remaining appreciation, or increase in value, is concluded to be active appreciation. The conclusion of passive appreciation could be in dollars of value or percentage of overall value.

Let’s revisit our original example involving a company worth $1 million at date of marriage and $10 million at the date of trial. If the appraiser had determined passive appreciation to be $4 million, then the resulting active appreciation would be $5 million as seen below:

Conclusion

Determining the value and classification of financial assets can be challenging during a divorce proceeding. As we have discussed, the classification of an asset can also change from the date of marriage to the current date of measurement (trial, separation, filing, etc.) and depending on state statute and precedent. Many states make the distinction between active and passive appreciation, only considering the active appreciation to be a marital asset.

The value of a couple’s closely held business could be the most valuable asset in the marital estate. If the business was owned prior to marriage, the identification and quantification of any appreciation as active or passive could be critical to the overall marital value placed on that asset.

A detailed valuation analysis of the appreciation will be needed in addition to the valuation of the business at each measurement date. A qualified business appraiser can perform both tasks, including examining the specific factors that contribute to the overall value of the business. It’s important for the appraiser to understand the applicable state laws of the jurisdiction in question and to discuss those with the attorney.

Bank Impairment Testing

Bank stocks have underperformed in the broad market since the beginning of the year and many currently trade below book value, which begs the question, is goodwill impaired? We discussed this topic most recently in June 2020 as banking stocks (along with the broad market) were pressured in 1Q20 based on fears from the COVID-19 pandemic. However, the market recovered quickly in 2H20 and set new highs in 2021 as interest rates were at historical lows, many banks benefitted from PPP and mortgage banking income, and immense liquidity flooded into the economy via government stimulus.

What once was the solution for the economy in 2020 now is a contributor to headaches for bankers in 2023. A combination of the influx in liquidity to the economy (and banking system) via government stimulus, supply disruptions from COVID and geopolitical events, and pent-up demand from reopenings led to higher inflation in 2021 and 1H22. The Federal Reserve attempted to cool inflation with an increase in short-term policy rates, from a range of 0.00-0.25% in March 2020 to 5.25-5.50% as of July 2023. However, the rise in interest rates led to unrealized losses on bond portfolios and pressure on deposit retention and funding costs.

