Themes from Q2 2019 Earnings Calls

Will “Capital Efficiency” Prevent Bankruptcy and Maintain Production as E&P’s Reduce CapEx?

While large, rapid commodity price declines are certainly harmful for near-term profits and long-term planning, persistently low prices may be more ominous for industry operators and investors. Prices rebounded from a low of $45/bbl, but crude has been below $60 for nearly 3 months. Natural gas prices have similarly languished, remaining below $2.50/mmbtu in that time. Two Houston-based E&P companies (Halcon & Sanchez) recently filed for Chapter 11 bankruptcy within days of each other, raising questions about the state of the industry. Size and operational efficiency may enable some players to stave off issues, while others may be forced into difficult decisions between preserving capital and investing over budget to produce enough debt-servicing cash flow.

Theme 1: Bankruptcies May Return if Prices Remain Low

- Over the last year, we have taken proactive steps to address the challenging oil and natural gas price environment, including stabilizing our production profile, improving our capital efficiency, and reducing our overall cost structure. Undergoing a financial restructuring through a voluntary process represents the next phase for Sanchez Energy, as we work with our creditors on a plan to right-size our balance sheet, further invest in our assets and generate long-term value for our stakeholders. – Tony Sanchez III, CEO, Sanchez Energy

- Ragan [incoming CFO] is joining Halcon at a critical time [bankruptcy restructuring] and will help lead our focus on capital discipline, cost control, and strategic plans for developing the Company’s assets to maximize shareholder return. – Rich Little, CEO, Halcon Resources

We start with quotes from companies that didn’t actually host earnings calls. Sanchez Energy has been beleaguered for years now, unable to turn a profit since the drop in oil prices. Once the third most active driller in the Eagle Ford, Sanchez filed for Chapter 11 bankruptcy on August 11th. Sanchez’ CEO touches on capital efficiency like many executives in the industry, as we’ll address later. He also harps on generating long-term value for stakeholders, a slight twist on the predictable “providing long-term value to shareholders” due to their debt-laden predicament.

Sanchez certainly isn’t alone. Halcon Resources filed for bankruptcy on August 7th. However, the company expects a 60-day turn around, during which it will continue to pay vendors, royalty owners, and others as part of ordinary business through the bankruptcy process, subject to approval from the courts. This is the second time since 2016 that the company has buckled under its debt load.

The Sanchez quote came as part of its press release regarding the bankruptcy proceedings, and the Halcon quote addresses the hiring of a new CFO in the wake of its filing. Each CEO outlines a critical issue for industry operators. Large scale, multi-year projects employ debt financing to lower the cost of capital, but too much debt can raise the cost of capital due to the increased risk of making the required payments. Fluctuating commodity prices further hamper the ability of E&P companies to make these payments. When companies are forced to file for Chapter 11 bankruptcy, they are usually able to resume operations, though the shareholders essentially lose all, or a substantial portion, of their investment. Industry operators will hope that these low prices will not persist, or other companies may join Sanchez and Halcon.

Theme 2: Size Matters

- We have a very large footprint though that allows us to work within certain areas over a vein, within certain areas due to these [Bakken gas processing] constraints. So we are able to work around them. And we have led the industry up there with gas capture we still do. – Harold Hamm, CEO, Continental Resources

- Combining Oxy and Anadarko will create a diverse portfolio of high quality and complementary assets, well suited for our core competencies. As we apply our development approach to the combined portfolio, we expect this to be the low-cost producer in all of the areas we operate. For example, along with the expertise I’ve already mentioned, we will apply our proprietary drilling process, Oxy drilling dynamics across Anadarko acreage. To date, Oxy drilling dynamics has reduced costs by at least 30% in all of the areas that we’ve applied it, and we expect to achieve similar results in Anadarko’s onshore and offshore developments. – Vicki Hollub, CEO, Occidental Petroleum

- One final point on our pending acquisition of Carrizo and one of the most important aspects of the transaction is the ability to optimize long-term development value of our combined inventory. By merging these two companies we are creating a vehicle that can effectively compete in a lower commodity price environment without the need to high-grade near-term target zones at the expense of other zones that are left behind for less efficient future development after the passage of time. – Joseph Gatto, CEO, Callon Petroleum

Size allows companies to achieve scale in their operations, spread expenses over larger amounts of revenue, access capital markets, and even negotiate lower capital costs. Larger E&P companies are typically less at risk of bankruptcy than smaller players in the industry.

Chevron began the quarter with its announcement of plans to acquire Anadarko Petroleum, but Occidental stepped up with a larger offer and eventually won the day. While this transaction has stolen the headlines, Callon’s smaller acquisition of Carrizo after quarter-end echoes the trend in the industry. Size allows these companies to achieve synergies, apply techniques to more acreage, and survive in low-price environments.

