Lately, talk of the domestic oil and gas market has been especially positive. But the oilfield services industry is still struggling to recover from the collapse of oil prices in mid-2014 and the subsequent reduction in capital spending by upstream companies.

We look at how the downturn in crude prices in 2014 still affects the oilfield service industry and consider the impact on company valuations.

What Happens to Oilfield Services Companies When Oil Prices Are Low

Oilfield service companies provide support services to oil and gas production companies – leasing drilling rigs, repairing wells, manufacturing drilling equipment, processing seismic data, and more.

When oilfield production companies cut capital expenditures and delayed drilling projects after oil prices fell in mid-2014, demand for oilfield service companies plummeted. They were no longer needed to drill new wells because new drilling activity essentially stopped when prices fell, and they were not needed to perform routine maintenance as many companies delayed repairs in order to cut costs.

When oil prices fell, some regions were deemed uneconomical by many players, while other regions, such as the Permian Basin, experienced a rush to grab land while it was still available. While oilfield service companies operating in the Permian were better off than others, even these companies struggled as oil producers played the game of survival of the fittest where only those who could cut costs and increase efficiency could win.

In order for drilling to remain economical in the new low oil price environment of 2015 and 2016, production companies invested in cost savings measures. Technological advancements, like multiwell pad drilling, reduced costs for the oil producers which in turn decreased revenue for oilfield service companies. As Dan Eberhart, contributor to Forbes wrote recently in “Revenge Of The Oil Services Sector in 2018”:

"Make no mistake, when producers boast of 'efficiency gains' made to outlast low prices, they are primarily referring to cost-cutting achieved by squeezing contractors for lower day rates on services like drilling and well completions, providing fracking sand and connecting new wells to pipeline systems."

Where Do Oilfield Companies Stand Today?

Although earnings in the E&P sector have improved over the last year, earnings in the oilfield service industry have taken a beating over the last few years. Three of the top four players had negative LTM EBITDAs until mid-year 2017.

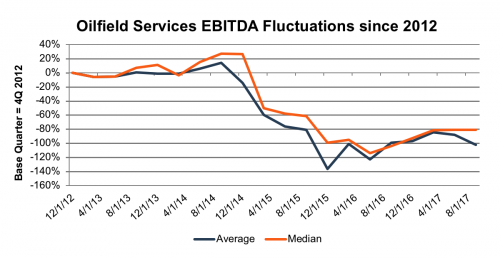

Per the chart below, EBITDA has varied as compared to 4Q12. Of the four companies that released 2017 year-end financials (most oilfield service companies have not yet released 4Q17 data), EBITDA for two is significantly down from the previous quarter, one is stable, and one is up. EBITDA at 4Q17 has stabilized around 80% to 100% lower than EBITDA in 4Q12.

Making matters worse, the oilfield service industry is highly capital intensive. The RMA average capital intensity ratios for companies that drill oil and gas wells (NAICS 213111) and companies that support activities for oil and gas operations (NAICS 213112) are $1.67 and $0.91, respectively.[1]

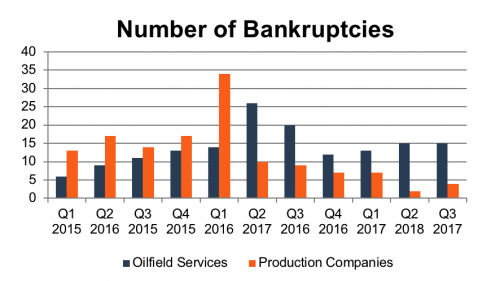

To fund the massive amounts of capital needed, oilfield service companies can either use debt or cash. After the downturn in price, over 150 oilfield service companies filed for bankruptcy. The high number of bankruptcies in the industry has demonstrated that oilfield service companies may not be able to rely on debt as heavily as they have in the past in order to fund future capital expenditures.

Making matters worse, the oilfield service industry is highly capital intensive. The RMA average capital intensity ratios for companies that drill oil and gas wells (NAICS 213111) and companies that support activities for oil and gas operations (NAICS 213112) are $1.67 and $0.91, respectively.[1]

To fund the massive amounts of capital needed, oilfield service companies can either use debt or cash. After the downturn in price, over 150 oilfield service companies filed for bankruptcy. The high number of bankruptcies in the industry has demonstrated that oilfield service companies may not be able to rely on debt as heavily as they have in the past in order to fund future capital expenditures.

While bankruptcies in the E&P sector slowed in 2017, bankruptcies continued in the oilfield service industry.

While bankruptcies in the E&P sector slowed in 2017, bankruptcies continued in the oilfield service industry.

What Are the Appropriate Approaches to Value Oilfield Service Companies Today?

In down cycles such as this, valuations are hard to understand because earnings alone cease to become particularly reliable indicators of value.

Public multiples provide less insight as negative earnings multiples make little sense. Reliance on the multiples of companies that are currently profitable is questionable because the low profitability can artificially inflate the multiples and not provide a holistic view of value.

Instead of using current earnings as indicators of value, the use of forward earnings and their associated forward multiples is considered. This is consistent with a forward-looking discounted cash flow method, but the valuation is then heavily dependent upon the reasonableness of the projections. The oilfield service industry is not expected to see a full recovery in 2018 so forward multiples may appear inflated even for fiscal 2018.

During down cycles of asset intensive industries, such as oilfield services, investors often rely on an asset-based approaches. The net asset value method is an asset-based approach that develops a valuation indication in the context of a going concern by adjusting the reported book values of a subject company’s assets to their market values and subtracting its liabilities (adjusted to market value, if appropriate).

Valuations Remain Challenging to Interpret

Understanding the value of your oilfield services company in the context of the broader oil and gas marketplace can be difficult during times like these.

Many think that the industry has recovered, or at least is on the way, but the oilfield service sector still appears to have a ways further to go.

Until rates and/or utilization for services companies begin increasing and E&P companies begin sharing the gains they have made since oil prices have recovered, valuations could remain challenging to interpret.

Mercer Capital has significant experience valuing assets and companies in the energy industry. Because drilling economics vary by region it is imperative that your valuation specialist understands the local economics faced by your oilfield service company. Our oil and gas valuations have been reviewed and relied on by buyers and sellers and Big 4 Auditors. These oil and gas related valuations have been utilized to support valuations for IRS Estate and Gift Tax, GAAP accounting, and litigation purposes. Contact a Mercer Capital professional today to discuss your valuation needs in confidence.