From Enduro to Permianville

A Closer Look at Permianville Royalty Trust

In previous posts, we have discussed the relationship between public royalty trusts and their market pricing implications to royalty owners. Many publicly traded trusts are restricted from acquiring other interests, so they have relatively fixed resources, and the value of these trusts comes from generally declining distributions. In many cases, the royalty comes from a related operator, though this is neither required nor characteristic of all trusts. There are also other MLPs such as Kimbell Royalty Partners, Viper Energy Partners, Dorchester Minerals, and Black Stone Minerals that are aggregators consistently gobbling up new acreage. In this post, we explore the subject characteristics of Permianville Royalty Trust, formerly known as Enduro Royalty Trust.

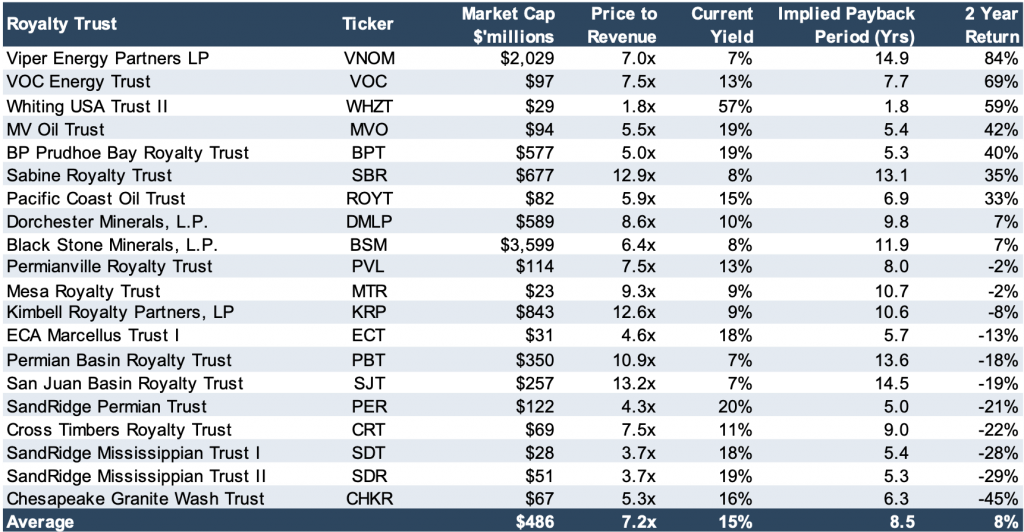

Market Observations

It’s been a while since we’ve looked at this group, and Permianville Royalty Trust isn’t the only change. Hugoton Royalty Trust voluntarily delisted from the NYSE last August after not being able to sustain a sufficient stock price. Over the previous two years, the performance of the remaining 20 publicly traded royalty trusts and partnerships has varied widely. The table below shows the performance and other key metrics of the 20 main oil and gas-focused entities that are publicly traded, as of March 28, 2019.

Returns are pretty evenly split, with 9 positive and 11 negative. With oil prices rising 23% in the past two years and natural gas declining 8%, it’s not too difficult to pick out which trusts receive royalties from which commodity, though other factors such as timing and operator certainly play a role.