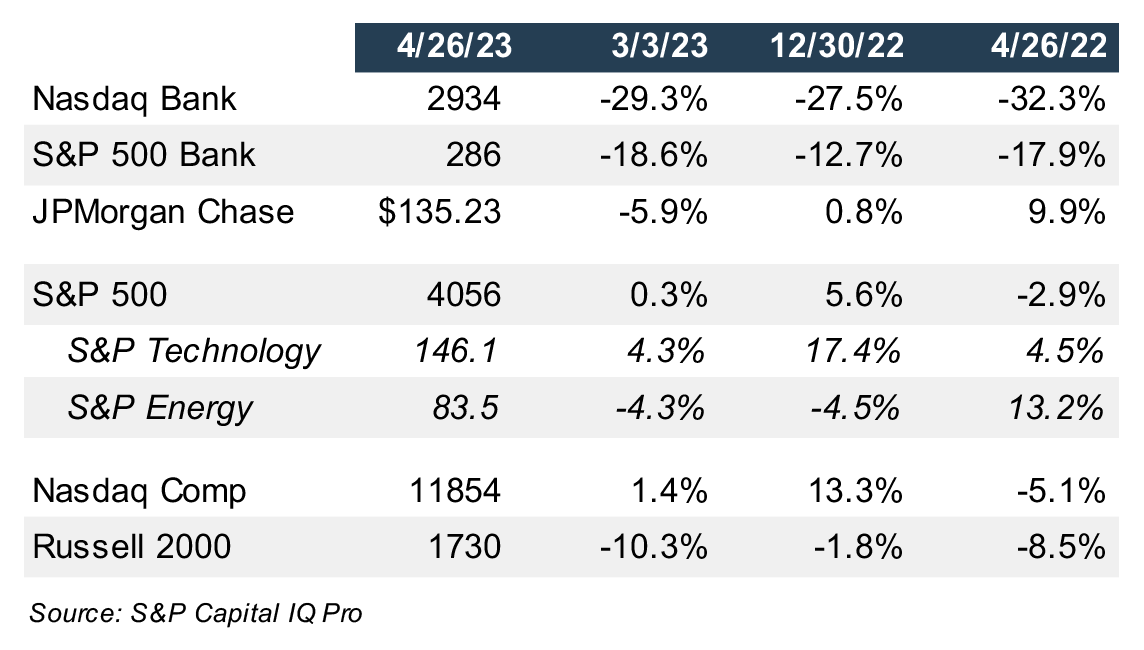

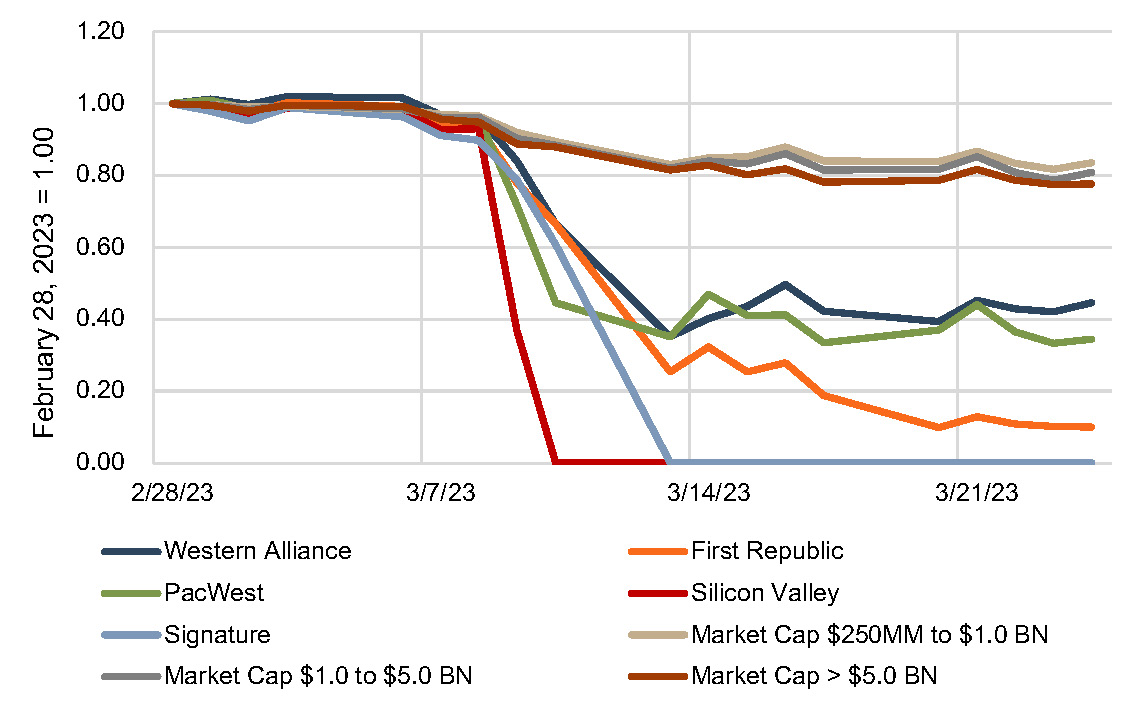

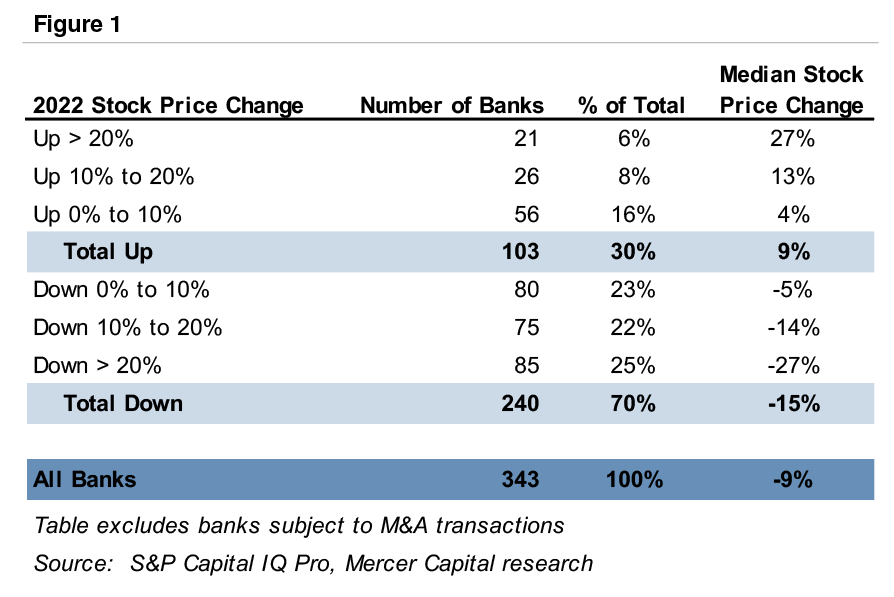

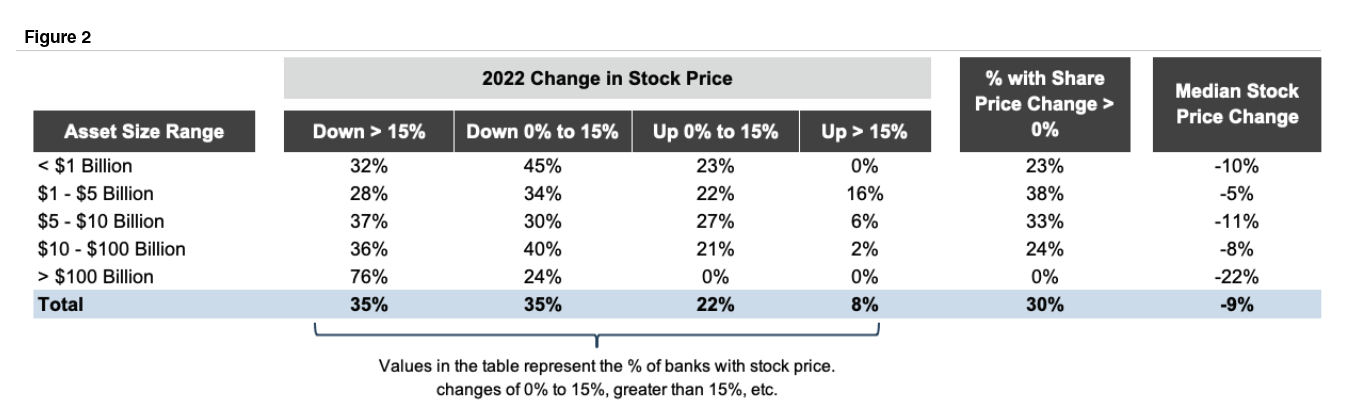

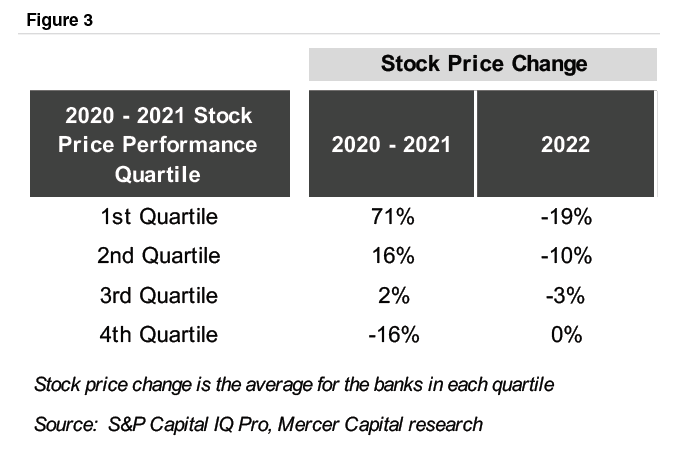

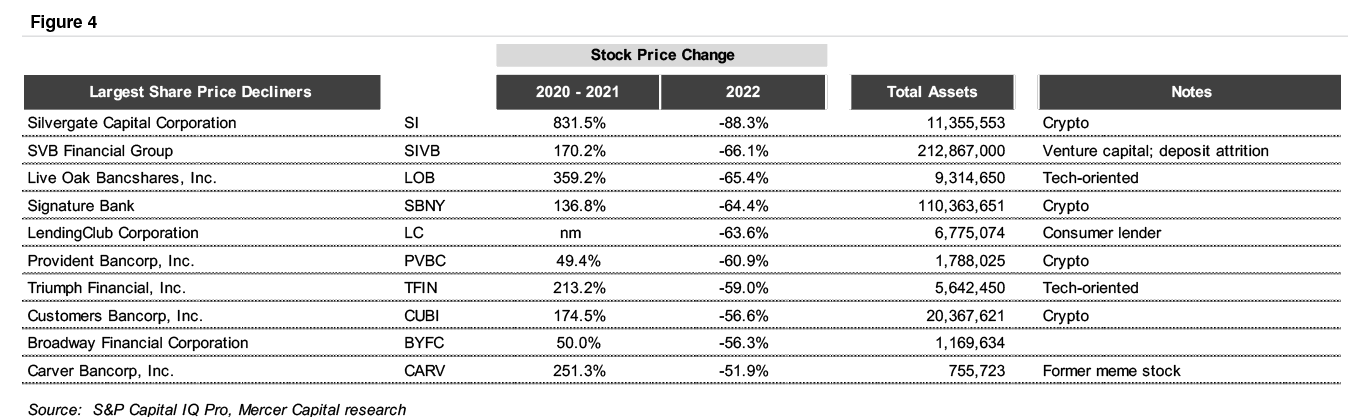

Public bank stocks performed well when compared to the broader markets in 2022. The median stock price change of the 343 banks and thrifts traded on the NYSE and NASDAQ, was negative 9% in 2022, compared to negative 19% for the S&P 500 and negative 33% for the NASDAQ. However, banking stocks diverged from the broad market in 2023 with declines during the Spring of 2023 (March and April) as concerns about higher cost of funds, unrealized bond losses, and the collapse of three high profile banks (SVB, FRC, and SBNY) arose. Banking stocks generally bottomed during early to mid-May before recovering a portion of the decline more recently.

However, of the nearly 300 banking stocks we analyzed that trade on the NYSE and NASDAQ, approximately half continue to trade below book value as of July 25, 2023. Deal activity also slowed in 2H22 and year-to-date 2023 due to a combination of factors including fair value marks on bonds and loans, widening buyer and seller expectations, and pressures on profitability and public bank stocks. For perspective, there have been 43 whole bank acquisitions announced in the year-to-date period ended July 26, 2023. This compared to 86 deals in the same period in 2022 and 103 transactions in 2021.

Against this backdrop, the remainder of this article will discuss two common questions that arise for companies considering an impairment test.1

Do I Need an Impairment Test?

Goodwill impairment testing is typically performed annually, usually near the end of a Company’s fiscal year. In fact, many companies may have completed an impairment test as of year-end 2022. However, the factors noted above may raise questions about whether an interim goodwill impairment test is warranted for many banks.

The accounting guidance in ASC 350 prescribes that interim goodwill impairment tests may be necessary in the case of certain “triggering” events. For public companies, perhaps the most easily observable triggering event is a decline in stock price, but other factors may constitute a triggering event. Further, these factors apply to both public and private companies, even those private companies that have previously elected to amortize goodwill under ASU 2017-04.

