The first quarter of 2017 was productive and active for upstream E&P but the change in market capitalizations of many oil and gas companies does not match the reported increase in earnings and production estimates. Looking at our universe of energy companies in the E&P space, over 70% beat earnings estimates. This statistic held true no matter if the energy company was a global integrated operator or a pure upstream producer. To provide a flavor of the attitude, we selected two larger publicly traded energy companies involved in E&P (STO and XOM) as well as six companies with primary operations in the Permian Basin (PXD, CXO, NBL, XEC, FANG, and RSPP) and reviewed the highlights of their latest earnings releases. As summarized below, each of these companies exceeded analyst expectations.

The first quarter of 2017 was productive and active for upstream E&P but the change in market capitalizations of many oil and gas companies does not match the reported increase in earnings and production estimates. Looking at our universe of energy companies in the E&P space, over 70% beat earnings estimates. This statistic held true no matter if the energy company was a global integrated operator or a pure upstream producer. To provide a flavor of the attitude, we selected two larger publicly traded energy companies involved in E&P (STO and XOM) as well as six companies with primary operations in the Permian Basin (PXD, CXO, NBL, XEC, FANG, and RSPP) and reviewed the highlights of their latest earnings releases. As summarized below, each of these companies exceeded analyst expectations.

STO – StatOil ASA

Over the first quarter StatOil’s market cap fell from $60.2 billion to $55.7 billion. But, Eldar Saetre, President and CEO of Statoil ASA had only good things to say about first quarter earnings.

Over the first quarter StatOil’s market cap fell from $60.2 billion to $55.7 billion. But, Eldar Saetre, President and CEO of Statoil ASA had only good things to say about first quarter earnings.

- Our solid financial result and strong cash flow across all segments was driven by higher prices, good operational performance and an organic production growth of 5%.

- We delivered seven discoveries from nine exploration wells drilled during first quarter. Many of these can be quickly put into profitable production.

- We are also about to start our exploration programme in the Barents Sea, testing several new opportunities over the next six months. In the quarter, we received approval for three plans for development and submitted additional two projects for approval by Norwegian authorities, showing commitment to industrial development on the NCS.

XOM – Exxon Mobil Corporation

Exxon’s market cap fell over the first quarter from $373 to $340 billion but overall the company reported positive results. Darren W. Woods, Chairman and CEO, said,

Exxon’s market cap fell over the first quarter from $373 to $340 billion but overall the company reported positive results. Darren W. Woods, Chairman and CEO, said,

The following six companies’ operations are focused in the Permian Basin. The bulleted information below is summarized from each of their earnings releases.

- Our results reflect an increase in commodity prices and highlight our continued focus on controlling costs and operating efficiently.

- We continue to make strategic acquisitions, advance key initiatives and fund long-term growth projects across the value chain.

- Upstream volumes were 4.2 million oil-equivalent barrels per day, a decline of 4 percent compared with the prior year, primarily due to the impact of lower entitlements due to increasing prices, and higher maintenance.

- Upstream earnings of $2.3 billion improved on higher liquids and gas realizations.

PXD – Pioneer Natural Resource Company

Pioneer’s market cap remained relatively stable over the first quarter of 2017 at $31.3 billion in January and $31.6 billion at quarter end.

Pioneer’s market cap remained relatively stable over the first quarter of 2017 at $31.3 billion in January and $31.6 billion at quarter end.

- Production for the first quarter increased by 3% from 4Q16 and was above the top end of Pioneer’s guidance range

- Production growth was driven by Spraberry/ Wolfcamp horizontal drilling program

- The company reduced production costs compared to 4Q16.

CXO – Concho Resources, Inc.

Over the first quarter Concho’s market cap fell somewhat from $19.6 billion to $18.6 billion but overall, the company reported positive earnings and activity results.

Over the first quarter Concho’s market cap fell somewhat from $19.6 billion to $18.6 billion but overall, the company reported positive earnings and activity results.

- Concho delivered quarterly production of 181.4 Mboepd, exceeding the high end of the company’s guidance range and raised full-year 2017 production outlook to a range of 21% – 25% annual growth while maintaining their capital expenditures outlook.

- They increased crude oil production to 113.6 Mbpd, up 28% year-over-year.

- The company achieved record well performance in their Delaware Basin and New Mexico Shelf assets.

- The shift to manufacturing mode was made with large-scale development projects in the Delaware Basin and in the Midland Basin.

- The company reduced per-unit production expense and interest expense by 27% and 42%, respectively, year-over-year.

- Concho lowered full-year 2017 guidance for per-unit production and depreciation, depletion and amortization expenses.

