Ever wonder why the local news teases the weather report in the first five minutes of each broadcast before returning to it later in the show? Because everyone wants to know the weather forecast so they can plan ahead.

In this post, we provide the weather report for the auto dealer industry with a review of the three recently released industry reviews.

Haig Partners and Kerrigan Advisors have released their Third Quarter Blue Sky Reports and J.D. Power just released its U.S. Sales Satisfaction Index. These reports are timely and informative of not only where the auto dealer industry is today, but where it is headed.

Transaction Volume

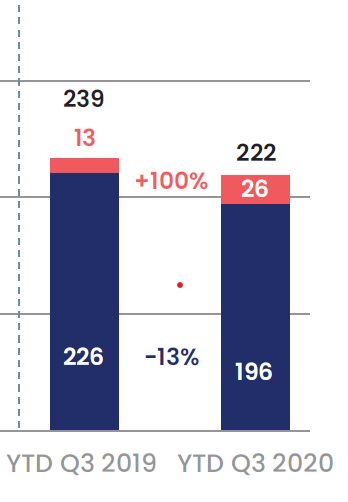

Transaction volume often defines the health of the industry. After a turbulent spring and slow climb during the summer, auto dealer transactions are on the rise in the third quarter. According to Haig Partners, transactions for the third quarter topped 95, representing a 9% increase over the same quarter for 2019. As seen in the graph below, public auto dealers have capitalized on their increasing market values, acquiring 21 dealerships in Q3 compared to only 6 in Q3 2019. The monthly average number of dealerships being acquired is currently about 30, compared to 5 or fewer per month in April/May.

[caption id="attachment_35044" align="aligncenter" width="277"]

[caption id="attachment_35044" align="aligncenter" width="277"] Source: Haig Partners[/caption]

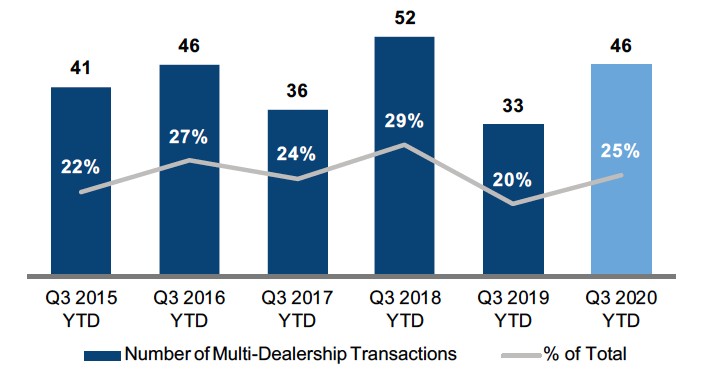

Kerrigan noted the increase in multi-dealership transactions. The much publicized acquisitions of luxury dealerships by Lithia Motors and Asbury Automotive was evidence of this trend. Other contributors include the formation of many special purpose acquisition companies (or SPACs) and investment companies, which we have previously written about.

Many dealerships are on the back side of the family ownership life span, and high multiples are making exits more intriguing. Specifically, Kerrigan notes that multi-dealership transactions are up from 33 to 46, or an increase of 25% from the first nine months of 2019. Q3 2020 is tied for the second most multi-dealership transactions for the same time period in the past 5 years.

[caption id="attachment_35054" align="alignnone" width="702"]

Source: Haig Partners[/caption]

Kerrigan noted the increase in multi-dealership transactions. The much publicized acquisitions of luxury dealerships by Lithia Motors and Asbury Automotive was evidence of this trend. Other contributors include the formation of many special purpose acquisition companies (or SPACs) and investment companies, which we have previously written about.

Many dealerships are on the back side of the family ownership life span, and high multiples are making exits more intriguing. Specifically, Kerrigan notes that multi-dealership transactions are up from 33 to 46, or an increase of 25% from the first nine months of 2019. Q3 2020 is tied for the second most multi-dealership transactions for the same time period in the past 5 years.

[caption id="attachment_35054" align="alignnone" width="702"] Source: Kerrigan Advisors[/caption]

Source: Kerrigan Advisors[/caption]

Profitability

Two weeks ago, we discussed the record level Gross Profit Margins per Unit (GPUs) in new and used vehicles and their contribution to the overall profitability of dealerships through October 2020. These metrics only tell part of the profitability story. Auto dealers have also been successfully minimizing their operating expenses during these unprecedented times and Haig points to three specific expense areas: advertising, labor, and floor plan.

As we have discussed several times throughout the year, new vehicle supply has been constrained as manufacturing plants have faced temporary shutdowns and other challenges. Dealers have had fewer new vehicles to sell, and consequently, have chosen to spend less on advertising. This lower level of inventory has reduced the cost to maintain the inventory, or floor-plan interest. Lower interest rates have further lowered these costs. As a result, auto dealers’ floor plan costs are currently much less than in a normal operating environment.

Finally, personnel or labor costs have been drastically reduced across many dealerships. The lack of foot traffic in showrooms and temporary shutdowns across the country have forced many auto dealers to reduce their staff. Kerrigan notes that few buyers they have spoken to expect dealers to return to pre-COVID staffing levels and are instead choosing to optimize digital sales platforms to help support operations with reduced staff.