For interim goodwill impairment tests, ASC 350 notes that entities should assess relevant events and circumstances that might make it more likely than not that an impairment condition exists. The guidance provides several examples, several of which are relevant for the bank industry including the following:

- Industry and market considerations such as a deterioration in the

environment in which an entity operates or an increased competitive environment - Declines in market-dependent multiples or metrics (consider in both absolute terms and relative to peers)

- Overall financial performance such as negative or declining cash flows or a decline in actual or planned revenue or earnings compared with actual and projected results of relevant prior periods

- Changes in the carrying amount of assets at the reporting unit including the expectation of selling or disposing certain assets

- If applicable, a sustained decrease in share price (considered both in absolute terms and relative to peers)

The guidance notes that an entity should also consider positive and mitigating events and circumstances that may affect its conclusion. If a recent impairment test has been performed, the headroom between the recent fair value measurement and carrying amount could also be a factor to consider.

How Does an Impairment Test Work?

Once an entity determines that an interim impairment test is appropriate, a quantitative “Step 1” impairment test is required. Under Step 1, the entity must measure the fair value of the relevant reporting units (or the entire company if the business is defined as a single reporting unit). The fair value of a reporting unit refers to “the price that would be received to sell the unit as a whole in an orderly transaction between market participants at the measurement date.”

For companies that have already adopted ASU 2017-04, the legacy “Step 2” analysis has been eliminated, and the impairment charge is calculated as simply the difference between fair value and carrying amount.

ASC 820 provides a framework for measuring fair value which recognizes the three traditional valuation approaches: the income approach, the market approach, and the cost approach. As with most valuation assignments, judgment is required to determine which approach or approaches are most appropriate given the facts and circumstances. In our experience, the income and market approaches are most commonly used in goodwill impairment testing. However, the market approach may be limited in the current environment given the lower amount of transaction activity in 2023. In the current environment, we offer the following thoughts on some areas that are likely to draw additional scrutiny from auditors and regulators.

Are the financial projections used in a discounted cash flow analysis reflective of recent market conditions? What are the model’s sensitivities to changes in key inputs

- Given developments in the market, do measures of risk (discount rates) need to be updated?

- If market multiples from comparable companies are used to support the valuation, are those multiples still applicable and meaningful in the current environment?

- If precedent M&A transactions are used to support the valuation, are those multiples still relevant in the current environment?

- If the subject company is public, how does its current market capitalization compare to the indicated fair value of the entity (or sum of the reporting units)? What is the implied control premium and is it reasonable in light of current market conditions?

Concluding Thoughts

At Mercer Capital, we have experience in implementing both the qualitative and quantitative aspects of interim goodwill impairment testing. To discuss the implications and timing of triggering events, please contact a professional in Mercer Capital’s Financial Institutions Group.

1A portion of the following text was excerpted from an article from my colleague Lucas Parris entitled “Goodwill Impairment Testing in Uncertain Times” https://mercercapital.com/article/goodwill-impairment-testing-in-uncertain-times/

Valuation of a Business for Divorce

Overview of Valuation Approaches and Normalizing Adjustments

Valuation of a business can be a complex process requiring accredited business valuation professionals. Valuations of a closely held business in the context of a divorce are typically multifaceted. Business valuations are a vital element of the marital dissolution process as the value of a business, or interests in a business, impact the marital balance sheet and the subsequent allocation/distribution of marital assets. In this article, we introduce the three valuation approaches and discuss the importance of normalizing adjustments to the subject company’s income statement.

Valuation Approaches

At the beginning of any valuation, the financial expert will request certain information and interview management of the Company. Information requested typically includes:

- Financial statements (usually the last five years)

- Tax returns (usually the last five years)

- Budgets or forecasted financials statements

- Buy-sell agreement

- Information on recent transactions

- Potential non-recurring and/or unusual expenses

- Qualitative information such as business history and overview, product mix, supplier and customer data, and competitive environment

The financial expert must assess the reliability of the documentation and decide if the documents appear thorough and accurate to ultimately rely on them for his/her analysis. The three approaches to value a business are the Asset-Based Approach, the Income Approach, and the Market Approach.

The Asset-Based Approach

The asset-based approach is a general way of determining a value indication of a business, business ownership interest, or security using one or more methods based on the value of the assets net of liabilities. Asset-based valuation methods include those methods that seek to write up (or down) or otherwise adjust the various tangible and intangible assets of an enterprise.

For more on the asset-based approach, click here.

The Income Approach

The income approach is a general way of determining a value indication of a business, business ownership interest, security or intangible asset using one or more methods that convert anticipated economic benefits into a present single amount.

The income approach can be applied in several different ways. Valuation methods under the income approach include those methods that provide for the direct capitalization of earnings estimates, as well as valuation methods calling for the forecasting of future benefits (earnings or cash flows) and then discounting those benefits to the present at an appropriate discount rate. The income approach allows for the consideration of characteristics specific to the subject business, such as its level of risk and its growth prospects relative to the market.

For more on the income approach, click here.

The Market Approach

The market approach is a general way of determining a value indication of a business, business ownership interest, security or intangible asset by using one or more methods that compare the subject to similar businesses, business ownership interests, securities or intangible assets that have been sold.

Market methods include a variety of methods that compare the subject with transactions involving similar investments, including publicly traded guideline companies and sales involving controlling interests in public or private guideline companies. Consideration of prior transactions in interests of a valuation subject is also a method under the market approach.

For more on the market approach, click here.

Synthesis of Valuation Approaches

A proper valuation will factor, to varying degrees, the indications of value developed utilizing the three approaches outlined. A valuation, however, is much more than the calculations that result in the final answer. It is the underlying analysis of a business and its unique characteristics that provide relevance and credibility to these calculations.

Importance of Normalizing Adjustments

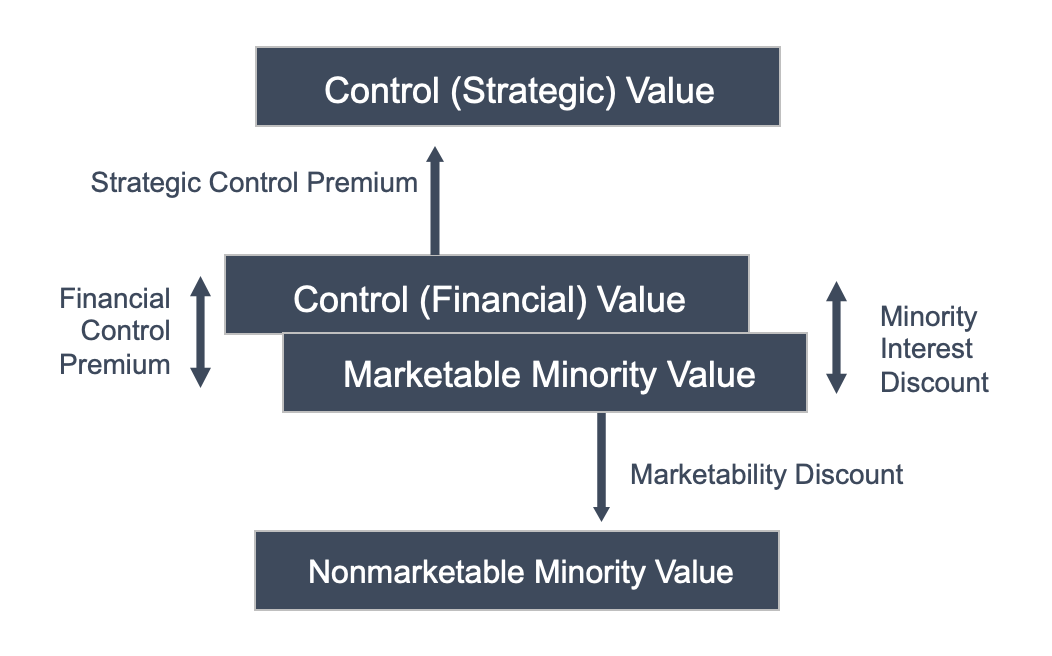

Normalizing adjustments adjust the income statement of a private company to show the financial results from normal operations of the business and reveal a “public equivalent” income stream. In creating a public equivalent for a private company, the marketable minority level of value (sometimes referred to as the “as if freely traded,” level of value) emphasizes that earnings are being normalized to where they would be as if the company were public, hence supporting the need to carefully consider and apply, when necessary, normalizing adjustments. (For further information on the Levels of Value, see “What is a ‘Level’ of Value, and Why Does It Matter?”).

