The Great Y2K scare led to approximately $134 billion in preparation for the world-altering event. The belief that computers would malfunction and the world as we then knew it would end at midnight of December 31, 1999, led all major companies and many families to seek out help in preparation for the event, no matter the cost. When the clocks struck midnight and everything but a few slot machines in Deleware continued running, we moved on to planning the next apocalyptic event – what if oil runs out?

From 2000 to 2005, “concerns that supply could run out and soaring oil prices sent energy companies on a grand, often wildly expensive, chase for new production.” They were investing in multi-billion-dollar projects in the Arctic waters and Kazakhstan’s Captain Sea. A WSJ article titled, “Oil Companies Take Thrifty Bets,” explained that when oil was worth $100 per barrel oil companies had much higher risk tolerance and were able to invest heavily in the exploration of undeveloped land and ocean. But as the price of oil declined and has settled around $50 per barrel, the wild goose chase for oil has come to an end.

Declining Capital Expenditures

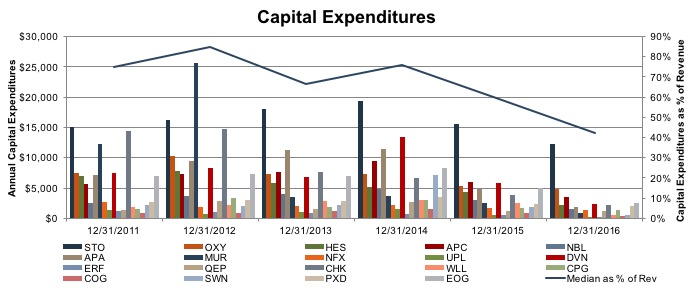

We are facing a different kind of supply crisis than previously imagined. Bloomberg analysts forecast that if OPEC cannot come to an agreement to extend cuts, it is forecasted that oil prices will fall to $40 per barrel. And if oil falls to $40 per barrel then much of the drilling activity that surged in the Permian Basin is expected come to a halt. Oil companies today can only focus on decreasing costs and reducing risks in order to stay afloat in an oversupplied market. From 2014 to 2016, capital expenditures of the E&P companies, shown below, declined, on average, by 64%.

In mid-2014 when the price of oil fell, exploration and production companies struggled to continue pumping oil from current wells. In order to fund day-to-day operations, companies had to pull the plug on most of their capital projects. Now that the price of oil has settled around $50 per barrel, exploration and production companies have begun to allocate small portions of their budget to research for new reserves and the exploration of new wells. Even as exploration and production companies’ revenues declined dramatically, capital expenditures shrunk from an average of 71% of revenues in 2011 to 43% of revenues in 2016. However, as capex budgets are shrinking, the cost to explore and drill new wells is increasing.

The price of fracking sand has increased recently as companies drill wells deeper in order to find efficiencies of scale. Deeper drilling, however, requires larger amounts of sand. As fracking has become more common, drilling in shale fields requires approximately 30% more sand every year. Although the price of fracking sand is still below $60 to $70 per ton, where it was before crude prices fell, Mr. O’Leary, director of oil-field services research at Tudor Pickering thinks that the price of sand will rise to $50 a ton this year. Last fall the cost of sand accounted for between 5% and 7% of the cost of a well but Mr. O’Leary expects that percentage to rise as exploration and production companies increase their usage of fracking sand this year. Further he said, “The millions of pounds of sand being poured down wells is pushing up sand prices, eroding some of the profits that energy companies have managed to regain since the oil bust ended.” In order to protect themselves from higher costs and shortages in fracking sand, some companies such as Pioneer Natural Resources have purchased their own sand mines.

In order to reduce costs and minimize risk, companies are looking for investments with shorter payback periods. Exxon, BP, Shell, and Chevron are investing in quick ventures in Texas and in existing projects in the Middle East and Brazil. Companies are looking back at old basins to see if new technologies can be used to extract any remaining resources. This is a big shift for companies who used to believe that the large upfront costs that would be paid off over 20 to 30 years generated the best return.

But what does the decline in capital expenditures today mean for supply and prices tomorrow? Due to the advancement of technology and the speed at which companies can bring new projects online, it is not likely that we will see a supply shortage any time soon. Rather low oil prices seem to be the new normal. When oil prices hit $60 then certain DUCS will be economical and will be brought online. And when oil hits $70… there will be more DUCs ready to be completed.

Mercer Capital has significant experience valuing assets and companies in the energy and construction industries. Our valuations have been reviewed and relied on by buyers and sellers and Big 4 Auditors. These valuations have been utilized to support valuations for IRS Estate and Gift Tax, GAAP accounting, and litigation purposes. Contact a Mercer Capital professional today to discuss your valuation needs in confidence.

In mid-2014 when the price of oil fell, exploration and production companies struggled to continue pumping oil from current wells. In order to fund day-to-day operations, companies had to pull the plug on most of their capital projects. Now that the price of oil has settled around $50 per barrel, exploration and production companies have begun to allocate small portions of their budget to research for new reserves and the exploration of new wells. Even as exploration and production companies’ revenues declined dramatically, capital expenditures shrunk from an average of 71% of revenues in 2011 to 43% of revenues in 2016. However, as capex budgets are shrinking, the cost to explore and drill new wells is increasing.

The price of fracking sand has increased recently as companies drill wells deeper in order to find efficiencies of scale. Deeper drilling, however, requires larger amounts of sand. As fracking has become more common, drilling in shale fields requires approximately 30% more sand every year. Although the price of fracking sand is still below $60 to $70 per ton, where it was before crude prices fell, Mr. O’Leary, director of oil-field services research at Tudor Pickering thinks that the price of sand will rise to $50 a ton this year. Last fall the cost of sand accounted for between 5% and 7% of the cost of a well but Mr. O’Leary expects that percentage to rise as exploration and production companies increase their usage of fracking sand this year. Further he said, “The millions of pounds of sand being poured down wells is pushing up sand prices, eroding some of the profits that energy companies have managed to regain since the oil bust ended.” In order to protect themselves from higher costs and shortages in fracking sand, some companies such as Pioneer Natural Resources have purchased their own sand mines.

In order to reduce costs and minimize risk, companies are looking for investments with shorter payback periods. Exxon, BP, Shell, and Chevron are investing in quick ventures in Texas and in existing projects in the Middle East and Brazil. Companies are looking back at old basins to see if new technologies can be used to extract any remaining resources. This is a big shift for companies who used to believe that the large upfront costs that would be paid off over 20 to 30 years generated the best return.

But what does the decline in capital expenditures today mean for supply and prices tomorrow? Due to the advancement of technology and the speed at which companies can bring new projects online, it is not likely that we will see a supply shortage any time soon. Rather low oil prices seem to be the new normal. When oil prices hit $60 then certain DUCS will be economical and will be brought online. And when oil hits $70… there will be more DUCs ready to be completed.

Mercer Capital has significant experience valuing assets and companies in the energy and construction industries. Our valuations have been reviewed and relied on by buyers and sellers and Big 4 Auditors. These valuations have been utilized to support valuations for IRS Estate and Gift Tax, GAAP accounting, and litigation purposes. Contact a Mercer Capital professional today to discuss your valuation needs in confidence.