Ford Motor Company (NYSE:F) is one of America’s most iconic brands. Did you also know they are still significantly led and run by the Ford family? One of the great-grandsons of founder Henry Ford, William Clay Ford Jr., leads the board of directors at Ford. Another great-grandson, Edsel II, is also on the board. Collectively, the Ford family holds enough Class B super-voting shares to elect 40% of the board of directors.

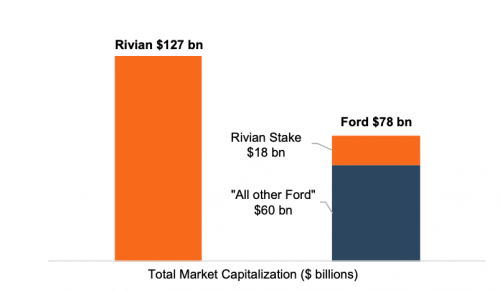

A newer car maker, Rivian Automotive (NasdaqGS: RIVN), saw its IPO price the company at nearly $70 billion. Admittedly, my first thoughts are best reflected by an investor of “The Big Short” fame Michael Burry: speculation gone wild. Rivian is an electric vehicle (or “EV”) start-up that has generated virtually no revenue. At the time of this writing (November 12, 2021), Rivian’s market capitalization was north of $127 billion, making it the second most valuable U.S. car maker behind Tesla. Rivian has made 156 vehicles, implying a cool $1 billion per vehicle delivered valuation. Those are numbers that would make Elon Musk blush. For perspective, Ford delivered over 5 million cars in fiscal 2019, or an implied $15,000 per car.

As fate would have it, Ford has an effective 14.4% ownership interest in the electric car start-up, giving it an implied stake of over $18 billion. Not bad given its sub-$1 billion of invested capital. If one were to do a "back-of-the-envelope" sum of the parts valuation of Ford, Rivian now represents over 20% of Ford’s market capitalization.

We don’t highlight the current irrational exuberance to spur you into investing in an EV start-up or give you a case of ‘FOMO', but to encourage us to think again about family business diversification, something we have written on previously. When thinking about diversification, it is helpful for family business owners to think about three questions: What, Who, and Why?

We don’t highlight the current irrational exuberance to spur you into investing in an EV start-up or give you a case of ‘FOMO', but to encourage us to think again about family business diversification, something we have written on previously. When thinking about diversification, it is helpful for family business owners to think about three questions: What, Who, and Why?

What Is Diversification?

Diversification is simply investing in multiple assets as a means of reducing risk. Suppose one asset in the portfolio takes a big hit. In that case, some other segment of the portfolio will likely perform well at the same time, thereby blunting the negative impact on the overall portfolio. A big question when considering diversification is correlation: if what you are investing in is closely tied to your business currently, diversification benefits are blunted. The following example illustrates the two sides of the equation when diversifying expected returns and correlation.

We note there is not a right answer to the investment choice example above ex-ante: That choice depends on who is investing and for what purpose (discussed in detail below). If you aim to maximize returns and have confidence in your industry, you would pick option #1. If you are more conservative or are not highly confident in your near-term outlook, you may likely choose #3. We discuss the who and why later in this article.

When one thinks about Ford’s investment in Rivian, it appears the legacy car company took the middle road (some correlation, but higher expected return). Rivian is very much a car company, but one focused on electric vehicles. Initially, Ford invested in Rivian so the two would work together to develop a fully electric Lincoln. Ford has catapulted into the electric car space in recent years to much fanfare, with its Mustang Mach-E and F-150 Lighting, making its current investment in a certain light appear redundant, albeit lucrative.

However, Ford considers Rivian a “strategic investment,” according to a spokesman’s comments to CNBC. “We’ve said that Rivian is a strategic investment and we’re exploring potential collaborations,” T.R. Reid said. “We won’t speculate about what Ford will do, or not, in the future.” What Ford decides to do with its very richly priced potential conflict-of-interest investment (competitor, plus Ford supplies certain parts to the start-up) is yet to be seen.

We note there is not a right answer to the investment choice example above ex-ante: That choice depends on who is investing and for what purpose (discussed in detail below). If you aim to maximize returns and have confidence in your industry, you would pick option #1. If you are more conservative or are not highly confident in your near-term outlook, you may likely choose #3. We discuss the who and why later in this article.

When one thinks about Ford’s investment in Rivian, it appears the legacy car company took the middle road (some correlation, but higher expected return). Rivian is very much a car company, but one focused on electric vehicles. Initially, Ford invested in Rivian so the two would work together to develop a fully electric Lincoln. Ford has catapulted into the electric car space in recent years to much fanfare, with its Mustang Mach-E and F-150 Lighting, making its current investment in a certain light appear redundant, albeit lucrative.

