Desert Peak Minerals and Falcon Minerals Corporation recently announced an all-stock merger, forming a pro form a ~$1.9 billion mineral aggregator company. This comes in the wake of Desert Peak’s attempted IPO in late 2021. In this post, we look at the transaction terms and rationale, the implied valuation for Desert Peak, and implications for the mineral/royalties space.

Transaction Overview

The merger will combine Falcon’s ~34,000 Eagle Ford and Appalachia net royalty acres with Desert Peak’s ~105,000 acre Delaware and Midland position, resulting in a combined company with ~139,000 net royalty acres. Approximately 76% of the company’s acreage position will be in the Permian, with 15% in the Eagle Ford and 9% in Appalachia. Pro forma Q3 2021 production was 13.5 mboe/d, which moves Falcon from the smallest (by production) publicly traded mineral aggregator in Mercer Capital’s coverage to number four, leapfrogging Dorchester and Brigham.

The transaction is expected to close during the second quarter of 2022, at which time legacy Falcon shareholders would own ~27% of the company, while legacy Desert Peak shareholders would own ~73%. The combined company will be managed by the Desert Peak team and headquartered in Denver.

Going forward, one of the key strategies of the company appears to be M&A. The company seeks “to become a consolidator of choice for large-scale, high-quality mineral and royalty positions” and touted its “strategic, disciplined, and opportunistic acquisition approach” in presentation materials.

The company also highlighted its ESG credentials, noting the diversity of its workforce and structural economic disincentives for flaring gas. However, most ESG discussions focused on the often-neglected G – governance. Management incentive compensation is expected to be 100% in the form of equity with an emphasis on total shareholder returns, rather than relative returns or growth metrics.

Desert Peak Implied Valuation

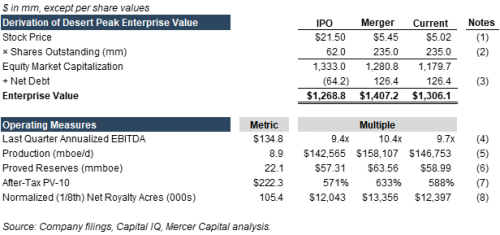

Desert Peak was pursuing an IPO in late 2021, looking to raise $200 to $230 million at an implied enterprise value of $1.2 to $1.4 billion, based on Mercer Capital’s analysis of Desert Peak’s S-1 filing. However, the deal was postponedin November and ultimately withdrawn in January.

Based on Falcon’s stock price immediately preceding the announcement, the merger terms imply an enterprise value of $1.4 billion for Desert Peak, slightly higher than the valuation implied by the top-end of the IPO range. However, Falcon’s stock price has slid since then, bringing Desert Peak’s implied valuation back in line with the mid-point of the IPO range.

Implied valuations and relevant multiples are shown in the following table.

IPO stock price reflects midpoint of $20 to $23 range indicated in Desert Peak’s S-1. Merger stock price reflects Falcon's closing stock price as of 1/11/2022 (immediately preceding merger announcement). Current stock price reflects Falcon's closing stock price as of 1/19/2022.

IPO shares pro forma for anticipated IPO offering. Other figures reflect the number of Falcon shares to be issued to Desert Peak.

IPO net debt pro forma for anticipated transaction proceeds, as indicated in Desert Peak’s S-1. Other figures reflect net debt as disclosed in the transaction press release.

Metric per transaction press release (as of 9/30/2021).

Metric per transaction presentation (as of 9/30/2021). Multiple calculated on a dollar per flowing barrel equivalent basis ($/boe/d).

Metric per Desert Peak S-1 (pro forma as of 12/31/2020). Multiple calculated on a dollar per barrel equivalent basis ($/boe).

Metric per Desert Peak S-1 (pro forma as of 12/31/2020).

Metric per transaction presentation.

Implications

Desert Peak's inability to complete its IPO highlights the lack of appeal of oil & gas assets among generalist investors, which is not welcome news for an industry facing capital headwinds and a dearth of IPO activity. However, Desert Peak was able to structure a new deal at essentially the same valuation should give mineral and royalty owners confidence that logical buyers can be found.

Conclusion

We have assisted many clients with various valuation needs in the upstream oil and gas space for both conventional and unconventional plays in North America, and around the world. Contact a Mercer Capital professional to discuss your needs in confidence and learn more about how we can help you succeed.