Permian Production Remains Strong

The economics of Oil & Gas production vary by region. Mercer Capital focuses on trends in the Eagle Ford, Permian, Bakken, and Marcellus and Utica plays. The cost of producing oil and gas depends on the geological makeup of the reserve, depth of reserve, and cost to transport the raw crude to market. We can observe different costs in different regions depending on these factors. In this post, we take a closer look at the Permian.

Production and Activity Levels

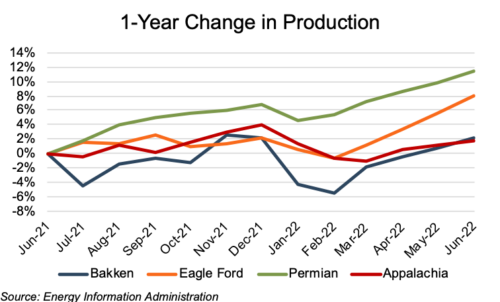

Estimated Permian production (on barrels of oil equivalent, or “boe,” basis) increased approximately 11.4% year-over-year through June. This is notably greater than the production increases seen in the Eagle Ford, Bakken and Appalachia (8.0%, 2.2% and 1.9%, respectively).

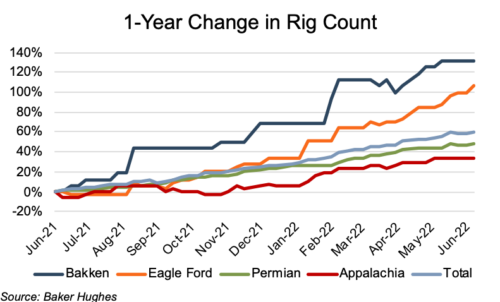

There were 345 rigs in the Permian as of June 10, up 49% from June 4, 2021. The Bakken, Eagle Ford, and Appalachia rig counts were up 131%, 106%, and 34%, respectively, over the same period.

In terms of production growth, the Permian has far exceeded the other basins, and Permian production is expected to continue increasing over the next several months based on anticipated increases in the rig count and new-well production per rig.

Commodity Prices Continue to Rise

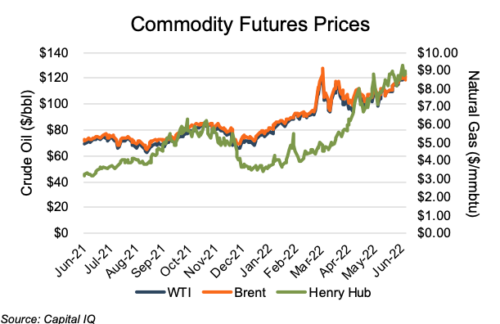

Oil prices generally rose through the second half of 2021, although they started to decline in mid-Q4. The shale revolution had largely put geopolitics in the back seat as the key driver of commodity prices. However, geopolitics once again came front and center as Russia launched its invasion of Ukraine in late February. Western nations responded with a series of economic sanctions against Russia. Although the sanctions generally included carve-outs for energy exports, issues with financing and insurance, and the exit of Western oil companies and oilfield service providers from Russia resulted in a substantial decline in oil exports from the country. The exclusion of oil from Russia, the third-largest producer of petroleum and other liquids in 2020 according to the U.S. Energy Information Administration, from global markets led to a high degree of volatility in oil prices. WTI front-month futures prices began the latest quarter at ~$99/bbl and were floating around $121/bbl as of mid-June. With no indications of any near-term resolution of the Russian-Ukraine war, and a continued outlook of relatively flat production in the U.S., the upward trajectory of global energy prices has no foreseeable inflection point at the moment.

Natural gas prices fluctuated over the past year, albeit with slightly less volatility than oil prices, and have exhibited the same upward trend over the past quarter. Natural gas is becoming more globalized as Europe grapples with replacing imports of Russian gas. In late March, President Biden pledged to boost LNG exports to Europe, which may re-invigorate the advancement of U.S. LNG export terminal projects.

Financial Performance

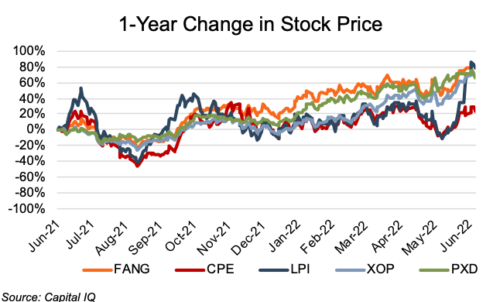

The Permian public comp group saw moderately positive stock price performance over the past year (through June 10). The prices of Diamondback Energy and Laredo Petroleum rose 79% and 78%, respectively, and more than the broader E&P sector (as proxied by XOP, which rose 68% during the same period). Pioneer Natural Resources’ stock price rose 66% over the period, and Callon Petroleum rose a relatively tepid 24%.

Survey Says Eagle Ford Wells Among Most Economic

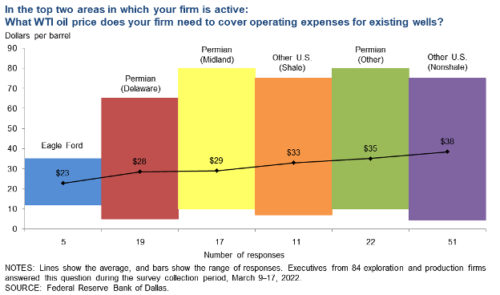

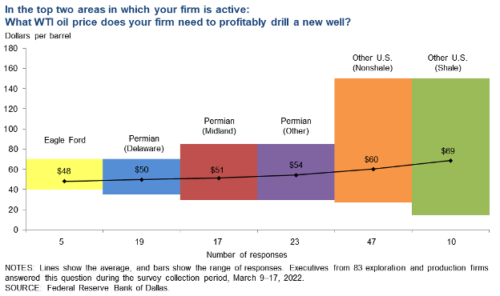

According to participants of the First Quarter 2022 Dallas Fed Energy Survey (the latest available as of mid-June), wells in the core plays of the Permian are positioned as some of the most economical in the nation.

Survey respondents indicated that the average WTI price needed to break even on existing wells in the primary Permian plays was $28/bbl to $29/bbl. This exceeds the average breakeven in the Eagle Ford ($23/bbl) but is still lower than other parts of the U.S. (over $30/bbl). The average breakeven price for new development in the Permian is in the middle of the pack at $50/bbl to $51/bbl, greater than the Eagle Ford’s breakeven ($48/bbl), but notably lower than in other parts of the country ($60/bbl to $69/bbl).

Conclusion

Production growth in the Permian continued to exceed growth in the Eagle Ford, Appalachia and Bakken over the past year as the basin remains one of the most economical regions in U.S. energy production. With the surge in commodity prices over the past quarter, it might have been expected that producers would start bringing more rigs online, leading to more production growth than what we saw. However, as upstream companies have signaled, it may not be realistic to expect such increased deployment of capital from public operators in the near future, though private operators may very well move to take advantage of the higher price environment. With greater emphasis on returning cash to shareholders, continued levels of relatively low investment in growth capital may be expected. However, its significantly large contribution to total energy production continues to make the Permian a steady source of growth for overall U.S. oil and gas production.

We have assisted many clients with various valuation needs in the upstream oil and gas space for both conventional and unconventional plays in North America, and around the world. Contact a Mercer Capital professional to discuss your needs in confidence and learn more about how we can help you succeed.

Energy Valuation Insights

Energy Valuation Insights