NBL - Noble Energy, Inc.

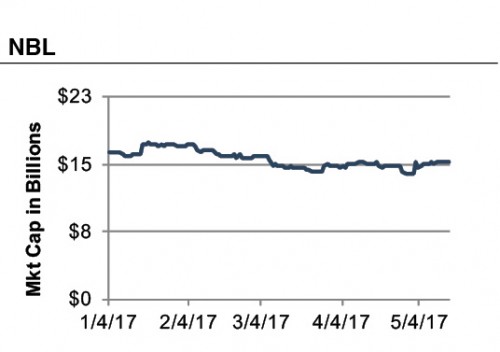

Nobel Energy’s market cap fell from $16.4 billion to $14.84 billion over the first quarter of 2017 even as President and CEO David L. Stover said, “Noble Energy is off to a great start in 2017, with strong operational and financial performance and importantly, numerous recent strategic accomplishments.”

Nobel Energy’s market cap fell from $16.4 billion to $14.84 billion over the first quarter of 2017 even as President and CEO David L. Stover said, “Noble Energy is off to a great start in 2017, with strong operational and financial performance and importantly, numerous recent strategic accomplishments.”

- The company delivered quarterly sales volumes at or exceeding the top end of guidance. And total oil volumes were at the high end of guidance, led by Delaware and DJ Basin performance.

- The company saw continued strong well performance in the Delaware Basin.

- Three new Wolfcamp A wells commenced production.

- Noble Energy's leading position in the Southern Delaware Basin was solidified through the acquisition of Clayton Williams Energy, increasing the company's position to 118,000 net acres.

- Full year sales volumes trended toward the upper half of original expectations, driven primarily from increased crude oil and NGL sales.

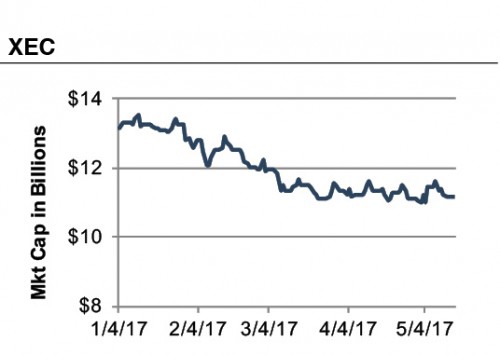

XEC – Cimarex Energy Co.

Cimarex’s market cap decreased over the first quarter from $13.2 billion to $11.4 billion.

Cimarex’s market cap decreased over the first quarter from $13.2 billion to $11.4 billion.

- Total production was up 11% sequentially.

- Oil production was up 15% sequentially.

- Total company production, which increased 9% over the first quarter, came in above the high end of our guidance.

- Commodity prices improved significantly from a year ago and had a positive impact on Cimarex's financial results for the quarter.

- Realized oil prices increased 70% from the first quarter of 2016.

- Realized natural gas prices were up 57% from the first quarter 2016.

- NGL prices were up 107% from the same period one year ago.

FANG - Diamondback Energy, Inc.

Over the first quarter Diamondback’s market cap increased from $9.3 billion to $10.1 billion.

Over the first quarter Diamondback’s market cap increased from $9.3 billion to $10.1 billion.

- 1Q17 production was up 19% over 4Q16 with 13% quarterly organic growth.

- Estimated 1Q17 Midland Basin drill, complete and equip cost per completed lateral foot was down 5% quarter-over-quarter.

- Closed Brigham Resources acquisition, which increased Diamondback's total leasehold to approximately 189,000 net surface acres in the Permian Basin.

- Diamondback continues to decrease drilling times, lower costs, and achieve new company records.

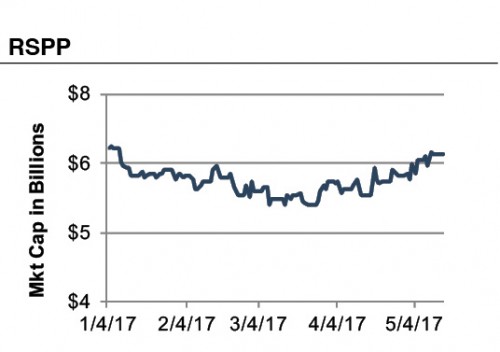

RSPP - RSP Permian, Inc.

RSP’s market cap decreased from $6.5 billion to $5.9 billion over the first quarter of 2017.

RSP’s market cap decreased from $6.5 billion to $5.9 billion over the first quarter of 2017.

