What’s “Play”-ing in the DJ Basin?

An Introduction to the Denver-Julesburg Basin

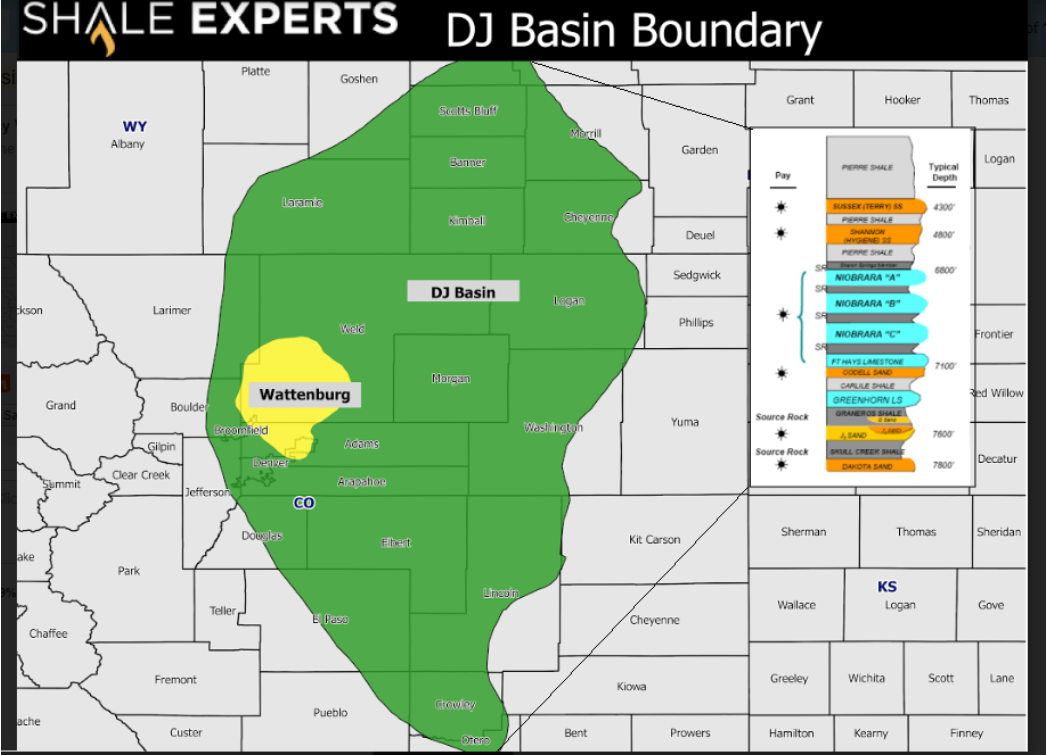

The Denver-Julesburg (“DJ”) Basin is a vast and geologically complex basin marked by sedimentary layering, tectonic shifts, and hydrocarbon generation. Encompassing an area of approximately 20,000 square miles, it stretches across regions of Colorado, Wyoming, Nebraska, and Kansas. Notable within the basin are various fields and geological formations, including the Wattenberg Field, Niobrara, Codell, Greenhorn, Adena Field, Hereford area, and the Redtail Field area.

