The Evolution of E&P ESG Scores

Trends from 2016-2020

As quarterly earnings calls have come and gone over the past several years, the frequency with which environmental, social, and governance topics are explicitly discussed have been ever-increasing. On the whole, ESG topics are sector and industry agnostic. While not all ESG topics come into play equally for every sector and industry, there are always some elements, issues or characteristics of any given company or industry that could be put into at least one, if not all, of those three buckets.

Within the E&P space–and the oil and gas sector overall–operators have increasingly included ESG talking points in their management commentary, signaling proactive initiative rather than reactive response. One could argue this approach helps to lead the discussion by addressing what they can do, are doing, and will do, as opposed to having to answer to why they are not taking actions to mitigate some issues that were determined or assumed to be a priority by an outside party.

Regardless of the impetus for ESG topics entering the zeitgeist, the result is an increase in self-reporting by E&P operators as to what they’re doing to improve, or at least address, noted ESG concerns.

Naturally, however, the noble action of self-reporting does not mean the stated or signaled information is accurate or fully reflects all known or knowable information. Of course, it should not be assumed that such information is inherently or purposefully misleading either. Sometimes you take it with a grain of salt; sometimes you empty the shaker or season to taste.

Given the potential for obfuscation, though, it helps to have a more objective party discern what information is verifiable and accurate, as far as that may be determinable. One such platform, S&P’s Global Market Intelligence, provides such ESG evaluation services, including the provision of ESG scores to gauge where companies stand with respect to their self-reporting.

In this post, we take a brief look at several ESG criteria among E&P operators to see what trends may be present among the operators with the highest and lowest ESG scores, as provided by Global Market Intelligence.

Total ESG Scores

It is far beyond the scope of this article to explain the machinations and processes that underlie the production of the ESG scores determined by Global Market Intelligence. For simplicity, we consider the ESG scores in an ordinal and relative way. For example, if Company A and Company B have ESG scores of 10 and 20, respectively, it is not to say that the self-reporting by Company B is twice as good as Company A’s reporting, but simply that Company B reports more information which can be verified.

The other side of the coin is that, in theory, a company could be a model example of ESG stewardship, but still have an ESG score of 0 if it doesn’t self-report or may not provide information that is readily verifiable. This would not be a likely scenario, but again, “in theory…”.

Note that, in addition to a company’s “Total” ESG score, there are scores for the respective E, S and G groups, with more granular scores for specific criteria within each of those three buckets. We will refer to the Total ESG scores, as well as scores for three criteria that represent the environmental, social, and governance groups, respectively.

We utilized the Global Market Intelligence platform to screen for U.S. E&P operators with market capitalizations over $10 million (as of October 6), with 124 resulting companies. We then pared this list down to 12 operators that consistently had annual Total ESG scores from 2016 to 2020 (the latest data available), presented as follows:

Click here to expand the image above

Generally, the list is presented in ascending order, with the lower-scoring operators towards the top and higher-scoring operators towards the bottom.

As may be gleaned from the chart above, the three lowest scoring E&P operators, on average, were Diamondback Energy, Continental Resources, and Coterra Energy.1

The three highest scoring operators, on average, were Hess Corporation, ConocoPhillips, and Ovintiv (formerly Encana Corporation).

We note that the ESG scores among the lowest-scoring companies all declined from 2016 to 2020, with Continental Resources’ and Coterra Energy’s scores among those with the greatest decline among the entire group of companies presented. The ESG scores for ConocoPhillips and Hess Corporation were approximately at the 3rd quartile with respect to their “growth”, while Ovintiv’s ESG scores showed a moderate decline from 2016 to 2020. Although we do not discuss Pioneer Natural Resources in depth here, we do note that it exhibited the greatest growth in its ESG score from 2016 to 2020.

E, S, and G

As mentioned earlier, each of the environmental, social, and governance groups have respective subsets of criteria which are surveyed, analyzed, scored, and weighted by Global Market Intelligence. For example: criteria within the environmental group includes items such as “biodiversity,” “climate strategy,” and “water related risks”; the social group includes criteria such as “social impacts on communities,” “human capital development,” and “human rights”; and the governance group includes criteria such as “brand management,” “marketing practices,” and “supply chain management.”