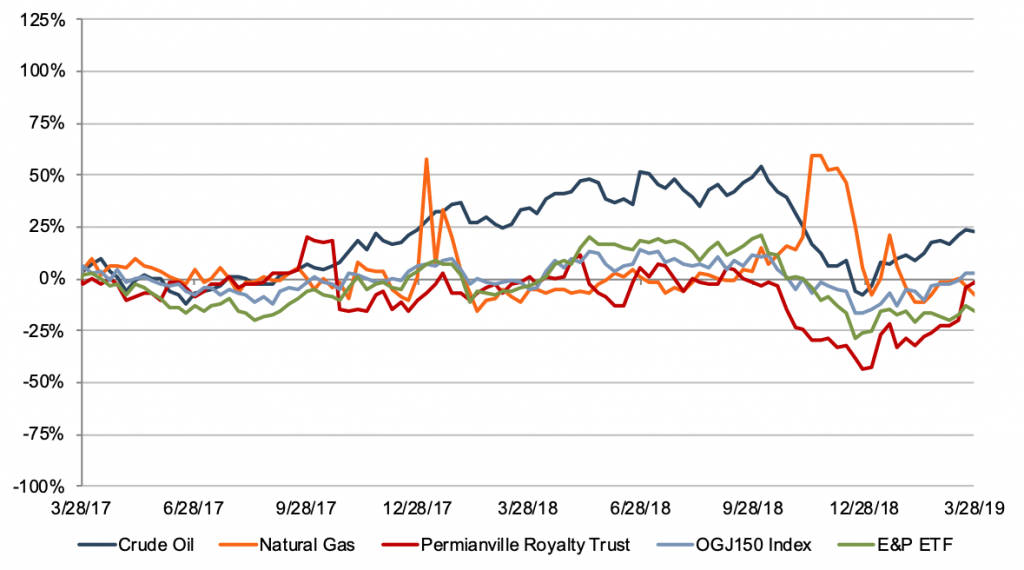

For comparison, the chart below shows the two-year returns from Permianville Royalty Trust (PVL), crude oil, natural gas, the O&G150 Index, and a publicly traded E&P ETF called “SPDR S&P Oil & Gas Explore & Prod. (XOP)”. Interestingly, PVL has had little correlation with either crude (+25.9%) or natural gas (-37.0%) prices over the past two years, likely due to its exposure to both commodities and other notable activity specific to the Trust as discussed later.

Permianville Royalty Trust Origination and Sale

Enduro Royalty Trust was formed in May 2011 to acquire and hold a net profits interest (NPI) representing the right to receive 80% of the net proceeds from interests in certain oil and natural gas producing properties located in Texas, Louisiana, and New Mexico. These underlying properties were held by Enduro Resource Partners and are in both conventional and unconventional plays. The initial IPO occurred in November 2011 issuing 13.2 million units at $22. A second offering occurred in October 2013 issuing 11.2 million additional units at a reduced price of $13.85. No further offerings or redemptions have occurred, leaving the number of Trust Units outstanding at 33 million, including the 8.6 million units originally retained by Enduro.

Seeking to rebrand from its former operator, the Trust opted to capitalize on the hype on opposite ends of Texas to reflect its holdings in the Permian and Haynesville Shale.

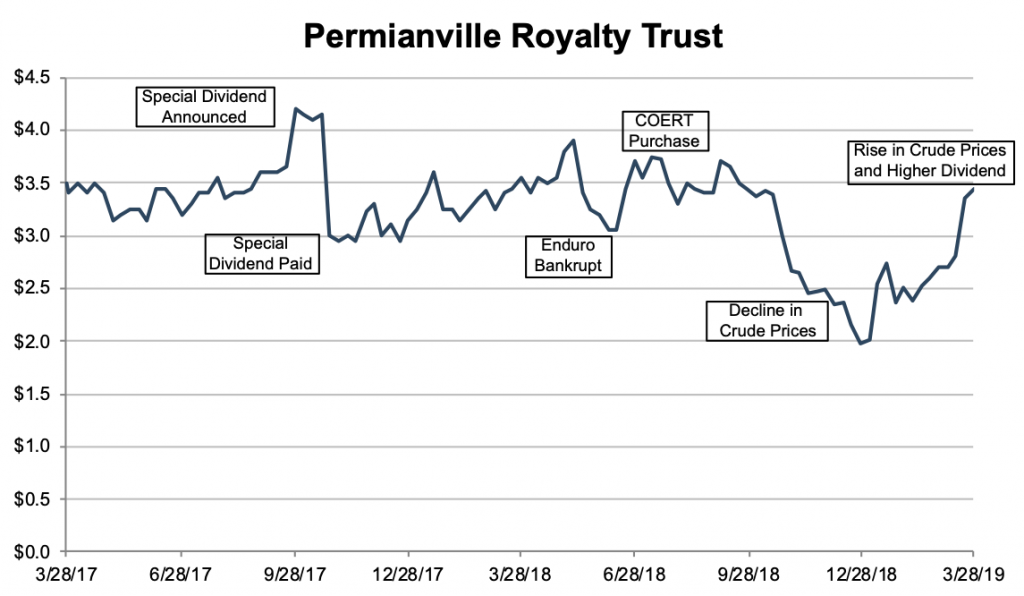

On May 15, 2018, Enduro Resource Partners buckled under its debt load and filed for Chapter 11 bankruptcy. This significantly impacted the royalty trust, similarly to how SandRidge’s issues have plagued its royalty trusts. Three days later, the Trust declared a dividend of $1.13 million, down 42.5% from the prior month, further exacerbating the decline. The Trust’s share price declined 12.8% from May 10th to May 17th and fell to almost $3 per share a month after the announcement when it was trading closer to $4. On August 31, Enduro finalized a sale of the underlying properties and its outstanding Trust Units to COERT Holdings 1 LLC. This helped stabilize the stock price of the royalty trust as it increased from $3.4 on August 30th to $3.7 by September 6th. According to footnotes of an SEC filing, COERT Holdings paid an aggregate gross consideration of $35.75 million for the 8.6 million Trust Units held by Enduro. This implies a unit price of about $4.16, significantly higher than the price seen around this time.