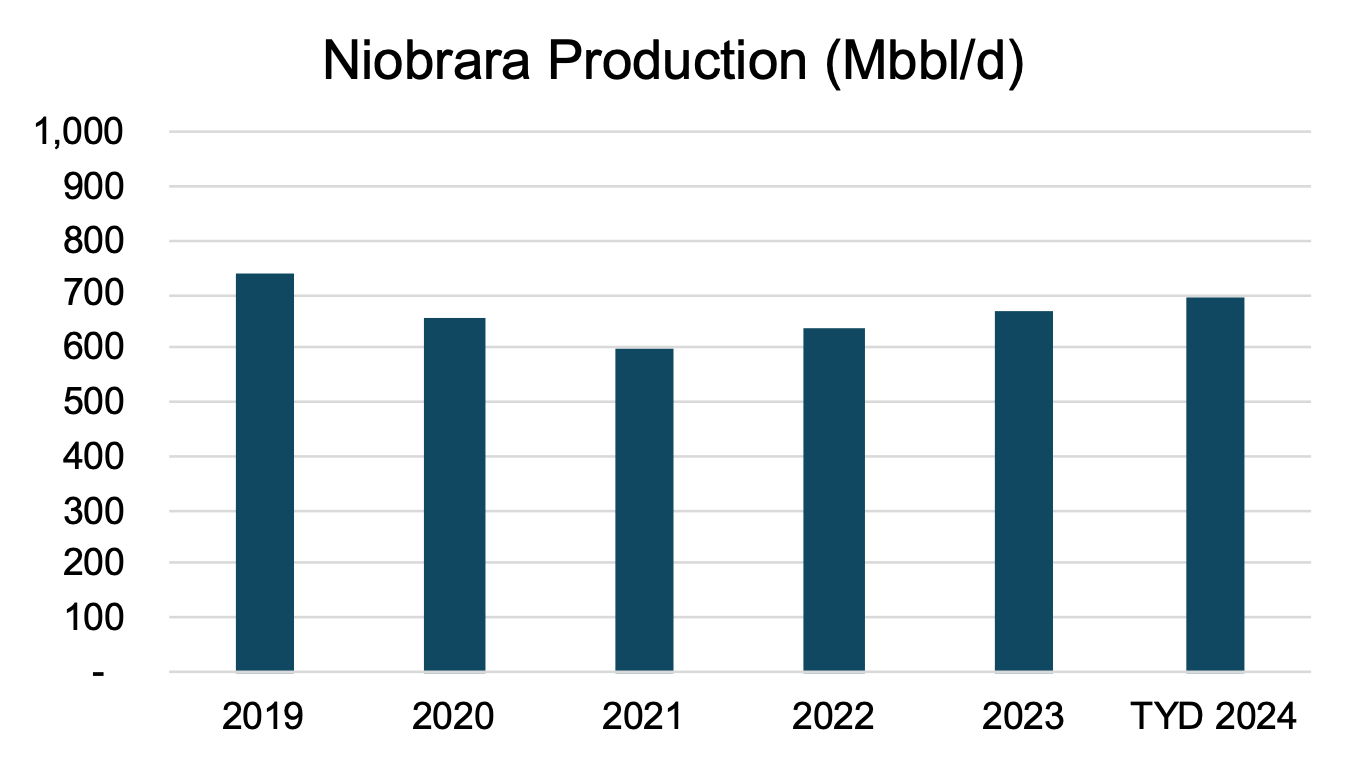

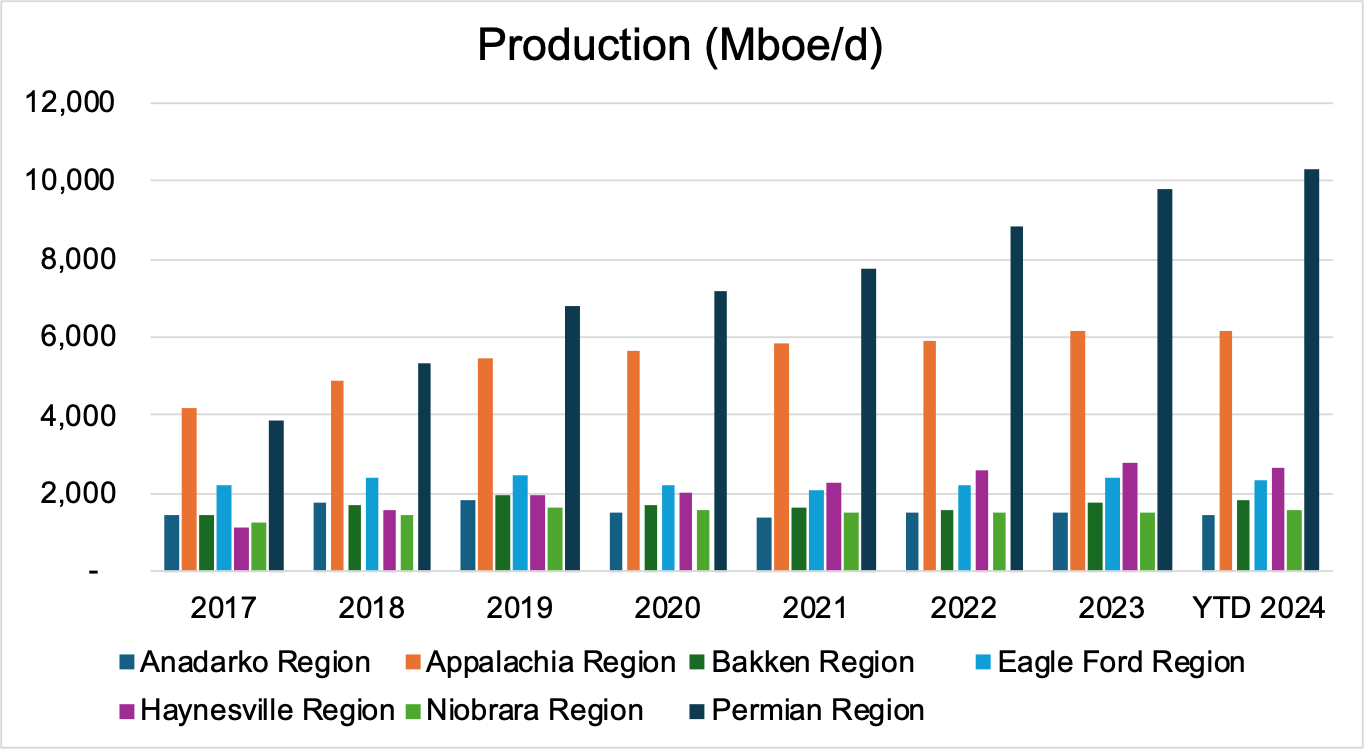

From an economic standpoint, the DJ Basin has long contributed significantly to the U.S. energy sector. Data from the U.S. Energy Information Administration (“EIA”) reveals the DJ Basin was among the top five oil producers in 2023. Specifically, the Niobrara region within the basin recorded a daily average output of 670,000 barrels of oil (mbbl/d) and 1,534,000 barrels of oil equivalent (mboe/d). The Niobrara shale, predominantly an oil-rich formation, is situated in northeastern Colorado with extensions into Wyoming, Nebraska, and Kansas.

The DJ Basin wasn’t immune to the downturns brought on by the Covid-19 pandemic, seeing a dip in production. Nevertheless, since 2021, there has been a steady resurgence in output, with figures nearing those seen prior to the pandemic.