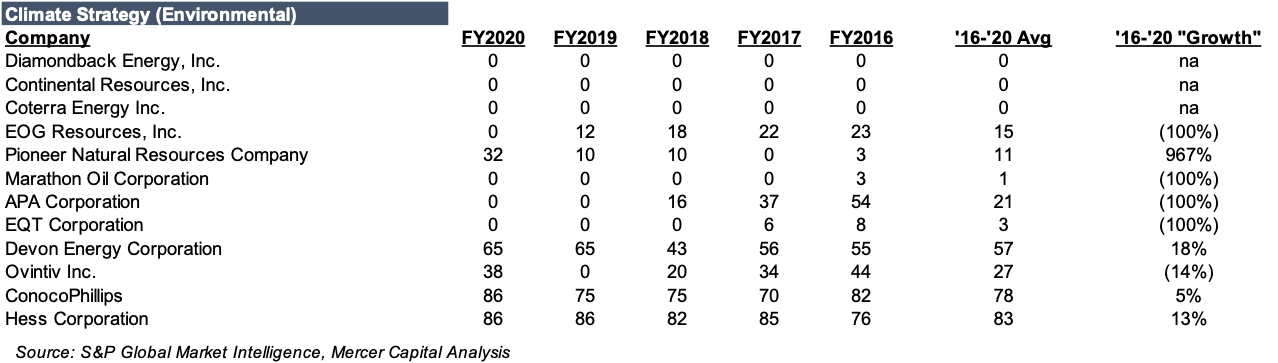

One environmental criterion we looked at was climate strategy, 2 with the company ESG scores as follows:

Click here to expand the image above

Only 3 companies had ESG scores for this criterion that indicated improvement from 2016 to 2020. However, the growth between these two periods masks the development of these scores in the interceding periods. Notably, the score for Diamondback Energy dipped in 2018 and 2019, but returned to the levels seen in 2016 and 2017. Furthermore, several companies, including EOG Resources, Pioneer Natural Resources, Marathon Oil, and Ovintiv all showed significant improvement in the score from 2019 to 2020.

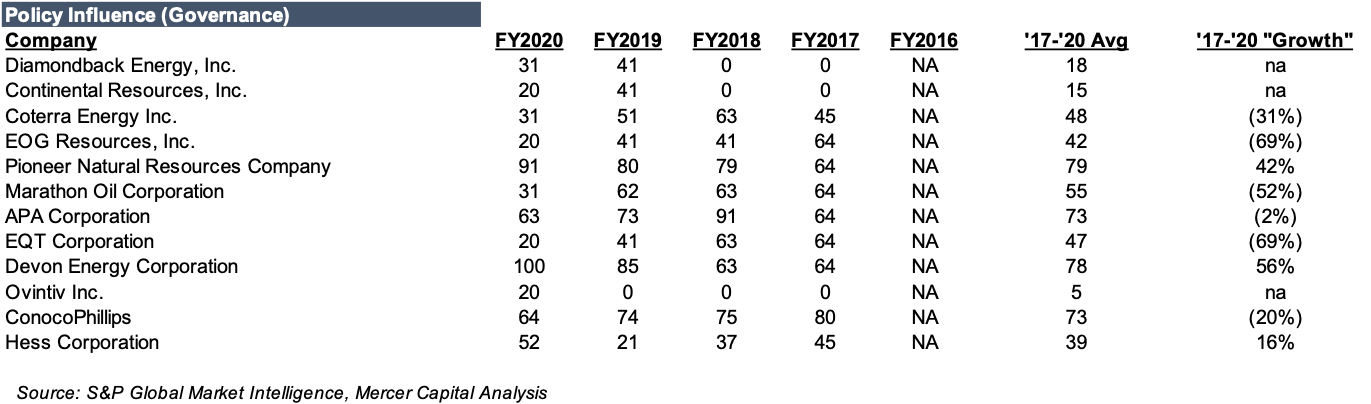

Last, but not least, we reach the criterion selected representing the governance topics: policy influence.3

Click here to expand the image above

As you will notice, all companies had “NA” in place of scores in 2016, indicating this criterion was not included on the Global Market Intelligence survey that year. We note that these scores objectively focus on the extent of the verifiable public disclosure related to the companies’ contributions to political campaigns, lobby groups, and trade associations which may influence the policies affecting industry operations and regulations; these scores do not indicate levels of financial contribution or subjective perspectives regarding levels of influence in promoting or interfering with any particular policy.

On the Horizon

Moving forward, it will be interesting to compare the objective ESG scores with the quantity and quality of the information divulged and discussed in E&P operators’ earnings calls. Presumably, the ESG scores should rise in tandem with the greater levels of discussion and disclosures in the calls. We may find out soon enough with the upcoming earnings call season, as Diamondback Energy, Continental Resources, EOG Resources, Pioneer Natural Resources, Marathon Oil, and EQT Corporation regularly make appearances in our quarterly blog post, Earnings Calls – E&P Operators.

Conclusion

Mercer Capital has its finger on the pulse of the E&P operator space. As the oil and gas industry evolves through these pivotal times, we take a holistic perspective to bring you thoughtful analysis and commentary regarding the full hydrocarbon stream. For more targeted energy sector analysis to meet your valuation needs, please contact the Mercer Capital Oil & Gas Team for further assistance.

Energy Valuation Insights

Energy Valuation Insights