The Rio Olympics are underway, but the Road to Rio was more than a little rocky. Reports of disease, pollution, and protests left us wondering if they could pull it off. But a dazzling Opening Ceremony made us wonder, are the Rio Olympics the next comeback story?

For the last two years we have been asking when will oil prices recover? But natural gas E&P companies have been asking this question for almost seven years. Analysts have worked to predict which companies will make a comeback once prices recover, but the road to recovery has been and will continue to be long and rocky.

Natural gas consumption has steadily increased since prices fell in 2009, but consumption of natural gas has been unable to keep up with the increased production that resulted from the shale gas revolution. Over the last ten years, natural gas production increased by a compound annual growth rate of 4% while consumption growth lagged at less than 3% per year.

Since 2012, the Marcellus and Utica provided 85% of the U.S.’ shale gas production growth as hydraulic fracturing techniques improved. But this fast growth led to excess supply. The American Oil and Gas Reporter commented, “Production in the Northeast is particularly abundant, with volumes increasing from 2 Bcf/d in 2008 to more than 18 Bcf/d in 2014. That astronomical growth rate is expected to continue, reaching 30 Bcf/d by 2020.” By November of 2015, the northeast was already producing 20.3 Bcf/d.

E&P companies have increasingly used debt to finance capital expenditures in order to drive sales volume and maintain revenue in a falling price environment. While heavy debt financing allows companies to maintain revenue, it also threatens their liquidity when prices stay low. A prime example is the case of Rex Energy.

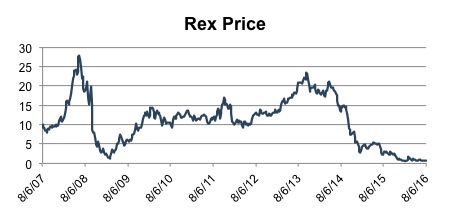

Until recently Rex Energy was picked by many analysts as one of the E&P companies expected to make a large rebound. Analysts calculated the implied upside potential as 146% and thirteen analysts gave Rex a buy rating. Rex’s stock price declined at the end of 2008 during the finanical crisis when natural gas prices fell. But, Rex quickly recovered by investing in the Marcellus right before the peak of the shale gas revolution.

Rex maintained a debt to equity ratio of less than 80% until mid-2013 when their stock price started to fall again. Since then, Rex’s debt to equity ratio has steadily risen, exceeding 1,320% by the end of the second quarter of 2016. Shares of Rex have been trading at sub $1 levels since early May of this year, placing the stock in danger of being delisted from the NYSE.

In an effort to improve short term liquidity, Rex announced two weeks ago that they would exchange debt for common shares. The deal will take some of the immediate pressure off of the company by reducing interest expense by approximately $11.1 million, but the long term solvency of the company is still in doubt barring a significant price rebound. For almost two years analysts have waited for a comeback of Rex Energy, but Shale Experts now predicts that Rex is on the verge of bankruptcy.

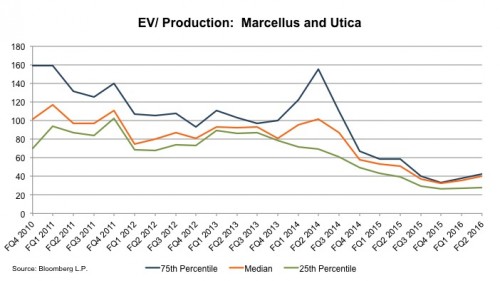

Rex Energy exemplifies why “cheap, abundant, and profitable” can’t last in the marketplace. As Art Berman explained, shale gas enthusiasts believe that shale is “cheap, abundant, and profitable thus defying all rules of business and economics. That is magical thinking.” Valuation multiples for E&P companies operating in the Marcellus fell over the last six years as natural gas prices declined and production increased.1 There have only been five reported transactions in the Marcellus this year compared with 28 in the Permian.

Until recently Rex Energy was picked by many analysts as one of the E&P companies expected to make a large rebound. Analysts calculated the implied upside potential as 146% and thirteen analysts gave Rex a buy rating. Rex’s stock price declined at the end of 2008 during the finanical crisis when natural gas prices fell. But, Rex quickly recovered by investing in the Marcellus right before the peak of the shale gas revolution.

