Joint ventures (JVs) are fairly ubiquitous in the energy sector with as much as 71% of upstream investment through alliance or JV relationships. Companies will often enter into JVs to share the sheer capital intensive load of upstream and midstream activities.

An oil and gas JV in its most basic form is fairly straightforward. A company will take on the operator role by working the field and constructing or managing the infrastructure in a given area, and another company will assume a non-operator role by providing capital so that each player is mutually benefited. Those entering into these relationships may contribute assets, capital, technologies, or even combinations of the aforementioned in order to access advantages such as scale, risk sharing, or entry into a specific market or play and both share in the future costs.

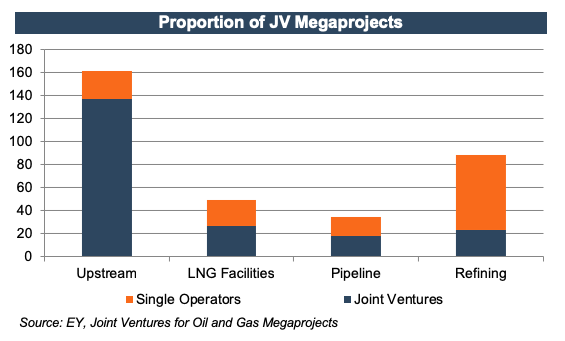

Megaprojects of over $1 billion are largely structured as JVs and are especially useful to capitalize on synergies, infrastructure, and risk sharing. In an EY study of 365 megaprojects, JVs made up 85% of the projects in upstream activities and over 50% were in LNG and pipeline projects.

On the surface, this may seem like an effective way for companies to structure a hedge and mitigate systematic risk through diversification of assets, but in reality, the benefits of a JV are much harder to realize. Management considerations quickly become complicated and time horizons tend to be short-lived. Research has shown that as many as 70% of JVs in oil and gas tend to fail within 5 years.

From a valuation perspective, struggling or failing JVs can put a strain on overall company value as future income streams are subjected to a greater amount of uncertainty and, thus, are further discounted. In addition, most JVs lack a defined exit plan as a study from Boston Consulting showed that only 19% of respondents had a clear exit strategy. Even in a well-structured JV agreement, the absence of an exit strategy in an environment of high failure rates inevitably results in large tangible and intangible exit costs that can erode the value the JV initially was set up to create.

On the surface, this may seem like an effective way for companies to structure a hedge and mitigate systematic risk through diversification of assets, but in reality, the benefits of a JV are much harder to realize. Management considerations quickly become complicated and time horizons tend to be short-lived. Research has shown that as many as 70% of JVs in oil and gas tend to fail within 5 years.

From a valuation perspective, struggling or failing JVs can put a strain on overall company value as future income streams are subjected to a greater amount of uncertainty and, thus, are further discounted. In addition, most JVs lack a defined exit plan as a study from Boston Consulting showed that only 19% of respondents had a clear exit strategy. Even in a well-structured JV agreement, the absence of an exit strategy in an environment of high failure rates inevitably results in large tangible and intangible exit costs that can erode the value the JV initially was set up to create.

Does the success of the JV hinge on the quality of the oilfield or the technical ability of the operator?

Put simply, executing a successful joint venture requires a number of items working in harmony such as solid due diligence, good location, cooperation between both firms, and a degree of luck on the bet they are making.

It seems a bit contradictory that a large number of projects are structured as joint ventures if they have such a high failure rate. This begs the question, does the success of the JV hinge on the quality of the oilfield or the technical ability of the operator? The answer, we think, lies somewhere in the middle.

Location, Location, Location

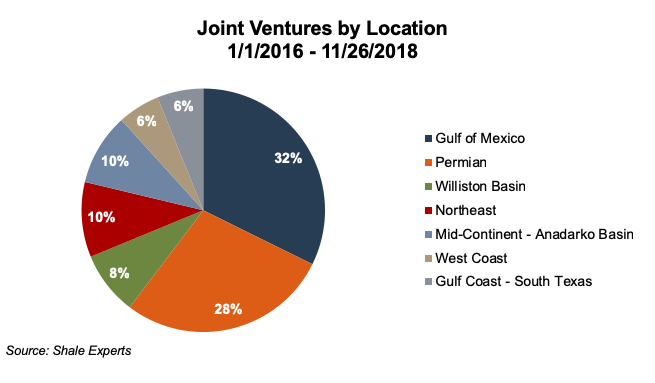

Even with the difficulties of maintaining a successful JV, many companies have been entering into joint ventures to take advantage of the oil boom that the U.S. has enjoyed for the past several years. Not surprisingly, a large portion of recently formed upstream JVs since 2016 has been in the Permian Basin, and several large midstream JVs have been formed in the Gulf of Mexico.

