In previous posts, we have discussed the existence of royalty trusts & partnerships and their market pricing implications to royalty owners. To summarize our previous posts, it is important to understand the economic rights and restrictions within the publicly traded royalty trust being used as a “benchmark” before using it as a pricing reference for a royalty interest.

For example, many of these publicly traded trusts have a set number of wells generating royalty income at declining rates for multiple years to come. In contrast, some of these trusts participate in a number of wells that have not been drilled, which represent upside potential for investors. The future growth and outlook potential for each of these two example publicly traded trusts is significantly different and a potential investor would want to know the details. The same is true for a privately held royalty interest.

Market Observations1

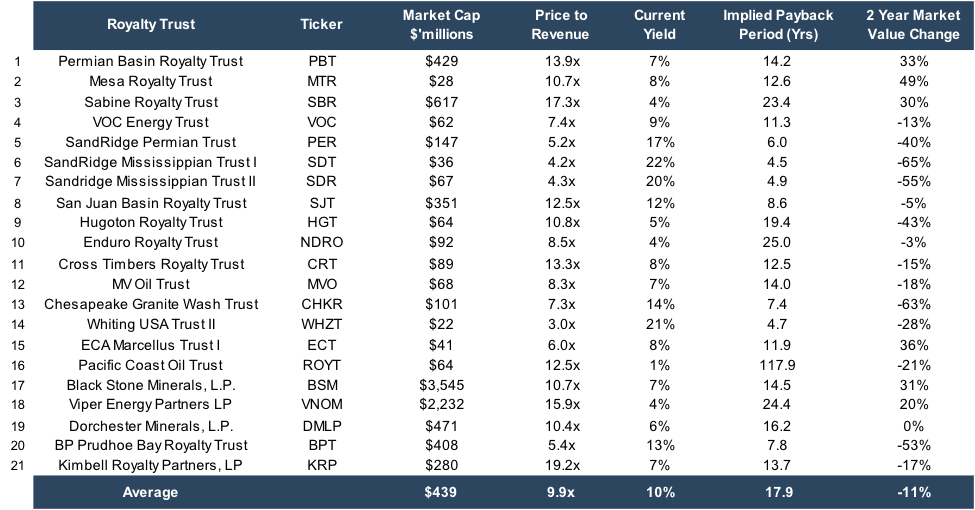

There are approximately 21 oil and gas-focused royalty trusts and partnerships publicly traded, as of October 31, 2017.

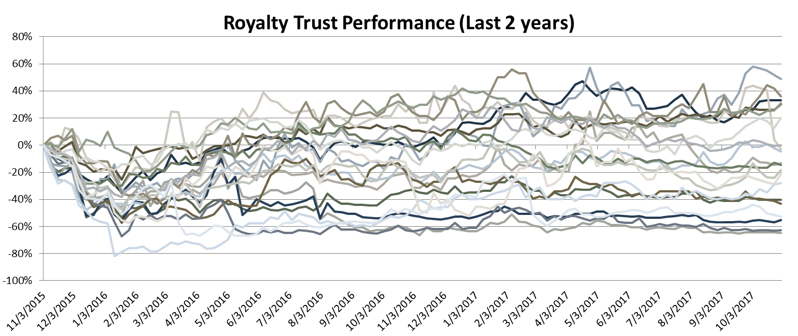

Over the previous two years, the performance of the 21 publicly traded royalty trusts has been a mixed bag. Fourteen have returned market value losses during the previous two years with an average market value return of negative 31%, six have experienced positive market value returns with an average of positive 33% and one has been flat.

Over the previous two years, the performance of the 21 publicly traded royalty trusts has been a mixed bag. Fourteen have returned market value losses during the previous two years with an average market value return of negative 31%, six have experienced positive market value returns with an average of positive 33% and one has been flat.

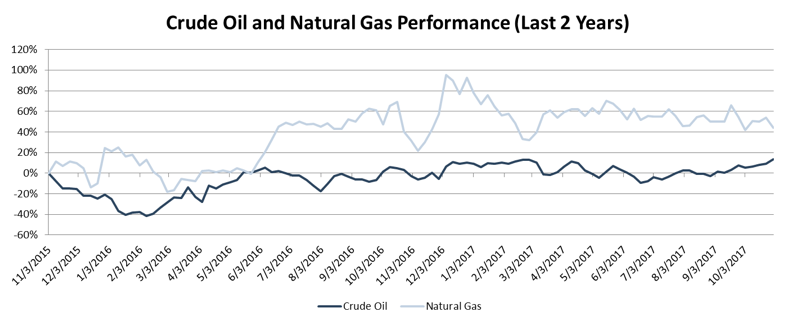

Contrast this wide return with the price of crude oil and natural gas which have both increased over the same period.

Contrast this wide return with the price of crude oil and natural gas which have both increased over the same period.

