Four Themes from Q4 2018 Earnings Calls

We Read the Earnings Calls so You Don’t Have to

Commodity prices exhibited significant volatility to end 2018 with steep declines in crude prices and a spike in natural gas prices that subsequently fell back. The general market also declined over the period, making it difficult to parse reasons for various stock price gyrations. While lower prices aren’t ideal for industry operators, earnings calls remind wary investors that there’s more to price than what trades on the NYMEX. Executives this quarter also note a shift in focus when it comes to capital outlays.

We take a look at some of the earnings commentary of large players in the oil and gas space to gain further insight into the challenges and opportunities developing in the industry.

Theme 1: Hedging Protects Operators from Lower Crude Prices

- Our 2019 crude oil hedge positions remain unchanged. We have 95,000 barrels of oil per day hedged for calendar 2019 with $60 WTI put option contracts. We expect option premium amortization will be approximately $29 million per quarter in 2019. –John Rielly, CFO, Hess Corporation

- It is notable that we remain the only publicly traded U.S. producer that is 100% hedged on expected natural gas production in 2019. –Glen Warren, President and CFO, Antero Resources Corporation

In order for operators to mitigate risk and volatility in commodities such as crude oil and natural gas, many companies will engage in hedging, mostly by use of derivative instruments. This ability to effectively pay a fixed price over future periods of time, commonly in the form of commodity futures and various option contracts, allows for more certainty and stability in cash flows particularly when prices exhibit volatility. This is particularly important for an industry that requires significant capital outlays and long term budgeting plans. While hedging is certainly beneficial when markets behave as they did in Q4, it is important to realize these contracts come at a cost as noted in the Hess quotation above. In response to analyst questions, Hess Corp’s CEO noted future hedging would be of a similar structure where they “protect the downside but we don’t cap the upside.”

Hedging protects E&P companies from adverse price realization, effectively propping up operations when commodity prices fall. These instruments tend to smooth results, so revenue does not drop too severely in bad times, though its costs do lower profits in times of rising prices. When valuing E&P companies, the increased cost would be a calculated reduction in value; however, hedging lowers volatility and risk. If companies sought to save this cost and expose themselves to commodity risk, it could be subject to a higher discount rate to account for these risks. Ultimately, hedging is a form of insurance and is a cost of doing business.

Theme 2: Local Pricing and Transportation Issues Also Obscure Prices Achieved by Operators

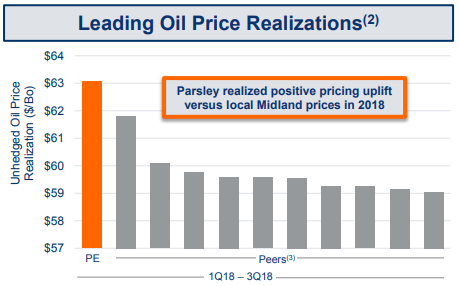

- 2018 was a volatile year for oil prices, especially in the Permian. As you can see on Slide 4, we successfully navigated a challenging midstream takeaway situation throughout the year and delivered a realized oil price that comfortably outpaced both, our peers and local Midland prices. Even more importantly, our proactive marketing strategy delivered ample flow assurance without burdening our long-term pricing structure. So we would expect to stay near the top of the class on this measure in coming years. –Matt Gallagher, President and CEO, Parsley Energy, Inc.

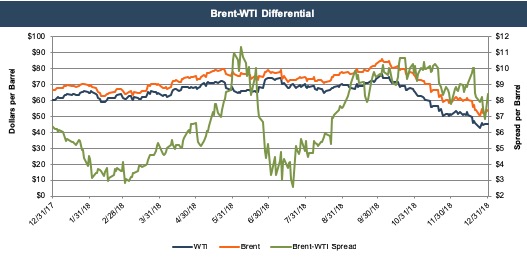

- Our strategy is to have multiple export markets here to provide us flexibility to move our oil into the highest value market. So, we can get about 70% of our oil to the coast to get the Brent influenced pricing. –John Rielly, CFO, Hess Corporation

- The ability to sell this oil at Brent-related pricing has had a very positive impact on both margins and returns in 2018. For instance during the fourth quarter, we moved about 90% of our oil to the Gulf Coast which had the effect of increasing our oil margins by over $9 per barrel. –Rich Dealy, Executive Vice President & CFO, Pioneer Natural Resources Company

A recurring theme throughout 2018 was the pricing differentials between localized prices and those seen on different exchanges such as the standardized Cushing, Oklahoma. The Brent-WTI spread was also pronounced throughout the year, with an average spread of $6.79 per barrel, peaking at $11.37 in June. Capacity constraints from a lack of infrastructure in place to bring the product to market played a role in this, and operators in all regions dealt with localized pricing differentials. As we see from these quotes, many operators are seeking markets where they can achieve higher pricing, particularly those related to Brent in the Gulf Coast.

Higher prices received for a given level of production increases profit for E&P companies, but transporting the product to these markets incurs increased costs too. Ultimately, companies must balance the increased revenue with the incrementally increased costs to make sure returns are realized from this strategy.