There are two categories of adjustments.

Non-Recurring, Unusual Items

These adjustments eliminate one-time gains or losses, unusual items, non-recurring business elements, expenses of non-operating assets, and the like. Examples include, but are not limited to:

- One-time legal settlement. The income (or loss) from a non-recurring legal settlement would be eliminated and earnings would be reduced (or increased) by that amount.

- Gain from sale of asset. If an asset that is no longer contributing to the normal operations of a business is sold, that gain would be eliminated and earnings reduced.

- Life insurance proceeds. If life insurance proceeds were paid out, the proceeds would be eliminated as they do not recur, and thus, earnings are reduced.

- Restructuring costs. Sometimes companies must restructure operations or certain departments, the costs are one-time or rare, and once eliminated, earnings would increase by that amount.

Discretionary Items

These adjustments relate to discretionary expenses paid to or on behalf of owners of private businesses. Examples include the normalization of owner/officer compensation to comparable market rates, as well as elimination of certain discretionary expenses, such as expenses for non-business purpose items (lavish automobiles, boats, planes, etc.) that would not exist in a publicly traded company.

For more, refer to our article “The Importance of Normalizing Financial Statements for a Business Valuation.”

Conclusion

If the business or an interest was recently bought or sold, if it was recently appraised, or if its value is in a financial statement or a loan application, that information may go a long way in establishing the value of the business (if both parties feel that this value is a fair representation). However, since a business valuation report and expert witness are admissible in court as evidence and since the value of a business or interest impacts the marital balance sheet and the subsequent asset distribution, it may be exceedingly beneficial to hire a professional for evidentiary support.

Fairness Opinions and Down Markets

The late Richard Russell, editor of Dow Theory Letters for 57 years, famously remarked that “markets make opinions.” One does not have to know much about markets to acknowledge that there is much truth in that statement. Trends tend to be extrapolated.

Taken at face value, investors should be biased and bullish today. The S&P 500, as of June 23, 2023, has risen 13% year-to-date after declining 19% in 2022. The NASDAQ is up 29% after falling 33% in 2022. However, ten or so mega-cap companies have driven the turnaround in these two market-cap-weighted indices. Shares of Nvidia, Alphabet and Tesla have more than doubled, while a 44% increase in Apple’s shares has pushed its market cap to $2.9 trillion.

On the other hand, the equal weighted S&P 500 (RSP), S&P 400 Mid Cap and Russell 2000 indices have each risen less than 5% after declining 15% to 20% in 2022. Most stocks are well below the highs that were posted in 2021.

Given the depressed market for many and sharply higher borrowing costs, it is not surprising that M&A activity has been subdued since the third quarter of 2022. Markets and M&A activity may not turnaround later this year, but some level of M&A activity will continue.

The role of the financial advisor becomes tougher when markets are depressed. Questions of value and fair dealing may be subjected to more scrutiny. Declining or depressed markets in the context of negotiating and opining on a transaction will raise the reasonable question: How do current market conditions impact fairness?

There is no short answer; however, the advisor’s role of reviewing the process, valuation, facts, and circumstances of the transaction in a declining or depressed market should provide the board with confidence about its decision and the merits of the opinion.

Some of the issues that may weigh on the decision process and the rendering of a fairness opinion in a depressed market include the following:

Process vs. Timing. Process can be a tricky consideration in any transaction (see our review of the Tesla-Solar City shareholder litigation here). A review of fair dealing procedures, when markets have fallen sharply, will raise additional process and valuation considerations. The analysis should be sensitive to actions that may favor one party and disadvantages shareholders (e.g., a buyback of a significant shareholder’s interest when prices were higher). Even an auction of a company may be subject to second guessing if the auction occurred in a weak environment.

Corporate Forecasts. A management forecast covering three-to-five years is a staple of any valuation analysis and board deliberations regarding a significant corporate transaction. Consideration should be given to the context of when the forecast was prepared and how different economic environments affect the subject company. A reasonable question to consider is whether depressed equity markets and widening high-yield spreads merit a below trend baseline forecast or vice versa. There is no correct answer, only perspective and alternatives to the baseline forecast to consider.

Valuation. Valuation should be viewed through multiple lenses, including absolute, relative to comps, and relative to the subject’s historical and prospective performance. Depressed markets add further nuance. Are markets temporarily depressed or resetting to a new normal that will require valuations to reset to a lower level? Does consideration consist of a fixed amount of cash, or does it entail the issuance of a fixed number of buyer shares that may (or may not) be temporarily depressed?

Exchange Ratios. Since the GFC, most acquisitions structured as stock swaps entail a fixed exchange ratio because buyers need certainty about the number of shares issued. Theoretically, declining markets do not change the calculus for buyers and sellers subject to a fixed exchange ratio to the extent the buyer’s shares have declined in line with the market; however, declining markets cause sellers to focus more intently on “price” rather than pro rata ownership and pro forma financial metrics. The more challenging analysis is when the buyer’s shares have materially underperformed a declining industry index that is not remedied through a provision in the merger agreement that provides for an upward adjustment to the exchange ratio.

Buyer’s Shares. Regardless of market conditions, fairness analyses should consider the investment attributes and merits of the buyer’s shares based on financial performance, share performance, and valuation relative to peers. Declining or depressed markets make this calculus harder, especially when the buyer’s shares have underperformed peers and/or are materially valued above peers because the shares have not fallen as much. If so, the outcome raises the issue of more downside potential even though fairness opinions and supporting analyses do not forecast future share performance.

Financing. If the consummation of a transaction depends upon the buyer raising cash via selling shares or issuing debt, a sharp drop in the market may limit financing availability. If so, the board and the financial advisor will want to ensure the buyer has backup financing from a bank. No matter how remote, the absence of backstop funding is an out-of-no-where potential that a board and an advisor should consider. Down markets make the highly unlikely possible if capital market conditions deteriorate unabated. While markets periodically become unhinged, a board entering into an agreement without a backstop plan may open itself to ill-informed deal-making if events go awry.

Summing it Up. Tomorrow is always uncertain. Fairness opinions do not offer opinions about where a security will trade in the future. Instead the opinion addresses fairness from a financial point of view to all or a subset of shareholders as of a specific date. The evaluation process is trickier when markets fall sharply, but it is not unmanageable. We at Mercer Capital have extensive experience valuing and evaluating the shares (and debt) of companies engaged in transactions during bull, bear, and sideways markets garnered from over three decades of business.

What Is a “Level” of Value, and Why Does It Matter?

Business owners and their professional advisors are occasionally perplexed by the fact that their shares can have more than one value. This multiplicity of values is not a conjuring trick on the part of business valuation experts, but simply reflects the economic fact that different markets, different investors, and different expectations necessarily lead to different values.

