Permian Production Pushes Higher

The economics of Oil & Gas production vary by region. Mercer Capital focuses on trends in the Eagle Ford, Permian, Bakken, and Marcellus and Utica plays. The cost of producing oil and gas depends on the geological makeup of the reserve, depth of reserve, and cost to transport the raw crude to market. We can observe different costs in different regions depending on these factors. In this post, we take a closer look at the Permian.

Production and Activity Levels

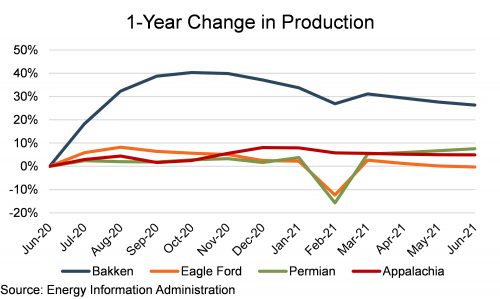

Estimated Permian production increased approximately 8% year-over-year through June, though current production remains below the peak observed in March 2020. Production in Appalachia increased 5% year-over-year, while the Eagle Ford’s production was essentially flat. The largest production gain was observed in the Bakken (up 26%), as the Bakken saw a high level of shut-in wells (in response to low commodity prices) which have subsequently been brought back online. Permian production has generally been increasing over the past year, but there was a meaningful decline in February driven by Winter Storm Uri that disrupted power supplies throughout Texas.

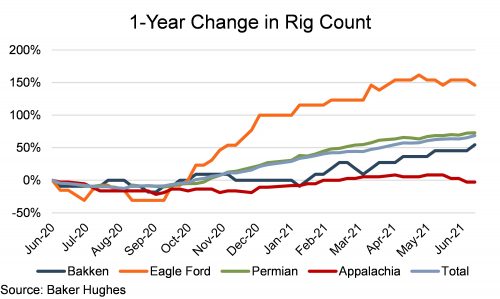

The Permian’s production increase is the result of more drilling activity in the basin. There were 237 rigs in the Permian as of June 18th, up 73% from June 12, 2020. Bakken and Eagle Ford rig counts were up 55% and 146%, respectively, while the Appalachia rig count was down 3%.

Permian production should continue to increase modestly over the next several months based on the current rig count, legacy production declines, and new-well production per rig.

Commodity Prices Grind Higher

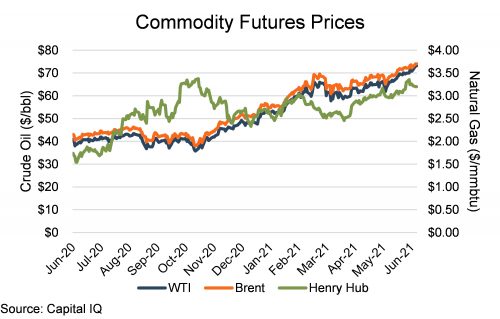

The second quarter of 2021 saw rising commodity prices, driven largely by accelerating travel and economic activity amid the vaccine rollout and fewer COVID cases in many parts of the world. Front-month WTI futures began the quarter at ~$60/bbl and broke above $70/bbl before the end of the quarter. The rise in prices was generally slow and steady, with the exception of a dip in mid-May, though that was likely driven by short-term dislocations caused by the shutdown of the Colonial Pipeline in response to a ransomware attack. Henry Hub natural gas front-month futures prices began the quarter at approximately $2.60/mmbtu and have been above $3/mmbtu for all of June thus far.

However, the current commodity price environment may be short-lived. WTI futures prices are in backwardation (meaning that current prices are higher than future prices), implying some near-term tightness that is expected to subside. This sentiment is echoed by the U.S. Energy Information Administration, which stated that “continuing growth in production from OPEC+ and accelerating growth in U.S. tight oil production—along with other supply growth—will outpace decelerating growth in global oil consumption and contribute to declining oil prices” in their June 2021 Short-term Energy Outlook.