Recently, Williams Companies Inc. announced that it is forming a joint venture with privately-held Brazos midstream in the Permian Basin to gain exposure to crude and NGL and position itself for potential midstream opportunities.

Williams is offering their gas gathering assets for a 15% stake in Brazos as part of the JV terms, with Brazos retaining 85% in the venture as well as operatorship. Almost all of the assets including gas and crude pipelines, storage and a planned processing plant are coming from Brazos Midstream with Williams offering dedicated acreage, a small amount of gas gathering infrastructure and inexpensive sources of financing.

Recently, Williams Companies Inc. announced that it is forming a joint venture with privately-held Brazos midstream in the Permian Basin to gain exposure to crude and NGL and position itself for potential midstream opportunities.

Williams is offering their gas gathering assets for a 15% stake in Brazos as part of the JV terms, with Brazos retaining 85% in the venture as well as operatorship. Almost all of the assets including gas and crude pipelines, storage and a planned processing plant are coming from Brazos Midstream with Williams offering dedicated acreage, a small amount of gas gathering infrastructure and inexpensive sources of financing.

Companies have been scrambling to get a piece of the pie in the more recent surge in demand for natural gas.

Even though the Permian has seen a large amount of activity and natural gas prices remain low, companies have been scrambling to get a piece of the pie in the more recent surge in demand for natural gas. Royale Energy has recently entered in a JV with California Resources Corp. to drill 30 wells throughout the Rio Vista Field, the largest dry gas field in California. This agreement expands on a previous JV and will give Royale up to three years to drill in any of the formations on the property.

The historic property is abundant with gas, producing approximately 4 trillion cubic feet from more than 15 stacked gas reservoirs, and according to Royale, “The joint venture will lead to multiple years of drilling activity at Rio Vista at a time of upward trending natural gas prices due to declining natural gas inventories nationwide.”

These transactions are but a few of the many JVs structured in areas to take advantage of the location and the resources it has to offer in a demanding market. And while it may seem like a no-brainer for the non-operator to search out operators in successful plays, many have had a history of missing the mark when it comes to structuring effective non-operated portfolios resulting in value being left on the table or outright failure.

Adding Value to Non-Operating Portfolios

Oil and gas companies are typically skilled at maximizing value with their operated assets. But more often than not, these companies tend to take a backseat approach to their non-operating portfolios, almost akin to treating them like equity investments. The detached and unsystematic treatment conflicts with the shared responsibility for the success or failure of their ventures.

Boston Consulting Group identifies three main sources of value loss due to failure of material participation by non-operators: A nonstrategic approach, inconsistency, and lack of priority.

They also outline a four-step framework for non-operators to add value to their non-operational portfolios:

- Clear strategic intent about what each non-operating venture (NOV) asset contributes to broader company goals

- Sharp risk and opportunity assessment

- Consistent NOV organization and governance

- Rigorous execution strategies for each NOV asset

- Level of experience and familiarity of the play/asset

- Understanding and application of proven technologies

- History of productivity and efficiency

- Clear understanding of role within the partnership

- Strong safety, environment, and previous contract records and

- Alignment on ethics.

Final Thoughts

A major benefit of a JV is to gain exposure to areas and effectively deploy resources and capital where it could be best used and thus create maximum value. As we have mentioned above, however, failure rates are very high in the short term mostly as a consequence of cost overruns due to inadequate planning. But the natural frictions associated with a JV make planning and communication all the more important. While non-operators need the proper location for success in a joint venture, they can get further through proper due diligence and planning concerning operators.

We have assisted many clients with various valuation needs in operator and non-operator roles in North America and around the world. In addition to our corporate valuation services, Mercer Capital provides investment banking and transaction advisory services to a broad range of public and private companies and financial institutions. We have relevant experience working with companies in the oil and gas space and can leverage our historical valuation and investment banking experience to help you navigate a critical transaction, providing timely, accurate and reliable results. Contact a Mercer Capital professional to discuss your needs in confidence.