Last year Kimbell Royalty Partners went public in a $90 million IPO. In May of this year, Kimbell announced its acquisition of Haymaker Minerals for $404 million in cash and stock. To top it off, last month Kimbell priced a follow on public offering for $57 million. The Haymaker acquisition remains the largest corporate mineral acquisition so far this year and exemplifies the continuing growth in a relatively new niche of publicly traded MLPs: Royalty MLPs. With around $1 billion in corporate or mineral rights acquisitions so far this year by leading royalty MLPs and mineral aggregators Viper Energy Partners (VNOM), Kimbell (KRP) and Black Stone Minerals (BSM), the segment is consolidating fast in a historically opaque market. Going back decades, the royalty and mineral market has been dominated by smaller, private transactions oftentimes with information asymmetry in negotiations. The strategy for Kimbell and its peers: create liquidity and thus value in an attractive, yet relatively untapped marketplace.

Royalty-focused MLPs and mineral aggregation has the potential to provide growth through acquisitions and distribution payments that public investors desire.

Kimbell is the most recent entrant to the public market and is emblematic of the increasing capital stacks being deployed to buy up mineral rights all across the country. Private equity players such as Haymaker’s sponsors, KKR and Kayne Anderson Capital Advisors, LP have been growing participants in this space, especially after the drop in oil prices in 2014.

On the investor side of the equation, individuals and institutions are looking for opportunities to be exposed to mineral plays and benefit from technological advances without taking operator risk. This is a primary attraction of these types of investments, and many of these investors’ best platform to do so is through public companies. More and more investors are looking to the mineral market to find investment growth. The emerging field of royalty-focused MLPs and mineral aggregation has the potential to provide this growth through acquisitions, as well as distribution payments that public investors desire. Kimbell’s acquisition of Haymaker is a good example of this.

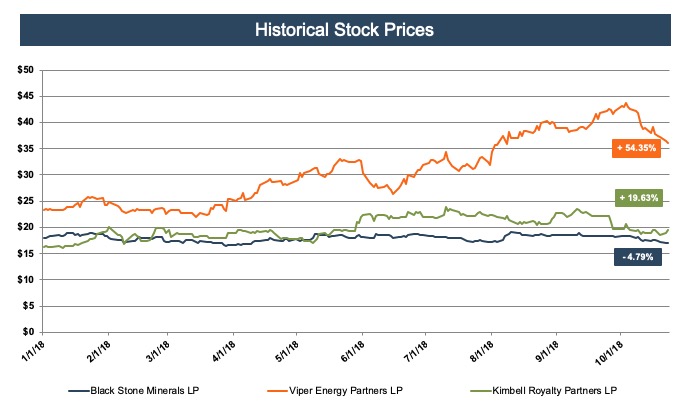

Royalty MLPs and aggregators (not to be confused with royalty trusts which do not actively aggregate minerals) have only recently entered the public investment sphere, although the oil and gas mineral market has been around since Colonel Drake begat the industry in 1859. Viper Energy Partners IPO’d in 2014, Black Stone Minerals followed in 2015 and Kimbell went public last year. Performance this year has generally been strong with Black Stone Minerals lagging. Viper Energy Partners has led the way this year in market value increase. Two factors appear to be pushing it ahead of its peers: (1) it is focused in the hot Permian Basin; and (2) about 39% of its acreage is operated by its sister company, Diamondback Energy (the “other” FANG stock).

[caption id="attachment_22837" align="alignnone" width="683"]

Source: Bloomberg[/caption]

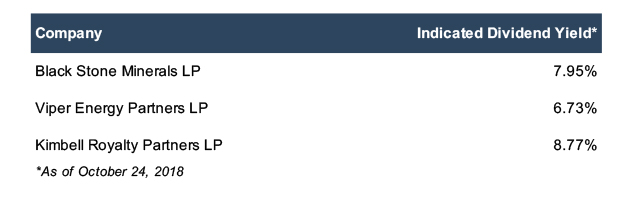

Growth aside, yields are the primary investment objective for these vehicles. Although potentially more volatile, the yields this year have been healthy as well.

