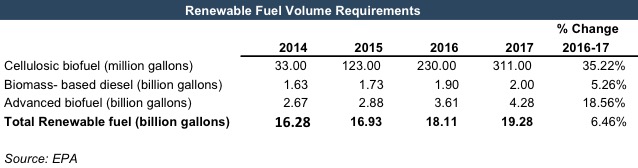

The Renewable Fuel Standards (RFS) program, which originated from the Energy Policy act of 2005, set a goal to use 36 billion gallons of renewable fuels by 2022. RFS was signed into law by President George W. Bush in order to reduce greenhouse gas emissions and boost rural farm economies. Each November, the EPA issues rules increasing Renewable Fuel Volume Targets for the next year. The following table shows the Renewable Fuel Volume requirements for the past three years and the targets for 2017.

Separate quotas and blending requirements are determined for cellulosic biofuels, biomass-based diesel, advanced biofuels, and total renewable fuel. The individual obligations for producers are called Renewable Volume Obligations (RVO). Refiners and importers of gasoline and diesel fuel must meet Renewable Volume Obligations (RVOs) by blending ethanol and biodiesel into gasoline and diesel fuel. An RVO is determined by multiplying the output of the producer by the EPA's announced blending ratios for each of the four standards described above.

RINs (Renewable Identification Numbers) are 38-digit numbers used to implement the Renewable Fuel Standards. RBN Energy describes RINs as the “Currency of the […] RFS program”. The EPA explains that when a producer makes one gallon of renewable fuel, RINs are generated. At the end of the year, producers and importers use RINs to demonstrate their compliance with the RFS. Refiners and producers without blending capabilities can either purchase renewable fuels with RINs attached or they can purchase RINs through the EPA's Moderated Transaction System. RINs can be carried over from one compliance year to another, if unused. On the other hand, a RIN deficit can be carried over into the next year but must be made up for during the following year.

While integrated refiners blend their petroleum products with renewable fuels, merchant refiners do not have the capability to blend their own petroleum products.

Tesoro Corp., an integrated refiner, is not affected by RIN costs. Steven Sterin, EVP & CFO explained in their third quarter earnings call, “in a quarter where RIN costs rise, we reflect the higher obligation in refining and the benefit from blending in our marketing segment. It's important to know that we run our business in the integrated manner. This does not have a material impact on total Company results.” But he did acknowledge that gasoline blending is where the true benefit of integration is realized. Even Tesoro faces challenges acquiring cellulosic and biodiesel RINs.

Merchant refiners are required to obtain RINs for RFS compliance purposes. A common theme across refiners’ earnings calls last quarter was the effect of the rising cost of RINs on already squeezed margins. Holly Frontier, a merchant refiner, spent $63 million on RINs, in the third quarter alone. Holly Frontier’s President and CEO, George Damiris, said in their third quarter earnings call that they have considered expanding into fuel marketing because of the current RINs environment.

The increase in RIN costs is at the simplest, an issue of supply and demand. Production targets that are greater than equilibrium supply and demand cause price increases to correct the shortage of goods. As Renewable Fuel Volume targets have increased year over year, the price of RINs continue increasing. Reuters quoted that on average Renewable fuel credits saw a 25% increase in price from 2Q 2015 to 2Q 2016.

Separate quotas and blending requirements are determined for cellulosic biofuels, biomass-based diesel, advanced biofuels, and total renewable fuel. The individual obligations for producers are called Renewable Volume Obligations (RVO). Refiners and importers of gasoline and diesel fuel must meet Renewable Volume Obligations (RVOs) by blending ethanol and biodiesel into gasoline and diesel fuel. An RVO is determined by multiplying the output of the producer by the EPA's announced blending ratios for each of the four standards described above.

RINs (Renewable Identification Numbers) are 38-digit numbers used to implement the Renewable Fuel Standards. RBN Energy describes RINs as the “Currency of the […] RFS program”. The EPA explains that when a producer makes one gallon of renewable fuel, RINs are generated. At the end of the year, producers and importers use RINs to demonstrate their compliance with the RFS. Refiners and producers without blending capabilities can either purchase renewable fuels with RINs attached or they can purchase RINs through the EPA's Moderated Transaction System. RINs can be carried over from one compliance year to another, if unused. On the other hand, a RIN deficit can be carried over into the next year but must be made up for during the following year.

While integrated refiners blend their petroleum products with renewable fuels, merchant refiners do not have the capability to blend their own petroleum products.

Tesoro Corp., an integrated refiner, is not affected by RIN costs. Steven Sterin, EVP & CFO explained in their third quarter earnings call, “in a quarter where RIN costs rise, we reflect the higher obligation in refining and the benefit from blending in our marketing segment. It's important to know that we run our business in the integrated manner. This does not have a material impact on total Company results.” But he did acknowledge that gasoline blending is where the true benefit of integration is realized. Even Tesoro faces challenges acquiring cellulosic and biodiesel RINs.

Merchant refiners are required to obtain RINs for RFS compliance purposes. A common theme across refiners’ earnings calls last quarter was the effect of the rising cost of RINs on already squeezed margins. Holly Frontier, a merchant refiner, spent $63 million on RINs, in the third quarter alone. Holly Frontier’s President and CEO, George Damiris, said in their third quarter earnings call that they have considered expanding into fuel marketing because of the current RINs environment.

The increase in RIN costs is at the simplest, an issue of supply and demand. Production targets that are greater than equilibrium supply and demand cause price increases to correct the shortage of goods. As Renewable Fuel Volume targets have increased year over year, the price of RINs continue increasing. Reuters quoted that on average Renewable fuel credits saw a 25% increase in price from 2Q 2015 to 2Q 2016.

What’s Next?

President-elect Trump voiced a pro-ethanol platform when visiting America’s farm states implying that he would keep increasing RFS targets. However, he is also known to be pro-oil and many oil groups have called for changes or the repeal of the RFS program which is known to hurt independent refiners.

President-elect Trump has nominated Exxon CEO, Rex Tillerson, as Secretary of State and former Texas Governor, Rick Perry, for Secretary of Energy. Additionally, many more cabinet positions are stacked with oil and gas supporters such as Montana Republican Ryan Zinke, who was nominated to the Department of the Interior, and Oklahoma Attorney General and EPA critic Scott Pruit, who was nominated to head the EPA.

Trump’s nominations suggest that the upcoming presidential term will provide a friendly oil and gas environment. While it is unclear what the President-elect’s plan is for the RFS program, it is likely that he will face challenges balancing farm and oil interests.