However, Ford considers Rivian a “strategic investment,” according to a spokesman’s comments to CNBC. “We’ve said that Rivian is a strategic investment and we’re exploring potential collaborations,” T.R. Reid said. “We won’t speculate about what Ford will do, or not, in the future.” What Ford decides to do with its very richly priced potential conflict-of-interest investment (competitor, plus Ford supplies certain parts to the start-up) is yet to be seen.

Diversification to Whom?

Whose perspective is most important in thinking about diversification? As we have discussed in previous posts, a family business shareholder likely has a view on diversification within the company based on their own personal portfolio mix. For example, if the vast majority of a shareholder’s personal wealth (and income) is derived from the family business, that individual would likely be more concerned with the riskiness of the business overall and prefer more diversification within the company to ensure stability.

Also, consider a well-diversified shareholder outside the family business, and their family business ownership represents a smaller allocation of their personal portfolio. That person would likely prefer to make their own diversification decisions (with dividends paid by the company) or prefer the company to make focused (undiversified) investment decisions to maximize expected returns.

In the case of Ford, one wonders how the Ford family feels maintaining a heavy weighting in the new venture. The Ford family has considerable wealth outside their Ford stock stakes, lowering the need to maintain conservatism within Ford. The family may view the large EV car company stake as a distraction and prefer to make their own, if they so choose, large EV investments outside the business. This logic could lead to a sale or paring down of the stake. This would also allow Ford to utilize part of the proceeds and invest deeper in their own company efforts.

Conversely, one could argue the ‘combustion engine’ is going the way of the Model T, and diversification into an electric vehicle company might be a way to stabilize company performance. The family may view the investment in the separate EV company as a ‘safety valve’ if Ford’s own EV efforts do not pan out. While it may partially distract from the core Ford mission, it could lead to more stable shareholder returns. Again, ‘who’ is experiencing diversification affects how the company will likely face this question in the future.

Why Diversify?

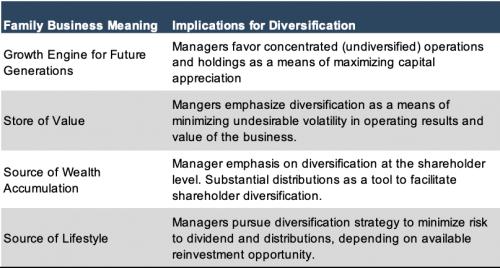

Family businesses often provide a different 'who' regarding diversification and a different 'why' to their publicly traded, non-family controlled counterparts. What the family business means to you impacts how you think about diversification decisions for the family business.

Depending on what the business means to the family, the potential for diversification benefits (correlation, discussed above) may take priority over absolute return. There are no right or wrong answers regarding risk tolerance, but there are tradeoffs that need to be acknowledged and communicated plainly. Family shareholders deserve to know the 'why' for significant investment decisions.

How do you or the Ford family think about your family business meaning? If dividends were key for Ford, with meaning in the ‘lifestyle’ or ‘wealth accumulation’ buckets, a divesture of sorts might be appropriate to generate liquidity for investing in other uncorrelated assets or maintain the family’s lifestyle. But as discussed, Ford’s recent performance and prior move into the EV space has been a big splash for the legacy car giant. Keeping Rivian may be a sign that the family views Ford as the combustion (or electric) engine for future generations of the family and is willing to keep diversification within the company lower and not attempt to overly diversify outside it. Your family must decide its meaning as a business before you begin to think about diversification to provide the framework and context for coming to a big decision.

Depending on what the business means to the family, the potential for diversification benefits (correlation, discussed above) may take priority over absolute return. There are no right or wrong answers regarding risk tolerance, but there are tradeoffs that need to be acknowledged and communicated plainly. Family shareholders deserve to know the 'why' for significant investment decisions.

How do you or the Ford family think about your family business meaning? If dividends were key for Ford, with meaning in the ‘lifestyle’ or ‘wealth accumulation’ buckets, a divesture of sorts might be appropriate to generate liquidity for investing in other uncorrelated assets or maintain the family’s lifestyle. But as discussed, Ford’s recent performance and prior move into the EV space has been a big splash for the legacy car giant. Keeping Rivian may be a sign that the family views Ford as the combustion (or electric) engine for future generations of the family and is willing to keep diversification within the company lower and not attempt to overly diversify outside it. Your family must decide its meaning as a business before you begin to think about diversification to provide the framework and context for coming to a big decision.

Next Steps

Family business owners can take these three questions and apply them to their businesses. Remembering what diversification is and the importance of correlation, who are the stakeholders seeing the largest impact of diversification, and defining what the business means to you all can help guide the diversification question. Some next steps he has highlighted in The 12 Questions That Keep Family Business Directors Awake at Night include:

- Calculate what portion of the family’s overall wealth is represented by the family business

- Identify the three biggest long-term strategic threats to the sustainability of the existing family business operations

- Establish a family LLC or partnership to hold a portfolio of diversifying assets (real estate, marketable securities, etc.)

- Create opportunities to provide seed funding to family members with compelling ideas for new business ventures