Rex maintained a debt to equity ratio of less than 80% until mid-2013 when their stock price started to fall again. Since then, Rex’s debt to equity ratio has steadily risen, exceeding 1,320% by the end of the second quarter of 2016. Shares of Rex have been trading at sub $1 levels since early May of this year, placing the stock in danger of being delisted from the NYSE.

In an effort to improve short term liquidity, Rex announced two weeks ago that they would exchange debt for common shares. The deal will take some of the immediate pressure off of the company by reducing interest expense by approximately $11.1 million, but the long term solvency of the company is still in doubt barring a significant price rebound. For almost two years analysts have waited for a comeback of Rex Energy, but Shale Experts now predicts that Rex is on the verge of bankruptcy.

Rex Energy exemplifies why “cheap, abundant, and profitable” can’t last in the marketplace. As Art Berman explained, shale gas enthusiasts believe that shale is “cheap, abundant, and profitable thus defying all rules of business and economics. That is magical thinking.” Valuation multiples for E&P companies operating in the Marcellus fell over the last six years as natural gas prices declined and production increased.1 There have only been five reported transactions in the Marcellus this year compared with 28 in the Permian.

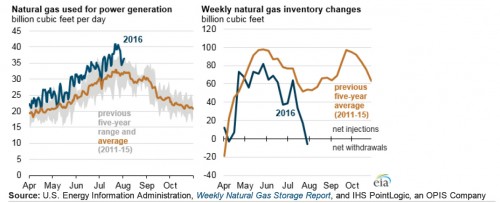

While no one can pinpoint when the price of oil and gas will recover, analyzing supply and demand indicators can be helpful for predicting future price movements. The supply of natural gas is not expected to ease in the near future, but a recent uptick in natural gas consumption may help ease the downward trend in prices by narrowing the gap between demand and supply. The EIA reported that in 2015 natural gas consumption increased more than any other source of power generation and that record consumption in July of 2016 led to an increase in net withdrawals from inventories. The chart below, shared by the EIA on August 8th inToday in Energy, demonstrates that demand is starting to catch up with production.

While no one can pinpoint when the price of oil and gas will recover, analyzing supply and demand indicators can be helpful for predicting future price movements. The supply of natural gas is not expected to ease in the near future, but a recent uptick in natural gas consumption may help ease the downward trend in prices by narrowing the gap between demand and supply. The EIA reported that in 2015 natural gas consumption increased more than any other source of power generation and that record consumption in July of 2016 led to an increase in net withdrawals from inventories. The chart below, shared by the EIA on August 8th inToday in Energy, demonstrates that demand is starting to catch up with production.

Rex Energy may not be making the comeback that analysts once forecasted, but that does not mean hope is lost for all E&P companies in the Marcellus. The current low price environment may squeeze out some of the highly levered companies, but less aggressively financed companies, such as Antero, have an opportunity to buy inexpensive acreage and expand operations in anticipation of a more favorable pricing environment in the future. A comeback may still be possible for the companies that can last until the price rebounds.

Have value questions in the oil and gas space, as an executive, investor, owner, creditor or other interested party? Utilizing an experienced oil and gas reserve appraiser can help in understanding valuation issues in this current environment. Contact Mercer Capital to discuss your needs and learn more about how we can help you succeed.

Rex Energy may not be making the comeback that analysts once forecasted, but that does not mean hope is lost for all E&P companies in the Marcellus. The current low price environment may squeeze out some of the highly levered companies, but less aggressively financed companies, such as Antero, have an opportunity to buy inexpensive acreage and expand operations in anticipation of a more favorable pricing environment in the future. A comeback may still be possible for the companies that can last until the price rebounds.

Have value questions in the oil and gas space, as an executive, investor, owner, creditor or other interested party? Utilizing an experienced oil and gas reserve appraiser can help in understanding valuation issues in this current environment. Contact Mercer Capital to discuss your needs and learn more about how we can help you succeed.