Fall 2022 Middle Market M&A Update

For this week’s post, we take a look at recent trends in middle market M&A. Despite turbulent economic and geopolitical conditions in the first half of the year, valuations in the middle market continued to hold their ground.

Still, whether looking to buy or sell, family business owners would be wise to act sooner rather than later, as declines in volume and value thus far in 2022 suggest tightening conditions in the middle market.

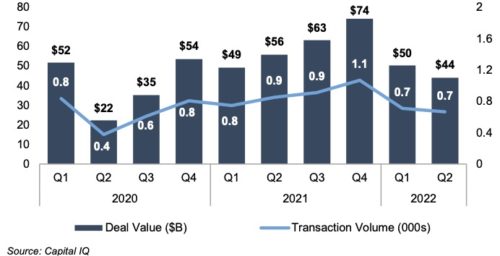

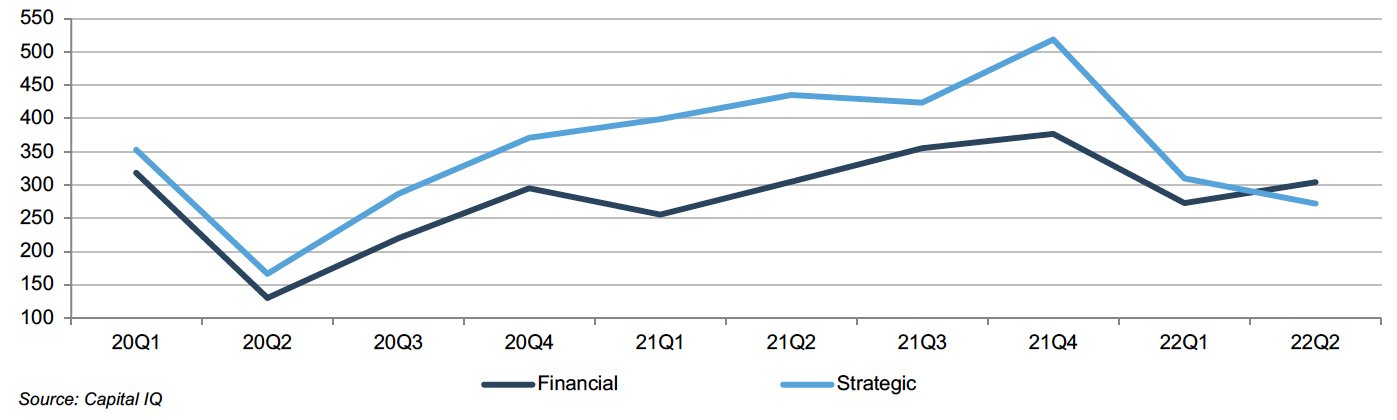

Overall deal activity in the second quarter of 2022 fell from levels seen in the first quarter of the year and the second quarter of 2021. In aggregate, deal activity in the first half of 2022 also fell from aggregate deal activity in the first half of 2021.

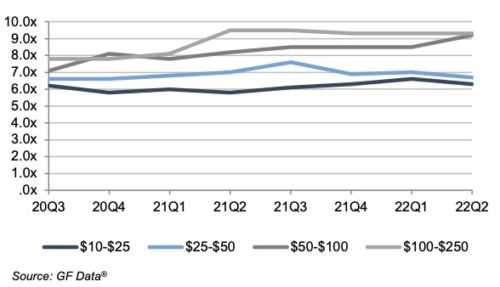

Despite the decline in U.S. deal value and volume, multiples on deals completed in the first half of the year remained in line with levels observed in 2020 and 2021, suggesting a potential “flight to quality” in the middle market in the first half of the year.