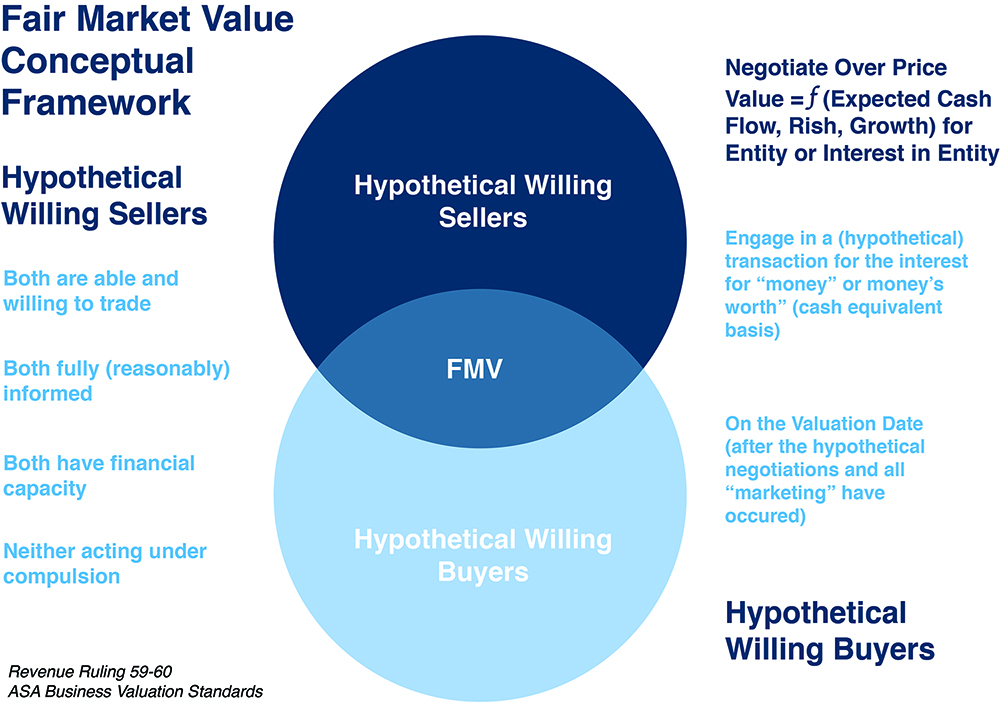

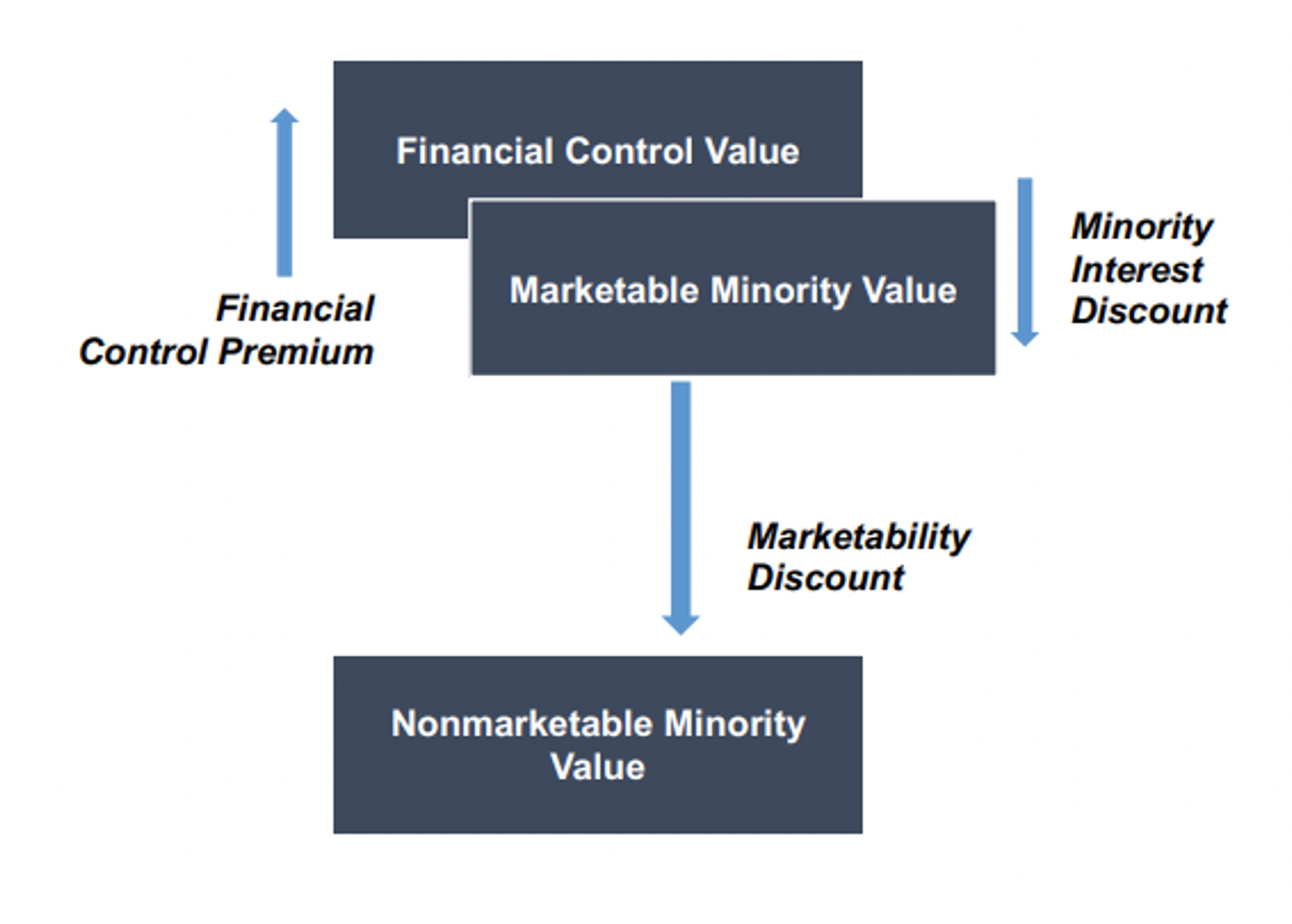

Business valuation experts use the term “level of value” to refer to these differing perspectives. As shown in Exhibit 1, there are three basic “levels” of value for a business.

Exhibit 1 :: Levels of Value

Each of the basic levels of value corresponds to different perspectives on the value of the business. In this article, we explore the relevant characteristics of each level.

Marketable Minority Level Value

The marketable minority value is a proxy for the value of a business if its shares were it publicly traded. In other words, if your business had a stock ticker, what price would the shares trade at? To answer this question, we need to think about expectations for future cash flows and risk.

- Expected cash flows. Investors in public companies are focused on the future cash flows that companies will generate. In other words, investors are constantly assessing how developments in the broader economy, the industry, and the company itself will influence the company’s ability to generate cash flow from its operations in the future.

- Public company investors have a lot of investment choices. There are thousands of different public companies, not to mention potential investments in bonds (government, municipal, or corporate), real estate, or other private investments. Public company investors are risk-averse, which just means that – when choosing between two investments having the same expected future cash flow – they will pay more today for the investment that is more certain. As a result, public company investors continuously evaluate the riskiness of a given public company against its peers and other alternative investments. When they perceive that the riskiness of an investment is increasing, the price will go down, and vice versa.

So, when a business appraiser estimates the value of a business at the marketable minority level of value, they are focused on expected future cash flows and risk. They will estimate this value in two different ways.

- Using an income approach, they create a forecast of future cash flows, and based on the perceived risk of the business, convert those cash flows to present value, or the value today of cash flows that will be received in the future.

- Using a market approach, they identify other public companies that are similar in some way to your family business. By observing how investors are valuing those “comps,” they estimate the value of the shares in the business.

While these are two distinct approaches, at the heart of each is an emphasis of the cash flow-generating ability and risk of the business.

We started with the marketable minority level of value because it is the traditional starting point for analyzing the other levels of value.

Control Level of Value

In contrast to public investors who buy small minority interests in companies, acquirers buy entire companies (or at least a large enough stake to exert control). Acquirers are often classified as either financial or strategic.

- Financially-motivated acquirers often have cash flow expectations and risk assessments similar to those of public market investors. As a result, the control (financial) level of value is often not much different from the marketable minority level of value, as depicted in Exhibit 1.

