Fair value measurements have been a hot topic for many years due to the judgmental nature of the estimation process. Despite ongoing improvement efforts by standards setters, regulators, and valuation specialists, deficiency findings in audits continue to proliferate.

In March 2015, a survey conducted by the International Forum of Independent Audit Regulators (IFIAR) found that nearly half of global audits contained a deficiency. Of those deficiencies, 20% centered on fair value measurements. The deficiencies included cases of failure to sufficiently test source data, failure to assess the reasonableness of assumptions, and lack of consideration of contrary/inconsistent evidence, where available. Other than fair value measurement, 24% of deficiencies were due to internal control testing and 14% were due to issues associated with revenue recognition. In the U.S., the PCAOB found that 39% of audit inspections within the four largest accounting firms resulted in deficiencies, compared to 37% the prior year. In a previous blog post, “New PCAOB Consultation Paper Addresses Fair Value Auditing Standards,” we discussed the PCAOB’s historical and continuing efforts to improve audit standards for accounting estimates and fair value measurements.

On a related front, the FASB has also begun to streamline fair value measurement and disclosure requirements for greater consistency between companies. Initial discussions about the topic began at the FASB’s September 2014 meeting, followed by a meeting on March 4, 2015, at which the FASB tentatively decided to eliminate or modify certain existing fair value measurement disclosure requirements. The changes affect the sensitivity analysis within the fair value hierarchy, Levels 1-3, which are based on market participant assumptions. Level 1 inputs are comprised of observable prices for identical assets or liabilities in an active market while Level 2 inputs generally include observable prices of similar assets in active markets or quotable prices for identical assets in markets that are not active. Level 3 inputs are “unobservable inputs” developed based upon the best information available under the circumstances, which might include the reporting entity’s own data.

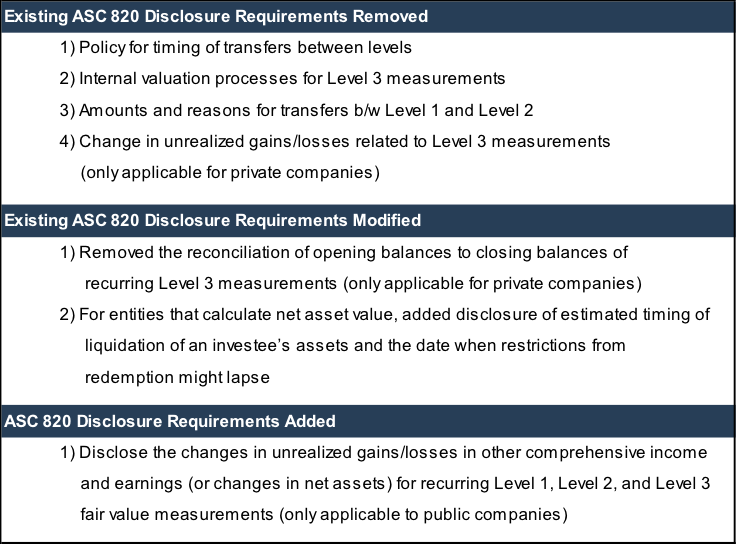

The following table summarizes the FASB’s tentative changes.

Mercer Capital will continue to monitor the status of these potential changes and other developments in arena of fair value accounting. Please refer to the FASB Board Meeting Handout Disclosure Framework—Fair Value Measurement March 4, 2015 for more information.

Related Links

- New PCAOB Consultation Paper Addresses Fair Value Auditing Standards

- Audit Deficiencies Continue to Cause Headaches

- SEC Signals Increased Focus on Financial Reporting

Mercer Capital’s Financial Reporting Blog

Mercer Capital monitors the latest financial reporting news relevant to CFOs and financial managers. The Financial Reporting Blog is updated weekly. Follow us on Twitter at @MercerFairValue.