Permian M&A Update: A Buyer’s Market

Pocketbooks Open for More Deals and Larger Positions

Transaction activity in the Permian Basin picked up in earnest this past year, indicating greater optimism in extracting value from the West Texas and Southeast New Mexico basin.

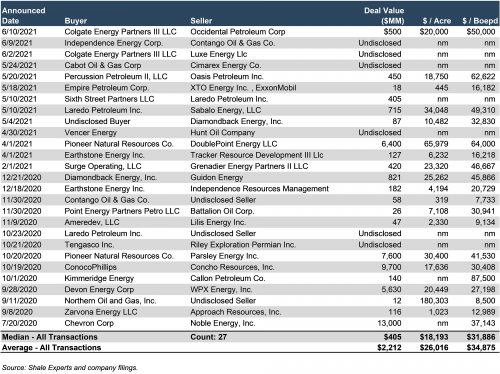

A table detailing E&P transaction activity in the Permian over the last twelve months is shown below. Relative to 2019-2020, deal count increased by five transactions, representing an increase of 23% over the 22 transactions in the prior period. Furthermore, median deal size nearly tripled from $138 million to $405 million, period-over-period. The median acreage among these transactions increased 2.5x from 14,500 acres to 36,250 acres (not shown below). Given the concurrent increase in transaction values and greater acreages acquired, the median price per net acre was down a slight 4% period-over-period.

The big story though, was production. The median production among transactions from June 2018 to June 2019 was 2,167 barrel-oil-equivalent per day (“Boepd”); while over the past twelve months, the median production value was 8,950 Boepd (not shown). As buyers “purchased in bulk” this period relative to the prior twelve-month period, the median transaction value per production unit declined nearly 41% from $53,584 per Boepd to $31,886 per Boepd. Transactions came in waves. There was one transaction announced regarding Permian properties between June and August 2020. September saw three deal announcements, and 10 transactions were announced during Q4 2020. Activity fell silent in Q1 2021 as the industry waited for the Biden Administration to settle in Washington. Deal announcements then resumed in earnest in Q2 as WTI crude oil and Henry Hub natural gas prices showed signs of fairly stable upward trajectories, with the exception of a temporary spike in gas prices due to the mid-February freeze.

Click here to expand the image

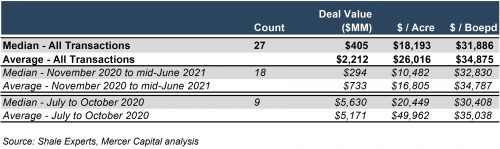

Looking a bit closer at the data, it appears there may have been an inflection point in deal valuations over the past twelve months. First and foremost, there was a notable concentration of larger-than-average deals, in terms of transaction values, from July to October 2020. Except for the Pioneer Natural Resources DoublePoint Energy transaction in early April, all deal values after October 2020 pale in comparison to those in the early period. As presented in the comparative statistical tables below, bifurcating the presented metrics further between the periods of July to October 2020 and November 2020 to the present reveals the potential pivot in valuations.

The post-October median transaction value declined 95% to just $294 million from the pre-November median value of $5.6 billion. However, more tellingly, the cost per acre nearly halved with the median metric value declining from $20,449/acre in the July-October 2020 transactions to $10,482/acre in the post-October transactions. If you remove the outlier value of the Northern Oil and Gas transaction ($180,303/acre), the nearly 50% decline is slightly reduced to an indicated decline of 45% in the price per acre. I am not a gambler, but without soliciting direct commentary from the respective management of the buyers listed above, I would wager that the inbound Biden Administration and the uncertainty surrounding potential regulatory changes were a significant factor in this valuation decline.

Click here to expand the image

One noteworthy pair of transactions, which may receive further Mercer Capital analysis sooner than later, relates to acquisitions made by Pioneer Natural Resources, including the October 2020 announcement of a definitive agreement to acquire Parsley Energy and its April 2021 announcement of a definitive agreement to purchase the leasehold interests and related assets of DoublePoint Energy. Pioneer was the only buyer to appear more than once on our list of transactions with a major transaction before November and one after (for which deal metrics were available), with indications of significant increases in the cost-per-net-acre and cost-per-Boepd valuation metrics.

Northern Oil and Gas Enters the Delaware Basin

In September 2020, Northern Oil and Gas announced its entrance into the Permian with its acquisition of non-operated working interests in Lea County, New Mexico from an undisclosed seller. The deal consisted of 66 net acres, with an initial 1.1 net wells proposed to be spud in late-2020 to early-2021 and production expected to start in Q2 2021. The total acquisition costs (including well development costs) were expected to be $11.9 million. At first blush, these metrics indicate a cost per net acre of approximately $180,300, which suggests a notable premium.

The next highest cost per net acre value among the transactions listed was $67,000 for the Pioneer Natural Resources-DoublePoint Energy deal announced in April. A premium was paid as far as net acreage acquired is concerned. However, at the expected peak production rate of 1,400 Boepd, the cost per production unit was $8,500 per Boepd, the second-lowest metric after Contango Oil & Gas’s acquisition in late November, and one-third of the minimum $-per-Boepd metric among the transactions listed in the June 2019-2020 season. Despite recent volatility in the industry due to energy prices and domestic regulatory changes–whether real or proposed–the economics of the Permian have remained attractive enough to induce Northern Oil and Gas, a stalwart Bakken E&P company, to try its hand in Southeast New Mexico.

Vencer Energy Acquires Hunt Oil Company’s Midland Basin Assets

In late April, Vencer Energy, the U.S. upstream Oil & Gas subsidiary of the Dutch energy and commodity trading giant, Vitol, announced its first investment in the Midland Basin. While the total transaction value was not disclosed, the acquisition included approximately 44,000 net acres with a total estimated production of 40,000 Boepd. This represents an estimated total annualized production of approximately 332 Boe per net acre. This “production density” value (annualized production per net acre) is the second-highest value among the listed transactions, only behind the comparable metric of 376 Boe per net acre indicated from the Pioneer-Double Point deal (with acquired/estimated production of 100,000 Boepd across 97,000 net acres).

Ben Marshall, Head of Americas – Vitol, commented on the transaction: “This is an important day for Vencer as it establishes itself as a significant shale producer in the U.S. Lower 48. We expect U.S. oil to be an important part of global energy balances for years to come, and we believe this is an opportune time for investment into an entry platform in the Americas. This acquisition represents an initial step to building a larger, durable platform in the U.S. Lower 48.”

Conclusion

M&A transaction activity in the Permian was a bit of a roller coaster over the past year in terms of deal timing, but the overall story is one of resurgence over the past twelve months relative to the twelve months before it. Still, despite a renewed interest in acquiring greater acreage and production positions, even greater changes could be on the horizon. This past week, it came to light that Shell was reviewing its Permian holdings for potential sale, according to certain people familiar with the matter. However, it is pure speculation at this juncture as to what option(s) Shell may pursue regarding the partial or full sale of the company’s estimated more-than-$10 billion of Permian holdings. Assuming any dispositions, though, this news could portend even more opportunities for continued buy-in into the Permian by existing regional E&P companies and potential new entrants.

Energy Valuation Insights

Energy Valuation Insights