December 2025 SAAR

Key Takeaways

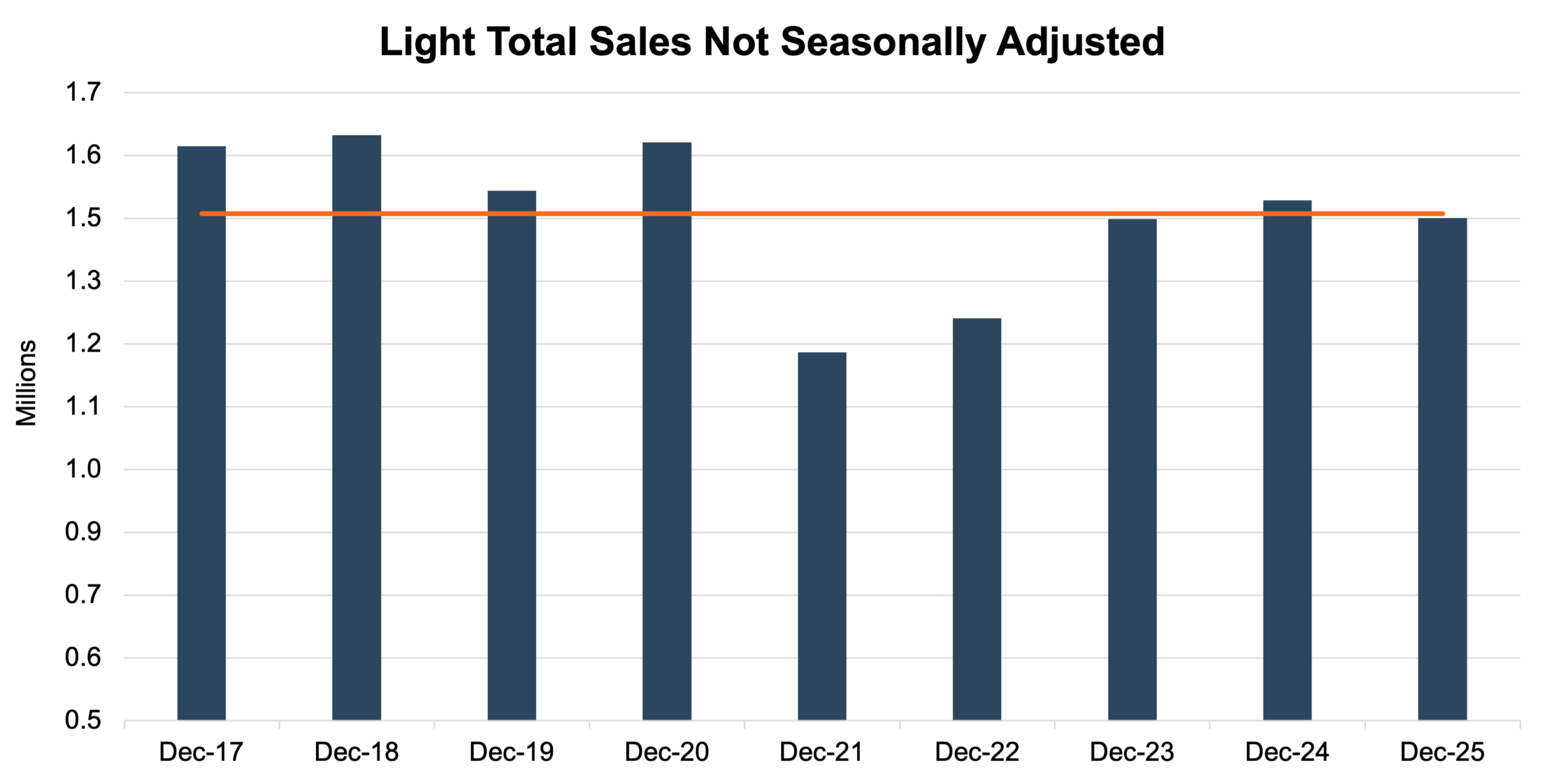

On an unadjusted basis, December 2025 industry sales finished at approximately 1.46 million units, reflecting typical year-end seasonality but still a slight decline versus December 2024. For the first time since the onset of the microchip shortage in 2021, December was not the highest unadjusted volume month of the year, as sales were greater in March, April, and May surrounding the tariff uncertainty.

Combined with October and November’s respective 1.28 million units, fourth-quarter unadjusted volumes were adequate to push the industry above the 16-million-unit threshold for the year for the first time since 2019. See the chart below for a look at unadjusted sales over the last nine Decembers.

