How to Value an Oilfield Services Company

When valuing a business, it is critical to understand the subject company’s position in the market, its operations, and its financial condition. A thorough understanding of the oil and gas industry and the role of oilfield service (“OFS”) companies is important in establishing a credible value for a business operating in the space. Our blog strives to strike a balance between current happenings in the oil and gas industry and the valuation impacts these events have on companies operating in the industry. After setting the scene for what an OFS company does and their role in the energy sector, this post gives a peek under the hood at considerations used in valuing an OFS company.

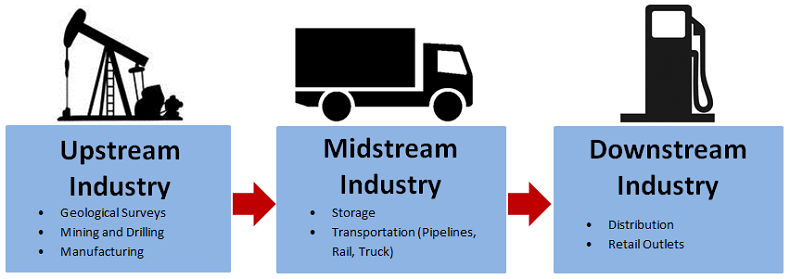

Oil and Gas Supply Chain

The oil and gas industry is divided into three main sectors:

- Upstream (Exploration and Production)

- Midstream (Pipelines and Other Transportation)

- Downstream (Refineries)

Exploration and production (E&P) companies search for reserves of hydrocarbons where they can drill wells in order to retrieve crude oil, natural gas, and natural gas liquids. To do this, E&P companies utilize oilfield service (OFS) companies to help with various aspects of the process including pumping and fracking, land contract drilling, and equipment manufacturers. E&P companies then sell the commodities to midstream companies who use gathering pipelines to transport the oil and gas to refineries. Finally, refiners convert raw crude and natural gas into products of value.

Oilfield Services Operations

E&P companies may own the rights to the hydrocarbons below the surface, but they can’t move them down the supply chain without the help from OFS companies in the extraction process. We can think of various OFS companies being subcontractors in the upstream process much like a general home builder might bring in people specially trained to set the foundation or wire electrical or plumbing. Because the services provided often require sophisticated technology or extensive technical experience, it stands to reason OFS companies would be able to charge a premium price. Thus, OFS would appear to be insulated from the commodity pricing that is inherent in the industry. However, E&P companies are the ones contracting these companies, and if oil prices decline enough, they are pressured to decrease production (and capex budgets), reigning in activity for OFS companies. This is where the specific service provided matters.

Regardless of service provided, or industry for that matter, there are certain aspects of a business that should always be considered.

As we discussed last week, there are a variety of different services provided by OFS companies. Companies that fall into the category of OFS can be very different from one another as the industry is fragmented with many niche operators. For example, companies servicing existing production are less impacted by changes in commodity prices than OFS companies that service drilling, as these activities are the first to decrease. Regardless of service provided, or industry for that matter, there are certain aspects of a business that should always be considered.

Oilfield Equipment and Service Financial Analysis

A financial analyst has certain diagnostic markers that tell much about the condition of a business both at a given point of time (balance sheet) and periodically (income statement).

- Balance Sheet. The balance sheet of an OFS company is considerably different from others in the energy sector. E&P companies have substantial assets attributed to their reserves. Refiners predominantly have high inventory and fixed assets. OFS companies will depend on the type of product or service, but generally, they tend to have a working capital balance that consists more of accounts receivable than inventory, like other service-oriented businesses. According to RMA’s annual statement studies, A/R made up 22.3% of assets while inventory was 9.3% for Drilling Oil and Gas Wells (NAICS #213111).[1] These figures were 26.6% and 10.8%, respectively for Support Activities for O&G Operations (#213112). Notably, drilling operations had a higher concentration of fixed assets (46.8%) compared to other support services which comprised 35.7% of assets. Broadly speaking, this illustrates the different considerations within the OFS sector as far as the asset mix is concerned.