Clearly, there were some winners and losers among the 21 royalty trusts over the previous two years and, noticeably, more losers than winners. Of the winners, the royalty trust with the highest market value return was Mesa Royalty Trust (MRT) (+49%) over the previous two years, with ECA Marcellus Trust I (+36%) and Permian Basin Royalty Trust (+33%) coming in second and third, respectively.

Why did Mesa Royalty Trust outperform all other royalty trusts over the previous two years and what is the nature of its economic rights and restrictions?

Clearly, there were some winners and losers among the 21 royalty trusts over the previous two years and, noticeably, more losers than winners. Of the winners, the royalty trust with the highest market value return was Mesa Royalty Trust (MRT) (+49%) over the previous two years, with ECA Marcellus Trust I (+36%) and Permian Basin Royalty Trust (+33%) coming in second and third, respectively.

Why did Mesa Royalty Trust outperform all other royalty trusts over the previous two years and what is the nature of its economic rights and restrictions?

Mesa Royalty Trust (MRT)

Description of Assets Owned by MRT

The only asset of MRT includes an overriding royalty interest (ORRI) as described in their latest 10K filing:

[MRT owns] an overriding royalty interest (the "Royalty") equal to 90% of the Net Proceeds (as defined in the Conveyance and described below) attributable to the specified interests in properties conveyed by the assignor on that date (the "Subject Interests"). The Subject Interests consisted of interests in certain oil and gas properties located in the Hugoton field of Kansas, the San Juan Basin field of New Mexico and Colorado, and the Yellow Creek field of Wyoming (collectively, the "Royalty Properties")

As the 10-K refers, MRT’s asset is an overriding royalty interest in three oil and gas fields within the United States. [For more information on overriding royalty interests, see our post]. These properties are primarily natural gas and natural gas liquid plays in the San Juan Basin2 of New Mexico/Colorado, and the Hugoton Field of Kansas, Oklahoma and Texas3. The Yellow Creek field in Wyoming is not described further in the documents and is assumed to be immaterial in comparison to the San Juan Basin and Hugoton Field assets.

Commodity Prices

The price for oil peaked in 2014 near $108 per barrel and close to $8 for natural gas before the collapse of both commodity prices during the 2nd half of the year. The nadir of the decline was during 4Q2015 and 1Q2016 for both oil and gas. Prices currently stand around $53 per barrel and $3.60 per mcf.

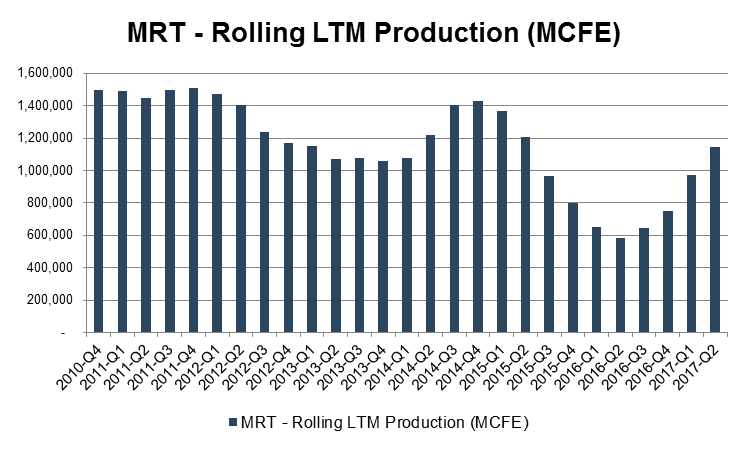

Asset Production

The following charts tracks the quarterly production for MRT since 2010, as well as a rolling latest twelve month (LTM) production figure. Each chart shows increasing production through 3Q2014 and subsequent decline in production from 4Q2014 through 1Q2016. Quarterly production increased 174% from 1Q2016 to 2Q2017. Much of the increase in market value could be due to the increase in MCFE volume produced by the properties over the previous five quarters.

We note that the production decline in MRT followed the commodity price decline. Additionally, the subsequent ramp up in production during 2Q2016 through 2Q2017 followed the stability and increase in commodity prices.

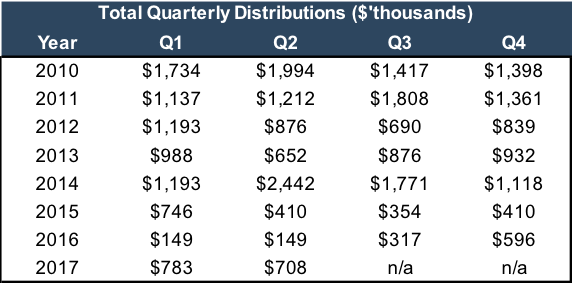

The combination of production and commodity price increases during the previous five quarters resulted in increases of distributions to unit holders in MRT by approximately 375% from 1Q2016 to 2Q2017.

We note that the production decline in MRT followed the commodity price decline. Additionally, the subsequent ramp up in production during 2Q2016 through 2Q2017 followed the stability and increase in commodity prices.