Theme 3: Capital Efficiency to Bridge Gap Between Production Estimates and CapEx Budgets

- We have also achieved the efficiencies throughout the first-half of 2019 that will allow the reduction of drilling rigs from 19 rigs in SCOOP STACK to 12 rigs on early fourth quarter of 2019. […] I am proud that our teams can exceed production estimates with lower rig activity, that is operating and capital efficiency at its best. […] We’re very committed to meeting our CapEx and other corporate guidance for the year, and have the flexibility to do so as we’re demonstrating. – Harold Hamm, CEO, Continental Resources

- For two quarters in a row we delivered more oil for less capital. With efficiency gains and new technology, we are achieving strong capital and operating cost reductions, while at the same time delivering excellent well performance. […] Looking ahead to the remainder of 2019, we modestly increased our full year U.S. oil production guidance as a result of better well performance. There is no change to our activity level in 2019. We will remain disciplined and still expect capital expenditures to be within the original range of $6.1 billion and $6.5 billion. – Bill Thomas, Chairman/CEO, EOG Resources

- Towards the end of the quarter, we shifted our focus to the completion of our first Delaware mega pad, which importantly utilized a simultaneous operation of two completion crews to increased efficiency and reduced cash cycle times. As we’ve emphasized previously, increased use of this model is made possible within a larger entity and is a clear strategic benefit of the Carrizo merger. – Joseph Gatto, CEO, Callon Petroleum

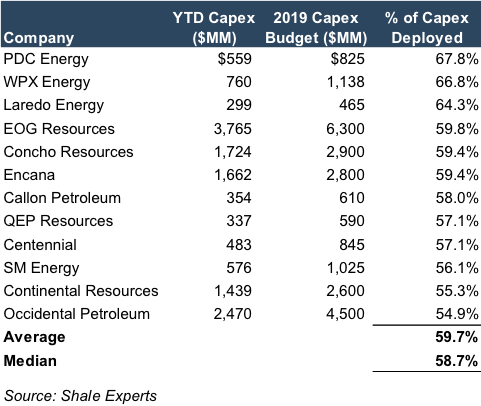

Shale oil production has increased output, and U.S. E&P companies have provided much of the supply growth in global production. However, shale’s inherently higher declines rates require more drilling to replace more rapidly declining production, making investors wary to receive their share (dividends) of the returns on these investments. This, in combination with depressed commodity prices at year-end, led to lower capex budgets for 2019. Seeking to keep their promises after blowing through their budgets last year, E&P companies have preached capital efficiency. They tout the operational efficiencies that will allow them to decrease their capital spend to close 2019. These efficiencies are crucial because according to data compiled by Shale Experts (subscription required) in the below table, many E&P companies have already spent over half their budget.

There are many factors at play in this number. Capex can and tends to be frontloaded due to seasonal factors. Still, executives will be hoping that their drilling efficiencies are achieved. Some companies may find issues hitting their production targets while decelerating drilling activities. They may be stuck between a rock and a hard place: failing to reach production targets or failing to remain within capex budgets.

Theme 4: Parent-Child Problem Continues to Plague Operators

- In the Delaware Basin, the 23 well Dominator project was designed to test logistical capabilities and well spacing that was approximately 50% tighter than our current resource assessment. While initial rates were solid, current performance data indicates that we developed the Upper Wolfcamp too densely. We’re incorporating the data into our development model to adjust spacing on future projects including those projects set to spud in the second half of 2019. -Tim Leach, CEO, Concho Resources

- We’ve always been conservative in our spacing assumptions, and we don’t really have any plans right now, especially as commodity price continues to decline, to look at any reasons to increase well spacing. This is one of those things where we’ve been pretty steadfast in our strategic development objectives on spacing. And we would pay attention to other spacing results that go on in the Permian Basin. And we try to learn from those as well too without exposing our shareholders to down spacing risks. -Travis Stice, CEO, Diamondback Energy

As we noted earlier, E&P companies are always looking to gain efficiencies. This can come from strategic M&A, contiguous acreage, repeatable drilling methods, and many other sources. However, there are limits. Specifically, well spacing has become increasingly important in the Permian as the parent-child problem continues to plague operators. Stated plainly, the first well drilled in a pad (the “parent”) tends to be the strongest well, getting the most bang for your buck in the reservoir. Subsequent wells drilled in the pad (the “children”) allow for more oil to be harvested quickly but at a decreasing rate per well. Trying to fit more wells onto pads may be more efficient from a drilling standpoint, but geological factors tend to lead to diminishing marginal returns from this approach.

As Concho’s CEO admitted at the beginning of the earnings call, their Dominator project was not properly spaced. This news was not well received, as Concho’s stock dropped 22.2% on the day and has slid even further since. It appears Diamondback’s approach to conservative well spacing was well received as its stock increased 2.7% on its announcement and has continued its upward trajectory.

Conclusion

Commodity price will always be at the forefront of the oil and gas industry. Higher prices allow for more investment, higher profits, and lofty valuations. On the downside, operators must make it through lean times while avoiding bankruptcy. While keeping debtholders happy by making their required payments, they must also seek to please equity investors by achieving production growth on a tight capex budget. Size tends to help both of these as capital becomes cheaper and scale allows for successful drilling techniques from one basin to be applied to operations in other areas.

At Mercer Capital, we have assisted many clients with various valuation needs in the upstream oil and gas industry in North America and around the world. We can help companies navigating the bankruptcy process, considering M&A in an acquisitive market, or maintaining their operations business as usual. Contact a Mercer Capital professional to discuss your needs in confidence.

Energy Valuation Insights

Energy Valuation Insights