Investors and boxing fans have some things in common. First, they both prefer champions. Second, there tends to be attention on heavyweights, when the best fighters may be in a different class.

Several attributes put the Eagle Ford among the most profitable shale basins in the U.S.

In the oil patch’s proverbial basin battle of economics and relative value, the Eagle Ford Shale is coming on strong. Granted, the Eagle Ford Shale may not reside in the same heavyweight class as the Permian Basin. Indeed, the Permian is in a class of its own and even may be winning over Saudi Arabia’s behemoth Ghawar field in a battle for the title of the largest oil field in the world. However, from a pound for pound well economics standpoint, the Eagle Ford Shale is currently a formidable challenger to the Permian due to several advantages in key areas: breakeven prices, well costs, certain productivity metrics and proximity. These attributes put it among the most profitable shale basins in the U.S. Some well-known operators such as BP and Chesapeake have noticed and are putting big money behind this play.

Ranked Contender Or Forgotten Champion?

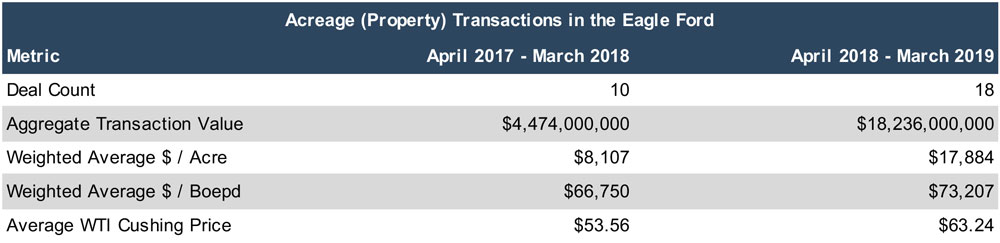

Although the Eagle Ford is a relatively mature basin compared to some other U.S. shale plays, the area has experienced a valuation resurgence over the past twelve months, and it’s not being driven by just the uptick in oil prices. Consider the transaction activity in the table below:

[caption id="attachment_26150" align="aligncenter" width="1000"]

Source: Shale Experts, Company Reports, EIA [/caption]

Activity, dollars and commitment have all swelled. This activity was anchored by two deals: (i) BP’s purchase of BHP Billiton and (ii) Chesapeake’s Wildhorse acquisition. WildHorse and Chesapeake were the fourth and fifth largest drillers in the region, respectively in 2018. Chesapeake appeared to pay a little more attention to current production, while BP’s acquisition appeared more geared towards future acreage. It’s also worth noting that although BP bought assets in other areas such as the San Juan Basin, Wamsutter area and Anadarko Basin, it’s shedding those assets to focus, in part, on the Eagle Ford. Regardless, the relative Eagle Ford acreage prices more than doubled while production values increased generally in lockstep with commodity prices.

In a time where oil and liquid production (as opposed to reserve accumulation) is the energy industry’s focus, the Eagle Ford Region is, according to the EIA, the second most prolific oil region in the United States from a myriad of standpoints: (i) overall oil production, (ii) per rig production and even (iii) DUC well count. Additionally, it is home to some of the lowest breakeven prices in the country, certainly from the standpoint of shale plays. Why are costs low? The answer lies in shallower wells, lower cost drilling, higher cuts (meaning there’s more oil and less water produced) and resultant premium commodity pricing near the Gulf Coast. In a time where Permian differentials were particularly wide in 2018, this pricing advantage was helpful to Eagle Ford shale producers.

Source: Shale Experts, Company Reports, EIA [/caption]

Activity, dollars and commitment have all swelled. This activity was anchored by two deals: (i) BP’s purchase of BHP Billiton and (ii) Chesapeake’s Wildhorse acquisition. WildHorse and Chesapeake were the fourth and fifth largest drillers in the region, respectively in 2018. Chesapeake appeared to pay a little more attention to current production, while BP’s acquisition appeared more geared towards future acreage. It’s also worth noting that although BP bought assets in other areas such as the San Juan Basin, Wamsutter area and Anadarko Basin, it’s shedding those assets to focus, in part, on the Eagle Ford. Regardless, the relative Eagle Ford acreage prices more than doubled while production values increased generally in lockstep with commodity prices.