Theme 3: Lower Prices Reign in CapEx Budgets

- Last month we discussed various capital budgets through three different pricing scenarios, but we’ve decided to limit our full capital spend in 2019 to $4.5 billion. This represents a $500 million or a full 10% reduction from 2018. By maximizing efficiencies, we are reducing spending to adjust to a lower oil price environment. –Vicki Hollub, President and CEO, Occidental Petroleum Corporation

- If we get extended in an extended low-price environment and really would have to go really more into 2020, the tail-end of 2019 into 2020, in that case an extended low-price environment we have the flexibility as we mentioned to reduce our annual CapEx by as much as $1 billion and that’s principally by reducing rigs in the Bakken. –John Hess, CEO, Hess Corporation

- In an effort to align spending with cash flow projections both Appalachia and Permian producers are reducing 2019 capital budgets, which results in lower supply growth in 2019 with an even more meaningful supply impact in 2020. –Glen Warren, President and CFO, Antero Resources Corporation

- Antero will remain flexible depending on the commodity price outlook. We will remain disciplined, spending within cash flow in a low case but have the ability to prudently grow production to maximize free cash flow if commodity prices improve ultimately delivering an appropriate mix of return of capital to shareholders and further deleveraging. –Paul Rady, Chairman & CEO, Antero Resources Corporation

Many CapEx budgets for 2019 and beyond were revised downward after the steep drop in oil price as it makes less sense for operators to ramp up production under these conditions. As is noted above, CapEx budgets will remain flexible as an increase in prices would induce operators to produce more in the short-term.

Higher CapEx spending in the near term increases revenue for E&P companies, though this will ultimately decrease overall return if the operator does not scale back production until prices rise again.

Theme 4: Market Not Paying for Growth Without Return

- Capital discipline has been the buzzword in the E&P industry throughout most of 2018, and certainly as we enter 2019. At Marathon, we have a very clear working definition of capital discipline […] It means prioritizing sustainable free cash flow generation at conservative prices over growth for growth sake. We’ve been very clear that production growth is simply an outcome of our disciplined capital allocation process, and given our commitment to returns and cash flow, we emphasize high-value oil growth to drive both high margins and capital efficiency. And with sustainable free cash flow, capital discipline for us is also a commitment to return capital back to shareholders, through both our peer competitive dividend and thoughtful share repurchases. –Lee Tillman, Chairman, President, and CEO, Marathon Oil Corporation

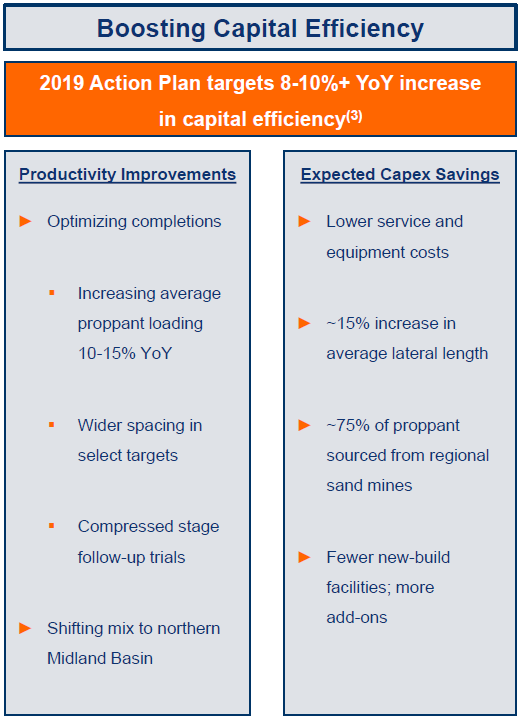

- The steps we took in 2018 will be really important when it comes to 2019 in the sense that we in our 2019 plan can point to a significant CapEx decrease about 11% compared to 2018, while at the same time delivering a strong 15% increase in production. So, we’re very excited about what 2019 holds when we can show that kind of capital efficiency gains. –Tim Dove, President & CEO, Pioneer Natural Resources

- Well, I think, first of all, we are slowing down growth, if you look at this year compared to the prior two years, we’ve been well into the 20s in terms of growth percentages. We have moved this down. We have a range now which centers on 15%. Obviously, we can ratchet within that range at a moment’s notice. It’s based on how much activity we want to execute on. But fundamentally, we’ve taken significant steps to increase basically return of capital to shareholders and we wouldn’t have a $2 billion share repurchase plan if that wasn’t the case. But I think we have to go further. –Tim Dove, President & CEO, Pioneer Natural Resources

- Parsley expects to see an 8% to 10% plus year-over-year improvement on capital efficiency during 2019. We expect both productivity gains and CapEx savings to drive this improvement as detailed down the right hand side of the slide. –Matt Gallagher, President and CEO, Parsley Energy, Inc.

As a consequence to reductions in capital budgets, companies are emphasizing capital efficiency over capital expenditures. The market has indicated that a perpetual cycle of growth not sharing the returns with investors is becoming less appealing. Doug Leggate, a Merrill Lynch analyst and frequent participant on industry earnings call Q&A sessions, posed this question directly to Pioneer, specifically noting the share price had not increased since March 2016 despite production doubling in that time frame. The CEO’s response is our third quotation above. Companies will need to strike a balance between funding their growth operations, paying down debt, and returning capital to investors in the form of dividends and share repurchases.

Capital efficiency, that does not negatively impact long-term growth prospects, would increase the value of E&P companies as it focuses on increasing returns. In the typical Gordon Growth model for determining intrinsic value of a stock, it gives investors a return in the form of dividends as opposed to capital appreciation, which is only rewarded if the market is willing to pay for it.

Energy Valuation Insights

Energy Valuation Insights