Transactions

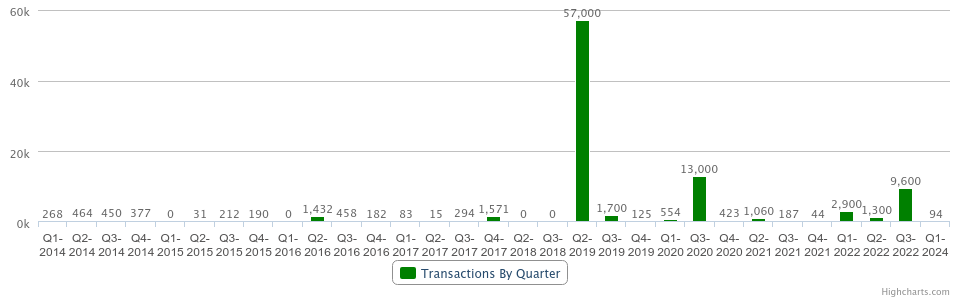

In an era where consolidation is reshaping both upstream and midstream sectors, the DJ Basin is marching to the same beat. While recent mergers and acquisitions may seem modest compared to colossal deals like Occidental Petroleum Corp.’s (OXY) $57 billion acquisition of Anadarko Petroleum Corp. in Q2 2019 or Chevron Corp.’s $13 billion takeover of Noble Energy, Inc. in Q3 2020, but their impact should not be underestimated.

Click here to expand the image above

As of May 6, 2024, IOG Resources II, LLC announced its acquisition of Civitas’ assets located in Weld County, which consists of approximately 1,480 developed and undeveloped wellbores. The mergers and acquisitions trend will likely persist in the DJ Basin, keeping pace with the industry’s rhythm.