- Strategic acquirers, on the other hand, have existing operations in the same, or an adjacent industry. These acquirers typically plan to make operational changes to increase the expected cash flows of the business relative to stand-alone expectations (as if the company were publicly traded).

The ability to reap cost savings or achieve revenue synergies by combining your family business with their existing operations means that strategic acquirers may be willing to pay a premium to the marketable minority value. Of course, selling the business to a strategic acquirer means that the business effectively ceases to exist. The name and branding may change, employees may be downsized, and production facilities may be closed.

Nonmarketable Minority Level of Value

While strategic acquirers may be willing to pay a premium, the buyer of a minority interest in a business that is not publicly traded will generally demand a discount to the marketable minority value. All else equal, investors prefer to have liquidity; when there is no ready market for an asset, the value is lower than it would be if an active market existed.

What factors are investors at the nonmarketable minority level of value most interested in? First, they care about the same factors as marketable minority investors: the cash-flow generating ability and risk profile of the business. But nonmarketable investors have an additional set of concerns that influence the size of the discount from the marketable minority value.

- Expected holding period. Once an investor buys a minority interest in a business, how long will they have to wait to sell the interest? The holding period for the investment will extend until (1) the shares are sold to another investor or (2) the shares are redeemed by the business, or (3) the business is sold. The longer an investor expects the holding period to be, the larger the discount to the marketable minority value.

- Expected capital appreciation. For most businesses, there is an expectation that the value of the business will grow over time. Capital appreciation is ultimately a function of the investments made by the business. Public company investors can generally assume that investments will be limited to projects that offer a sufficiently high risk-adjusted return. Business shareholders, on the other hand, occasionally have to contend with management teams that hoard capital in low-yielding or non-operating assets, which reduces the expected capital appreciation for the shares. All else equal, the lower the expected capital appreciation, the larger the discount to the marketable minority value.

- Interim distributions. Does the business pay dividends? Interim distributions can be an important source of return during the expected holding period of uncertain duration. Interim distributions mitigate the marketability discount that would otherwise be applicable.

- Holding period risk. Beyond the risks of the business itself, investors in minority shares of public companies bear additional risks reflecting the uncertainty of the factors noted above. As a result, they demand a premium return relative to the marketable minority level. The greater the perceived risk, the larger the marketability discount.

Conclusion

The so-called “levels” of value reflect the real-world concerns of different investors in different circumstances. It is important for family law attorneys and their clients to understand the levels of value. When business appraisers are called upon to value a business in a divorce engagement, they will reference the levels of value. The more family law attorneys understand basic valuation concepts, the better guidance you can provide to your clients.

The Terminal Value

The valuation of portfolio companies usually is a straight forward process; however, it is more challenging in the current bear market following a period of wide-open monetary spigots that drove rich valuations for venture-backed firms. Capital raises were outwardly easy to complete as were richly valued exits via an IPO or M&A. For traditional PE-backed companies, low-cost debt financing was readily available, too, which often supported an extra turn or two of EBITDA for acquisitions and sometimes dividend recaps.

Now the hangover is in full swing.

The valuation process is intended to determine the fair value of an asset as of the valuation date. Stated differently, it is the market clearing price, not a price target based upon an investment thesis. The accounting profession provides more formality via ASC 820 as “the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date.”

Current depressed market conditions make it difficult to utilize the recent bull market capital raise data without a fundamental adjustment for market conditions as well as differences between the subject and the comp data. The same applies to M&A and IPO pricing, too. What was is no more.

Depending upon the subject company, the Guideline Public Market Company Method (i.e., public comps) may be a suitable method to develop an indication of value, though often venture-backed companies may be too early in their life cycle to compare to public comps. But virtually all valuations will consider the Discounted Cash Flow Method (“DCF”).

The DCF Method has three primary components: a) projected unlevered free cash flows that accrue to capital providers, b) a terminal value and c) weighted average cost of capital (“WACC”) to discount the cash flows and terminal value to present values, the sum of which represents the enterprise value of the firm.

Most venture-backed firms and sometimes PE-owned companies can be described as long duration equities in which the value of the firm is in the out years rather than near-term cash flows as is the case for mature businesses with high profit margins. Like any model, terminal values have their sensitivities including and especially growth.

The terminal value represents the present value of all cash flows as of the end of the discrete forecast period. In our experience, the courts—especially in Delaware—and private equity analysts tend to favor an income approach to deriving a terminal value rather than a market approach based upon public company comps and/or M&A comps. An income approach to deriving the terminal value will rely upon the capitalization of earnings or free cash flow in which the multiple reflects a “build-up” of the components of capital costs less a long-term growth rate. Such an approach to deriving the terminal value excludes market data other than some of the capital cost components. Viewed from this perspective, the DCF method is a “pure” income approach to valuation as is the single-period (earnings or cash flow) capitalization method.

On the other hand, market participants tend to favor market multiples applied to one or more of the projected performance measures at the end of the forecast period to derive the terminal value. The courts may not favor this approach as a mixing of income- and market-based approaches, but viewing exit multiples in the context of market observations is not illogical.

It is important to note that a market-derived multiple used to determine a terminal value has an implicit growth expectation. All else equal, the higher the market multiple the higher the growth rate expectation. Stated differently, one should be judicious in selecting a market-based terminal value multiple. High growth rates tend to normalize in time with once high multiples compressing toward industry averages. Market multiples observed over the past several years may overstate future growth just as today’s “low” multiples could understate future growth.

