How has the Asphalt Industry been Affected by Depressed Oil Prices?

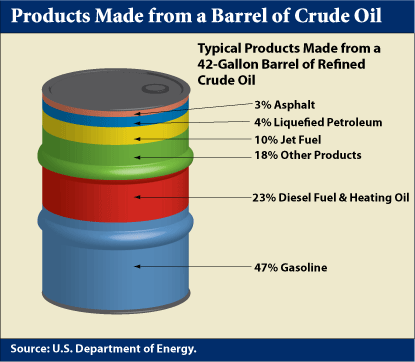

Asphalt and road oil are used primarily by the construction industry for roofing and waterproofing and for road construction. Asphalt is a byproduct of petroleum refining. During the distillation process of crude oil, asphalt does not boil off and is left as a heavy residue. Generally around 90% of crude is turned into high margin products such as gasoline, diesel, jet fuel, and petrochemicals while the other 10% is converted into asphalt and other low margin products. Petroleum refiners sell asphalt to asphalt product manufacturers who produce retail products such as asphalt paving mixtures and blocks; asphalt emulsions; prepared asphalt and tar roofing and siding products; and roofing asphalts and pitches, coating, and cement.

Demand for asphalt products is determined by the health of the construction industry and the level of infrastructure funding.

Demand for asphalt products is determined by the health of the construction industry and the level of infrastructure funding.

How has the Construction Industry Impacted Demand for Asphalt?

Spending on construction in December 2016 increased 0.2% from November 2016 and 4.2% from December 2015 to $1.18 trillion. After several years of steady growth followed by decelerating growth in 2016, Dodge Data & Analytics forecasts total construction starts will increase by 5% in 2017 reaching $713 billion. AIA believes that factors such as job growth, consumer confidence and low interest rates have propelled construction spending.

How has Funding for Infrastructure Impacted Demand for Asphalt?

About 93% of the 2.2 million miles of paved roads and highways in the U.S. are paved with asphalt. Most road construction is funded by states, counties, or other federal programs. Thus demand for asphalt and road oils are largely dependent on the level of funding available. During the recession most local governments collected less revenue and could not afford investment in infrastructure. Both federal and state level taxes designed to generate revenue for transportation use a per-gallon fuel tax. Due to increasing fuel efficiency and lower gas prices, fuel taxes have generated less money. Further, the 18.4 cent-per-gallon federal gas tax has not been increased in more than twenty years and has not kept up with inflation or increasing costs. Some states have increased their state gas tax in order to fund these programs, but funding of infrastructure over the last decade has generally been insufficient.

For the past decade, the federal government has been funding transportation for short periods of time using extensions of previous plans. In August 2005, the Safe, Accountable, Flexible, Efficient Transportation Equity Act: A Legacy for Users (SAFETEA-LU) was signed into law. In July 2012, after multiple extensions of the SAFETEA-LU, the Moving Ahead for Progress in the 21st Century Act (MAP-21) was passed by Congress. MAP-21 extended SAFETEA-LU for the remainder of 2012, with new provisions for FY 2013 and beyond. Funding levels were maintained at FY 2012 levels with minor adjustments for inflation.

President Obama signed the FAST (Fixing America’s Surface Transportation) Act in December of 2015. The FAST Act provided $305 billion from 2016 to 2022 for programs to improve highways, highway and motor vehicle safety, and other critical transportation projects. Included in this legislation is a new National Highway Freight Program which will focus most of its funding on highways. The legislation also aims to reduce administrative and bureaucratic obstacles allowing the DOT to delegate project oversight to states on a project and programmatic basis.

While investment did modestly increase in 2016, it is likely that demand will pick up more in 2017 as projects funded by the FAST Act start being implemented. Mike Acott, president of the National Asphalt Pavement Association (NAPA) said that the most significant change since the FAST Act was passed has been a pickup in resurfacing activity. Resurfacing roads is a much cheaper alternative to repaving and many local governments were able to work the resurfacing of roads into the limits of their tight budgets. Increased demand for repaving materials led to industry innovation and new product developments to meet this demand.

How did the Asphalt Industry Perform in 2016?

