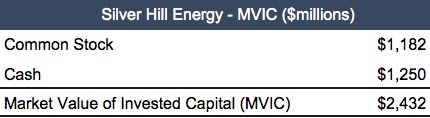

On October 13, 2016 RSP Permian (RSPP) announced the acquisition of Silver Hill Energy (SHE) for approximately $2.4 billion dollars. SHE will receive approximately $1.182 billion in RSPP common stock and $1.25 billion in cash. Based on RSPP disclosures, the assets received include (1) wells currently producing 15,000 barrels of oil equivalent per day (BOEPD); and (2) 41,000 in net acreage throughout Loving and Winkler County Texas. Approximately 69% of the current production is crude oil. Based upon the consideration given by RSPP, here is the implied market value of invested capital (MVIC) for SHE:

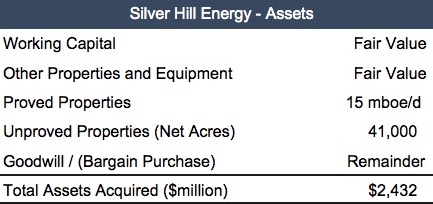

The other side of the transaction ledger is the value of the individual assets acquired. Since SHE is not a public company, allocating the purchase price to the individual assets is, dare we say, educated guesswork at best. Here is our guestimate of the assets that will need allocated value. 1

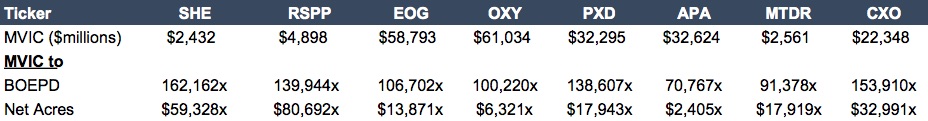

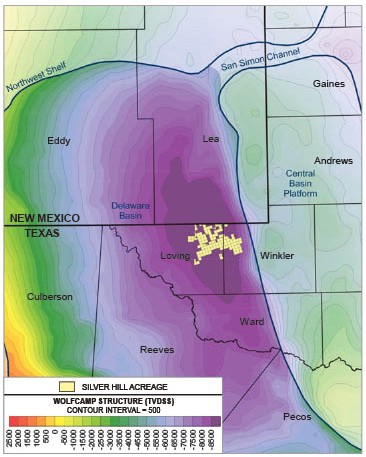

The other side of the transaction ledger is the value of the individual assets acquired. Since SHE is not a public company, allocating the purchase price to the individual assets is, dare we say, educated guesswork at best. Here is our guestimate of the assets that will need allocated value. 1 Before venturing into our approach to the allocation, we have compared pricing multiples of the SHE acquisition and other oil and gas public companies. At the time of the transaction, SHE owned acreage rights in one of the most popular domestic resource plays, the Delaware Basin. The chart below shows the implied pricing metrics for SHE versus the market pricing multiples for publicly traded operators in the Delaware Basin.

Before venturing into our approach to the allocation, we have compared pricing multiples of the SHE acquisition and other oil and gas public companies. At the time of the transaction, SHE owned acreage rights in one of the most popular domestic resource plays, the Delaware Basin. The chart below shows the implied pricing metrics for SHE versus the market pricing multiples for publicly traded operators in the Delaware Basin.

Valuation Metrics

Based upon these ratios2, we have the following observations:

Based upon these ratios2, we have the following observations:

- RSPP is approximately 2x larger than SHE;

- Of the seven public companies, SHE is very close in size to Matador Resources Company (MTDR). SHE has acreage adjacent to acreage operated by MTDR;

- Based on per day production, the SHE transaction was priced at the highest indicated value;

- Based upon net acres acquired, the SHE transaction was priced at the higher end of the indicated value of all the publicly traded companies. Note that approximately 95% of the acreage acquired is considered developed;

- It appears the majority of SHE’s asset values are in the producing 58 wells:

- 95% of the 41,000 net acreage is considered producing;

- 49 of the 58 producing wells are horizontal;

- Less than 5% of the net acres are undeveloped;

- 58 wells over 39,050 acres equates to well spacing of one per 673 acres. While 49 are horizontal wells, it appears they may be opportunities to add additional wells;

- Additionally, with less than 5% of the net acres to be explored, a higher than average BOEPD multiple may be explainable.

- Lastly, based on the data reviewed to date and the location of SHE’s acreage, RSPP may have identified opportunities to recomplete existing wells, with longer lateral and horizontal wells which may produce from other resource plays within the area.

Assets Purchased

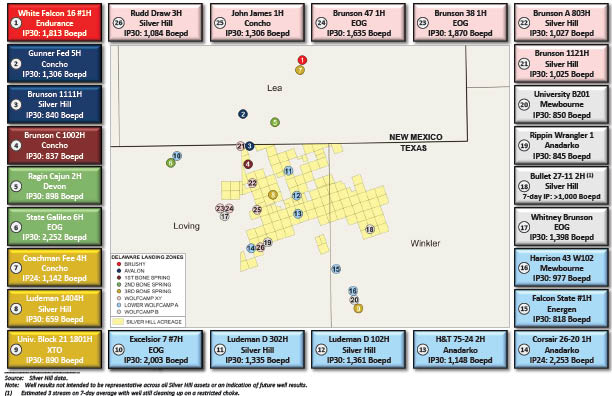

Earlier, we displayed the high level categories for an allocation of purchase price. Three of these categories are oil and gas related assets: (1) 58 wells currently producing 15,000 barrels of oil equivalent per day; (2) proved developed reserves; and (3) 41,000 net acres, of which 5% are considered undeveloped. The valuation for current production and proved developed reserves is fairly straight forward. No doubt SHE prepared a reserve report which would aid in the valuation of the currently producing wells and the remaining proved reserves. However, the valuation gap between the proved developed reserves and the remaining proved undeveloped, probable and possible reserves or acreage value can be detailed, tedious, and complex. The historically low oil and gas price environment and financial tension within the industry creates a complicated market place for using market transactions as indications of value.

More information is needed to drill down into the specifics and valuation of each of the acquired oil and gas assets. Interested parties may want to consider the following information areas:

- Reserve Reports. Specifically, we would like to understand the amount of acreage in each of the maps above that have been drilled versus what areas are included in the drilling plan, PV 10 indications and price deck assumptions;

- Financial Statements. It would also be helpful to understand more about SHE’s decision to sell and perhaps the financial situation immediately prior to the sale. If SHE was backed by private equity investors rather than a typical oil and gas operator, management could have had different reasons to exit their investments. Timing may also have played a part as Permian dominated assets currently appear to be selling for a Premium compared to other domestic plays.

- Synergistic efficiencies. Drilling efficiencies have been disclosed by RSPP, but we don’t know how many are new well locations verses recompletion of existing into multiple resource plays.