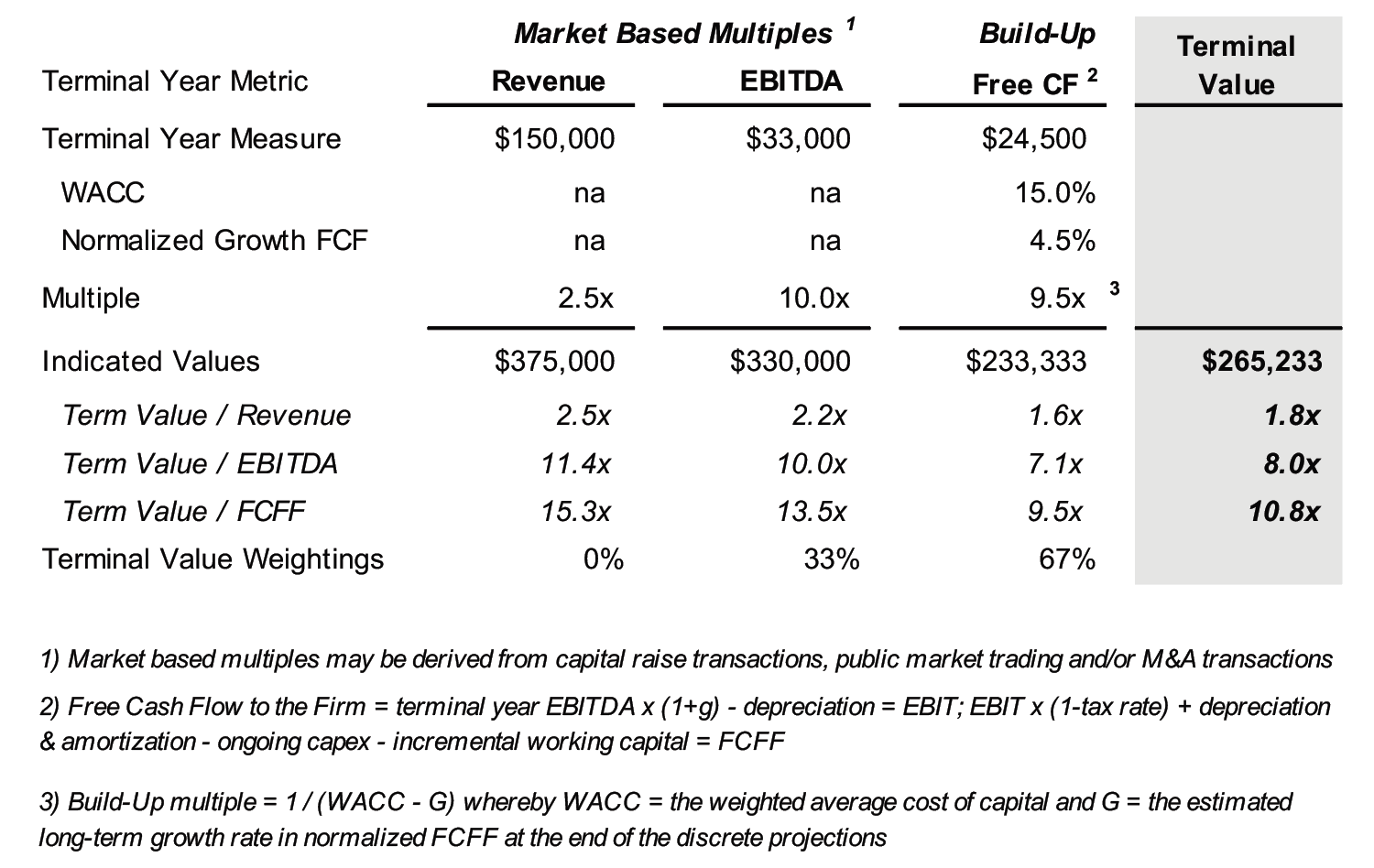

Figure 1 compares a market-based approach to determining a terminal value with a build-up approach. The illustration is intended to emphasize the delta that may exist presently between a market-based approach and a build-up. Firms that are projected to be marginally cash flow positive by the terminal year, all else equal, likely will not produce a substantial DCF value unless elevated market multiples are used to derive the terminal value. With the passing of the ultra-easy money era, that probably does not make sense unless the market observations were derived since interest rates returned to a “normal” level by late 2022.

Figure 1: Derivation of the DCF Terminal Value

An alternative to solely weighting the build-up multiple would be to weight both market-based and build-up multiples. That may make sense to bridge an evolving market, though if a court were to review the analysis it likely would solely weight the build-up multiple consistent with Delaware case law.

Another point to consider in calculating terminal values is relative valuation – does the terminal value as a multiple of earnings, revenues and whatever other metrics are relevant to the subject company’s industry make sense? The resulting multiple may make sense, but one also has to question the terminal year earnings measure. If management projections reflect a “to the moon” trajectory, then the WACC probably should too.

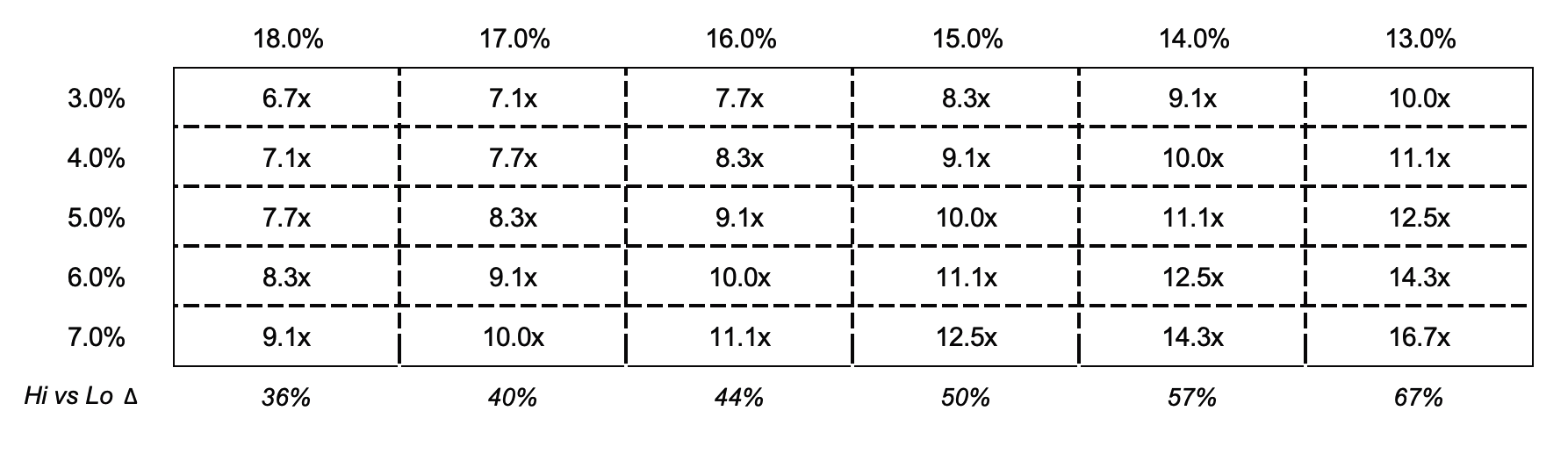

Terminal values are sensitive to the assumptions, especially the growth rate of the terminal year earnings measure that is capitalized as shown in Figure 2 as it relates to a build-up method used in the single period capitalization method. The current outlook for lower economic growth and higher rates/cost of capital implies DCF values all else equal have (or will) decline.

Figure 2: Sensitivity of the Build-Up Multiple re WACC vs Long-Term Growth

of Earning Power

About Mercer Capital

Mercer Capital is an independent valuation and transaction advisory firm that was founded in 1982. We provide valuation, fairness and solvency opinions for a broad range of clients, including private equity and private credit funds. Please call if we can assist in establishing the fair value of your private equity and credit investments, or alternatively provide assurance opinions.

