Non-GAAP performance measures are becoming more and more popular, particularly for companies looking to raise capital in an IPO. Although financial statements prepared in accordance with GAAP provide the public a standardized basis for historical and comparable financial statements, the use of non-GAAP measures, such as adjusted EBITDA or adjusted gross profit, can allow management to emphasize alternative measures. As recently noted in CFA Institute Magazine, non-GAAP performance measures provides companies an opportunity to “provide users with information they believe will put them in a better position to understand a company’s performance, financial statements, or management’s point of view.”

After the Sarbanes-Oxley Act of 2002, non-GAAP measures were strictly monitored and rarely used in financial statements. Issued in 2003, Regulation G required that companies which present non-GAAP measures define the basis of the calculation and reconcile the measure to the most relevant GAAP measure. Full disclosure explaining the usefulness and purposes for inclusion is also required. More recently, regulators appear to be becoming less skeptical of non-GAAP measures as more companies and investors rely on non-GAAP measures as a means of understanding and analyzing companies.

In October 2014, PricewaterhouseCoopers published a study on non-GAAP measures used in over 400 IPOs between 2011 and 2013. The study found that approximately 60% of IPOs used at least one non-GAAP measurement. The analysis found that the most commonly used measure was EBITDA, used by over 65% of the IPOs analyzed. Further, of these IPOs presenting EBITDA, 46% also presented adjusted EBITDA. The adjustments included equity-based compensation, impairments, acquisitions, restructuring and reorganization, non-recurring & unusual changes, and gain/loss on foreign exchange currency.

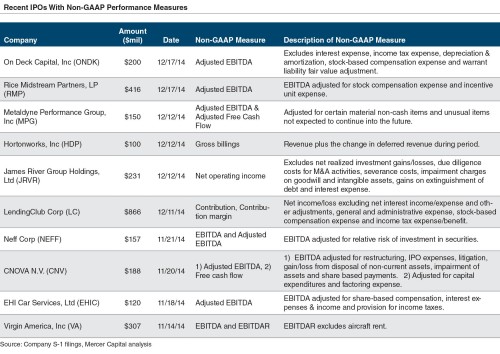

A look at more recent IPOs confirms the popularity of non-GAAP measures.

As shown above, Mercer Capital reviewed ten recent IPOs that each raised in excess of $100 million. Adjusted EBITDA continues to be the most commonly used non-GAAP measure. However, each company may define Adjusted EBITDA differently, which creates problems when investors and analysts attempt to track and benchmark companies over time and to each other. So while non-GAAP measures might make for a shorthand way to communicate results, they are no replacement for sound financial analysis when it comes to valuation.

Related Links

Mercer Capital’s Financial Reporting Blog

Mercer Capital monitors the latest financial reporting news relevant to CFOs and financial managers. The Financial Reporting Blog is updated weekly. Follow us on Twitter at @MercerFairValue.