On May 21, Mercer Capital attended the Minerals Workshop at the DUG Permian Basin Conference in Fort Worth, Texas. The agenda included five presentations and eleven speakers, including royalty brokers, royalty aggregators, and royalty managers.

- Leslie Haines, Hart Energy

- George Soulis, Oil & Gas Asset Clearinghouse

- Darren Barbee, Oil and Gas Investor

- C.H. Scott Rees III, NSAI

- James R. Elder, Momentum Minerals LLC

- Nick Varel, Wing Resources LLC

- Will Cullen, LongPoint Minerals LLC

- James Wallis, NGP Energy Capital Management

- James S. Crain, EnCap Investments LP

- John M. Greer, Latham & Watkins LLP

- Henry S. May III, Post Oak Energy Capital

- Mike Allen, Providence Energy Corporation

Growing Universe of Mineral Buyers

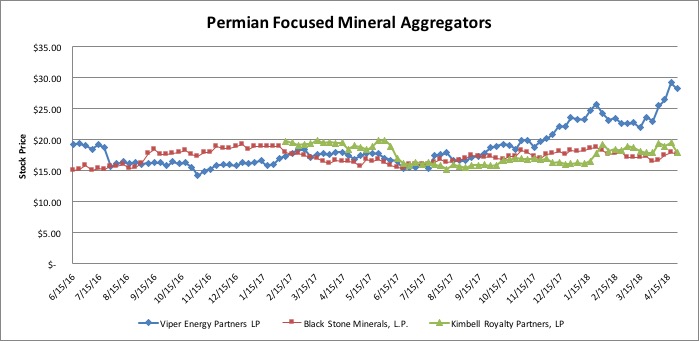

With the interest rate environment near all-time lows, many investors are looking for alternative investments to provide higher yields. This has driven private equity money into oil and gas. While part of private equity is targeting returns in operating exploration and production companies, mid-stream assets and refineries, significant money has found its way into the mineral and royalty market. Over the past four years, the mineral business has changed due to a surge in popularity. Minerals provide higher yield investment opportunities in a low yield environment. As a result of the surge, buying minerals is getting more and more competitive. Many of the speakers mentioned the prices for mineral buyers are increasing, and the market is attracting larger and more efficient mineral buyers. One speaker mentioned that prices on the ground have increased 40% to 50% in the last several years. In effect, increased competition is making it tough for the “small guys” to compete. A low yield investment environment is driving more money into the industry, increasing the number of buyers, increasing competition, and driving up prices of mineral interests. The chart below demonstrates the upward trend of the three most discussed mineral "aggregators" at the Minerals Workshop.

Target Double-Digit Returns

Investments are graded based on the returns of alternatives and their prospective risk. For example, debt issued by the United States Treasury Department is considered “risk-free” (we can discuss the merits of that assumption later). Therefore, the yields for U.S. Treasury bonds and bills provide a measure of risk-free required returns. As of June 11, 2018, the 20 year Treasury bond yields approximately 3.10%, which means nothing without a comparison. For comparison, buyers of mineral rights have target returns upwards of 50% in some cases. While bonds produce low 3% returns, large capitalization equities in the public market return 5% to 8%. An asset class that can produce 50% returns is a significant difference! While part of the delta is due to the incremental risk assumed by the buyer, a significant reason for the delta is due to the negotiating power many mineral buyers have flexed in the industry over the last few years.

To put it simply, demand for mineral rights was low in the last quarter of 2014. This is understandable as oil prices collapsed from $100+ to $20’s. Interest was low, oil and gas operators were going bankrupt, and the outlook was uncertain. As a result, the activity level for selling mineral rights was low to non-existent. Therefore, when one of the private equity speakers mentions “in 2015 there were many mineral interests to purchase,” it should come as no surprise. They were buying when there was “blood in the street.” Since that period of time, many operators have recovered, the Permian Basin has become the hottest shale play in North America, and oil prices have reached $60+. Investment capital has taken notice of the higher return opportunity and has created more demand for mineral rights. The interest has been spurred on by the promise of high rates of return.

Of the 11 presenters, more than half shared their targeted internal rates of return for their investments. The interesting part of this discussion was not the high double-digit returns, but the range of returns each was targeting. For mineral and royalty interests, target rates of returns were 10% to 50%. It was clear that broad range was based on several factors including: (1) use of leverage; (2) time horizon; and (3) information. One might wonder how mineral buyers are able to create this type of return in an increasingly competitive market. The reason for this: actual and perceived information asymmetry between buyers and sellers.

Asset Knowledge & Due Diligence

When a mineral buyer approaches a mineral owner, there is a real chance the buyer knows more about the minerals than the owner.

Increasingly sophisticated buyers perform the following due diligence on mineral and royalty interests: (1) Analysis of the lease historical production; (2) well spacing analysis; (3) infrastructure analysis; (4) reserve and geological analysis; (5) decline curve analysis; (6) “closeology” analysis which is using public data from operators to assess the activity within an area; and (7) lease detail analysis. All of which, is done before offers are made to the mineral owner. However, buyers don’t stop there. After an offer is made, more due diligence is performed which requires mineral ownership approval. These due diligence steps are focused on cash flow and pricing differential analysis which can be understood from check stubs that royalty owners received each month.

Since many mineral rights and royalty rights are passed down from generation to generation, it is not uncommon for the 2nd, 3rd, or 4th generation owners to negotiate from a disadvantaged position, due to lack of information sometimes not transferred from one generation to the other. All of the above due diligence items are available to the mineral owner; however, it takes time and experience to know where to find the information and to understand the data. Information asymmetry is one of the biggest reasons the market for royalty sellers is inefficient. Large, very highly capitalized buyers have invested the time and energy to understand the opportunities in minerals and utilize this advantage in negotiations.

We have assisted many clients with various valuation needs in the upstream oil and gas space in the Marcellus and Utica areas, other conventional and unconventional plays in North America and around the world. Contact Mercer Capital to discuss your needs in confidence and learn more about how we can help you succeed.