Oilfield Services 2022

The Rise of the OFS Bulls

In our Energy Valuation Insights post from last week, Bryce Erickson focused on Oilfield Services (OFS) company valuations. This week we follow the same OFS theme, but with a focus on OFS “expectations” and the question: “Has the OFS industry turned the corner to a more prosperous outlook?”

Enthusiasm Among Experts

One can’t come away from a review of current OFS industry musings without feeling that, in the endless battle between OFS Bulls and OFS Bears, the Bulls have gained the advantage and are on the rise.

From Bloomberg Intelligence – and under the noteworthy heading of OFS Recovery to Reach Cruising Altitude in 2022 – we find that oilfield services industry revenues are expected to grow by ten to fifteen percent in 2022, compared to nearly flat revenue growth in 2021. North American OFS is expected to lead the way with likely 20% revenue gains.

Representatives of investment banking firm Evercore’s E&P and OFS groups noted in a recent Natural Gas Intelligence piece that the E&P and OFS groups’ expectations for 2022 remain bullish as they believe we are in the early stages of a long, strong, multi-year E&P spending upcycle.

In its recent industry outlook, Zacks noted that the OFS industry is bright again and that the business environment for E&P activities has shown drastic improvement. That improvement is reflective of oil prices having returned to the “glorious days,” thereby leading drillers to return to the oil patch, resulting in significantly improved demand for oilfield services.

Many more significantly optimistic references are available, but suffice it to say that expectations for the OFS industry (due to E&P industry activity) have changed a lot, for the better, in the last year.

Basis for Optimism

So, what are the industry experts seeing that is leading to this optimism? In short:

- oil demand rising as the Covid pandemic recedes and the world begins the return to normal levels of activities that require energy use,

- significant potential for an oil supply shortage, and

- recent under-investment in the new production needed to sustain supply.

In light of the factors above, industry analysts are detailing some very positive expectations for the OFS industry. Such as:

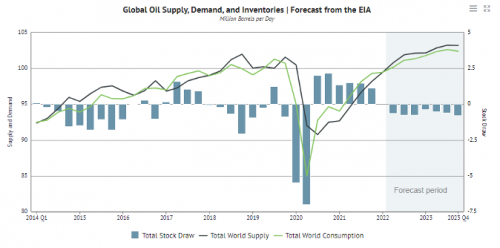

The Energy Information Administration (EIA) forecasts that global consumption of petroleum and liquid fuels will average 100.6 million b/d for all of 2022, which is up 3.5 million b/d from 2021 and more than the 2019 average of 100.3 million b/d. On top of which the EIA forecasts that global consumption of petroleum and liquid fuels will increase by 1.9 million b/d in 2023. So, for the first time since Covid reared its head in early 2020, global oil consumption is expected to rise to a level materially higher than pre-Covid consumption.

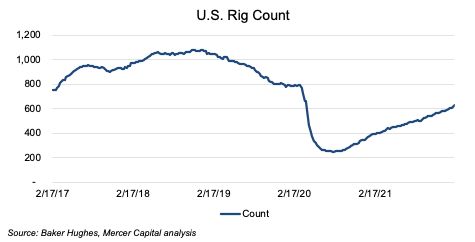

Mizuho Securities USA LLC indicates in a January 2022 NGI article (U.S. E&Ps, OFS Players Expected to Reset in 2022, with Eyes on Inflation, Supply Chains) that in order to generate sustainable oil volumes through 2022 based on current production volumes, the rig count across the five major U.S. oil basins would have to increase by 100 rigs, compared to a 178 rig increase since January 2021.

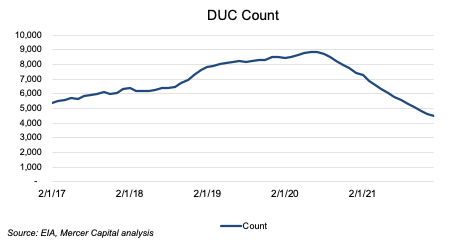

Mizuho further indicated that the rate of completions in the major U.S. basins is probably sufficient to support growth. However, the drilled but uncompleted (DUC) inventory is at a historically low level, so more drilling activity will be required. Otherwise, the needed 2022 growth in the U.S. supply could be materially held-back.