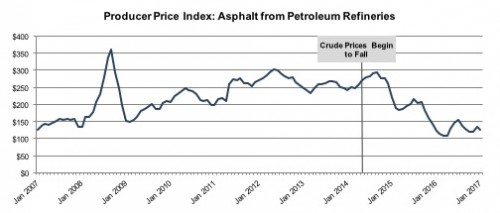

As the price of crude oil fell so did the price of asphalt sold by petroleum refineries. Crude oil prices fell by 50% from June 2014 to January 2017 (the most recent PPI data available for asphalt) while asphalt prices fell 55% over this same time period.

Refiner’s margins generally increased in 2015 and fell over the last year. As shown in the chart above, the movement of refined product prices lags changes in crude prices. Thus in 2015, refiners purchased crude for cheaper prices than before but sold their products at the same prices. In 2016 however, asphalt prices began to fall and margins narrowed. Marathon reported that their asphalt operations were weaker than their “exceptionally strong” year of operations in 2015. Analysts expect the price of asphalt to increase over the next few years. As refining technology improves refiners are able to produce more gasoline out of a barrel of oil leaving less to be made into paving grade asphalt. This reduction in supply will likely increase asphalt prices.

As the price of crude fell, refiners margins narrowed, which led to a decrease in cost of goods sold for asphalt manufacturers resulting in a pickup in earnings. Because of the impact of transportation costs on the industry and the quick hardening time of ready mix asphalt, competition is based primarily on location and price.

In general asphalt manufacturers’ margins increased in 2016 as their cost of goods fell. Vulcan Materials, Inc. (VMC) produces aggregates and ready mix asphalt in Birmingham, Alabama. Its asphalt mix segment’s gross profit increased 25% in 2016. While sales volume and sales price declined by 3% and 2%, respectively the cost of goods sold decreased and expanded the Company’s gross profit margin by 4.3 percentage points. Martin Marietta (MLM), which produces aggregate and asphalt products in North Carolina, realized a 15.7% gross profit margin in its asphalt and paving segment in 2016 compared to a 12.6% margin in 2015.

Refiner’s margins generally increased in 2015 and fell over the last year. As shown in the chart above, the movement of refined product prices lags changes in crude prices. Thus in 2015, refiners purchased crude for cheaper prices than before but sold their products at the same prices. In 2016 however, asphalt prices began to fall and margins narrowed. Marathon reported that their asphalt operations were weaker than their “exceptionally strong” year of operations in 2015. Analysts expect the price of asphalt to increase over the next few years. As refining technology improves refiners are able to produce more gasoline out of a barrel of oil leaving less to be made into paving grade asphalt. This reduction in supply will likely increase asphalt prices.

As the price of crude fell, refiners margins narrowed, which led to a decrease in cost of goods sold for asphalt manufacturers resulting in a pickup in earnings. Because of the impact of transportation costs on the industry and the quick hardening time of ready mix asphalt, competition is based primarily on location and price.

In general asphalt manufacturers’ margins increased in 2016 as their cost of goods fell. Vulcan Materials, Inc. (VMC) produces aggregates and ready mix asphalt in Birmingham, Alabama. Its asphalt mix segment’s gross profit increased 25% in 2016. While sales volume and sales price declined by 3% and 2%, respectively the cost of goods sold decreased and expanded the Company’s gross profit margin by 4.3 percentage points. Martin Marietta (MLM), which produces aggregate and asphalt products in North Carolina, realized a 15.7% gross profit margin in its asphalt and paving segment in 2016 compared to a 12.6% margin in 2015.

How will the Asphalt Industry Perform in 2017?

Going forward investment in infrastructure is expected to increase. After many states cut infrastructure funding, there is currently much work that needs to be done to improve the conditions of roads and highways. As state and local government budgets have improved since the recession, it is anticipated that tax revenue available for investment in road infrastructure will expand. Additionally, President Trump, during his campaign, pledged to invest $1 trillion in infrastructure in order to spur economic growth. Finally, prices for cement, which is a substitute for asphalt, are expected to rise which will increase the demand for asphalt. Overall, industry revenue is expected to increase by 2.3% over the next five years.1

Mercer Capital has significant experience valuing assets and companies in the energy and construction industries. Our valuations have been reviewed and relied on by buyers and sellers and Big 4 Auditors. These valuations have been utilized to support valuations for IRS Estate and Gift Tax, GAAP accounting, and litigation purposes. Contact a Mercer Capital professional today to discuss your valuation needs in confidence.