When oil prices crashed in mid-2014, companies were forced to become more efficient in order to survive. It became clear that location meant more than ever and companies could no longer justify operating in regions such as the Bakken and the Eagle Ford, where break-even prices were higher than they were in the Permian. Thus in order to stay in business, companies flocked to the Permian. This week, we look at how the increased appeal of the Permian Basin has affected M&A activity in the oil and gas sector.

The trend towards the Permian Basin was somewhat slow to begin as the uncertainty that accompanied the price collapse led to a standstill in activity. While some investors were quick to move to the Permian when acreage was still relatively inexpensive, most were slow to sell their acreage in other basins as the low oil price environment pushed down the price of acreage. Now that the Permian has become the clear leader in production, M&A activity in the region has picked up and multiples for Permian acreage have increased due to high demand. Although it was three to four years ago that the Permian emerged as the cost leader, companies are still moving to the Permian with haste.

This trend is especially apparent as it relates to Pioneer Natural Resources’ recent acquisition activity. Pioneer announced earlier this year that it would shift its focus to become a pure-play Permian producer, with plans to spend its entire $2.9 billion capex budget in the Permian Basin.

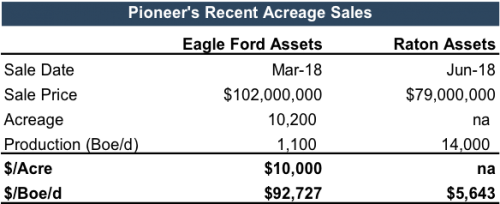

Since the announcement, Pioneer sold Eagle Ford assets for $102 million and southeastern Colorado assets for $79 million, as summarized below. It appears that Pioneer was willing to take a loss in order to re-deploy capital to the Permian Basin.

In March 2018, Pioneer sold its assets in the Eagle Ford for $10,000/acre and $92,727 per flowing barrel. The price Pioneer received was in line, or even above, industry averages which are more along the line of $4,200/acre and $98,000 per flowing barrel.

However, this month Pioneer announced the sale of its Raton assets for only $79 million, a multiple of $5,600 per flowing barrel. Meanwhile, multiples for acreage in southeastern Colorado are not expected to be at the same level as multiples seen in the Eagle Ford. BusinessWire reported that this sale “is expected to result in a pretax noncash loss of $65 million to $75 million.”

In March 2018, Pioneer sold its assets in the Eagle Ford for $10,000/acre and $92,727 per flowing barrel. The price Pioneer received was in line, or even above, industry averages which are more along the line of $4,200/acre and $98,000 per flowing barrel.

However, this month Pioneer announced the sale of its Raton assets for only $79 million, a multiple of $5,600 per flowing barrel. Meanwhile, multiples for acreage in southeastern Colorado are not expected to be at the same level as multiples seen in the Eagle Ford. BusinessWire reported that this sale “is expected to result in a pretax noncash loss of $65 million to $75 million.”

Pioneer seems to have shifted its strategy from a planned liquidation to a "take what you can and get out" approach.

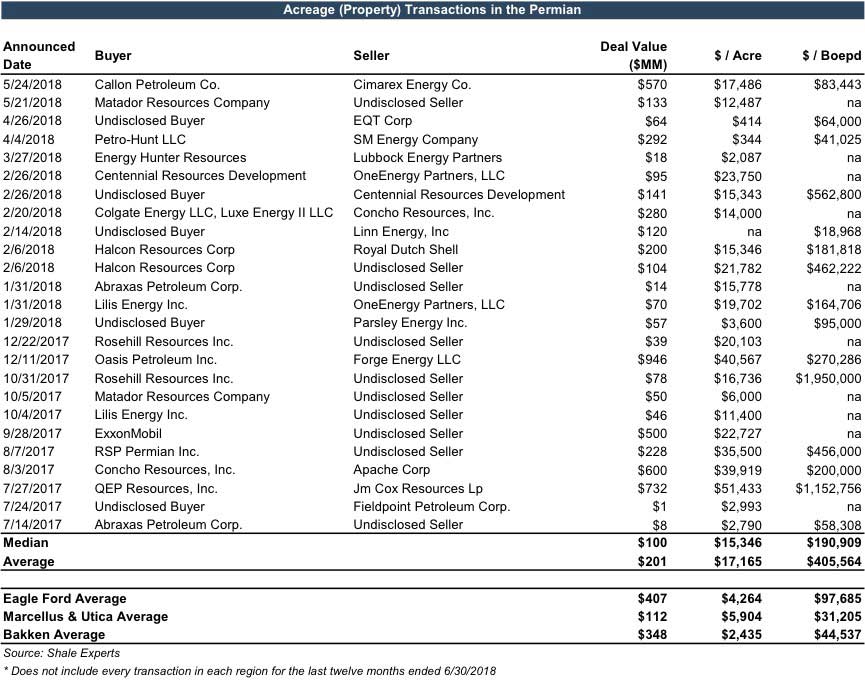

While Pioneer just exited its current position at multiples lower than what might be otherwise expected for the region, they are looking to buy acreage in a region where multiples have flown through the roof. Recent acreage transactions in the Permian Basin are closing at median multiples of $16,000 per acre and over $180,000 per flowing barrel as summarized below, according to Shale Experts.

Pioneer’s recent transaction activity shows the urgency with which companies are now shifting their focus to the Permian. Pioneer’s acceptance of a large loss for its Raton assets is symptomatic of the recent dominance of the Permian to all other U.S. shale plays. And while Pioneer accepted a loss in order to sell its acreage at meager multiples of $5,600 per flowing barrel, it will now likely use that cash to pay for Permian acreage at multiples of over $100,000 per flowing barrel.

Part of the reason for paying the premium multiple can be explained by the existence of more proved undeveloped (PUD) reserves in the Permian Basin as compared to other regions. Many transactions in the Permian are motivated by the existence of future drilling potential over current production. Thus multiples of current production in the Permian are inflated when compared to transactions in regions that have more current production but less potential for the development of PUD reserves. However, the difference is mainly due to the obvious benefits of operating in the Permian Basin as compared to other unconventional shale plays, including low break-even prices, efficiencies generated multiple stacked plays, and lower costs from shorter transportation distances to refineries. However, it is worth noting that increased drilling activity in the Permian Basin is beginning to strain the existing infrastructure in the Permian, creating transportation bottlenecks (or as Bryce Erickson likes to call it, a hydrocarbon traffic jam).

Javier Blas with Bloomberg recently pointed out the logistical difficulties in getting Permian oil and gas to market and the growing price differentials as a result. This could be a cause of short to intermediate term revenue and valuation disruptions for some producers.

With such wide range of observed transaction multiples, it is especially important to understand each transaction and the main drivers of value before using a transaction as a benchmark of value. We have assisted many clients with various valuation needs in the upstream oil and gas space in the Permian Basin, other conventional and unconventional plays in North America and around the world. Contact Mercer Capital to discuss your needs in confidence and learn more about how we can help you succeed.