U.S. Deal Value and Volume: Q1-2020 to Q2-20222

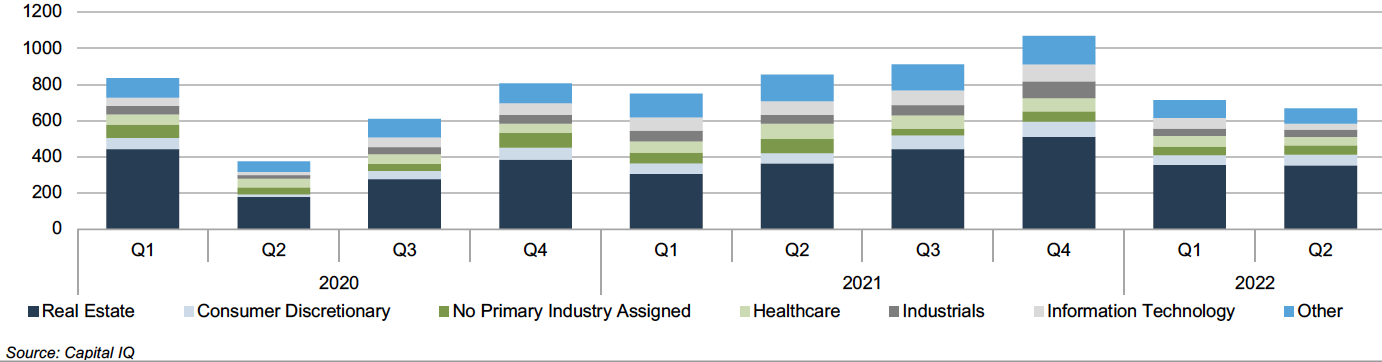

U.S. Deal Volume by Industry: Q1-2020 to Q2-2022

Click here to expand the image above

Broader economic conditions in the U.S. negatively influenced deal value and volume in the first half of 2022 but did not stifle overall deal activity. In the second quarter of 2022, U.S. GDP declined for the second straight quarter, and annual and monthly inflation measures continued to hit record levels.

In response to the rampant inflation in the U.S. economy, the Fed executed two sizable rate increases in the second quarter, including enacting the largest rate increase since 1994 at its June meeting. While the U.S. economy has not yet officially fallen into a recession (despite the two straight quarters of decline in GDP), most Fed watchers agree that Jay Powell and the FOMC won’t relent in their fight to bring down inflation even if it does cause a recession. In short, the Fed appears to be willing to take a cool down in inflation in exchange for a weaker short-term outlook in terms of GDP and overall economic growth.

TEV/EBITDA Multiples: Financial Buyers

Last 8 Quarters

Yet despite these challenging macroeconomic conditions, deal activity did not come to a screeching halt in the first half of 2022, as seen in the middle of 2020. We believe this is a good sign for the overall health of the middle market, particularly when coupled with the fact that multiples on PE deals were relatively unchanged in the second quarter, as seen in the chart above. The prolonged “sellers’ market” of the past several years appears to be holding up to this point in 2022, as buyers continue to be willing to pay elevated multiples for well-positioned businesses coming to market. Deals in the $50-$100 million tranche of the middle market realized multiple expansions in the second quarter, growing from an average multiple of 8.5x to 9.2x. Multiples in other tranches were either unchanged or slightly down.

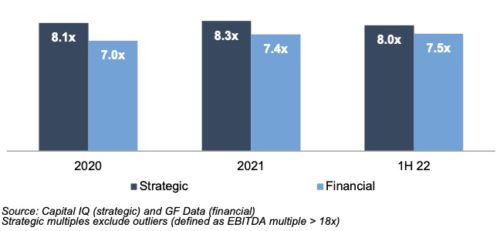

EBITDA Multiples by Buyer Type: 2020 to 1H 2022

Number of Deals by Buyer Type: Q1-2020 to Q2-2022

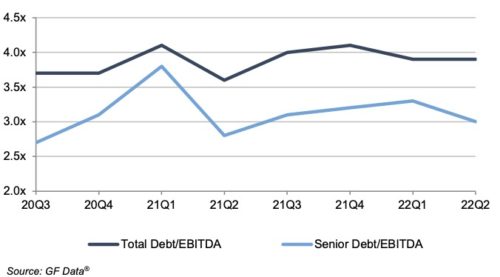

Click here to expand the image above

Debt multiples on PE deals fell in the second quarter of 2022. The drop in debt utilization in deal activity is likely a sign that rising interest rates are beginning to weigh on deal activity and financing terms. Rising interest rates equate to an increased cost of borrowing and overall cost of capital for businesses, increasing the discount rates used in buyers’ valuations of potential targets. While elevated discount rates, in theory, should lead to valuations (and hence multiples) coming down from levels seen over the past several years, corporate balance sheets and PE firms still appear to be flush with cash. We believe there is still a great deal of readily deployable capital on the sidelines that should continue to support elevated multiples and valuations in the middle market in the foreseeable future.

Debt Multiples: Financial Buyers

Through 2Q 2022

In conclusion, while deal volume was down in the second quarter of 2022 (and in the first half of the year in general), activity did not come to a screeching halt despite a challenging economic environment in the U.S. and geopolitical strife abroad.

In our opinion, there has been a “flight to quality” in the middle market, which has supported valuations and multiples despite reduced deal volume. This has created heavy competition among strategic and financial buyers for well-positioned businesses coming to market and, in the process, has helped maintain the elevated multiples and deal values seen in the middle market over the past year or so.

While observed multiples remain elevated, owners looking to transact their business would be advised to begin the process sooner rather than later, given the prospects of further interest rate hikes, continued volatility in the public markets, ongoing geopolitical tensions globally, and the upcoming midterm elections.

While the state of the middle market remained relatively placid in the first half of 2022, these and other factors will likely hamper deal activity in the middle market in the coming quarters and years.

Family Business Director

Family Business Director