M&A in the Permian: Acquisitions Slow as Valuations Grow

Transaction activity in the Permian Basin cooled off this past year, with the transaction count decreasing to 21 deals over the past 12 months, a decline of 6 transactions, or 22%, from the 27 deals that occurred over the prior 12-month period. This level is in line with the 22 transactions that occurred in the 12-month period ended mid-June 2020. It is difficult to interpret the significance with any certainty. On one hand, it could indicate increased trepidation regarding production prospects in the basin. On the other hand, it could simply be a sign that regional E&P operators have started to “right-size” their inventories in the West Texas and Southeast New Mexico basin. Based on the evolving economics of the region, as we will examine further below, the latter case may be closer to the truth.

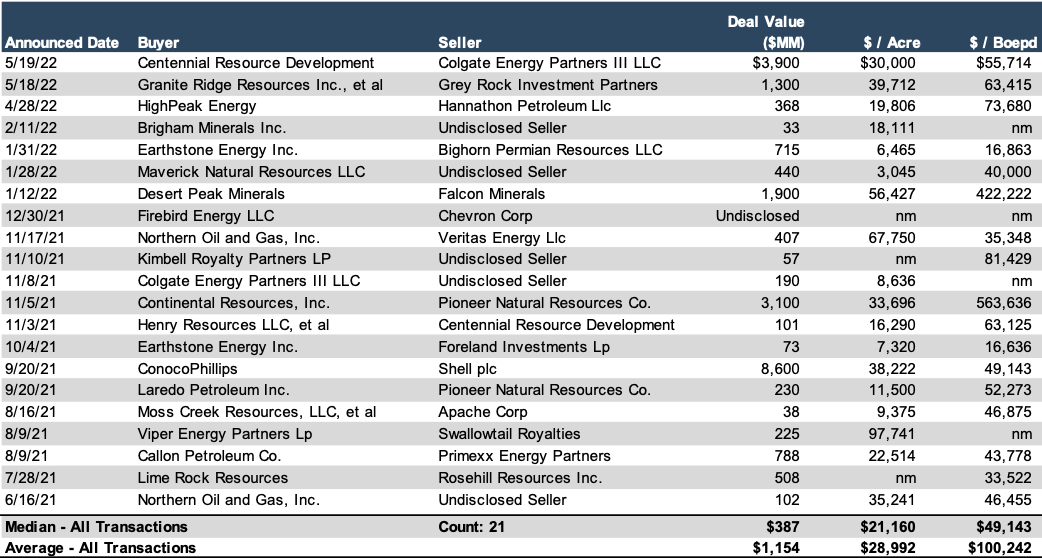

A table detailing E&P transaction activity in the Permian over the last twelve months is shown below. Relative to 2020-2021, the median deal size nearly was $387 million, just 4% lower than the median deal size of $405 million in the prior 12-month period. However, the median acreage purchased over the past year was 21,000 net acres, just over 42% lower than the 36,250 acres among the deals in the previous year. Given the concurrent decrease in acquired acreage and relatively unchanged median transaction price, the median price per net acre was up 16% period-over-period. Looking at acquired production, the median production among transactions over the past year was 5,500 barrel-oil-equivalent per day (“Boepd”), a 39% decrease from the 8,950 Boepd metric from the prior year.

Given the relatively unchanged level in the median transaction value in conjunction with a lower median production level, the median transaction value per Boepd, unsurprisingly, jumped 54% from $31,886 in the prior 12-month period to $49,143 in the latest 12-month period. This willingness to pay over 50% more per acre and/or per Boepd suggests that these targets’ underlying economics have been, and remain, supportive. However, the marginal costs of these acquisitions may be approaching the perceived marginal returns projected for these properties, as evidenced by the decrease in the transaction count relative to last year.

Click here to expand the image above.