Days’ Supply

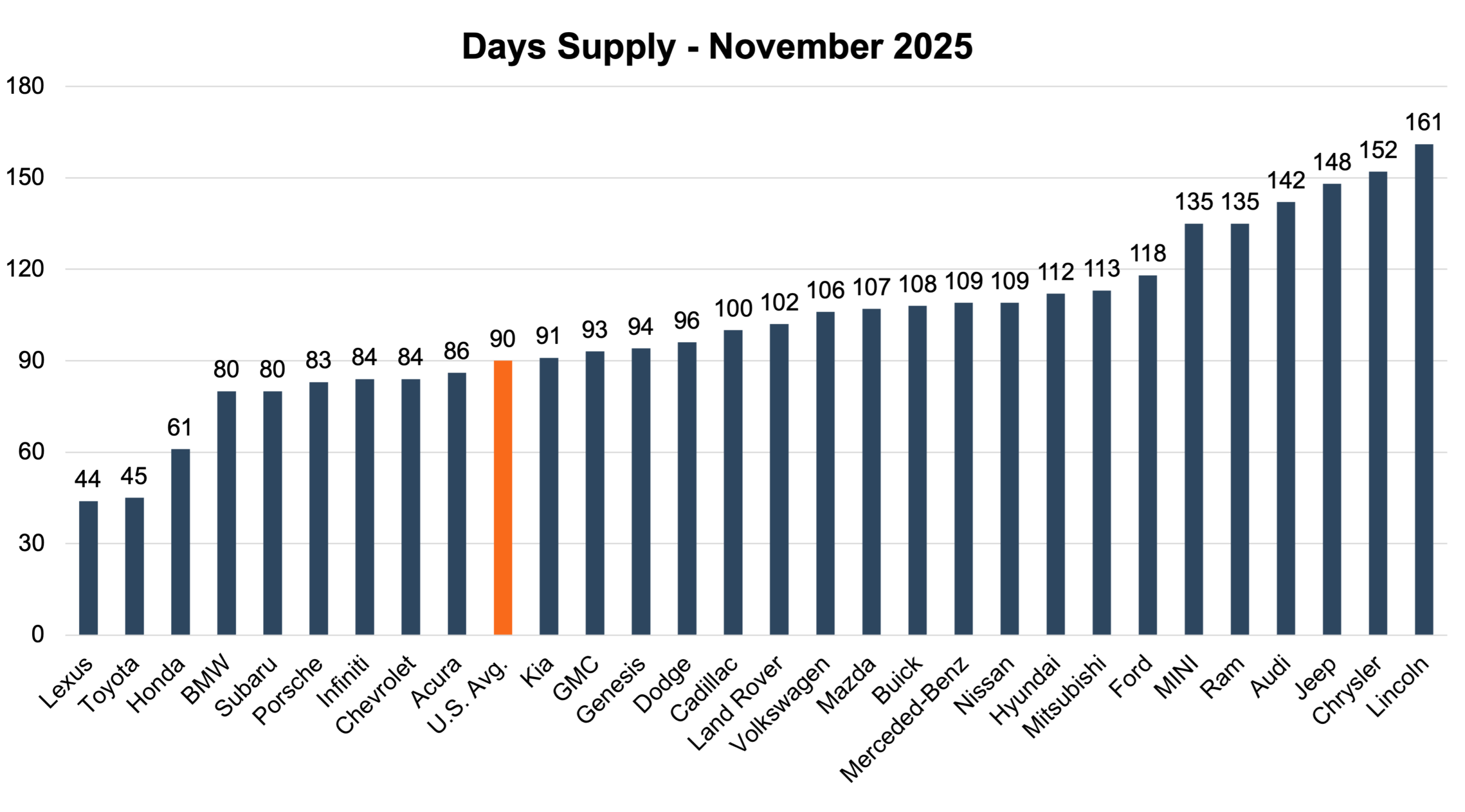

Brand-level days’ supply data from Cox Automotive provides a granular view of OEM inventory strategies, emphasizing that a dealer’s inventory position is increasingly driven by brand-specific discipline rather than industry averages.

See the chart below for a look at days’ supply by brand in November 2025.

Click here to expand the image above

Inventory management remains a key differentiator among OEMs. Evaluating franchise value now requires a closer examination of how effectively a brand maintains operational steadiness. From October 2025, there was not a material change in days’ supply with the U.S. average edging up 2 days. Days’ supply increased the most for brands on the opposite ends of the spectrum. Lexus and Toyota’s increases can be seen as normalization though they are still well below peer figures. On the other end, brands with elevated inventory levels (VW, CDJR, Mini and Lincoln) also saw their days’ supply increase, which is putting pressure on margins and working capital. No other brands saw their days’ supply change by more than a few days up or down.

Transaction Prices

According to J.D. Power, the average new-vehicle retail transaction price in December 2025 is projected to be approximately $47,104, representing a year-over-year increase of roughly 1.5%. The increase for non-EVs was 1.4% over the same period, as EVs are selling for modestly more on average but the relatively small volume of EV sales causes the impact to be minimal. Post-EV tax credit, it will be interesting to see how these pricing dynamics continue to evolve.

Incentive Spending and Profitability

Thomas King, the president of OEM solutions at J.D. Power, discussed the factors impacting incentive spending in December:

“The average manufacturer’s incentive spend per vehicle is on track to reach $3,433, which is $140 higher than November and $77 higher than a year ago. Expressed as a percentage of MSRP, incentive spending is currently at 6.5%, up 0.1 percentage points from last year. Discounts on EVs are expected to average $11,414 in December, down $57 compared with December 2024, and down $472 from November 2025. Discounts on non-EVs are projected at $3,219, an increase of $425 from last year.”

Total retailer profit per unit, including vehicle gross and finance & insurance income, is projected to decline modestly year over year in December, reflecting continued normalization from post-pandemic highs and increased competitive pressure. While profits remain above long-term historical averages, the trend exiting 2025 is clearly downward.

January 2026 Outlook

After two months of depressed sales, December delivered modest sequential improvement on a SAAR basis and full-year 2025 volumes successfully surpassed the 16 million threshold, marking an important milestone for the industry.

That said, declining per-unit profitability and elevated inventory of certain brands may result in weaker total dealer performance, even with stable volumes. The industry has yet to reach the 17-million-unit threshold since the pandemic, and based on current demand, affordability, and inventory conditions, we do not expect a return to that level in 2026.

Mercer Capital provides business valuation and financial advisory services, and our auto team helps dealers, their partners, and family members understand the value of their business. Contact a member of the Mercer Capital auto dealership team today to learn more about the value of your dealership.

Auto Dealer Valuation Insights

Auto Dealer Valuation Insights