M&A Activity in the Oilfield Service Sector

From Surviving to Thriving

The oilfield service sector has recovered significantly since the crash in oil prices in mid-2014. As capex budgets have expanded, especially in the Permian Basin, demand for oilfield services such as drilling and pumping has increased. But what does this mean for transaction activity in the sector?

The oilfield service industry was in consolidation mode over the last few years as smaller servicers struggled to survive in the low oil price environment which translated to lower day rates. Thus the relatively fewer transactions from 2015 through much of 2017 were mainly distressed sales.

Now that oil prices have recovered, drilling activity has picked up, and day rates have increased, the reason for deals has changed. Rather than merging to survive, companies are acquiring in order to thrive. When discussing transactions in oilfield services sector over the past few years, maybe it should be called mergers THEN acquisitions.

From Mid-2014 to Mid-2017 Oilfield Servicers Were Surviving

When oil prices fell, demand for oilfield services declined significantly. Despite the steep drop in prices, production did not fall through the floor because the cost of stopping and starting production can outweigh the loss incurred from lower oil prices. Still, the oilfield services sector felt the pain as many of its high value-added services occur at new sites rather than currently producing ones. With low oil prices, people became more judicious with how they deployed capital and new projects were largely tabled. Companies in financial duress were forced out of the market through consolidations and bankruptcy, as other sources of capital such as debt or additional equity offerings dried up due to the uncertainty surrounding future oil prices.

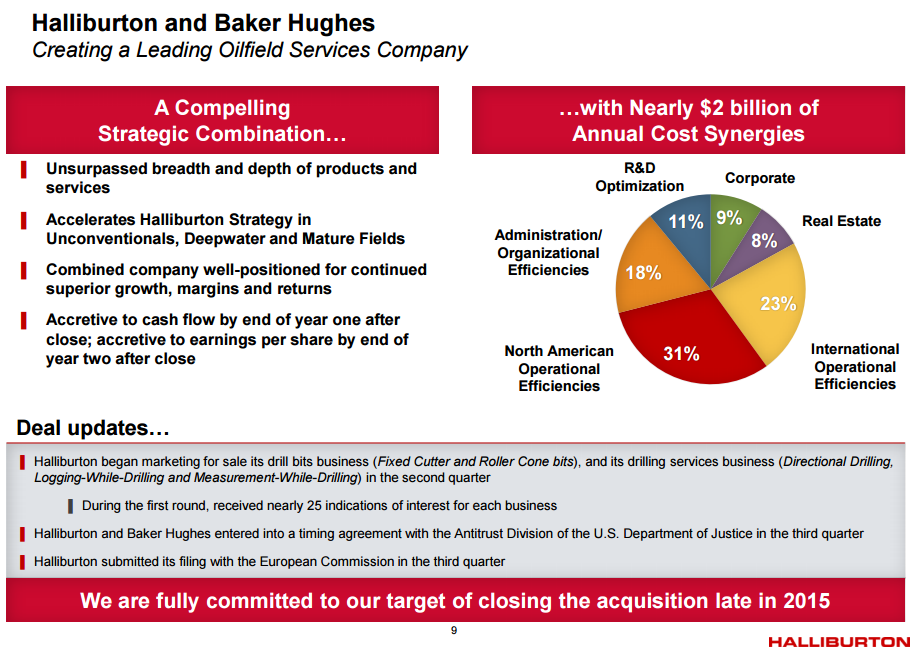

M&A activity for the oilfield services sector was largely muted during the downturn in terms of both deal volume and value. Deal value would have been larger had Halliburton Company successfully completed its megamerger with its competitor Baker Hughes Inc. for an announced $34.6 billion. Instead of searching for synergies to boost revenue, companies were seeking to combine to eliminate duplicative expenses. In the case of Halliburton and Baker Hughes, the merger was expected to cut nearly $2 billion in annual costs according to the investor material seen below. Ultimately, this became the downfall of the deal as regulators denied it on grounds of decreased competition and reduced innovation on account of too much overlap in services.

One year after the U.S. Justice Department blocked the deal due to anti-trust laws, General Electric bought a controlling interest (62.5%) in Baker Hughes. The combined entity resulting from GE’s investment caused GE’s combined revenue to surpass Halliburton, becoming the second largest company by revenue in the industry, trailing only Schlumberger.