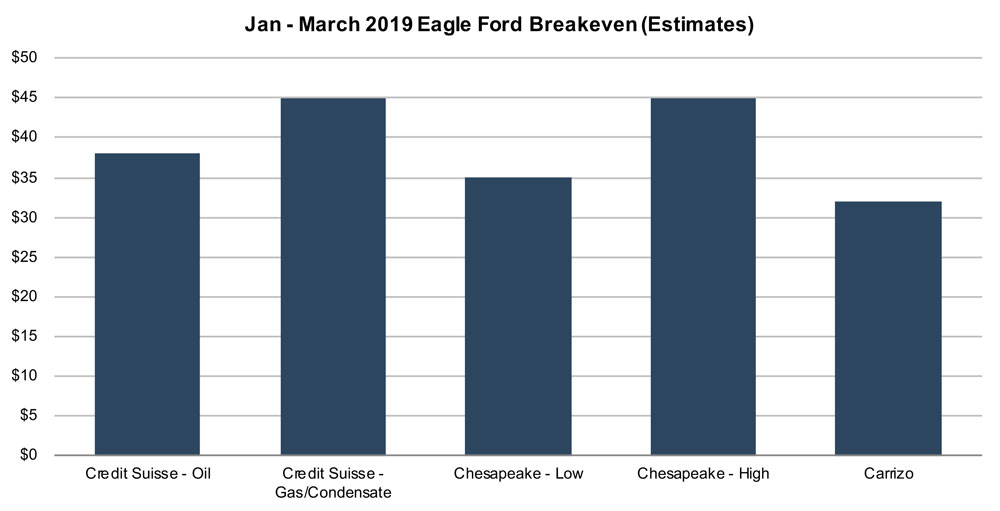

In a time where oil and liquid production (as opposed to reserve accumulation) is the energy industry’s focus, the Eagle Ford Region is, according to the EIA, the second most prolific oil region in the United States from a myriad of standpoints: (i) overall oil production, (ii) per rig production and even (iii) DUC well count. Additionally, it is home to some of the lowest breakeven prices in the country, certainly from the standpoint of shale plays. Why are costs low? The answer lies in shallower wells, lower cost drilling, higher cuts (meaning there’s more oil and less water produced) and resultant premium commodity pricing near the Gulf Coast. In a time where Permian differentials were particularly wide in 2018, this pricing advantage was helpful to Eagle Ford shale producers.

Why are costs low? The answer lies in shallower wells, lower cost drilling, higher cuts and resultant premium commodity pricing near the Gulf Coast.

Producers are encouraged by this. At an industry conference last fall, Conoco Phillips’ Greg Leville said that there were certain areas where breakevens were as low as between $20 and $30 per barrel. EOG has noted that they can make money at $30 per barrel on some of their leases. This enthusiasm was characterized according to Marathon’s CEO Lee Tillman at another recent industry conference: “I would compare the returns in the Eagle Ford to anything,” he said, given its $4-5 million/well completion costs, oiliness and Louisiana light sweet pricing. “There's really nothing today on a zone-by-zone basis that can touch the Eagle Ford.” Costs can be particularly lower for operators in 2019 that will be focused on producing from existing DUC wells such as Murphy Oil.

Other less choice areas of the Eagle Ford do have higher breakevens, but overall the play, particularly its oil window, boasts among the lowest costs in the country challenging the Permian in this respect. A picture of the generalized spread of breakeven prices in the play can be seen in the chart below.

[caption id="attachment_26151" align="alignnone" width="1000"]

Source: Company Reports & Investor Presentations[/caption]

Source: Company Reports & Investor Presentations[/caption]

Fighting For Capital Efficiency

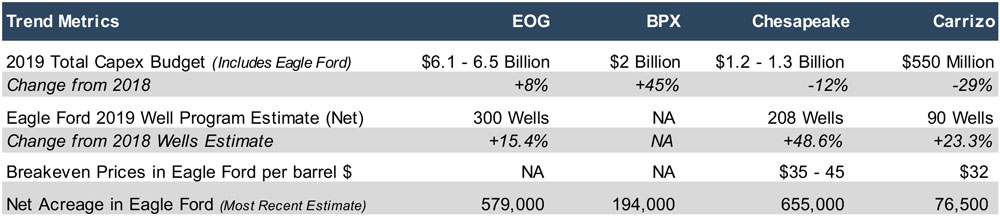

The trends show that key producers (EOG, BPX and Chesapeake) are working towards consolidating their acreage. More money is going into the basin overall, but operators, wary of overspending, are being more strategic about their capex use. The trend is towards the fewest dollars and the most wells. Note particularly the well count below. It’s becoming a more relevant leading metric than rig counts these days. Rig counts can be somewhat misleading when it comes to well count and productivity as the ratios have changed with technology. The key takeaway is that these producers are all growing well counts significantly.

[caption id="attachment_26152" align="aligncenter" width="1000"]

Source: Company Reports & shaleexperts.com[/caption]

In addition to this group, SM Energy’s capital plan is overall down from last year, but it is increasing its Eagle Ford spending. The hope is that with more experience than other basins, being longer in the tooth will pay off in the near and intermediate term. It also helps that gas produced in the basin will be very competitive in the oncoming LNG market growth on the Texas coast.

Source: Company Reports & shaleexperts.com[/caption]

In addition to this group, SM Energy’s capital plan is overall down from last year, but it is increasing its Eagle Ford spending. The hope is that with more experience than other basins, being longer in the tooth will pay off in the near and intermediate term. It also helps that gas produced in the basin will be very competitive in the oncoming LNG market growth on the Texas coast.

Get Stronger Or Get Out Of The Ring

The prognosis for the Eagle Ford is not all positive. The play struggles (as do other basins) with steep decline curves and production replacement, thus impacting rates of return. Economic critics of the shale plays warn of the “treadmill” effect of replacing production and the costs to do so. There is validity to this. Follow on wells in pad drilling have had productivity problems known as parent-child well interference. Carrizo and Equinor have changed their frac designs to attempt to counter this, and the downside risk to BP’s Eagle Ford bet is that they will be able to flatten their declines enough to keep Eagle Ford wells economical for longer periods of time. Many companies have questioned where Eagle Ford assets fit in their long-term plans. Encana, a reputable Canadian producer, has recently characterized their Eagle Ford acreage as “non-core.” Pioneer Resources has been selling their Eagle Ford positions over the past year, and Earthstone Energy is leaving the play. A long time region producer, Sanchez Energy, was recently delisted from the NYSE.

Pound For Pound – A Strong Challenger For The Valuation Title

These issues can be warnings to investors to be sure, but they can also be interpreted as a natural part of the consolidation cycle in the play as top producers commit and smaller or less successful operators step out of the proverbial ring. The good news for these exiting producers is that they are getting better prices as they leave. Where they cashed out around $8,000 per acre a year or more ago, many are getting closer to $18,000 per acre now. Even gas-heavy producers are more optimistic as the Eagle Ford is the single most proximate play to many oncoming LNG facilities in South Texas.

Will the Eagle Ford win the profitability fight with other basins? It may not have the scale or heft of the Permian, but its profitability punches are as strong as anyone's.

Originally appeared on Forbes.com.