In 2015 the United States consumed over 3.6 billion gallons of tea. There’s nothing like a cold glass of sweet tea on a hot day in Memphis, where the average humidity is over 80%. But too many glasses of sweet tea leads to a sugar crash that makes you feel worse than before.

Until December, the amount of sweet light crude in the U.S. almost exceeded the amount sweet tea at any Southern picnic. The Shale revolution changed the domestic oil and gas industry. As the stockpiles of sweet light crude increased, and the price of WTI fell, refiners purchased cheap crude in the domestic market. Until December 2015, refiners could buy domestic crude in the U.S. at a price approximately 10% cheaper than the rest of the world, sell refined products in the global petroleum market where prices were dictated by world demand and supply, and realize juicy margins. While the oversupply of sweet crude was at first a blessing for refiners, their sugar crash may be a permanent one.

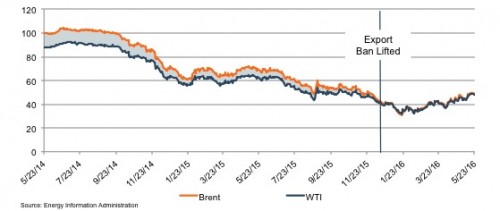

Brent WTI Spread

The shale revolution, in conjunction with the export ban, created an oversupply of light, sweet crude in the U.S., which put downward pressure on the price of domestic crude oil. This pressure can be seen by examining the WTI – Brent oil price spread. One year ago the European benchmark, Brent crude, sold for $6.33 more than its American counterpart, WTI. The lifting of the export ban has narrowed the Brent WTI spread to less than $1 per barrel today.

Refiner Marker Margin

The refiner marker margin (RMM) is a general indicator, calculated quarterly by BP, which shows the estimated profit refiners earn from refining one barrel of crude. Refiners’ margins increased dramatically in the second and third quarters of 2015 as the price of crude fell and the price of refined petroleum products remained high. Refiners in the U.S. were on average making $25 per barrel of oil, while global profit margins barely reached $20 per barrel.

Refiners anticipated crude oil exports would increase when the export ban was lifted which reduced excess supply in the U.S. and relieved the downward pressure on market prices. Once the price of crude increased in the U.S., refiners profit margins shrink. As you can see in the graph below, profits shrank as expected. But with falling crude prices worldwide, the compression of downstream margins cannot be explained by the story refiners expected.

If the export ban had been lifted in early 2014, before global crude prices started falling, the story would have played out as expected. However, when the export ban was lifted, the U.S. producers were then open to compete in a market which was swimming in crude oil. At year end, there were approximately three billion barrels of excess supply inventory across the globe. No one wanted our excess crude.

Exxon Mobil’s downstream earnings were down 67% from this time last year to $187 million for the three months ended March 31, 2016. The reduced downstream margin is driving much of that change, as the company attributes $470 million of their drop in revenue from Q4 2015 to Q1 2016 to this falling margin. On their most recent earnings call VP of Investor relations explained that in order to understand refiner’s current situation, you have to look at the macro level of supply and demand.

Thus decline in downstream profits was a result of excess global supply and the decreasing price of petroleum products around the globe. The export ban was lifted and U.S. raw crude oil exports initially declined relative to last year. U.S. Crude exports were down 26% in January and 13% February compared to the previous year. However, as the price of oil rebounded slightly, we have seen a 22% year over year increase in crude oil as of March 2016.

When the market readjusts and crude prices rise, E&P profits may increase back to what they were, however refiners may never see the same fat margins they used to as they are now operating in a global market place. Refiners may have to adjust to a new normal.

If the export ban had been lifted in early 2014, before global crude prices started falling, the story would have played out as expected. However, when the export ban was lifted, the U.S. producers were then open to compete in a market which was swimming in crude oil. At year end, there were approximately three billion barrels of excess supply inventory across the globe. No one wanted our excess crude.

Exxon Mobil’s downstream earnings were down 67% from this time last year to $187 million for the three months ended March 31, 2016. The reduced downstream margin is driving much of that change, as the company attributes $470 million of their drop in revenue from Q4 2015 to Q1 2016 to this falling margin. On their most recent earnings call VP of Investor relations explained that in order to understand refiner’s current situation, you have to look at the macro level of supply and demand.

Thus decline in downstream profits was a result of excess global supply and the decreasing price of petroleum products around the globe. The export ban was lifted and U.S. raw crude oil exports initially declined relative to last year. U.S. Crude exports were down 26% in January and 13% February compared to the previous year. However, as the price of oil rebounded slightly, we have seen a 22% year over year increase in crude oil as of March 2016.

When the market readjusts and crude prices rise, E&P profits may increase back to what they were, however refiners may never see the same fat margins they used to as they are now operating in a global market place. Refiners may have to adjust to a new normal.

What Does This Mean for Valuation?

While E&P companies have been struggling for over twelve months now in the current low price environment, refiners are just starting to feel the pressure. Although the valuation implications are not expected to be as extreme, we expect to see similar valuation issues in upcoming months as we have seen for E&P companies over the last year. As margins compress and cash flows decrease, valuation multiples are expected to fall.

Mercer Capital has been valuing oil and gas companies for over 20 years. We understand the volatility of the oil and gas market and can help your company understand the value of your company beyond this year’s cash flows.