Last week, Mercer Capital attended the DUG Permian Basin Conference in Fort Worth. It was a solidly attended event hosted by Hart Energy. The session speakers were a mix of mostly company executives and industry analysts. The presentations were tinged with a lot of optimism – centered on the positive and unique economics of the Permian, tempered by (some) cautionary commentary. We will follow on in later posts with some more detail on specifics, but today we want to touch on a few thematic elements:

- The Permian was the center of the M&A activity in 2016 and will be in 2017

- Efficiency and productivity gains are helping to fuel activity

- Rise in rig counts will eventually mean rise in costs

Activity and M&A Epicenter

Most of the major M&A deals in the upstream sector were in the Permian Basin in 2016. It is clearly the most sought after basin. According to James Scarlett of RS Energy Group approximately 25% of the U.S.’ lower 48 production came from the Permian Basin and 38% of the rigs in the U.S. are in the Permian. The reason for so much concentration here, as opposed to other plays such as the Bakken or Eagle Ford, is that about 80% of currently economic (economic meaning under $50 breakeven oil) oil is in the Permian, particularly the Delaware Basin.

Secondly, due to the numerous potential production zones (Wolfcamp, Bone Spring, Leonard Shale, Delaware Sands, etc.) there is a huge amount of oil in place for potential recovery (3,000 feet of pay zones – or as one presenter described: a “cubic mile of oil”). Couple this with an area (West Texas) that has ample existing infrastructure from decades of development, and this has led to what some people are calling a land grab in the area. According to one presentation, we saw the re-emergence of the “strategic bid” which was a term all but lost since 2014.

Efficiency & Productivity Gains

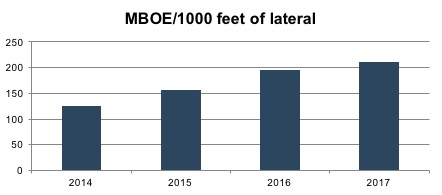

One of the key reasons for the positive economics for the Permian has been the increased gains in production efficiency. Much of this is simply the benefit of the Permian's superior geology; however, even within the play, drilling techniques and new technology have increasingly benefited production. The relative production of wells (measured by MBOE per 1000 feet of lateral drilling) has nearly doubled in the past three plus years:

In addition, production type curves are actually exceeding predictions in many cases in the Delaware. This has led to operators considering drilling up to 60 wells per section (effectively 6 acre spacing)! In addition, costs have come down in the past two years by about 25% per perforated lateral foot. However, that cost reduction may be temporary as more demand pours into the Permian.

In addition, production type curves are actually exceeding predictions in many cases in the Delaware. This has led to operators considering drilling up to 60 wells per section (effectively 6 acre spacing)! In addition, costs have come down in the past two years by about 25% per perforated lateral foot. However, that cost reduction may be temporary as more demand pours into the Permian.

Potential Headwinds

There were some tempered presentations that noted how as more rigs are needed in the region, that costs will proportionately rise. Much of the cost efficiencies in 2015 and 2016 were a result of an oversupply of rigs, equipment, people, etc. The gap began to shrink at the end of 2016 and is continuing to balance out further in 2017. As a consequence, costs will flatten out and even rise. Early signs of this are already being felt.

Although not mentioned much, conference goers were keenly aware that economics may change as well if OPEC decides to abandon its production cuts. This would change the supply balance in world oil prices and could further change the equation. However, this was not a centerpiece of discussion.

Takeaways

The marketplace is excited about the potential for the Permian Basin. One analyst mentioned that up to $100 billion of capital could be available for investment in the near future. Its exceptional economics with potential for outsized wells (3 million EUR) could keep the rig count high for decades. What does this mean from a valuation standpoint? Well, that question lies more on whether the marketplace is already capturing these potentials and risks in valuations. Deals are essentially priced at PDP plus a development program. PDP is pretty straightforward. Whether a development plan is properly valued is another, more complex issue.