In connection with the sale, COERT assumed all of Enduro’s obligations (became the “Sponsor” of the Trust) with minimal disruption to unitholders anticipated. Notably, the portfolio consisted primarily of non-operated interests, easing any transition concerns. Seeking to rebrand from its former operator, the Trust opted to capitalize on the hype on opposite ends of Texas, changing its name to Permianville Royalty Trust to reflect its holdings in the Permian and Haynesville Shale. It should be noted, however, that not all of its holdings in East Texas are in the Haynesville.

Permian + Haynesville = Permianville

Underlying Properties

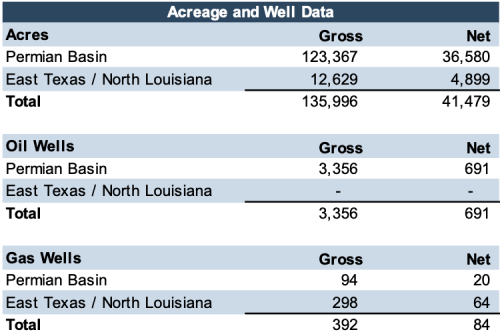

The Permian has dominated shale production in the U.S. over the past year, but Haynesville Shale has made a push of its own recently. It surpassed the Bakken with 58 rigs in the first week of March, which it has only done for a brief period at the beginning of 2018 and before then in 2011 when it also had more rigs than Appalachia and the Eagle Ford. According to the EIA March Drilling Productivity Report, Haynesville only trailed Appalachia in new-well gas production per rig while legacy gas production has declined slower than both Appalachia and the nearby Eagle Ford. Despite these gains, the Permian still dominates in terms of production and the majority of Permianville Royalty Trust’s acreage is in the Permian basin with 88% of net acreage and 92% of net wells.

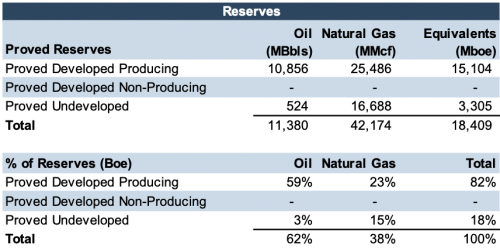

As seen in the chart below, the majority of the Trust’s proved reserves are developed, oil reserves at 59%. Natural gas makes up approximately 38% of reserves, split between producing and undeveloped. This makes sense as the Permian is the main focus of the Trust, with Haynesville adding a bit of upside in terms of reserves with potential that have yet to begin producing.

Operators and Customers

As noted earlier, Permianville Royalty Trust is operated predominantly by operators other than COERT. Only 17 of 3,748 gross wells (0.5%) are operated by the Sponsor, and these wells are in the East Texas/North Louisiana region. Other operators include Aethon Energy Operating, BHP Billiton, EXCO Resources, and Indigo Resources. The primary operators in the Permian Basin are Apache Corporation, XTO Energy, and Occidental Petroleum. Most drilling activity for the underlying properties in 2018 was focused on the Permian Basin with six gross (0.5 net) wells drilled in 2018. In 2017, roles were reversed as six gross (0.5 net) wells were drilled in the Haynesville Shale. While capex budgets are determined by each individual operator and subject to change (as we saw many operators do in 2018) the Sponsor anticipates capex for 2019 to range between $5 million to $7 million prior to consideration of the 80% NPI.

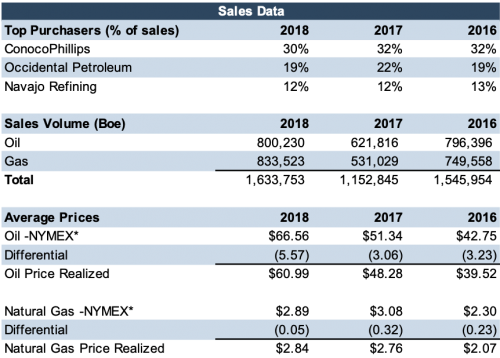

The top purchasers of the oil and gas produced from the underlying properties are displayed in the chart below. The realized prices are also included. Notably, the realized price on natural gas increased in 2018 despite declines on the NYMEX, likely because most of the gas harvested is near the Henry Hub.