[caption id="attachment_22838" align="alignnone" width="640"]

Source: Bloomberg[/caption]

Growth aside, yields are the primary investment objective for these vehicles. Although potentially more volatile, the yields this year have been healthy as well.

[caption id="attachment_22838" align="alignnone" width="640"] Source: Bloomberg[/caption]

Alongside the acquisition, Kimbell converted its tax status from an MLP to a C Corp, a growing trend in light of the recent tax law changes. Now that the corporate tax rate is lower than the individual tax rate, the tax pass-through structure of an MLP does not provide the benefit it once did. Kimbell believes that this conversion will give the company access to a much broader base of investors and access to a more “liquid and attractive currency.”

Source: Bloomberg[/caption]

Alongside the acquisition, Kimbell converted its tax status from an MLP to a C Corp, a growing trend in light of the recent tax law changes. Now that the corporate tax rate is lower than the individual tax rate, the tax pass-through structure of an MLP does not provide the benefit it once did. Kimbell believes that this conversion will give the company access to a much broader base of investors and access to a more “liquid and attractive currency.”

Tapping The Vast Mineral Royalty Market

Kimbell estimates that the total oil and gas royalty mineral buying market is close to $500 billion, excluding overriding interests which are hybrid style mineral interests. These estimates suggest that public companies make up only about 2% of the total market or about $10 billion, with the two largest players, Black Stone Minerals and Viper Energy Partners, making up over $8 billion of that total market value. While the public minerals market is only made up of a handful of companies giving public investors a limited number of investment options, the private minerals market is highly fragmented. Organizations such as the National Association of Royalty Owners work to educate mineral owners, but they still only scratch the surface of the market. Small mineral aggregators can operate with a higher attention to acreage details. These small aggregators are able to focus more on negotiating directly with the landowners and handpick the acreage of their choosing. As a result, they expect higher yields than the public companies. While these yields are higher, the acreage is typically less diversified. Combined with their small size, these investments are inherently riskier than a larger, more diverse pool of assets, such as those held by public royalty trusts.Liquidity Discounts And Valuation Opportunity

Kimbell’s acquisition of Haymaker also demonstrates disconnect between the public and private markets and the discounts at which private LPs are valued. It appears that private royalty LPs simply do not have the same access to capital as the public MLPs or C Corps. This lack of access is potentially why KRP and Haymaker had distinctly different yields and why KRP was able to successfully negotiate such a highly accretive deal. Valuation professionals call this a liquidity or marketability discount. Mercer Capital sees this phenomenon quite often when valuing client’s privately held assets as demonstrated in the chart below, which highlights these “levels” of value.

Source: Mercer Capital[/caption]

Source: Mercer Capital[/caption]

Private equity investors and sponsors recognize this too. Haymaker’s sponsors most likely saw the potential behind the accretive mix of the two companies, which is why they were willing to accept roughly 50% of the purchase price in Kimbell shares. Not only was Kimbell public, its transition to a C Corp opened itself up to a broad array of inexpensive capital, less expensive than what Haymaker likely would have been able to find on its own. This access to cheaper capital makes it easier for Kimbell to grow through acquisitions and continue to increase returns and shareholder value.

The Royalty Sector Is Just Warming Up

This is one of the biggest deals so far this year, but it may not be the last. Regardless of whether the MLP moniker sticks or they mostly become C Corp vehicles, the market remains vast, and public royalty aggregators are still at the front end of the consolidation trend. Oil and gas conferences regularly feature these firms now and they have become a regular part of the industry’s conversation. However, as more light shines on this market, efficiencies will grow and value will eventually get harder to find. In the meantime, there is opportunity to feed investors’ appetites and value seekers with oil and gas royalty minerals.

Originally appeared on Forbes.com.