The economics of oil and gas production vary by region. Mercer Capital focuses on trends in the Eagle Ford, Permian, Bakken, and Marcellus and Utica plays. The cost of producing oil and gas depends on the geological makeup of the reserve, depth of reserve, and cost to transport the raw crude to market.

Appalachian Basin

The Marcellus formation and the underlying Utica are two large shale layers in the Appalachian basin. The Utica is the larger and denser of the two layers and rests a few thousand feet below the Marcellus. Producers must use techniques such as hydraulic fracturing, horizontal drilling, and pad drilling to make wells economically viable.

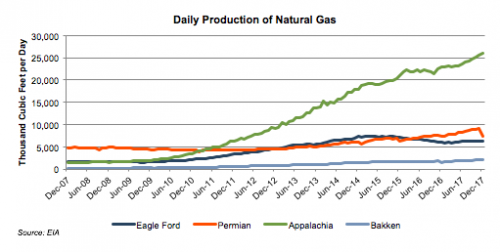

As shown in the chart below, the region produces more than 2.5x as much natural gas as any other region in the U.S. The Marcellus is already the second most prolific natural gas producer in the world after the Pars/North Dome field in Iran. Additionally, since the productivity of both plays is newly discovered, most of the recoverable gas is still in the ground. It appears as though the region will remain the center of natural gas production in coming years.

As production in the region multiplied, however, regional well-head prices fell. The amount of natural gas being produced in the Northeast far exceeded the infrastructure available to move supplies across the U.S. resulting in a supply surplus. This supply surplus caused the price of natural gas in the region to fall below the already depressed price of natural gas across the U.S.

Midstream oil and gas companies recognized the need for pipeline capacity in the Northeast, and many companies are in various stages of completion of new pipelines and/or existing pipeline reversals. These projects have already proven successful at transporting low-cost Marcellus shale gas out of the region. The EIA reported in August 2017 that the difference between the price of Henry Hub (the national benchmark for natural gas) and the price at hubs in Appalachia has narrowed as new pipeline projects and expansions are completed.

Further, the lack of refining and cracking capacity in the region has kept prices low and hampered growth. In June 2016, Shell announced that it would invest $3-$4 billion building an ethane cracker plant and petrochemical complex in Beaver County. Shell estimates that 70% of North American polyethylene consumers are within 700 miles of this facility. They began construction in late September 2017 and have signed 10-20 year supply agreements with 10 natural gas producers in Appalachia.

According to a presentation by the United States Department of Energy (USDE) at the NARO Appalachia conference, there have been four crackers announced to date in the region, bringing a combined capacity of 4.0 million metric tons to the region.

Natural gas producers have been dealing with low prices for over ten years. However, there is now hope of some relief in the next few years as new infrastructure in the region helps to reduce the supply glut. Additionally, demand for natural gas has been increasing as electricity generation fueled by coal has decreased and natural gas has taken its place.

As production in the region multiplied, however, regional well-head prices fell. The amount of natural gas being produced in the Northeast far exceeded the infrastructure available to move supplies across the U.S. resulting in a supply surplus. This supply surplus caused the price of natural gas in the region to fall below the already depressed price of natural gas across the U.S.

Midstream oil and gas companies recognized the need for pipeline capacity in the Northeast, and many companies are in various stages of completion of new pipelines and/or existing pipeline reversals. These projects have already proven successful at transporting low-cost Marcellus shale gas out of the region. The EIA reported in August 2017 that the difference between the price of Henry Hub (the national benchmark for natural gas) and the price at hubs in Appalachia has narrowed as new pipeline projects and expansions are completed.

Further, the lack of refining and cracking capacity in the region has kept prices low and hampered growth. In June 2016, Shell announced that it would invest $3-$4 billion building an ethane cracker plant and petrochemical complex in Beaver County. Shell estimates that 70% of North American polyethylene consumers are within 700 miles of this facility. They began construction in late September 2017 and have signed 10-20 year supply agreements with 10 natural gas producers in Appalachia.

According to a presentation by the United States Department of Energy (USDE) at the NARO Appalachia conference, there have been four crackers announced to date in the region, bringing a combined capacity of 4.0 million metric tons to the region.

Natural gas producers have been dealing with low prices for over ten years. However, there is now hope of some relief in the next few years as new infrastructure in the region helps to reduce the supply glut. Additionally, demand for natural gas has been increasing as electricity generation fueled by coal has decreased and natural gas has taken its place.

Valuation Implications

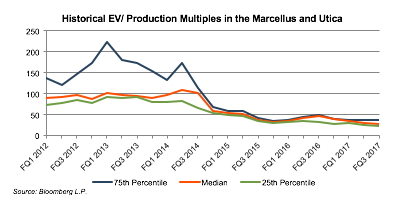

Over the past few years valuation multiples have been falling in the region as enterprise values have remained relatively constant and production has been increasing. As infrastructure projects near completion and the possibility of higher regional natural gas prices starts to materialize, we expect valuation multiples in the Marcellus and Utica to increase.

Mercer Capital has significant experience valuing assets and companies in the energy industry. Because drilling economics vary by region it is imperative that your valuation specialist understands the local economics faced by your E&P company. Our oil and gas valuations have been reviewed and relied on by buyers and sellers and Big 4 Auditors. These oil and gas related valuations have been utilized to support valuations for IRS Estate and Gift Tax, GAAP accounting, and litigation purposes. We have performed oil and gas valuations and associated oil and gas reserves domestically throughout the United States and in foreign countries. Contact a Mercer Capital professional today to discuss your valuation needs in confidence.

Mercer Capital has significant experience valuing assets and companies in the energy industry. Because drilling economics vary by region it is imperative that your valuation specialist understands the local economics faced by your E&P company. Our oil and gas valuations have been reviewed and relied on by buyers and sellers and Big 4 Auditors. These oil and gas related valuations have been utilized to support valuations for IRS Estate and Gift Tax, GAAP accounting, and litigation purposes. We have performed oil and gas valuations and associated oil and gas reserves domestically throughout the United States and in foreign countries. Contact a Mercer Capital professional today to discuss your valuation needs in confidence.