I was 14, playing a golf tournament in Austin, Texas. At the time, Hole 11 gave me fits and nightmares. My strength was accuracy and short game, and my weakness was driving distance. Unfortunately, Hole 11 required the participants to carry a rather large hazard, a distance which I could achieve about once every 82 attempts. To add to my frustration, there were no lay-up options, no bail outs, and no safe shots. This situation left me with one option to survive the drive, hit the perfect shot at the perfect time for each round of the tournament. This option had a very low probability of success. As any golfer can imagine, I felt exposed, angry and stuck in a bad situation. Clearly, I did not select a tournament where the course fit my strategy.

In today’s energy climate, many exploration and production companies find themselves in a similar situation. Exposed with too much debt, angry with the oil price environment and stuck selling reserve assets at prices they are forced to take because their strategy did not fit their location. For me, I did not pay attention to the layout of the course before entering the tournament. For E&P Companies, the reserves location is playing a significant role on if they can succeed in the current economic environment. For some, their "core plays" continue to produce profitably and new well investment is economic. However, for others, the cost of production is too high and they find themselves stuck in a bad situation with few options, which include selling "non-core" assets before or during bankruptcy reorganization.

According to our analysis of the major shale plays in the U.S. (Permian, Eagle Ford, Marcellus, Utica and Bakken), in general the breakeven costs to produce are highest in the Bakken and lowest in the Permian. The remaining plays range between the two. Due to its lower cost structure, the Permian is gaining significantly more attention from opportunistic market participants.

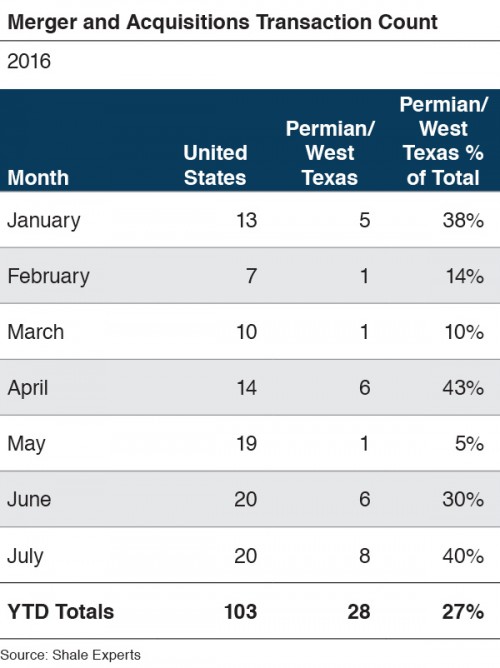

Deal activity, while quiet in the first quarter of the year, has picked up significantly in the last four months. In the U.S., there were 103 transactions of oil and gas resource properties with a total disclosed value of $19.7 billion, according to Shale Experts. Approximately 27% of these deals were in the Permian Basin and accounted for 25% of the total dollar volume, or $5 billion dollars. However, activity in the Permian has increased. In the last two months, deals in the Permian accounted for 35% of the transaction volume and 43% of the total dollar volume, or $3.3 Billion for June and July. Therefore, 67% of the Permian’s year to date transaction dollar volume occurred in June and July.

Pioneer (PXD) has been one of the more active companies making investments in the play. Although PXD had a large presence in the Permian already, two months ago Pioneer invested $435 million in an additional 28,000 net acres by purchasing the rights from Devon Energy (DVN). According to CEO, Scott Sheffield, PXD’s motivation was protection based:

"Why we are acquiring 28,000 net acres in the Midland Basin from Devon…? It's simply because it's totally integrated among our acreage. We did not want somebody to come in… most of the competition couldn't bid on this because they couldn't get longer laterals. We have it, had it totally surrounded allocated $14,000 per acre. And what’s interesting right after we made the announcement on the acquisition, somebody is paying $58,000 per acre right next to this acreage."

Clearly PXD has found itself in the right location at the right economic time and is using its recent strong performance and relatively low leverage levels to be aggressive when so many of its competitors are in the weaker position or changing strategies and "core assets", including their transaction counterpart, Devon.

Additionally, PXD appears to benefit from successful placement of horizontal wells within their acreage rights, high production rates and operational efficiencies. This translates into favorable cost per BOE information. As CEO Sheffield explained in the 2Q16 earnings call:

"What’s amazing to me is that the horizontal well operating costs, excluding taxes, are down to almost $2 per BOE. So definitely we can compete with anything that Saudi Arabia has."

While that has the power to drive headlines in the media world (confession, I believe that is how I learned about it), it also appears to be a very selective disclosure. A Forbes article written by Art Berman sheds more light on the specifics of PXD’s cost per BOE. The short of it is, overall PXD has significantly higher cost per BOE company-wide, as in $19 per BOE. However, CEO Sheffield’s comments could be read as an indication that one or more of their wells is experiencing operating costs per BOE of approximately $2.00 (excluding taxes of course and perhaps a few other selective expenses). Regardless, the intimation from the comments is that the Permian is a productive and profitable play at current prices and some wells may produce so well that it can compete with the lowest cost producers in the world. This is also supported by the transaction activity of the stronger E&P companies buying up assets from the weaker entities and the existence of drilling activity in the Permian.

However, each location in the Permian is different and the "sweet spots" are just that — spots. They are not everywhere in the Permian. As a result, the valuation implications of reserves and acreage rights can swing dramatically in resource plays. Utilizing an experienced oil and gas reserve appraiser can help to understand how location impacts valuation issues in this current environment. Contact Mercer Capital to discuss your needs and learn more about how we can help you succeed.