E&P Activity

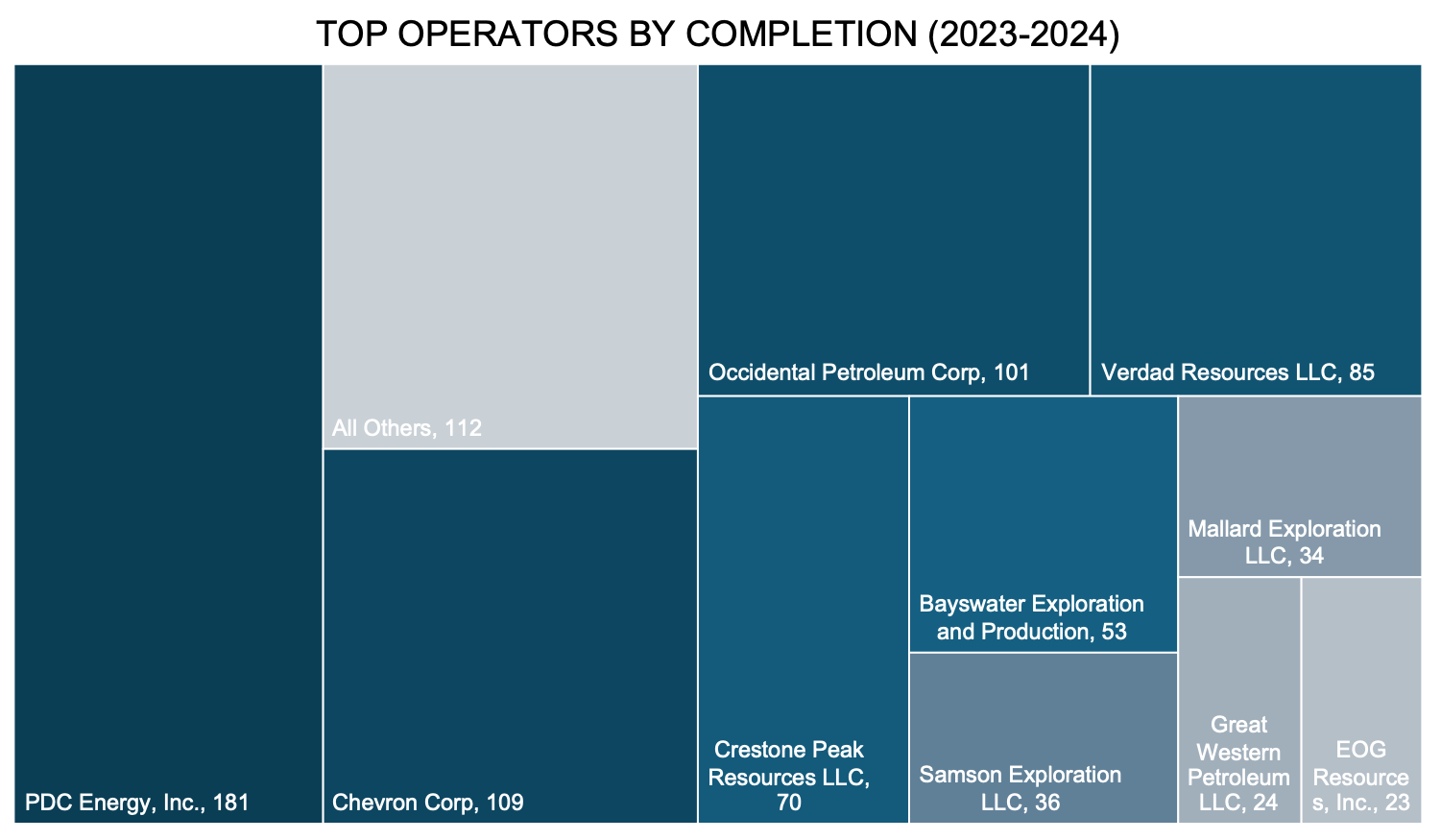

Throughout the 2023-2024 timeframe, the DJ Basin was managed by a total of 23 operators. The leading ten operators, as indicated, were responsible for about 85% of all completions within the basin. Given the notable transactions highlighted earlier, industry giants like Chevron and Oxy are expected to be among the top three operators.

These completions were primarily within Weld County, which accounts for 80%-90% of the basin’s production.

The activity within the DJ Basin, particularly in the Niobrara Region, is centralized with respect to both geography and operational control. Despite this concentration, the basin has maintained stability over recent years, in line with other regions such as the Bakken and Anadarko, as shown below.