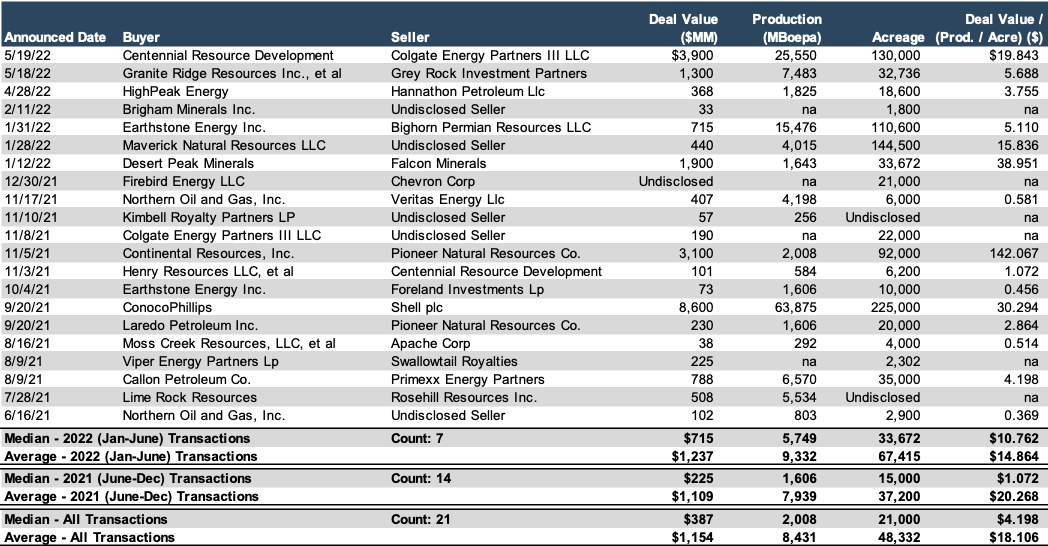

The approach to the marginal “equilibrium” appears to have been a pretty short runway to land on. Of the 21 transactions completed, 14 occurred from June to December, with the remaining 7 occurring from January 2022 to the present. One metric we analyzed, based on the deal value per production (annualized) per acre, indicates a sharp decline in the “bang for the buck” exhibited by the transactions before and after year-end 2021. As presented below, the median cost per production acre for the 14 transactions from June to December 2021 was $1.072. In contrast, the median metric for the seven transactions from January to June 2022 was $10.762, indicating a 10.0x increase in the cost per production acre.

A deeper dive into the details of each transaction would be needed to discern any common causes for this movement, but this could indicate a shift in focus from proven reserves towards unproven acreages. In other words, acquirers may be putting increased value on the potential optionality for greater-but-yet-proven production presented by these targets.

Click here to expand the image above.

Despite the upward trend in energy prices over the past year, what we are seeing is a likely slowdown in M&A activity in what is generally considered to be the most economical oil and gas basin in the U.S. If the Permian is a bellwether of U.S. production in general, are we likely to see a slowdown in M&A activity in other basins soon? I would venture to say “yes.”

Earthstone Energy Acquires Bighorn’s Permian Portfolio

In late January 2022, Earthstone Energy announced its agreement with Bighorn Permian Resources to acquire its Midland Basins assets for a total consideration of $639 million in cash and 5.7 million shares of Earthstone’s Class A common stock (the “Bighorn Acquisition”). The effective date of the Bighorn Acquisition was January 1, 2022, and the deal closed on April 18, 2022. The Bighorn Acquisition included 110,600 net acres (98% operated, 93% WI, 99% HBP), primarily in Reagan and Irion counties, with an estimated production of 42,400 Boepd (57% liquids, 25% oil), and proved reserves of 106 MMBoe (20% oil, 34% NGL, 46% natural gas).

Robert Anderson, President, and CEO of Earthstone Energy, commented, “The transformation of Earthstone continues with the announcement of the significant and highly-accretive Bighorn Acquisition. Combining the Bighorn Acquisition with the four acquisitions completed in 2021 and the pending Chisholm Acquisition, we will have more than quadrupled our daily production rate, greatly expanded our Permian Basin acreage footprint and increased our Free Cash Flow generating capacity by many multiples since year-end 2020. The proximity of the Bighorn assets to existing Earthstone operations positions us to create further value by applying our proven operating approach to these assets, primarily in the form of reducing operating costs. The addition of the high cash flow producing assets from Bighorn to the strong drilling inventory of Earthstone, including the Chisholm Acquisition, furthers Earthstone’s transformation into a larger scaled, low-cost producer with lower reinvestment in order to maintain combined production levels.”

Earthstone Energy Acquires Midland Basin Assets from Foreland Investments

In early November 2021, Earthstone Energy announced the completion of its acquisition of privately held operating assets located in the Midland Basin from Foreland Investments LP (“Foreland”) and from BCC-Foreland LLC, which held well-bore interests in certain of the producing wells operated by Foreland (collectively, the “Foreland Acquisition”). The aggregate purchase price of the Foreland Acquisition was $73.2 million at signing, consisting of $49.2 million in cash and 2.6 million shares of Earthstone’s Class A common stock valued at $24.0 million based on a closing share price of $9.20 on September 30, 2021. The Foreland Acquisition included approximately 10,000 net acres with an estimated production of 4,400 Boepd (26% oil, 52% liquids), and PDP reserves of approximately 13.3 MMBoe (11% oil, 31% NGL, 58% natural gas).

Mr. Robert Anderson, President and CEO of Earthstone, commented, “This transaction will be our fourth acquisition this year as we continue to advance our consolidation strategy and enhance our Midland Basin footprint with additional scale. The acquisition of these low operating cost, high margin, producing assets at an attractive valuation is a nice addition to our production and cash flow base. The Bolt-On Acquisition also includes approximately ~10,000 net acres (100% operated; 67% held by production) in Irion County. We expect to benefit from additional operating synergies when production operations are combined with other assets in the area. As we have done in prior acquisitions, we look forward to applying our operating approach to these assets in order to reduce costs and maximize production and cash flows.”

Conclusion

M&A transaction activity in the Permian declined at an increasing rate over the past year, with two-thirds of the 21 transactions occurring in 2021, and the remaining third transpiring in the YTD period ended in mid-June. But the overall upward trend in deal cost per unit (be it per-production level, acreage, or production-acre) indicates buyers’ willingness to pay more to achieve their desired asset base. The overall story is one of the companies right-sizing their presence in the basin.

We have assisted many clients with various valuation needs in the oil and gas industry in North America and globally. In addition to our corporate valuation services, Mercer Capital provides investment banking and transaction advisory services to a broad range of public and private companies and financial institutions. We have relevant experience working with companies in the oil and gas space and can leverage our historical valuation and investment banking experience to help you navigate a critical transaction, providing timely, accurate and reliable results. Contact a Mercer Capital professional to discuss your needs in confidence.

Energy Valuation Insights

Energy Valuation Insights