Public Royalty Trusts (Part II)

Can Revenue Interests Still Benefit from Capital Appreciation?

In a recent post, we explored the ins and outs of MV Oil Trust. We analyzed the underlying net profit interests it holds, the underlying properties of the trust, and the rights of unitholders including their rights during termination of the trust. This week, we will look into how these play into the composition of the MV Oil Trust’s stock price, and the balance struck between investor’s current return in the form of dividends and potential for returns from capital appreciation.

Tradeoff Between Current and Future Returns

There is a natural friction between distributions of earnings versus reinvestment for growth. Young and growing companies tend to reinvest their earnings to fund future growth opportunities. Investors in such companies, therefore, have to be willing to forego upfront returns in hope of realizing greater returns down the road. Investors in mature companies, however, generally expect to receive dividends as a return on their investment because these companies typically have fewer opportunities for growth.

Composition of Stock Price

While public royalty trusts are equity securities by name, they have unique characteristics that differentiate them from many equity securities. Investors typically take on exposure to equity securities for two basic reasons: receipt of cash dividends and anticipation of capital appreciation. Cash dividends are residual earnings of the Company paid to the investor at the discretion of management, and these are current returns. Capital appreciation occurs through the sale of shares at a price higher than what the investor paid, and this is a future return.

Investors in public royalty trusts are typically seeking dividends. Because the investment is ultimately in a depleting asset (oil or gas reserves), capital (and therefore stock price) is expected to depreciate to zero in the long run. Many public royalty trusts, including MV Oil Trust, are restricted from acquiring more assets or interests, and most earnings are required to be paid out. These restrictions are similar to another type of trust: Real Estate Investment Trusts (REITs). Because most earnings must be distributed, dividends paid to investors would not appear to be constrained by the discretion of management, and therefore some investors consider investments in trusts to be less risky. This is not necessarily the case for royalty trusts, however, because the source of income is less stable and the ultimate level of cash distributions is dependent on the level of production set by the operator (who is not always associated with the management of the trust). Thus, investments in royalty trusts may be viewed to be riskier than investments in REITs due to this unique control structure.

Let’s Get Theoretical

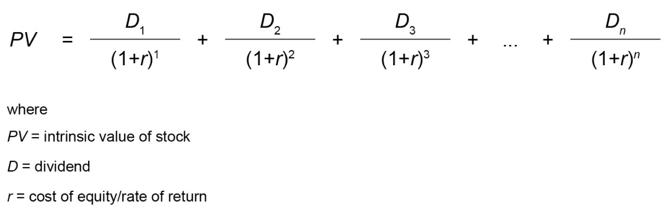

According to the dividend discount model, the intrinsic value of a stock is the expected value of future dividends, discounted back to the present at an appropriate discount rate. Forecasts of dividends are typically estimated for anywhere between 3-15 years, or until a time where future dividends will grow/decline at a stable rate. At this point, a terminal value is added, which accounts for all remaining value after earnings have stabilized, which is discounted back to the present.

In the case of public royalty trusts, units of the trusts tend to hold declining intrinsic value. That is, their intrinsic value will drop to zero upon expiration of the trust agreement. This would imply no terminal value, save for the potential liquidation of assets. In the case of MV Oil, the trust will distribute the net proceeds from the sale of assets upon dissolution of the trust, so there will be a terminal value that accounts for future production remaining from the underlying properties.

When a dividend is paid, the market value of the trust should decrease by the amount of the dividend. As an example, imagine a public royalty trust paying quarterly distributions of about 50¢ per share for the next two years prior to termination with a terminal value of zero. If the stock price is a little under $4.00, after accounting for the present value of these distributions, the stock price should decline by 50¢ upon receipt of the first dividend, because the stock at that point will only be worth the remaining seven distributions.

