RMA Annual Statement Studies

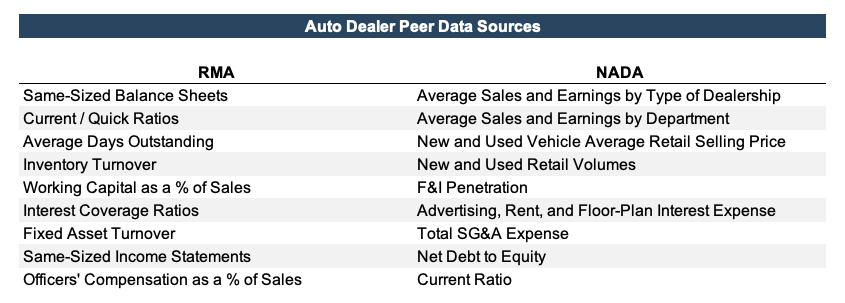

Beginning on the outer layer of our proverbial onion, one of the base resources employed by appraisers for companies in a variety of industries is the Annual Statement Studies: Financial Ratio Benchmarks, as published by the Risk Management Association. We refer to this information simply as “RMA” for short.

This annual study allows users to determine the composition of common sized balance sheets, income statements, and other key financial ratios. Though RMA data was initially published to aid banks in determining the suitability of loans, this information is still helpful in the valuation context because it allows us to gain insight into industry financial trends.

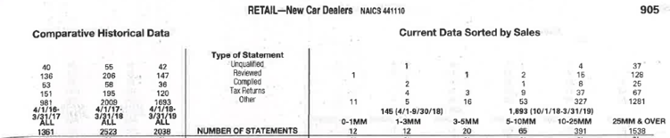

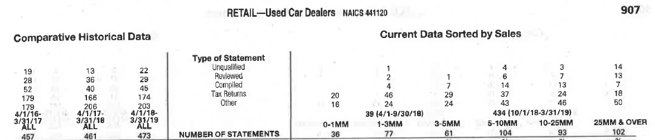

RMA data is offered by North American Industry Classification System codes (“NAICS” codes). For auto dealers, there are Retail – New Car Dealers (#441110) and Retail – Used Car Dealers (#441120). As seen in the pictures below, the vast majority of peer information comes from new vehicle dealers with over $25 million in sales. Most auto dealers, whether they have one rooftop or several, tend to fall into the over $25 million category. In an industry where vehicles retail around $30 thousand, a dealer only needs to sell about 830 vehicles a year to get to $25 million in revenue, and this doesn’t even consider fleet, wholesale, and fixed operations.

While we frequently show both new and used vehicle financial ratios from RMA, the data from new dealers is more likely to be appropriate for a typical franchised dealer, even those with material used vehicle operations.

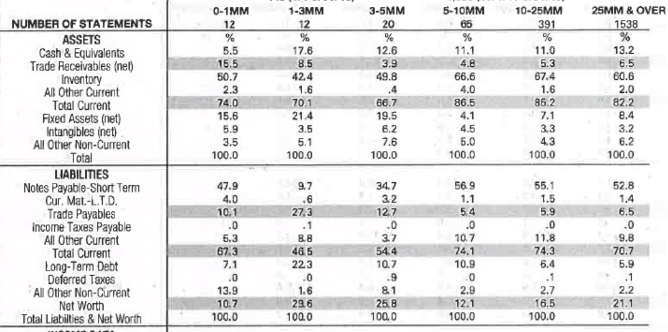

As alluded to previously, this data provides common size balance sheet and income statements. For example, RMA data shows inventory comprises about 60% of total assets, while short-term notes payable (the vast majority of which for auto dealers is floor-plant debt) comprise about 52.8%. Many dealers do not fully finance their used vehicles, which likely plays a role in inventory exceeding short-term notes payable in the RMA data. Inventory as a percentage of total assets and inventory turnover can also be used to determine the amount of inventory held by a dealer.

These data points can then be applied to the subject company we are valuing to consider how floor plan debt usage may impact liquidity and expenses and whether they are carrying adequate inventory to support sales.

