I recently attended the National Association of Royalty Owners (NARO) National Convention in Dallas, Texas. The seminars on lease negotiations, mineral management, shale drilling, and more were all interesting and informative, but there was one topic that was brought up in almost every session: Post-Production Deductions (PPDs).

From the first Board Meeting to the last session of the conference, post-production deductions were discussed in great detail. Why were these deductions brought up time and time again? Because post-production deductions affect the value of a mineral owner’s interest yet the regulations surrounding them is somewhat unclear and exists mainly on a contractual basis.

What are Post-Production Deductions?

The Marcellus Shale Coalition defines post-production deductions (PPDs) as “the expenses incurred in order to get the gas from the wellhead to market.” These costs include gathering, compression, processing, marketing, dehydrating, transportation, and more. PPDs vary significantly between operators and between oil fields because the quality of the products and the distance to market differ.

In its raw form, natural gas has little value. In order to make it more marketable, the gas has to be processed so that it is ready to be transported and sold. When an operator markets the product so that it can be sold at a higher price, the royalty owner also benefits if the new net price is greater than the price they would have received.

Are PPDs legal?

Royalty interests represent a share of net revenue, which means that royalty owners get their share of gross revenue and their share of appropriate expenses. “But,” you say, “I thought royalty owners don’t share in the costs of production!” That is true. Royalty owners are not responsible for costs associated with research, exploration, drilling, or any other aspects of production; but they can be liable for their share of expenses generated post-production.

In December 2016, the West Virginia Supreme Court decided that EQT (and therefore other operators) can “not deduct from that (royalty) amount any expenses that have been incurred in gathering, transporting or treating the oil or gas after it has been initially extracted, any sums attributable to a loss or beneficial use of volume beyond that initially measured or any other costs that may be characterized as post-production”. However, in May of this year, the West Virginia Supreme Court reversed its previous decision from last year, allowing post-production deductions for gathering, transporting, or treating gas after extracted. As summarized in WV Supreme Court Reverses Itself, Post-Production Deductions OK, the court said that, “oil and gas companies may use “net-back” or “work-back” methods to calculate royalties owed but that the “reasonableness” of those expenses in specific instances may be decided by future court cases.”

In general, the matter of post-production deductions is generally a contractual one between the lessee and lessor. The Louisiana law review says that in general there are three kinds of royalty clauses: (1) the proceeds clause, (2) the market value clause, and (3) the market price clause. The proceeds clause requires that royalty owners be paid a percentage of the actual amount of proceeds, net proceeds, or gross proceeds that the company received. Unless otherwise specified the owner should be paid proceeds determined at the well not at the place of sale. According to Louisiana state law the market value clause allows the owner to determine the hypothetical price that a willing buyer would pay a willing seller for the product while the market price clause requires the operator to pay the royalty owner the actual price received at market. Both, however, allow the royalty owner to be charged for transportation and marketing costs.

Future court cases will likely better define the level of post-production deductions that are considered to be fair to both the royalty owner and the operator. But it is important that royalty owners familiarize themselves with the current laws surrounding mineral rights and post-production deductions in the states in which they own mineral rights.

How Do PPDs Affect the Value of Your Royalty Interest?

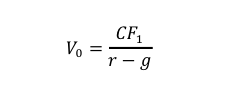

The effect that PPDs have on royalty interests can be explained by one of the fundamental concepts of business valuation: value is a factor of cash flow, growth, and risk.

PPDs directly reduce cash flow which reduces the value of a royalty interest as shown by the equation above. Additionally, the lack of a “no-deducts” clause in a lease agreement increase the risk associated with an interest. Even if a royalty owner does not currently pay post-production deductions, there is the possibility that the operator could charge PPDs in the future which increases risk. In our white paper titled, “How to Value an Oil and Gas Royalty Interest,” we explain how market and the income approach together can give a complete picture of value.

PPDs directly reduce cash flow which reduces the value of a royalty interest as shown by the equation above. Additionally, the lack of a “no-deducts” clause in a lease agreement increase the risk associated with an interest. Even if a royalty owner does not currently pay post-production deductions, there is the possibility that the operator could charge PPDs in the future which increases risk. In our white paper titled, “How to Value an Oil and Gas Royalty Interest,” we explain how market and the income approach together can give a complete picture of value.

Conclusion

The National NARO convention had educated speakers who talked on a broad range of topics. The organization encourages royalty owners to ask questions and continue learning no matter how long they have worked in the industry. The convention reminded me why industry expertise is so important in the field of business valuation. In order to fully understand the operations of a business, an analyst must have knowledge of all aspects of the industry. Mercer Capital has over 20 years of experience valuing assets and companies in the oil and gas industry. We have valued companies and minority interests in companies servicing the E&P industry and assisted clients with various valuation and cash flow issues regarding royalty interests. Contact one of our oil and gas professionals today to discuss your needs in confidence.