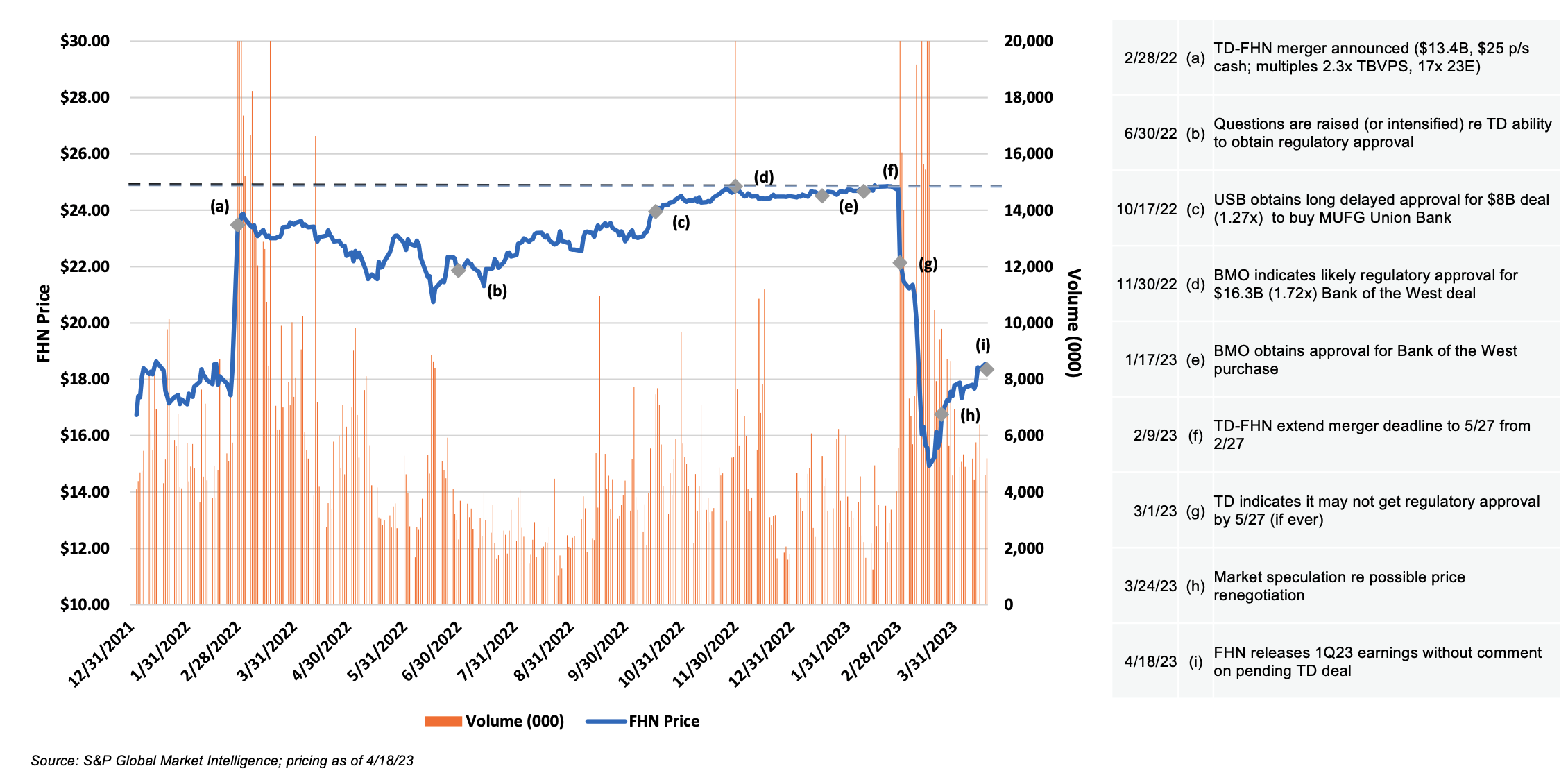

Merger Arbitrage and Valuation

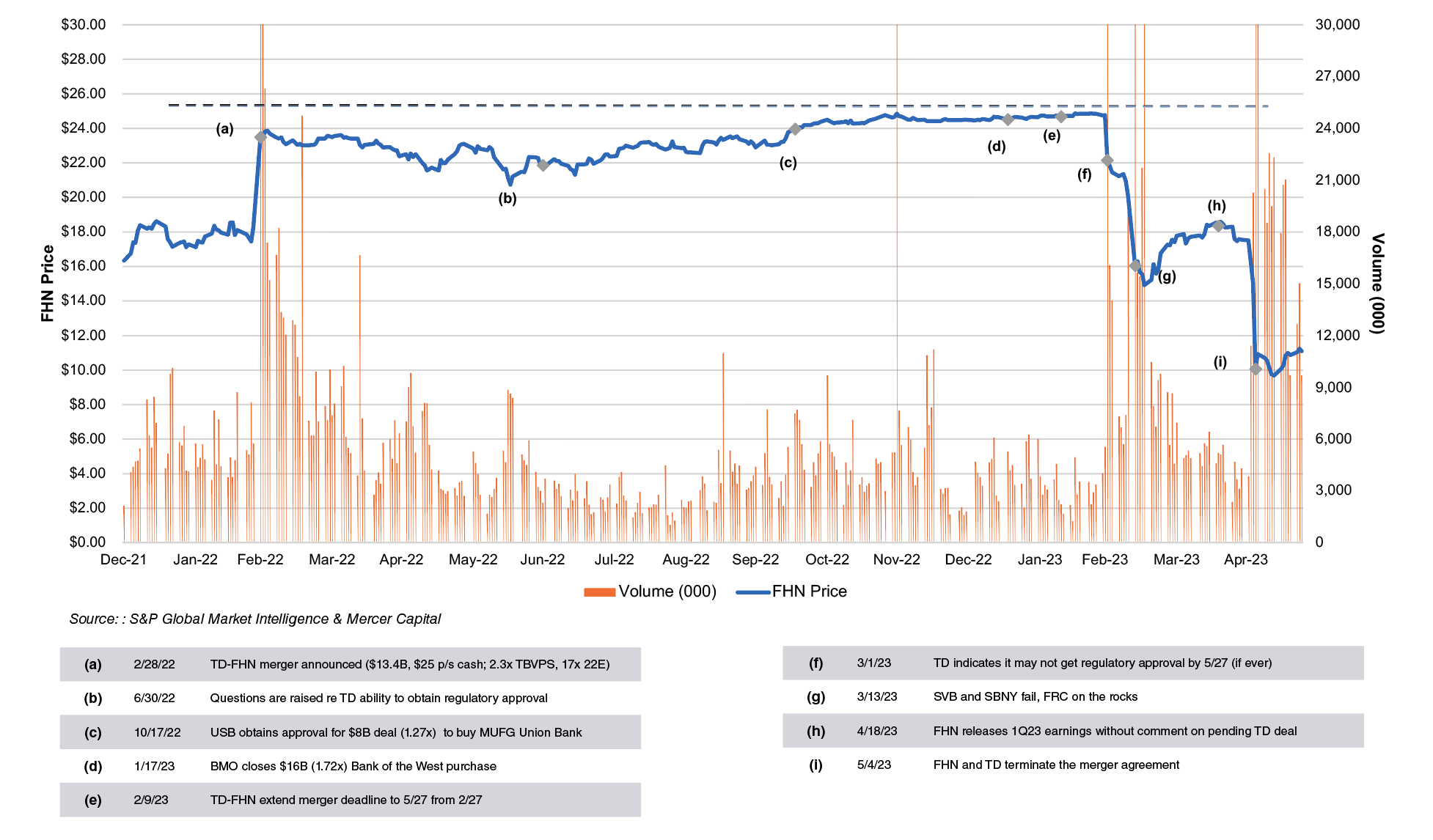

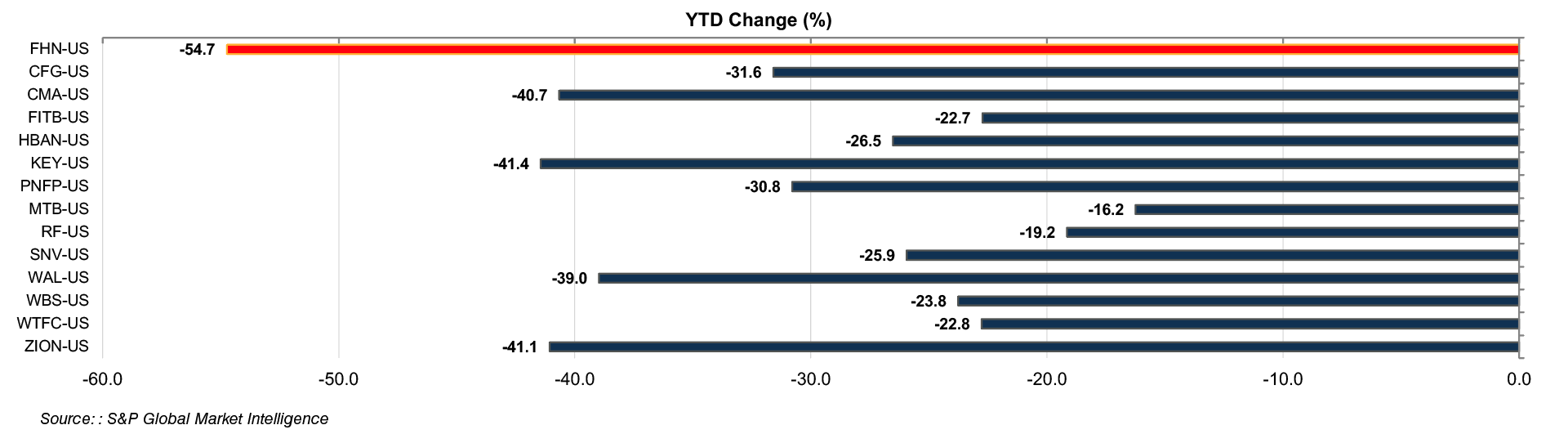

We are sometimes asked to value common equity securities where the target (usually our client) has agreed to be acquired but the transaction has not yet closed. The valuation could be required for a number of reasons: annual year-end ESOP/KSOP valuation, tax compliance matters, and litigation.