The Eagle Ford Shale is one of the largest economic developments in the state of Texas. Almost $30 billion was spent developing the play in 2013. However, that figure dropped off dramatically in 2015 and 2016. In the wake of that drop-off some of the key residuals of that investment remain and are still on the precipice of becoming more active. These residual investments exist in the form of drilled, but uncompleted horizontal wells – sometimes known as “DUCs” or “Fracklog”.

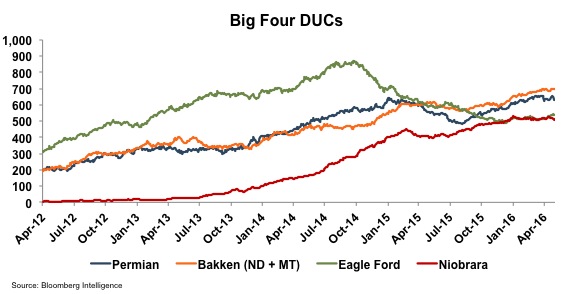

Economically, these DUCs function as a form of storage for companies who do not want to complete and produce these wells at current pricing. Thus, they sit idle – waiting to be completed and graduate to a full-fledged producing PDP well. This is a phenomenon that exists in all the major shale plays in the U.S. and second only to the Bakken, the Eagle Ford has the largest inventory of DUCs (460) in the U.S.

Many of the big shale producers are jumping on board the fracklog bandwagon. The largest U.S. shale producer to fracklog is EOG Resources (EOG). It started 2015 with 200 DUCs and announced it would “intentionally delay” about 85 more wells this year (these are overall figures, not Eagle Ford specific). Anadarko Petroleum (APC) said it expects to have about 440 uncompleted wells by the year’s end.

As a point of comparison, last week there were only a total of 44 rigs in the Eagle Ford, as compared to 205 at year-end 2014.

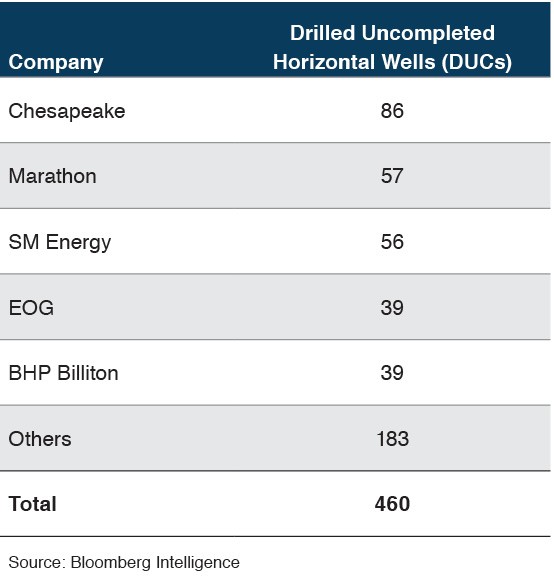

As it pertains to the Eagle Ford specifically, Chesapeake leads the way with 86 DUCs with several other major Eagle Ford players with significant counts as well.

Many of the big shale producers are jumping on board the fracklog bandwagon. The largest U.S. shale producer to fracklog is EOG Resources (EOG). It started 2015 with 200 DUCs and announced it would “intentionally delay” about 85 more wells this year (these are overall figures, not Eagle Ford specific). Anadarko Petroleum (APC) said it expects to have about 440 uncompleted wells by the year’s end.

As a point of comparison, last week there were only a total of 44 rigs in the Eagle Ford, as compared to 205 at year-end 2014.

As it pertains to the Eagle Ford specifically, Chesapeake leads the way with 86 DUCs with several other major Eagle Ford players with significant counts as well.

Producers have hoped this would bring value to their shareholders, by delaying capital expenditures and functioning as storage for future reserves. These companies can then wait for more favorable oil and gas prices that justify the capital investment to complete the wells. This brings a favorable ROI to the costs, which is the core metric that management teams are tracking. How much value that this creates (or preserves depending on point of view) is linked to how much capital it requires to complete the well as compared to production and price (production x price = revenue). The Eagle Ford shale has pockets of some of the best possible wells for this ROI potential. Bloomberg Intelligence has estimated that breakeven prices for oil in the Eagle Ford can be as low as $27 per barrel. This helps explain why DUCs in the Eagle ford actually decreased in 2015 while other plays had a marked increase; several groups of wells in the Eagle Ford still had positive ROI’s and were economical to be drilled.

However, there is a flip side to simply waiting until oil prices go up. Some estimates claim it will take only one to three months to get production from these now-uncompleted wells. Bloomberg Intelligence has projected the output from these wells to be as high as three million barrels per day. This onslaught of new oil could serve to cap any rally in the oil prices.

Producers have hoped this would bring value to their shareholders, by delaying capital expenditures and functioning as storage for future reserves. These companies can then wait for more favorable oil and gas prices that justify the capital investment to complete the wells. This brings a favorable ROI to the costs, which is the core metric that management teams are tracking. How much value that this creates (or preserves depending on point of view) is linked to how much capital it requires to complete the well as compared to production and price (production x price = revenue). The Eagle Ford shale has pockets of some of the best possible wells for this ROI potential. Bloomberg Intelligence has estimated that breakeven prices for oil in the Eagle Ford can be as low as $27 per barrel. This helps explain why DUCs in the Eagle ford actually decreased in 2015 while other plays had a marked increase; several groups of wells in the Eagle Ford still had positive ROI’s and were economical to be drilled.

However, there is a flip side to simply waiting until oil prices go up. Some estimates claim it will take only one to three months to get production from these now-uncompleted wells. Bloomberg Intelligence has projected the output from these wells to be as high as three million barrels per day. This onslaught of new oil could serve to cap any rally in the oil prices.

“The destruction of production potential that we've needed to see to complete the bust cycle in oil and completely rebalance markets, allowing for a long-term constructive rise in the prices of oil and natural gas, have yet to be seen.” – Daniel Dicker, Real Money

If Eagle Ford producers wish to capitalize on these undrilled wells, timing, resources and capital must be ready to go when the time becomes right.