Over the past few weeks, we have discussed the increase in M&A activity in the Permian and looked at specific characteristics that make the Permian attractive in a low price environment. Today, we take a step back and review the broad characteristics of the Permian Basin. Download this information in a convenient PDF at the bottom of this post.

Permian at a Glance

| First Discovered | 1920 |

| Discovery as Viable Play | Began in 1923, declined post 1970s, increased again after 2007 |

| Primary Production | Oil |

| Oil Type | Sweet, Light Crude |

| Play | Conventional & Unconventional Plays |

| Drilling | Vertical (traditionally), Horizontal (81% of recent drilling) and Multi-Stage Hydraulic Fracturing |

| Top 3 Production Companies | Occidental, Pioneer, Apache |

| Breakeven | $25 – $63 per barrel 1 |

| Abnormal DUCs | 433 2 |

| Production Since 2007 | 7,156 MMBOE 3 |

| Issues | Cheapest Oil Has Already Been Produced |

| Potential | Improving Technology, Easy Entry, Stacked Play Efficiency, Low Service & Transport Costs, & Under-Explored Layers |

| 1 Bloomberg Intelligence county-level estimates 2 Drilled Uncompleted Wells with > 3 months in inventory as of January 2016; also referred to as fraclog (Bloomberg Intelligence) 3 EIA as of June 2016 | |

Overview of Permian Basin

Stretching over 86,000 sq. miles in western Texas and New Mexico, the Permian Basin is the most productive formation in the U.S. Since 2007, new technologies have created a boom in the region by increasing the production of old wells and enabling drilling in previously underdeveloped geological layers. In the current low price environment, Permian production has been affected less than other large U.S. reserves.

Geography & Drilling

The Permian Basin produces from a variety of geological formations. These formations are layered on top of each other, creating stacked reservoirs of limestone, sandstone, and shale. For decades, wells have targeted conventional, permeable reservoir layers that trap oil and gas produced primarily in the shale layers. Recently developed enhanced extraction techniques have maintained these reservoirs’ outputs. However, since 2007, hydraulic fracturing targeting the less permeable tight sand and shale layers has driven over 60% of new production growth. Many of these new wells are “stacked plays” that capitalize on the region’s layered geography by exploiting multiple producing zones (conventional and unconventional) from one surface drill point. The Permian is divided into basins such as the Delaware Basin and Midland Basin which are further divided into zones, or stacks, such as the Wolfcamp, Spraberry, Clearfork, Avalon, and Bone Springs.

Issues & Future Potential

The easiest, cheapest oil and gas to extract from the Permian Basin was produced long ago making many areas uneconomical to produce at low oil prices. However, Permian wells tend to be more efficient than pure shale plays because they drill through many productive layers. For example, Wolfcamp wells are estimated by Bloomberg Intelligence to have the lowest break-even point of any U.S. shale oil play. The Permian will benefit from continued technological advances, development of less-known, potentially productive layers, and an abundance of low cost support services and pipelines.

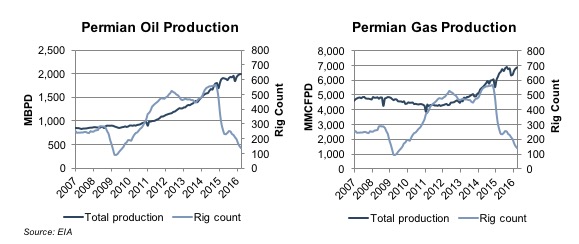

Permian Production

Baker Hughes collects and publishes information regarding active drilling rigs in the United States and internationally. The number of active rigs is used as a key indicator of demand for oilfield services & equipment. However, rig counts can be misleading if not considered along with production. Rig counts in the Permian drastically decreased in late 2014 and throughout 2015. However, production did not experience the same decline. This demonstrates that producers with average or poor locations, higher costs, and inefficiencies were forced out of the market, while those with good locations and lower costs continued to drill for oil and gas in the Permian.

Baker Hughes collects and publishes information regarding active drilling rigs in the United States and internationally. The number of active rigs is used as a key indicator of demand for oilfield services & equipment. However, rig counts can be misleading if not considered along with production. Rig counts in the Permian drastically decreased in late 2014 and throughout 2015. However, production did not experience the same decline. This demonstrates that producers with average or poor locations, higher costs, and inefficiencies were forced out of the market, while those with good locations and lower costs continued to drill for oil and gas in the Permian.

AVAILABLE RESOURCE

Quick Facts: Permian Basin

Download this information in a convenient, one-page PDF. Download