Early Indications Favoring the Bulls

As to early evidence supporting those expectations, Baker Hughes’ most recent North American rig count is at 854, a level not seen since the onset of the Covid pandemic in March 2020.

According to Bank of America, due to the draw-down in global oil inventories in 2021, the oil market is anticipated to move from a steep deficit to a more balanced market. With that in mind, BofA is predicting that WTI and Brent will average $82 and $85 over the course of this year.

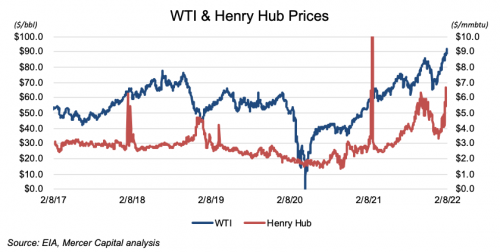

Other industry analysts, including Goldman Sachs Group, are indicating that oil prices could reach $100 during 2022, while forecasting average 2022 oil prices at $85.

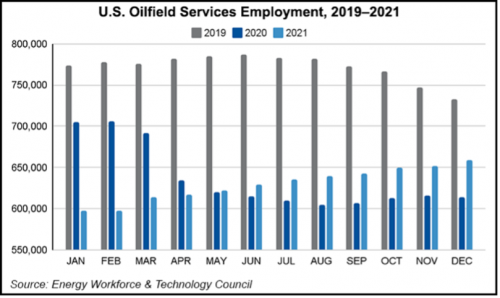

Employment in the U.S. oilfield services and equipment sector rose by an estimated 7,450 jobs in December, according to the Houston-based Energy Workforce & Technology Council.

Zacks Equity Research summarized how all this ties in to the OFS outlook: “The price of West Texas Intermediate (WTI) crude is trading higher than $89 per barrel, marking a massive improvement of more than 50% in the past year. Strong fuel demand across the world and ongoing tensions in Eastern Europe are aiding the rally in oil prices. The massive improvement in oil price is aiding exploration, production and drilling activities. This, in turn, will boost demand for oilfield service since oilfield service players assist drillers in efficiently setting up oil wells.”

Potential Headwinds

Of course, there are also headwinds for the OFS sector that will have to be dealt with, including inflation being a key consideration. As detailed in our January 14, 2022 Energy Valuation Insights post, industry analysts are projecting over 30% average OFS revenue growth in 2022, although average EBITDA margins are expected to edge downward from 13% toward 12%. Inflationary factors are pushing up OFS costs, but such increased costs are expected to only partly be passed through to their E&P clients.

In addition, the Biden Administration is clearly adamant about getting the country moving rapidly away from hydrocarbon-based energy, despite the public already complaining mightily about fast-rising energy prices and more general inflationary pressures. Where those political winds will carry the matter is anyone’s guess.

In Summary

As indicated, the companies that comprise the OFS segment – at least those that survived 2020 – experienced some stabilization in 2021, and are now facing what appears to be a market that has the industry analysts feeling fairly bullish. Influenced by rising oil demand, an existing shortage, and recent E&P investment well below the sustainable level, expectations have moved from OFS stabilization to strong multi-year OFS growth in 2022 and likely beyond.

Mercer Capital has significant experience valuing assets and companies in the energy industry. Our energy industry valuations have been reviewed and relied on by buyers, sellers, and Big 4 Auditors. These energy-related valuations have been utilized to support valuations for IRS Estate and Gift Tax, GAAP accounting, and litigation purposes. We have performed energy industry valuations domestically throughout the United States and in foreign countries.

Contact a Mercer Capital professional today to discuss your valuation needs in confidence.

Energy Valuation Insights

Energy Valuation Insights