A few days ago the Wall Street Journal published an article discussing what the author described as “crazy” stock valuations, and in particular the inflated valuations of oil and gas stocks from the perspective of operating earnings ratios.

“The energy sector stands at more than 30 times Thomson Reuters IBES’s estimate of operating earnings over the next 12 months, higher than any time from when the sector data started in 1995 up to last year – when it briefly reached an extreme of almost 60 times.”

The article also mentions that the S&P 500 as a whole is trading at almost 18 times estimated future operating margins. This got us to thinking - In light of what has transpired over the past two plus years in the energy sector, could it really be that stocks are overvalued? That certainly hasn’t been the sentiment that we hear from our clients. Maybe we’re all wrong? If so, what could be driving this?

While we certainly are believers that value is driven by future operating earnings, and that earnings in the energy sector have fallen precipitously since 2014, is this all that determines the market’s pricing of the S&P 500 energy sector? As we reflect on this for a moment, a few additional considerations came to mind that may explain these “crazy” valuations more fully.

Anticipated Tax Relief

One consideration not captured in an operating earnings ratio that markets are using to impact values is expectations for future tax reform. Since the new administration has been inaugurated the stock market has risen significantly. Clearly, one of the sources of this market optimism is the platform of tax reform – including corporate taxes. There are a number of sources describing what this new structure may look like. One particularly insightful article was written by Jason B. Freeman in the January/February issue of Today’s CPA titled "Tax Reform Under a Trump Administration".

President Trump’s plan would drop the corporate tax rate from 35% (among the highest in the world) to 15% or 20%. This would immediately bring tax relief at a corporate level and boost earnings. Judging by the equity market’s early reaction this morning to Mr. Trump’s State of the Union address, in which he highlighted this issue, anticipation of this action is fueling higher stock prices.

Anticipated Regulation Reform

The market may also be considering the future impact President Trump’s regulation reform. While there is much uncertainty surrounding the future regulation of the oil and gas industry, President Trump ran as a friend to the oil and gas sector and promised to reduce regulations on the industry in order to boost the U.S. economy. Additionally, Oklahoma Attorney General Scott Pruitt was confirmed as the Environmental Protection Agency administrator. Pruitt has openly opposed the EPA, which is one of the main regulators of the oil and gas industry. Looser regulations on the oil and gas industry could reduce operating expenses associated with meeting current regulation and could provide new opportunities for the industry.

Growth Underpinnings

The energy sector has been hit hard, but a less visible aspect of the WSJ article’s premise is that there are signs that the energy sector’s depression in earnings may be short lived and the market is forecasting a rebound. Consider this, the price of oil is at or near decade lows and earnings are sensitive to commodity prices, particularly when the price of oil hovers close to breakeven costs for producers (which it is currently). Slight upward changes in oil and gas prices could have significant upward impacts on profits. In addition, due to the drop in commodity prices, the industry has responded by innovating and pushing costs downward for drilling shale wells.

Reserves Reserves Reserves!

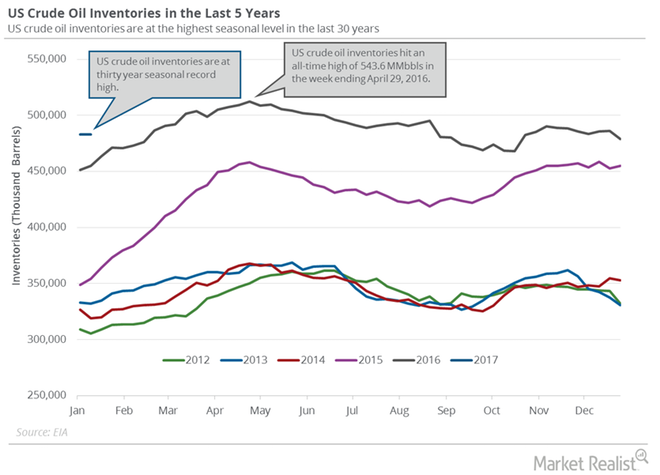

Another aspect that can’t be detected by an operating earnings ratio is how awash in reserves we currently are. U.S. crude oil inventories have hit all-time highs, and demonstrate how poised the energy sector is to respond to manufacturing and consumer growth.

Reserves are the foundation of value for E&P companies which is why this metric is oftentimes much more important than mere earnings. It shows the potential for earnings 5 to 10 years or even 20 years down the road, which is something one year earnings estimates do not consider. Better ratios to consider here are equity values relative to daily or annual production or total proved reserves.

Reserves are the foundation of value for E&P companies which is why this metric is oftentimes much more important than mere earnings. It shows the potential for earnings 5 to 10 years or even 20 years down the road, which is something one year earnings estimates do not consider. Better ratios to consider here are equity values relative to daily or annual production or total proved reserves.

The Big Picture

At any given moment it can be hard to say if equities, sectors or companies are “overvalued”. Valuation is relative to begin with and ultimately at a point in time the “value” is what market participants will pay. As it pertains to oil and gas companies, it appears clear that earnings are low as the sector better copes with $50-55 oil and $3 gas. However, the market appears to see brighter days ahead, beyond 2017 and that confidence along with optimism for tax reform, operating efficiencies, and positioning for future growth are buoying prices. Perhaps investors aren’t crazy after all. Of course that’s just my opinion….I could be wrong.