From Unfriended to Best Friends Again?

Attaining Efficiency Through Restructuring

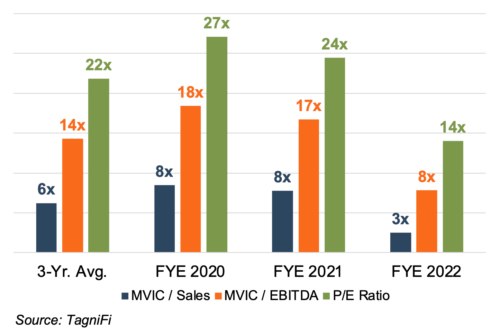

Our old friend Facebook, now known as Meta Platforms (NASDAQ: META), released fourth-quarter earnings and full-year 2022 results earlier this month. If you have been looking up in the sky for unidentified objects, reports were you could also see Meta’s skyrocketing stock price, with shares soaring 23% in a single day, making it the best daily performance in nearly a decade. The stock is currently trading at its highest level in the last six months, albeit still at relatively low implied valuation multiples, as depicted in Figures 1 and 2.

Figure 1:: Meta (Facebook) Stock Performance

Figure 2:: Meta (Facebook) Valuation Multiples

This comes after a notably tough year for Facebook, as its stock fell 64% last year due to heightened competition from TikTok and a slump in the digital ad market. My colleague, Atticus Frank, wrote a great post in October, discussing the heightened skepticism surrounding Meta’s long-term plans as shares fell over 20% after third-quarter earnings were released.

So, what changed? Meta’s reported revenue exceeded analysts’ expectations, but the stock price increase was more than that. The two main changes for this significant increase are cost cuts and the announcement of a $40 billion increase in their share repurchase authorization. While Meta previously taught us about long-term planning and plant/harvest decisions, Facebook’s belt-tightening and share repurchase plan bring up another few lessons on forecasting and share repurchasing.

Forecasting & Restructuring in Uncertain Times

Facebook has adjusted its outlook and is significantly lowering its expense and capital expenditure guidance for the upcoming year by $5 billion and $4 billion, respectively. In addition, the Company also announced that it would lay off 11% of its staff, or approximately 11,000 employees, as reported in quotes from a Wall Street Journal article:

“We expect this recently found discipline to drive a stronger and more nimble organization over the long run, not just for the next 12 months.”

“The positive surprise was the level of reduction in [Operating Expense] and Capex guidance demonstrating significant commitment to being disciplined going forward.”

Mr. Zuckerberg also stated that over 80% of the forecasted capital expenditures spending would be dedicated to its “legacy family of apps business” rather than new ventures. This still leaves considerable spending for new VR and metaverse spending for future growth while making sure to feed the goose that lays the golden eggs (Facebook, Instagram, WhatsApp).

We’ve written previously on forecasting during uncertain times, and today we revisit two of those reminders. Consistency is key. To make your budgets useful, consistently evaluating your process relative to actual performance will allow the family business directors to understand where the forecast process went wrong and right. This insight will help you make better-informed budgets and forecasts in the future. A good budget is adaptable. A forecast is a tool; to be a great tool, it must be adaptable to changing facts and circumstances. Being able to pivot allows your family business to be flexible and to be able to execute when the right opportunities arise. To dive deeper, visit an earlier post focusing on specific revenue, expense, and cash flow forecasts.

Is Now the Time to Buy Back?

In January 2023, the Meta Board of Directors authorized an additional $40 billion of share repurchases under the current program. Share buybacks enable companies to generate additional shareholder value by reducing the number of total shares and increasing the relative value of the business to the remaining shareholders.

Share buybacks are a little more complicated for family businesses than those on Wall Street (buyback your grandma’s stock, anyone?). Of course, the questions surrounding the decision and timing of shareholder redemption do not have a simple answer. This previous post is a great place to start understanding how sizable shareholder redemptions can serve several purposes in your family business. It is important to keep in mind there are multiple viewpoints to consider with family shareholder redemptions: the selling shareholder, the family business, and the remaining shareholders. Each of these parties brings a unique perspective and need, along with the undoubted family baggage that comes with family ownership. Balancing these competing perspectives is one of the bigger challenges of executing a significant redemption. While a share redemption may be viewed with suspicion by some, it is helpful to remember that shareholder redemptions can be useful in matching the economic benefits of ownership with the preferences and needs of individual family shareholders. Only when the goals and tradeoffs are identified will the parties be able to create a financial model that supports the balancing act of a family shareholder redemption.

Conclusion

If an outside perspective can help your forecast process or it might be time for a shareholder redemption in your family business, give one of our professionals a call to discuss your situation in confidence.

Family Business Director

Family Business Director