Financial Performance

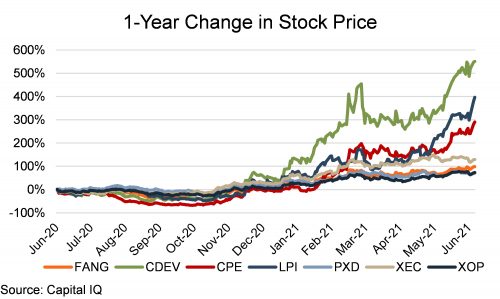

In a nice change of pace for energy investors, the Permian public comp group saw strong stock price performance over the past year (through June 22nd). All of the Permian companies except Pioneer outperformed the broader E&P sector, as proxied by XOP (which was up 73% during the past twelve months). That stock price performance is probably more reflective of the dire straits of some companies last year in the aftermath of the Saudi/Russian price war and COVID-19 lockdowns, as small, leveraged companies like Centennial and Laredo have had the biggest gains. However, stock prices for all of the Permian comp group companies remain below all-time highs.

Federal Lands Drilling Ban Could Shift Production Within the Basin

Part of President Biden’s environmental platform was banning new oil and gas permitting on public lands. An initial action under this platform was a 60-day moratorium on permitting activity, though that was recently blocked by a federal judge. While many think a ban would have relatively modest impacts at a macro level, the impacts could be more severe for companies and areas with a high level of exposure to federal lands.

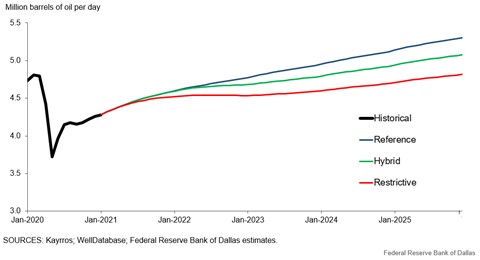

The Federal Reserve Bank of Dallas performed an analysis to look at the potential impact to the Permian Basin. Under a restrictive policy scenario, production growth would slow (relative to no change in policy), though overall production from the basin is still expected to increase.[1]

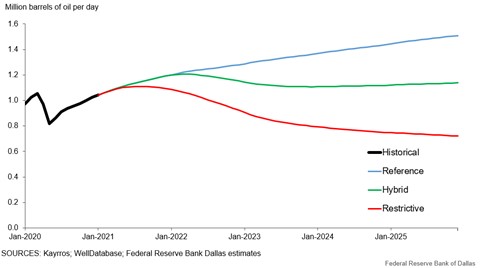

However, approximately half of New Mexico’s Oil & Gas production comes from federal acreage. As such, the impacts to New Mexico are much more acute under a restrictive policy scenario. The consequence is a shifting of drilling activity (and associated employment and spending) from New Mexico to Texas.

Conclusion

The Permian was not immune to the impacts of historically low oil prices observed in 2020, though it has proven to be resilient. Production, while still below peak levels, is growing, and growth is generally expected to continue. Activity levels are improving, though companies’ current emphasis on returning cash to shareholders may lead to less investment than has been seen in previous periods with similar commodity price environments.

We have assisted many clients with various valuation needs in the upstream oil and gas space for both conventional and unconventional plays in North America, and around the world. Contact a Mercer Capital professional to discuss your needs in confidence and learn more about how we can help you succeed.

[1] The Dallas Fed describes the policy scenarios as follows:

- Reference Case: This serves as the benchmark and assumes little-changed leasing, permitting and drilling from first-quarter 2021 levels.

- Hybrid Case: It assumes no new federal leasing, but existing leaseholders continue receiving drilling permits. Permit reviews are more rigorous, leading to slower approvals and a costlier operating environment beginning in 2022. Based on companies’ public statements, firms that hold acreage across the basin gradually relocate drilling rigs and completion crews to their nonfederal locations.

- Restrictive Case: No new federal permits or extensions are granted starting in 2023. This is when the most-recently issued permits will expire. The existing permitting freeze adversely affects production in the near-term due to a lack of approvals of permit modifications and pipeline rights-of-way. As in the Hybrid Case, companies shift their focus to nonfederal acreage.

Energy Valuation Insights

Energy Valuation Insights