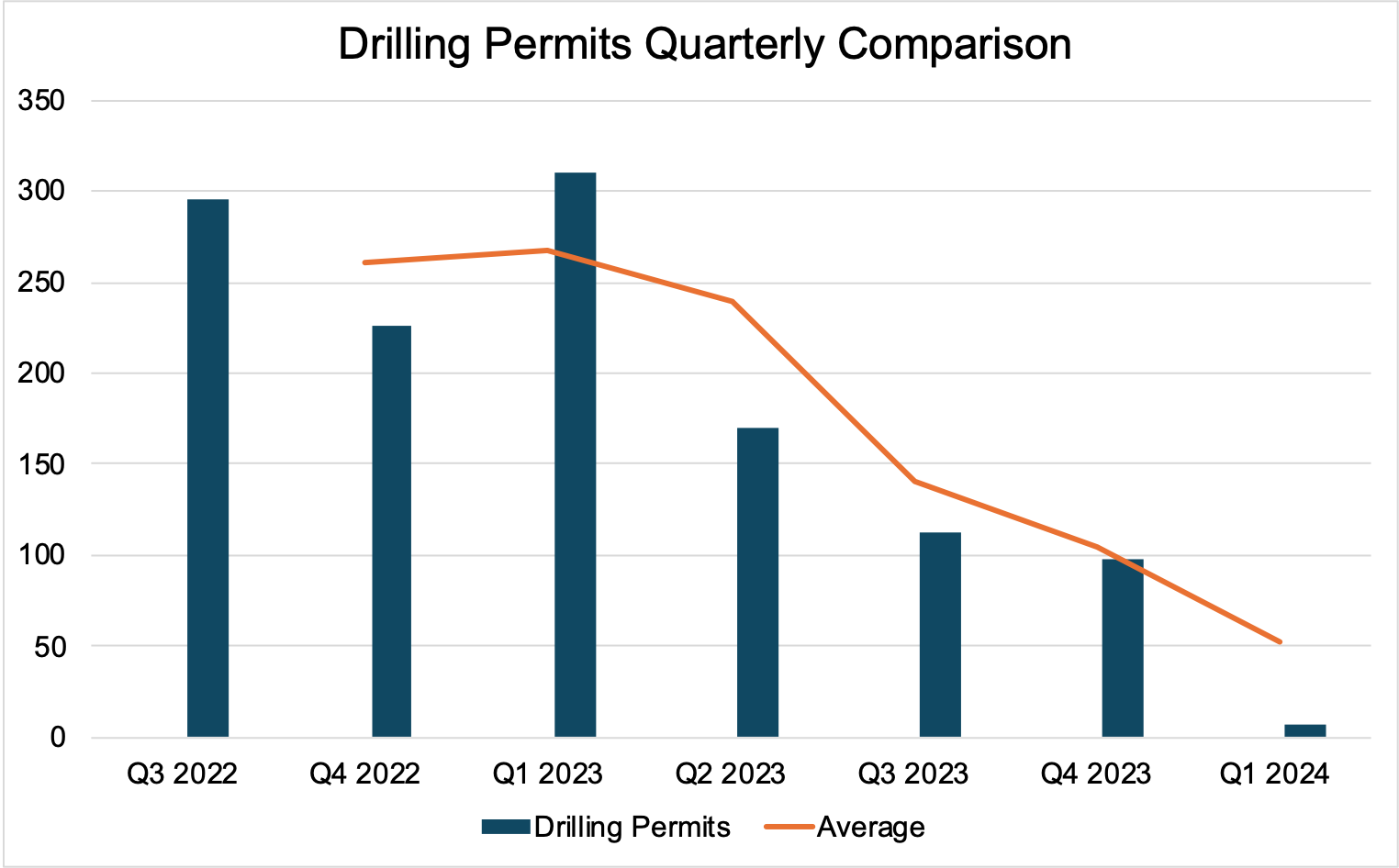

While production levels have shown relative consistency over time, the number of drilling permits issued has seen a marked decline quarter-over-quarter. Excluding the first quarter of 2023, there’s been a steady reduction from Q3 2022 through Q1 2024, averaging a 29% drop. The stark contrast between the mere seven permits issued in Q1 2024 and the 310 permits in Q1 2023 casts a concerning shadow over future projections.

Mercer Capital has assisted many clients with various valuation needs in the oil and gas industry in North America and globally. In addition to our corporate valuation services, Mercer Capital provides investment banking and transaction advisory services to a broad range of public and private companies and financial institutions. We have relevant experience working with companies in the oil and gas space and can leverage our historical valuation and investment banking experience to help you navigate a critical transaction, providing timely, accurate, and reliable results. Contact a Mercer Capital professional to discuss your needs in confidence.

Energy Valuation Insights

Energy Valuation Insights