I recently attended the 38th Annual National Association of Royalty Owners (NARO) National Convention in Denver, Colorado. NARO is an organization that represents the interests of oil and gas royalty owners. The group promotes education and collaboration among its members for royalty owners to better understand their minerals, what goes into the royalty checks they receive, and the future of both production and legislation for the energy industry.

The conference had educated speakers who talked on a broad range of topics, and the fast-paced and engaging lectures tied together nicely. Royalty owners learned about laws and court cases currently impacting other areas that could affect them in the future. They also learned about the future of production and consumption both in the U.S. and abroad. Additionally, speakers discussed how critical phrasing included (or not included) in their lease can have an impact on the royalties they receive and the importance of advocating on their own behalf. There were even more topics discussed, some of which could have their own blog posts devoted to them, but below are the key takeaways I drew from the conference.

1. Regional Regulation and Legislation Doesn’t Stay Regional

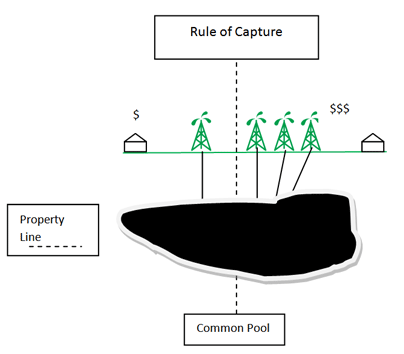

A panel on Thursday discussed current legislative initiatives in various regions of the U.S., such as a court case in Pennsylvania (Briggs v. Southwestern Energy Prod. Co. 2017) currently dealing with the rule of capture. The rule of capture means that the first person to “capture” or extract oil from the ground is the owner of the resource.

[caption id="attachment_22968" align="alignnone" width="404"]

Source: Marcellus Drilling News[/caption]

As illustrated in the above picture, sources of oil do not fall along property lines. Even if the oil comes from a common pool that extends to another property owner’s land, common law currently says the resource belongs to whoever can extract it. The court case in Pennsylvania is challenging this ruling, as it grapples with whether or not the “extraordinary means” associated with hydraulic fracturing could cause this means of production to be deemed trespassing. In other words, because fracking requires significantly more effort to extract the oil and could pose more environmental concerns, the impact it could cause to a neighbor’s property may mean that the extraction of oil that crosses property lines could be trespassing.

Another big topic was Colorado’s Prop 112 that could increase setback measures to the detriment of royalty owners in the region. As it turns out, this Proposition was defeated 57% to 43%. Regardless of the outcome of these court cases and legislative initiatives, one thing became clear at the conference: rules and regulations, like drilling, have the ability to cross borders, whether they are state lines or property lines.

Source: Marcellus Drilling News[/caption]

As illustrated in the above picture, sources of oil do not fall along property lines. Even if the oil comes from a common pool that extends to another property owner’s land, common law currently says the resource belongs to whoever can extract it. The court case in Pennsylvania is challenging this ruling, as it grapples with whether or not the “extraordinary means” associated with hydraulic fracturing could cause this means of production to be deemed trespassing. In other words, because fracking requires significantly more effort to extract the oil and could pose more environmental concerns, the impact it could cause to a neighbor’s property may mean that the extraction of oil that crosses property lines could be trespassing.

Another big topic was Colorado’s Prop 112 that could increase setback measures to the detriment of royalty owners in the region. As it turns out, this Proposition was defeated 57% to 43%. Regardless of the outcome of these court cases and legislative initiatives, one thing became clear at the conference: rules and regulations, like drilling, have the ability to cross borders, whether they are state lines or property lines.

2. Net Exports Doesn’t Equal Independence

Dr. Mark Cronshaw is a natural resource economist with vast experience in the industry. He discussed different ways in which energy is produced and consumed in different plays and regions in the country as well as across the globe. Of particular note, he spoke on the notion of energy independence. We can view this through the following equation:Imports/(Exports) = Consumption - Production

For a long time, consumption has outpaced production, requiring imports to balance the equation. However, with consumption flat and increasing production, it is anticipated that production will surpass consumption in 2022, making the U.S. a net energy exporter. Keep in mind that becoming a net energy exporter does not necessarily equate to energy independence. While horizontal drilling and fracking have had a profound impact on U.S. production, exports of LNG, coal, gasoline, etc., are vital for the economy. The U.S. may produce more than it consumes, but trade is still necessary, meaning true “independence” is unlikely.