- Income Statement. The development of ongoing earning power is one of the most critical steps in the valuation process, especially for businesses operating in a volatile industry environment. Cost of goods sold is a significant consideration for other subsectors in the energy space, particularly as the product moves down the supply chain towards the consumer. This is not the case for OFS companies. RMA does not even break out a figure for gross profit, but instead combines everything under operating expenses. Still, OFS companies deal with significant operating leverage. If expenses are less tied to commodity prices that means costs may be more fixed in nature. That means when activity decreases and revenues decline, expenses don’t decline in lock-step resulting in margin compression and profitability concerns.

While the balance sheet does not directly look at income, it can help determine sources of return. Fixed-asset heavy companies like drillers tend to be more concerned with utilization rates as the more their assets are deployed, the more money they will earn. On the other hand, predominantly service-based companies that rely on their technology and expertise tend to be more concerned with the market-determined prices they are able to charge and terms they are able to negotiate. Additionally, OFS companies may have significant intangible value that may not be reflected on the balance sheet. Intangible assets developed internally are accounted for differently than those that are acquired, and a diligent analyst should be cognizant of assets recorded or not recorded in developing an indication of value.

How to Value OFS?

There are fundamentally three commonly accepted approaches to value: asset-based, market, and income. Each approach incorporates procedures that may enhance awareness about specific business attributes that may be relevant to determining an indication of value. Ultimately, the concluded valuation will reflect consideration of one or more of these approaches (and perhaps several underlying methods) as being most indicative of value.

The Asset-Based Approach

The asset-based approach generally represents the market value of a company’s assets minus the market value of its liabilities.

The asset-based approach can be applied in different ways, but in general, it represents the market value of a company’s assets minus the market value of its liabilities. Investors make investments based on perceived required rates of return, so the asset-based approach is not instructive for all businesses. However, the capital intensive nature of certain OFS companies does lend some credence to this method, generally setting a floor on value. If companies have paid off significant portions of their debt load incurred financing its equipment, the valuation equation (assets = liabilities + equity) tilts towards more equity and higher asset approach indications of value. Crucially, as time goes on and debt is serviced, the holding value of the assets must be reassessed. Price paid, net of accumulated depreciation may appear on the balance sheet, but if the equipment or technology begins to suffer from obsolescence, it will have less value in the marketplace. For example, due to the shale revolution in the United States and the increased demand for horizontal drilling, equipment and services that facilitate vertical drilling have less market value than it did less than a decade ago. Ultimately, the asset-based approach is typically not the sole (or even primary) indicator of value, but it is certainly informative.

The Income Approach

The income approach can be applied in several different ways. Generally, analysts develop a measure of ongoing earnings or cash flow, then apply a multiple to those earnings based on market risk and returns. An estimate of ongoing earnings can be capitalized in order to calculate the net present value of an enterprise. The income approach allows for the consideration of characteristics specific to the subject business, such as its level of risk and its growth prospects relative to the market through the use of a capitalization rate. Stated plainly, there are three factors that impact value in this method: cash flows, growth, and risk. Increasing the first two are accretive to value, while higher risk lowers a company’s value.

The income approach allows for the consideration of characteristics specific to the subject business.

To determine an ongoing level of earnings, scrutiny must be applied to historical earnings. First, analysts must consider the concentration of revenues by customers. A widely diversified customer base is typically worth more than a concentrated one. Additionally, an analyst should adjust for non-recurring and non-normal income and expenses which will not affect future earnings. For example, disposing of assets utilized in the business is not considered an ongoing source of return and should be removed from the company’s reported income for the period when the disposition occurred. The time period must also be considered. Assuming cash flows from last year will continue into the future may be short-sighted in the energy sector. Instead of using a single period, a multi-period approach is preferable due to the industry’s inherent volatility, both in observing historical performance and projecting into the future. Discounted cash flow (DCF) analyses are an important tool, but factors such as seasonality, cyclicality, and volatility all call for a longer projection period.