As the above earnings excerpts explain, the first quarter brought (1) higher oil and gas prices; (2) higher production rates; (3) lower production costs; (4) investment in new wells; and (5) an active environment for asset purchase and divestures. However, the stock price performance does not reflect the positive quarter performance. Of the 64 energy companies we track, 49 had lower market capitalizations as of May 11, 2017 compared to December 31, 2016.

- Production increased 84% compared to 1Q16 and increased 26% compared to 4Q16.

- Adjusted EBITDAX increased by 249% from 1Q16 and 37% compared to 4Q16.

- On March 1, 2017, RSP Permian closed their previously announced SHEP II acquisition for approximately $646 million of cash and 16.0 million shares of RSP common stock.

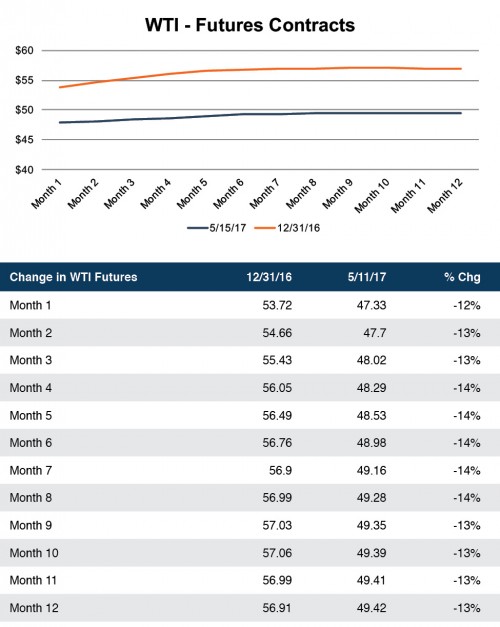

Why Is This?

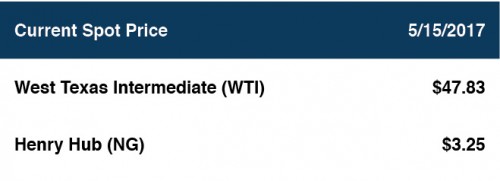

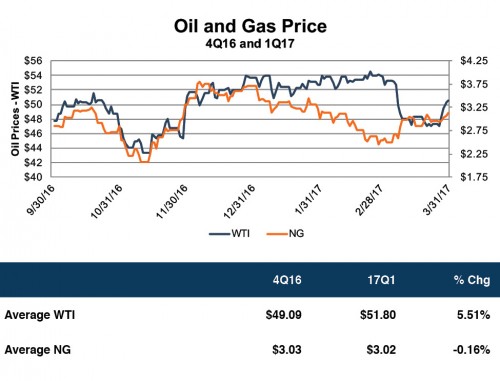

One significant reason for this mismatch is the outlook for crude oil has declined approximately 14% from the end of Q4 to the middle of May 2017. The following is a comparison of the 12 months futures contracts for WTI at the end of 4Q16 and middle of May 2017:

The fear of too much oil supply is dampening the pricing outlook for oil. Although 1Q17 resulted in slightly higher prices for oil, the successful increase in production from new drilling techniques and stacked reserve play wells is boosting production and moving prices lower. The industry now looks to OPEC and Russia for production cuts to assist in increasing the price.

In a volatile oil and gas market, the market capitalization of companies is more of a representation of the future earning potential of companies rather than the past. While the first quarter of 2017 showed hopeful results, the change in the market pricing of these companies puts a damper on the increase in earnings and makes us question if these companies’ successes are short lived.

Mercer Capital has significant experience valuing assets and companies in the energy industry, primarily oil and gas, bio fuels and other minerals. We have assisted many clients with various valuation and cash flow issues regarding royalty interests. Contact Mercer Capital to discuss your needs in confidence and learn more about how we can help you succeed.

The fear of too much oil supply is dampening the pricing outlook for oil. Although 1Q17 resulted in slightly higher prices for oil, the successful increase in production from new drilling techniques and stacked reserve play wells is boosting production and moving prices lower. The industry now looks to OPEC and Russia for production cuts to assist in increasing the price.

In a volatile oil and gas market, the market capitalization of companies is more of a representation of the future earning potential of companies rather than the past. While the first quarter of 2017 showed hopeful results, the change in the market pricing of these companies puts a damper on the increase in earnings and makes us question if these companies’ successes are short lived.

Mercer Capital has significant experience valuing assets and companies in the energy industry, primarily oil and gas, bio fuels and other minerals. We have assisted many clients with various valuation and cash flow issues regarding royalty interests. Contact Mercer Capital to discuss your needs in confidence and learn more about how we can help you succeed.