Last week, Lucas Paris analyzed the SEC’s $6.2 million settlement with a Big 4 audit firm relating to auditing failures associated with Miller Energy Resources, an oil and gas company with activities in the Appalachian region of Tennessee and in Alaska. In late 2009, Miller acquired certain Alaskan oil and gas interests for an amount the company estimated at $4.5 million. The company subsequently assigned a value of $480 million to the acquired assets, resulting in a one-time after-tax bargain purchase gain of $277 million. Following the deal, the newly acquired assets comprised more than 95% of Miller’s total reported assets.

The SEC order determines that the Big 4 audit firm did not properly use the reserve reports conclusion of PV-10 (present value at 10%).

This post considers the proper use of reserve reports and risk adjustment factors when determining fair market value.

What Is Fair Market Value?

The American Society of Appraisers defines the fair market value as:

The price, expressed in terms of cash equivalents, at which property would change hands between a hypothetical willing and able buyer and a hypothetical willing and able seller, acting at arm’s length in an open and unrestricted market, when neither is under compulsion to buy or sell and when both have reasonable knowledge of the relevant facts.1

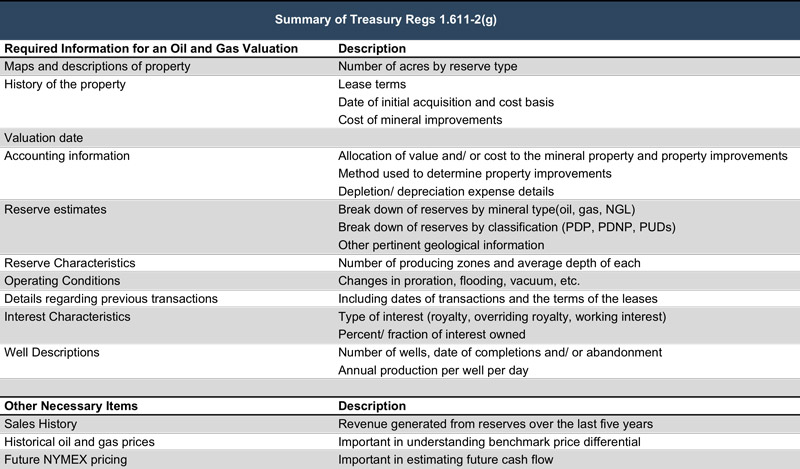

Treasury Regulation Section 1.611-1(d)(2) provides guidance in determining the fair market value of oil and gas properties. It similarly provides that “the fair market value of an [oil and gas] property is the amount which would induce a willing seller to sell and a willing buyer to purchase.” Additionally, Section 1.611-2(g) outlines some considerations that a valuation of mineral properties must include for tax-oriented appraisals. A summary of these considerations is shown in the chart below.

A review of Treasury Regulations 1.611-2(g) clearly demonstrates that an analyst must do more than rely on reserve reports when determining fair market value.

What Is a Reserve Report?

The SEC defines reserves as “estimated remaining quantities of oil and gas and related substances anticipated to be economically producible, as of a given date, by application of development projects to known accumulations.”

A reserve report is prepared by a petroleum engineer who estimates the remaining quantities of oil and gas and categorizes them based on the likelihood that they will be produced. There are three main categories of proved reserves (P1) which are distinguished in a reserve report. Proven reserves are defined to have at least a 90% probability of being recovered.

- Proved Developed Producing (PDP) reserves are defined by the OJFG as “the estimated remaining quantities of oil and gas anticipated to be economically producible, as of a given date, by application of development projects to known accumulations under existing economic and operating conditions.”

- Proved Developed Non-Producing (PDNP) reserves are proven reserves “that can be expected to be recovered through existing wells and existing equipment and operating methods.”

- Proved Undeveloped (PUDs) reserves are proven reserves “that are expected to be recovered from new wells on undrilled acreage or from existing wells where a relatively major expenditure is required for completion.”

How to Use a Reserve Report

The income approach is generally accepted among industry professionals as the most accurate representation of fair market value of oil and gas interests, and the reserve report can be used as one of the main sources of information for the inputs of the discounted cash flow. Treasury Reg 1.611-2(e)(4) provides a straightforward outline of how the approach should be used. In general, a discounted cash flow analysis is the method of choice.

In practice, the income approach requires that:

- The appraiser project income, expense, and net income on an annual basis

- Each year’s net income is discounted for interest at the “going rate” to determine the present worth of the future income on an annual and total basis

- The total present worth of future income is then discounted further, a percentage based on market conditions, to determine the fair market value.

What About Probable and Possible Reserves?

Reserve reports only account for proven reserves; they do not estimate the value of possible and probably reserves which are less likely to be recovered. While less certain, there is still some potential upside of the Probable and Possible reserve categories. In order to estimate the value of probable and possible reserves the market approach can be used.

The market approach is a general way of determining a value indication of an asset by using one or more methods that compare the subject to similar assets that have been sold. Because reserve values vary between oil and gas plays and even within a single play, finding comparable transactions is difficult. A comparable sale must have occurred at a similar time due to the volatile nature of oil and gas prices. A comparable sale should be for a property that is located within the same play and within a field of similar maturity.

If transactions show premiums over the value of proven reserves, then the buyer likely was paying for something else in addition to the proved reserves; he was likely paying for the less certain upside potential of probable and possible reserves. Through these transactions, the value of these reserves can be understood as they vary by basin and between fields. In many basins probable and possible reserves may currently be worthless because the price of oil may not rebound to a point where it would be economical to explore for and drill these reserves; however, in fields such as the Delaware and Midland Basins in the Permian recent transactions tell a different story.

The valuation implications of reserves and acreage rights can swing dramatically in resource plays. While a reserve report is helpful, it does not measure fair market value or fair value. Utilizing an experienced oil and gas reserve appraiser can help to understand how location impacts valuation issues in this current environment. Contact Mercer Capital to discuss your needs and learn more about how we can help you succeed.