Blue Sky Multiples

So far, 2020 has been the tale of three quarters in terms of Blue Sky multiples. Q1 saw a decline in virtually every brand covered by the Haig Report. While Q2 showed some recovery in Blue Sky multiples coinciding with a steady climb in SAAR, Haig has raised the Blue Sky multiple range for nearly every brand in Q3. The only brands not to see an increased rating by Haig for Q3, are Infiniti, Cadillac, and Lincoln. However, Haig has recently reported franchise value ranges for these brands in lieu of Blue Sky multiples for several quarters due to operational struggles.

Kerrigan’s Blue Sky multiples have mostly been held steady in Q3 except for a reported increase in three brands: Chevrolet, Buick/GMC, and Volvo. The difference in perspective of these multiples can be explained in the pricing of transactions. With unparalleled profitability experienced by many auto dealers in 2020 due to increased GPUs and decreased operating expenses, buyers must ponder the sustainability of each of these measures, as well as overall profitability. Historically, according to Haig and Kerrigan, auto dealer transactions were often priced based upon the latest year’s earnings. Buyers now need to evaluate the expected level of earnings for the dealerships into the future, a metric that the auto dealer industry has never relied on much. According to Kerrigan, buyers are pricing transactions off of a modified/sustainable 2020 earnings stream. In other words, buyers are adjusting or discounting actual 2020 earnings from elevated levels to a future expectation.

Similarly, Haig Partners discusses buyers' pricing transactions based on previous 2019 level of earnings, rather than the heightened/unsustainable 2020 levels.

Sales Satisfaction Index

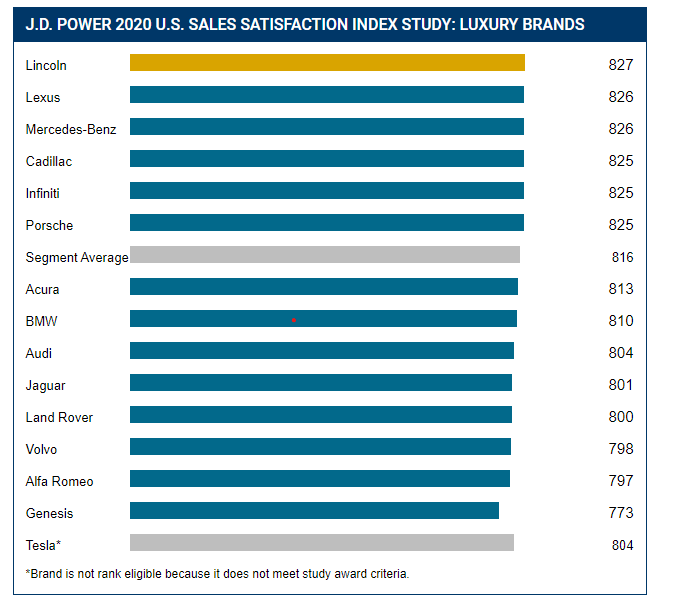

In addition to transaction volume, profitability, and blue sky multiples, the Customer Service Index (CSI) and Sales Satisfaction Index (SSI) results provide another lens when considering auto dealership valuations. J.D. Power recently released its 2020 SSI report. The results for Luxury Brands are displayed below.

[caption id="attachment_35040" align="alignnone" width="696"]

Source: J.D. Power[/caption]

It’s interesting to note that the three brands without a reported Blue Sky multiple from Haig (Lincoln, Cadillac, and Infiniti) all scored in the upper half of the results from the SSI for luxury brands. While SSI is clearly important, observing other factors is necessary when considering a brand’s overall perception and value proposition. Each of these three has struggled with some combination of aging models/inventory, introduction of new models, and entrance into the electric vehicle market. The results for the Mass Market Brands are as follows.

[caption id="attachment_35043" align="alignnone" width="653"]

Source: J.D. Power[/caption]

It’s interesting to note that the three brands without a reported Blue Sky multiple from Haig (Lincoln, Cadillac, and Infiniti) all scored in the upper half of the results from the SSI for luxury brands. While SSI is clearly important, observing other factors is necessary when considering a brand’s overall perception and value proposition. Each of these three has struggled with some combination of aging models/inventory, introduction of new models, and entrance into the electric vehicle market. The results for the Mass Market Brands are as follows.

[caption id="attachment_35043" align="alignnone" width="653"] Source: J.D. Power[/caption]

Source: J.D. Power[/caption]

Conclusion

The current forecast for the auto dealer industry looks bright heading into 2021. Both Haig Partners and Kerrigan Advisors predict Blue Skies ahead for auto dealers, though dealers will certainly recall the rainy days of March and April. Even the successful private auto dealers that have been able to navigate the challenges of 2020 face decisions regarding the future of their dealerships.

Conversations regarding profitability and expense levels and their sustainability are prevalent in all auto dealer valuation projects. Contact a professional at Mercer Capital to discuss these questions or to find out the value of your auto dealership.