With analysts and pundits trying to identify those sectors that may be overheating as the market grinds to all-time highs, one sector to keep an eye on is financial technology (“FinTech”). While the industry is difficult to define precisely, financial technology broadly covers companies utilizing technology to provide or facilitate financial services in niches ranging from payments to providing solutions to traditional financial institutions to bitcoin to peer-to-peer lending.

Optimism and investor interest in FinTech is growing and has been for some time. A recent report by CB Insights noted that total FinTech start-up funding grew 45% in the last year and totaled $13.7 billion in 2014. Finovate noted that the number of FinTech “unicorns” tripled to 36 in mid-2015 compared to 11 in the prior year. Mercer Capital’s FinTech industry reports have noted an uptick in both M&A and IPO activity in recent periods as well. A number of factors are driving optimism towards FinTech and include technology advancement and evolution, evolving consumer behavior and expectations for digital delivery of financial services, and regulatory response to the financial crisis, which has served to create opportunities for emerging, less regulated FinTech companies.

The mainstream media appears to be picking up on the story as well with The Economist devoting a section of a recent issue to a special report on FinTech. A portion of that report notes that an “uneasy symbiosis” exists between FinTech and traditional financial services incumbents. Another article commented that “the threat the fintechers pose to incumbents is that they might just seize the profitable add-ons” as opposed to taking over day-to-day core banking activities.

For additional perspective in terms of profit potential for FinTech, Goldman Sachs noted in a recent report that they see millenials as the key drivers of change and “over $4.7 trillion of revenue at traditional financial services companies at risk of disruption by the new, technology-enabled, entrants. Assuming a 10% profit margin, implies a $470 billion profit pool at risk.” The report goes on to note that the addressable market could largely be spread across four sectors: crowdfunding, wealth management, lending, and payments. However, Goldman’s report does acknowledge that how much market share the new FinTechers take versus the traditional financial services incumbents who are also looking to evolve, potentially acquire or partner with, and/or compete will be an interesting thing to watch as FinTech evolves.

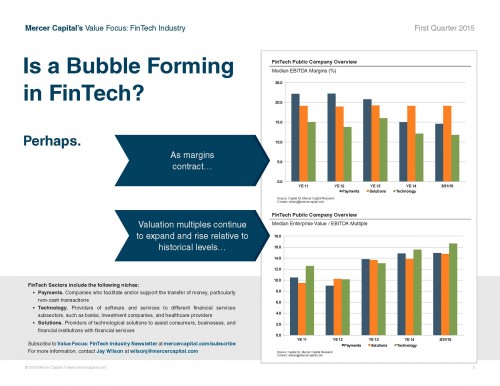

Against this backdrop, we thought it might be useful to examine valuation multiples within the FinTech industry over time to see whether public markets are reflecting these trends as well. While key valuation drivers such as profitability, growth prospects and risks vary among each FinTech niche, the graphic below illustrates that the public market is indeed telling a similar story and perhaps a FinTech bubble is emerging or at least starting to form as margins are generally down across various FinTech niches while valuation multiples have expanded.

Mercer Capital has a long history of working with financial and non-financial companies and helping to solve complex problems ranging from valuation issues to considering different strategic options. If you would like to discuss the FinTech sector or your company’s unique situation in confidence, feel free to give us a call or email.

For those interested in additional FinTech trends, check out our latest FinTech industry newsletter and sign up for future issues here.

Related Links

- FinTech Value Focus Q1 2015: Case Study on Coinbase

- How to Value Venture Capital Portfolio Investments

- How to Value a Company Planning to IPO

Mercer Capital’s Financial Reporting Blog

Mercer Capital monitors the latest financial reporting news relevant to CFOs and financial managers. The Financial Reporting Blog is updated weekly. Follow us on Twitter at @MercerFairValue.