The combination of production and commodity price increases during the previous five quarters resulted in increases of distributions to unit holders in MRT by approximately 375% from 1Q2016 to 2Q2017.

This type of activity is rare for an overriding royalty interest. While commodity prices can be very volatile, production is normally a steady decline except for improvements from existing well workovers. It is not normal to see ORRI’s impacted by the addition of new wells. Judging by the significant increase in production, more research is needed to understand exactly what is impacting the ORRI owned by MRT. To do that, first consider the details within 10K regarding the ORRI owned by MRT and the economic rights and restrictions afforded.

This type of activity is rare for an overriding royalty interest. While commodity prices can be very volatile, production is normally a steady decline except for improvements from existing well workovers. It is not normal to see ORRI’s impacted by the addition of new wells. Judging by the significant increase in production, more research is needed to understand exactly what is impacting the ORRI owned by MRT. To do that, first consider the details within 10K regarding the ORRI owned by MRT and the economic rights and restrictions afforded.

Economic Rights and Restrictions for a Unit Holder in MRT

The following is excerpted from the 2016 Annual Report.

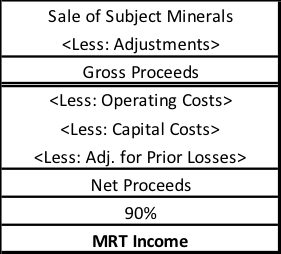

The Trust was created on November 1, 1979. On that date, Mesa Petroleum Co., predecessor to Mesa Limited Partnership ("MLP"), which was the predecessor to MESA Inc., conveyed to the Trust an overriding royalty interest (the "Royalty") equal to 90% of the Net Proceeds (as defined in the Conveyance and described below) attributable to the specified interests in properties conveyed by the assignor on that date (the "Subject Interests"). …Under the Conveyance, the Trust is entitled to payment of 90% of the Net Proceeds (as defined in the Conveyance), realized from Subject Minerals (as defined in the Conveyance), if and when produced from the Royalty Properties…The Conveyance provides for a monthly computation of Net Proceeds. "Net Proceeds" is defined in the Conveyance as the excess of Gross Proceeds, received by the working interest owners during a particular period over operating and capital costs for such period. "Gross Proceeds" is defined in the Conveyance as the amount received by the working interest owners from the sale of Subject Minerals, subject to certain adjustments. Subject Minerals mean all oil, gas and other minerals, whether similar or dissimilar, in and under, and which may be produced, saved and sold from, and which accrue and are attributable to, the Subject Interests from and after November 1, 1979. Operating costs mean, generally, costs incurred on an accrual basis by the working interest owners in operating the Royalty Properties, including capital and non-capital costs. If operating and capital costs exceed Gross Proceeds for any month, the excess plus interest thereon at 120% of the prime rate of Bank of America is recovered out of future Gross Proceeds prior to the making of further payment to the Trust. The Trust, however, is generally not liable for any operating costs or other costs or liabilities attributable to the Royalty Properties or minerals produced therefrom. The Trust is not obligated to return any royalty income received in any period.

To chart the above narrative, here is the “waterfall” from mineral production to MRT Income.

In addition to the above “waterfall,” MRT is not obligated to return any royalty income received in any period for any purpose, including losses incurred in future periods. Based on the “waterfall” analysis and the limited liability of future losses, it appears the asset owned by MRT functions more closely with a “profits interest” and less like an ORRI. ORRI’s typically participate at the revenue level and take a percentage off the top. They function much like royalty interests except for certain restrictions on the length of time they can receive royalties and a defined set of wells to which they have rights to production. In contrast, a “profits interest” is defined thusly:

In addition to the above “waterfall,” MRT is not obligated to return any royalty income received in any period for any purpose, including losses incurred in future periods. Based on the “waterfall” analysis and the limited liability of future losses, it appears the asset owned by MRT functions more closely with a “profits interest” and less like an ORRI. ORRI’s typically participate at the revenue level and take a percentage off the top. They function much like royalty interests except for certain restrictions on the length of time they can receive royalties and a defined set of wells to which they have rights to production. In contrast, a “profits interest” is defined thusly:

The award consists of receiving a percentage of profits from a partnership without having to contribute capital to the partnership.

As the revenues available to MRT must go through several layers of cost for operations, capital expenditures and adjustments for losses incurred in prior periods before flowing through to MRT, the similarities are more akin to a profits interest versus an interest in the revenues (i.e. ORRI).

Conclusion

The discussion above is the first of several key differences to understand before using MRT as a comparable company for royalty interest holders. We will discuss the other differences related to MRT in a later blog post, most notably the full reason for the increase in production over the previous five quarters.

We have assisted many clients with various valuation and cash flow issues regarding royalty interests. Contact Mercer Capital to discuss your needs in confidence and learn more about how we can help you succeed.