After developing the earnings to be capitalized, attention is given to the multiple to be applied. The multiple is derived in consideration of both risk and growth, which varies across different companies, industries, and investors. When valuing an OFS company, customer concentration is of particular concern to both risk and growth. Developing a discount rate entails more than applying an industry beta and attaching some generic company risk premium. Analysts must look deeper into the financial metrics addressed earlier and consider their market position. Are they financially stable or over-levered by either fixed costs or debt? Are they a sole provider or one of many? If more players are entering the market, prices charged may be lower than those historically observed. If a company stops investing in its equipment and technology, demand for the company’s products and services declines. Again, metrics such as utilization and day rates are important to analyze when developing a discount rate.

Income is the main driver of value of a business as the goal is to generate a reasonable return (income) on its assets. People don’t hang a sign above their door and go into business if they don’t think they will eventually turn a profit. Still, differences of opinion on risk and growth can occur, and analysts can employ a market approach as another way to consider value.

The Market Approach

As the name implies, the market approach utilizes market data from comparable public companies or transactions of similar companies in developing an indication of value. In many ways, this approach goes straight to the heart of value: a company is worth what someone is willing to pay for it. The OFS subsector is a fragmented industry with many niche, specialty operators. This type of market lends itself to significant acquisition activity.

However, transactions must be considered with caution. First, motivation plays a role, where a financially weak company may not be able to command a high price, but one that provides synergies to an acquirer might sell for a premium. Transactions must also be made with comparable companies. With many different types of companies falling under the OFS umbrella, analysts must be wary of comparing apples to oranges. While they work in the same subsector, there are clearly important differences between equipment manufacturers and pumpers and frackers. Untangling the underlying earnings sources of these businesses is important when looking at guideline transactions as well as directly comparing to guideline companies.

In many ways, the market approach goes straight to the heart of value: a company is worth what someone is willing to pay for it.

Larger diversified players, such as Schlumberger and Halliburton, are more likely to provide similar services to companies an analyst might value, but their size, sophistication, and diversification of services likely renders them incomparable to smaller players. Given the relative considerations and nuances, taking their multiples and applying a large fundamental adjustment on it is crude at best and may miss the mark when determining a proper conclusion of value.

Analysts using a market-based approach should also be judicious in utilizing the appropriate multiple and ensuring it can be properly applied. Industries focus on different metrics and it is important to consider the underlying business model. For E&P companies, EV/EBITDAX may be more insightful as capital expenditure costs are significant and can be throttled down in times of declining crude prices. For OFS companies, potentially relevant multiples include EV/Revenue and EV/Book Value of Invested Capital, but there is no magic number, and these useful metrics cannot be used in isolation. Ultimately, analysts must evaluate the level of risk and growth that is implied by these multiples, which tends to be more important than the multiples used.

The market approach must also consider trajectory and location. There’s a difference between servicing vertical wells that have been producing for decades as opposed to the hydraulic fracturing and long horizontal wells in the Delaware Basin. Distinctions must also be drawn between onshore and offshore as breakeven economics are similar (don’t produce if you can’t earn a profit), but costs related to production vary significantly.

Ultimately, the market-based approach is not a perfect method by any means, but it is certainly insightful. Clearly, the more comparable the companies and the transactions are, the more meaningful the indication of value will be. When comparable companies are available, the market approach should be considered in determining the value of an OFS company.

Synthesis of Valuation Approaches

A proper valuation will factor, to varying degrees, the indications of value developed utilizing the three approaches outlined. A valuation, however, is much more than the calculations that result in the final answer. It is the underlying analysis of a business and its unique characteristics that provide relevance and credibility to these calculations. This is why industry “rules of thumb” or back of the napkin calculations are dangerous to rely on in any meaningful transaction. Such calculation shortcuts fail to consider the specific characteristics of the business and, as such, often fail to deliver insightful indications of value.

A thorough approach utilizing the valuation approaches described above can provide significant benefits. The framework provided here can facilitate a meaningful indication of value that can be further refined after taking into account special considerations of the OFS industry that make it unique from other subsectors of the oil and gas industry. In our next post, we plan to delve deeper into these special valuation considerations beyond the framework established in this post. Stay tuned…

[1] 2018-2019 RMA Statement Studies. NAICS #213111 and 213112. Companies with greater than $25 million in sales.

Energy Valuation Insights

Energy Valuation Insights