In early 2017, streamlining operations and eliminating expenses via consolidations was viewed as “the last big step to margin improvement,” according to the Coker Palmer Institutional. By the end of the year, there were 215 transactions in 2017, up 13% from 2016. As the tide began to turn, factors influencing transaction activity shifted from financial stress and cost efficiencies to economies of scale and enhanced offerings, particularly in digital technology.

Oilfield Servicers Are Now Thriving

As oil prices have recovered, up to $60 a barrel at the end of 2017 and peaking at $72 in May 2018, transaction activity has increased, but the reason for this increase in activity has changed. Companies that survived the downturn in oil prices stood to gain as rising oil prices aided margins and increased capex budgets for E&P companies. As break even prices became less of a concern for the industry, growth and innovation became the focus. Oilfield services companies depend on innovation to distinguish themselves in a highly fragmented industry, and when prices caused capital to flow out of the industry, companies were unable to fund the research and development necessary to innovate. Now, that trend is reversing with funding flowing into the sector to support growth and innovation. This is particularly important due to the capital-intensive nature of oilfield services, requiring significant investment to buy more equipment to meet growing demand.

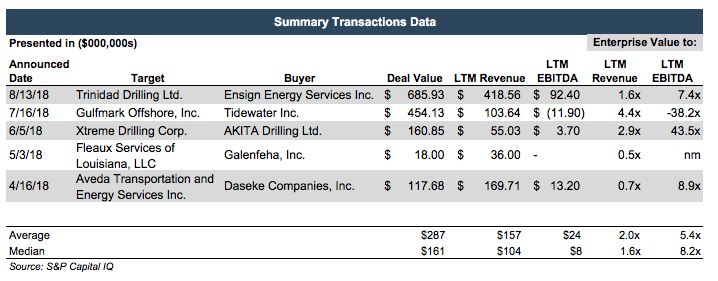

The following table shows some strategic transactions that have occurred thus far in 2018, as companies seek growth opportunities. However, we are starting to see more investment from other sources.

Private Equity Firms Are Suppling Growth Capital

After years of industry executives searching for diamonds in the rough, institutional investors have joined the fray. Over the last twelve months, there has been an influx of funds from private equity firms and hedge funds as growth, innovation, and fragmentation are all desirable traits for these investors.

In March, Morgan Stanley Energy Partners (MSEP), the energy-focused private equity arm of Morgan Stanley Investment Management, completed an investment in Specialized Desanders, Inc. a Canadian-based oilfield equipment company that specializes in efficiently removing sands and other solids during the well flowback and production process. MSEP’s investment seeks to accelerate growth in the U.S. market and expand their product offerings.

In August, MSEP continued investing with its announcement of a partnership with Catalyst Energy Services. Proceeds from the investment will be used to buy state-of-the-art equipment which will allow the company to grow to meet increased demands for modern completion designs from E&P companies.

Black Bay Energy Capital recently closed its inaugural fund with commitments of $224 million, exceeding their $200 million target. This includes six investments in oilfield service companies exhibiting rapid growth that “improve the efficiency and cost-profile of oil & gas producers.”

These investments made by MSEP and Black Bay show the three trends currently being exhibited in transactions in the oilfield services sector: niche product or specialty, innovative offering or technology, and growth. Whether it be strategic investors or private equity sponsors, acquisitions we are seeing now are largely spurring revenue growth instead of eliminating expenses.

Conclusion

Transaction volume in the oilfield services sector ebbed and flowed with oil prices over the last few years. On the way down, companies cut costs to survive, and mergers played an important role in increasing efficiencies in order to survive. On the way back up, companies sought capital to propel growth and fund innovation. As the market shifts from backwardation to contango and back again, Mercer Capital is here to help throughout all stages and economic environments.

In addition to our corporate valuation services, Mercer Capital provides investment banking and transaction advisory services to a broad range of public and private companies and financial institutions. We have relevant experience working with companies in the oil and gas space and can leverage our historical valuation and investment banking experience to help you navigate a critical transaction, providing timely, accurate and reliable results.

Whether you are selling your business, acquiring another business or division, or have needs related to mergers, valuations, fairness opinions, and other transaction advisory needs, we can help. Contact a Mercer Capital professional to discuss your needs in confidence.

Energy Valuation Insights

Energy Valuation Insights