3. What’s in Your Lease and Maybe More Importantly, What Isn’t

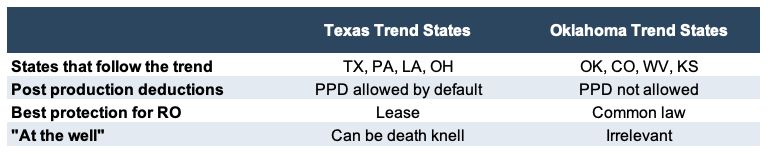

James Holmes, Esq. is an attorney in the Dallas area with diverse experience in oil and gas litigation, operation, and investment. He spoke on post-production deductions (PPDs), which is a continuous cause of concern for royalty owners. As we discussed a while back, PPDs are the expenses incurred in order to get the gas from the wellhead to market, such as gathering, compressing, processing, marketing, dehydrating, and transporting. Royalty owners benefit when their royalty percentage is applied to the ultimate price achieved when the gas is sold in the market. However, the oil and gas companies who bear the costs of making the product marketable would prefer to deduct the expenses they incur after extracting the gas. The laws governing the deductibility of post-production expenses are different depending on location.Compared to Texas trend states, Oklahoma trend states tend to be more favorable to royalty owners.

Compared to Texas trend states, Oklahoma trend states tend to be more favorable to royalty owners, as they do not allow PPDs by default. Royalty owners are protected by common law in these states, whereas Texas trend states get their best protection from well-crafted lease agreements.

If a lease in a Texas trend state uses the phrase “at the well,” that means the price on which the royalty percentage will be applied is the value of production when first taken out of the ground, or “at the well.” This is before it makes its way to a refiner, where the value will ultimately be higher. Even with clauses in a lease that specifically restrict PPDs, the phrase “at the well” can act like Pacman, gobbling up all helpful clauses and leaving royalty owners with less money on their royalty checks.

The differences in the two trends and the states that follow each are enumerated in the table below:

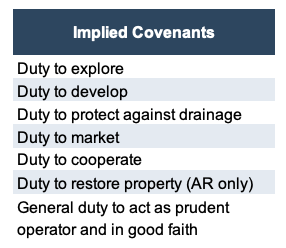

While Mr. Holmes emphasized handling these issues up front, particularly in Texas trend states, we learned from another speaker that sometimes implicit beats explicit. It seems obvious that a lease contract should have everything spelled out to protect the royalty owners, but John McArthur talked about implied covenants and how they can help.

Implied covenants date back to a court case in 1905 that stated, “a covenant arising by necessary principle is as much a part of the contract—is as effectually a part of its term—as if it had been plainly expressed.” Just because something isn’t explicitly stated, doesn’t mean a producer can give royalty owners the short end of the stick. In general, they must act as a prudent operator and in good faith, along with the other main implied covenants listed below.

While Mr. Holmes emphasized handling these issues up front, particularly in Texas trend states, we learned from another speaker that sometimes implicit beats explicit. It seems obvious that a lease contract should have everything spelled out to protect the royalty owners, but John McArthur talked about implied covenants and how they can help.

Implied covenants date back to a court case in 1905 that stated, “a covenant arising by necessary principle is as much a part of the contract—is as effectually a part of its term—as if it had been plainly expressed.” Just because something isn’t explicitly stated, doesn’t mean a producer can give royalty owners the short end of the stick. In general, they must act as a prudent operator and in good faith, along with the other main implied covenants listed below.

4. Royalty Owners Need to be Self Advocates

Many royalty owners have reaped the benefits of consistent and long-lasting production. Mineral interests tend to be passed down from one generation to the next, which distances current owners from the process that was involved with negotiating the original lease. Economic and personal circumstances change, however, and this can leave royalty owners looking for a better lease arrangement.

Frequently, leases are held by production meaning once an E&P company has drilled on the property, their lease will continue as long as they continue to produce. At a certain point, further production at a well may become disadvantageous to an operator if they cannot get a good enough price in the market. The location can also be depleted to the point that it is more expensive to produce than it would be in other areas.

As the saying goes, “the squeaky wheel gets the oil.”

Even if E&P companies don’t intend to produce any more, however, they are not motivated to terminate a lease. The end of a lease requires companies to incur expenses that do not produce revenue, like cleaning up and leaving the site. Additionally, when a company loses access to a reserve, it is removed from the company’s balance sheet. Although production of a reserve is not economical, removal from the balance sheet can impact a key metric used to assess a firm’s value in the marketplace.

Therefore, the onus is on the royalty owner to terminate a lease, which can be done if there is not production in paying quantities (an implied covenant from Garcia v. King 1942). Additionally, royalty owners can also negotiate a new lease for new production in untapped zones, even if the acreage is leased, if the current operator is unable to reach these zones. As the saying goes, “the squeaky wheel gets the oil.”

Conclusion

These takeaways are only some of the topics that were discussed at the NARO 2018 Convention, which provided an excellent platform for new attendees to become informed about the industry while still being beneficial to more experienced people who have been attending the conference for years. Going for the first time myself, I certainly learned about the issues that impact royalty owners most.

In order to fully understand the operations of a business, an analyst must have knowledge of all aspects of the industry. Mercer Capital has over 20 years of experience valuing assets and companies in the oil and gas industry. We have valued companies and minority interests in companies servicing the E&P industry and assisted clients with various valuation and cash flow issues regarding royalty interests. Contact one of our oil and gas professionals today to discuss your needs in confidence.