Capital Expenditures Constraints

MV Oil Trust is restricted from acquiring other properties or interests, but it will still spend money on drilling new wells on their established sites, as well as covering maintenance of currently producing wells. These maintenance expenditures may affect the quantity of proved reserves that can be economically produced. Because MV Partners has agreed to limit the amount of capital expenditures in a given year, they may choose to delay certain capital projects into the next year when the budget allows. If operators do not implement required maintenance projects when warranted, the future rate of production decline of proved reserves may be higher than the rate currently expected. So, the capital expenditure limit, implemented as a protection for unitholders, could actually have a deleterious effect.

Is There Any Room for Capital Appreciation?

The question then becomes, can revenue interests in an oil and gas royalty experience capital appreciation? With the requirement to pay out substantially all of its earnings as distributions and restriction on acquiring new properties or interests, it would appear that capital appreciation is unlikely. However, as we have seen in the public market, commodity price expectations can vary and change significantly in a relatively short time period. In the case of MV Oil Trust, the rebound in commodity prices and subsequent return to distributions caused the significant increase in unit price over the past two years. Even though investors are purchasing the right to obtain future distributions, buying low and selling high on the units is possible, as with any investment. For public royalty trusts, investors would need to be able to anticipate shifts in either production or price.

Drill Baby Drill?

Capital appreciation for royalties is not limited to the potential upside from increasing crude and natural gas prices. MV Oil Trust has drilled new wells in each of the past three years, providing investors with an upside not seen in all royalty trusts. Additional wells increase capacity which will increase royalty revenue and therefore increase future dividends, thus raising the value of the trust. Proved undeveloped reserves (PUDs) present an upside to unitholders, and drilling wells is the next step in developing these reserves, so they can eventually be produced and sold.

Many royalty trusts either have not recently drilled any new wells or they do not have any proved reserves that are left undeveloped. This includes Permian Basin Royalty Trust, Mesa Royalty Trust, Sabine Royalty Trust, VOC Energy Trust, San Juan Basin Royalty Trust, and Pacific Oil Trust.

Some trusts originally had upside from wells that they were contractually obligated to drill in an “Area of Mutual Interest (AMI)” when the trust was started. This includes the three SandRidge trusts, which we discussed in a recent post. Chesapeake Granite Wash Trust and ECA Marcellus Trust I also agreed to drill wells in an AMI, neither have drilled any further wells after fulfilling this requirement. Thus investors in these trusts will likely only realize capital appreciation if crude prices unexpectedly increase and stabilize at this higher price.

Hugoton Royalty Trust and Cross Timbers Royalty Trust have had little to no drilling in recent years, but both benefit from having XTO Energy as an operator, who has indicated plans to drill new wells that will benefit each of these trusts.

Enduro Royalty Trust, MV Oil Trust, BP Prudhoe Bay Royalty Trust, and Whiting USA Trust II have all had drilling in recent years. MV Oil Trust’s undeveloped reserves represent 14% of proved reserves, representing potential upside from future drilling. Prudhoe Bay has drilled over 100 wells in the past three years, and it has experienced the third highest 2-year return. Whiting USA Trust II has significant undeveloped acreage in the Permian, which likely plays a role in its superior 2-year return for investors.

The remaining four mineral partnerships are either C Corporations or MLPs. As discussed recently, they are designed to gather assets and grow through acquisitions. Because they are not structured as trusts, they are not required to distribute a substantial amount of their earnings.

Conclusion

Even when royalty trusts are prohibited from acquiring more assets, investors can realize capital appreciation if oil price expectations change, the operator of the underlying assets drill more wells and/ or increase their operating efficiency, or if management expedites distributions.

While the value of the underlying asset of royalty trusts (royalty interests) are expected to decline over time, there is still an opportunity for capital appreciation with commodity price changes or additional drilling. Ultimately, declining revenue distributions for private owners of royalty interests typically do not benefit from capital appreciation, but selling at the opportune time can effectively function as capital appreciation.

We have assisted many clients with various valuation and cash flow questions regarding royalty interests. Contact Mercer Capital to discuss your needs in confidence and learn more about how we can help you succeed.

Energy Valuation Insights

Energy Valuation Insights