RMA data also provides helpful insights into the following metrics:

- Working capital as a percentage of sales

- Inventory turnover

- Average Days Outstanding (on receivables and payables)

- Gross and Pre-Tax profit margins

- Officer/director compensation as a % of sales

NADA Dealership Financial Profiles

While RMA data is a useful starting point, the auto dealer industry has more directly comparable data available. Peeling back the next layer of the onion, The National Automobile Dealers Association (“NADA”) publishes Dealership Financial Profiles on a monthly basis.

Like RMA, data from all types of dealerships is compiled in the “Average Dealership Profile.” For dealers with many rooftops, this may give a good overall perspective. However, when valuing a single point location, Dealership Financial Profiles help us to get even more specific.

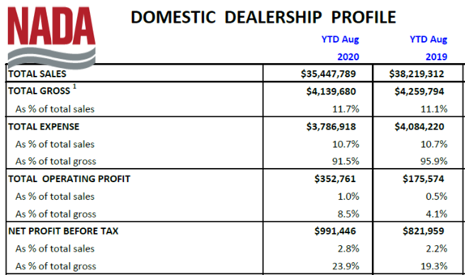

NADA offers data for domestic, import, luxury, and mass market dealerships. This is helpful because while operations can be substantially similar for different brands of dealerships, margins and profit drivers tend to be different for the various types of dealerships. This enhanced granularity allows for better comparisons than the information provided by RMA, and monthly information is also more helpful than annual studies. However, NADA information focuses primarily on the income statement, with minimal information on the balance sheet available (excluding the net debt-to-equity and current ratio). Sales, gross profit, operating profit, pre-tax profit figures are offered for various types of dealerships as seen below for domestic dealerships.

Beyond just margins, NADA data drills down further into the following:

Beyond just margins, NADA data drills down further into the following:

- Profitability by department (new, used, and fixed operations)

- New and used retail volumes

- F&I penetration

- Advertising, rent, floor-plan interest, and SG&A expenses

20 Group Data

In our valuation engagements, we frequently ask for 20 Group data, which is compiled by OEMs and compares dealers to their peers.

Unlike NADA data, the peers in a 20 Group statement will be only the same brand, and selected peers will likely be more similar to the subject company in terms of size or geography (or both). As such, this represents the closest comparison possible.

Unfortunately, this data is not always available, and as noted in our other sources, we caution against heavy reliance on such information as necessary valuation adjustments are not frequently considered on dealer financial statements, and therefore, will not lead to fool-proof data points upon which to base valuation adjustments.

Blue Sky Transactions Data

Another data source frequently considered in transactions of auto dealerships are Blue Sky multiples, as published by Haig Partners and Kerrigan Advisors.

Blue Sky multiples offer different perspectives than the above information. These auto dealer focused investment banks publish indications of dealership intangible value they encounter in the transaction space. For valuation purposes, these multiples can be used in conjunction with peer performance to explain the Blue Sky value of a dealership. If a certain branded dealership typically gets a 5-6x Blue Sky multiple, and the dealership is performing better than their peers, all else equal, they may get a multiple at the upper end or even above this range.

However, not everything is all equal. You’d pay more for a dealership that delivers consistently strong returns. But how much of the increased value is due to higher earnings and how much is to a higher multiple?

If a company is underperforming its peers, but the buyer believes they can improve performance up to peers, a higher value paid on lower historical earnings implies a higher multiple, so even an underperforming dealer might get a higher multiple than a better performing peer.

Multiples are based on some indication of value and some indication of earnings; they frequently describe value rather than prescribe value. Stated more simply, a valuation does not simply derive tangible book value and apply the mid-point of the Blue Sky multiple range to pre-tax earnings. A proper valuation will determine the value of the dealership and be able to communicate why the implied Blue Sky value is reasonable within the context of historical and expected earnings and compare this performance to that of its relevant peers.

Conclusion

In total, these various sources offer plenty of perspective into the historical performance and expected value in the marketplace for an auto dealership. Each source offers a different type of insight, and each comes with its own strengths and drawbacks. We have summarized data available from RMA and NADA in the following table.

For a better understanding of where your dealership stacks up relative to peers and potentially in the marketplace, contact a member of the Mercer Capital Auto Dealer Valuation team today.