We have previously noted that the degree of difficulty for fair value measurements has been low for some time. Switching metaphors, choppy equity markets and widening credit spreads during the third quarter of 2015 indicate that it may no longer be safe to move about the valuation cabin.

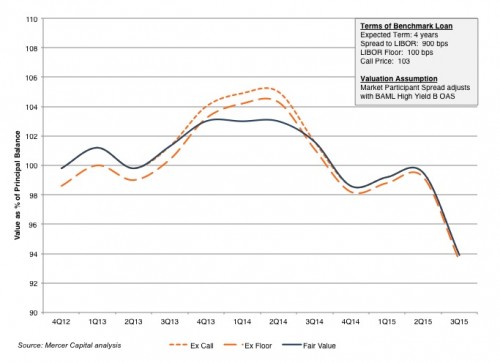

A nearly 200 basis point increase in the B0fA Merrill Lynch US High Yield B Option-Adjusted Spread during the quarter pushed the fair value of our benchmark loan from 99.5 to 93.9, as shown in the following chart:

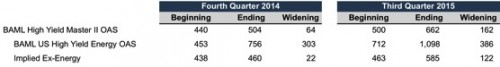

As was the case in 4Q14, energy credits led the way down. However, unlike 4Q14, the spread widening was much broader. Assuming that energy credits account for approximately 15% of the high yield universe, non-energy spreads widened 122 basis points during the third quarter.

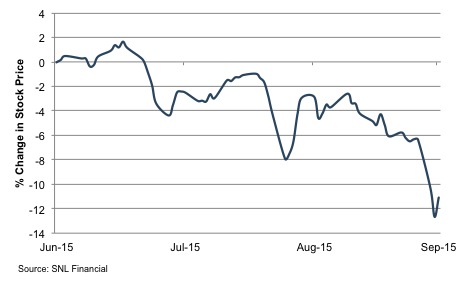

For business development companies and many other debt-focused funds, the use of financial leverage magnifies the pressure on net asset value from wider credit spreads. Using our benchmark loan as a proxy for the fair value of portfolio assets (see here for a discussion of the limitations of this assumption), the 5.6% decline in the value of portfolio assets translates into a 9.4% decrease in net assets for a fund with 40% leverage. As evident below, BDC investors seem to be taking a similar – perhaps even a bit dimmer – view of portfolio values, as stock prices fell about 11% during the quarter.

Widening credit spreads ultimately signal market concerns about credit quality. While reported credit statistics for BDCs and other non-traditional lenders have remained robust so far in this cycle, the market signals suggest that lenders are likely to begin disclosing less healthy portfolio credit metrics. Measuring the fair value of individual credits in such an environment becomes even more difficult as one must evaluate not only market-wide inputs, but also closely scrutinize the financial results and prospects of each borrower. Those assessments are difficult to make in real-time. For highly leveraged structured products like CLO equity, the sensitivity of a given fair value measurement to changes in inputs can be substantial.

The growing list of valuation-related litigation and enforcement actions is a testament to the fact that fair value reporting matters. Valuation disputes are a portion – but by no means all – of the controversy surrounding the Zohar funds managed by Patriarch Partners LLC.

Whether the third quarter represents merely a small patch of rough air or the beginning of a long, bumpy multi-quarter ride remains to be seen. In either event, it is a reminder that fair value measurement is not always so easy.

Related Links

- If Valuation Were An Olympic Sport

- Credit Spread Blues & Portfolio Valuation Marks

- Portfolio Marks: 2Q15 Outlook

Mercer Capital’s Financial Reporting Blog

Mercer Capital monitors the latest financial reporting news relevant to CFOs and financial managers. The Financial Reporting Blog is updated weekly. Follow us on Twitter at @MercerFairValue.