*Applicable NPI Period per 10-K

Termination of the Trust

A traditional royalty interest typically continues into perpetuity. In contrast, many public royalty trusts have a set termination based on a specific date and/or production level. Permianville Royalty Trust differentiates itself as it is not subject to any pre-set termination provision such as time or production. The Trust will dissolve upon the earliest of the following:

- The Trust sells the NPI (subject to approval from at least 75% of unitholders);

- The annual cash proceeds received by the Trust attributable to the NPI are less than $2 million for two consecutive years;

- 75% of unitholders vote in favor of dissolution; or

- The Trust is judicially dissolved.

Upon dissolution, the trustee would then sell all of the Trust’s assets and distribute the net proceeds of the sale to the trust unitholders. Net profits allocable to NPI have been $15.2 million, $7.5 million, and $9.3 million in the past three years, mitigating concern the Trust would be dissolved in the near-term.

Disposal of Interests Related to Permianville Royalty Trust

NPI received by unitholders exclude the sale of underlying properties, but this does not prevent the sale of assets; however, unitholders will be compensated if a sale occurs. Without a vote of approval, the Trust is only able to release the net profits interest associated with a lease that accounts for up to 0.25% of total production for the past 12 months without consent of unitholders. The sale also cannot exceed a fair market value of $500,000, and both limits are common features of royalty trusts. COERT sold a couple of producing wells and corresponding acreage in Glasscock County for approximately $62 thousand in January 2019.

With the large capital outlays required, companies must be conscious of their cost of capital, frequently increasing debt to fund new projects.

To make a larger sale, approval originally required consent from 75% of unitholders. However, at a special meeting in August 2017, unitholders approved amendments to the Trust Agreement decreasing this figure to a simple 50% majority. The next month, the Trust under Enduro’s stewardship divested $49.1 million worth of its underlying properties. Net of transaction expenses, the 80% NPI, and an indemnity holdback, the Trust distributed nearly $38 million to unitholders, a special dividend amounting to about $1.15 per share. By comparison, the Trust has only distributed about 90 cents per share in regular monthly dividends over the past three years. As expected, shares of the Trust spiked upon announcement of the special dividend, then decreased by approximately the amount of the dividend once paid a month later.

Divestitures are much more common in the oil and gas industry than the general market as companies seek to develop expertise in core regions. With the large capital outlays required, companies must be conscious of their cost of capital, frequently increasing debt to fund new projects. The need to service this debt sometimes causes E&P companies to divest certain holdings. This is why industry participants frequently refer to transactions as A&D (acquisitions and divestitures) as opposed to M&A (mergers and acquisitions) in other industries.

Such disposals, like the divestiture made by Permianville Royalty Trust, can have either positive or negative impacts on unit/shareholders. Ultimately, it depends on the sale price achieved. For royalty trusts, large divestitures lead to special dividends that represent an expedited yield. This could be a positive as such investments are typically seeking a return of their capital with declining distributions. According to the principles of time value of money, it is better to receive cash sooner rather than later. However, such divestitures could lead to different tax treatment and alter the expected return profile for investors. Also, if prices or production turn out to be higher than expected, the upfront sale can have a negative impact in the long-run. This is particularly interesting for Permianville Royalty Trust as it does not have a defined termination date.

Conclusion

The performance of Permianville Royalty Trust has varied over the past two years, as it divested assets, changed its name and sponsor, and experienced commodity price volatility. Those who initially sold their units after Enduro filed for bankruptcy may wish they had held on longer. This is certainly true for people who couldn’t wait for oil prices to rebound following the crash in 2014 and likely anyone who sold prior to the announcement of the special dividend in 2017. After the Q4 dip in prices, the Trust also announced its largest monthly dividend since July 2014 concurrent with its 2018 10-K filing, boosting share price further.

When investing in a public royalty trust or using it as a pricing benchmark for private royalty interests, there are many items to consider that are unique to each royalty trust. The source of income, region, operator, sponsor, termination (or lack thereof), and other key aspects make each trust unique.

We have assisted many clients with various valuation and cash flow questions regarding royalty interests. Contact Mercer Capital to discuss your needs in confidence and learn more about how we can help you succeed.

Energy Valuation Insights

Energy Valuation Insights