Production and Activity Levels

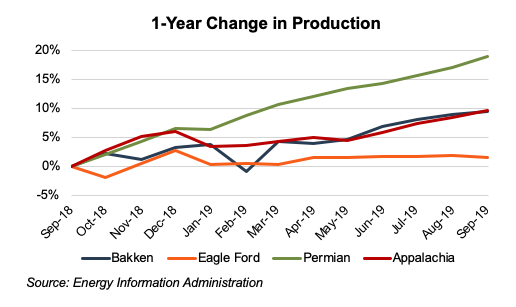

Bakken production grew approximately 10% year-over-year through September. While this growth rate lags behind the Permian, it is in line with production growth in Appalachia and meaningfully bests the Eagle Ford.

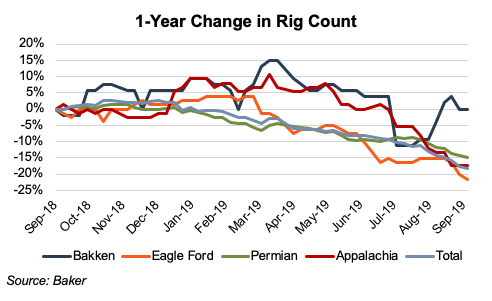

The rig count in the Bakken at the end of September was unchanged from the year prior at 53. While not impressive at first glance, the total U.S. rig count declined nearly 20% over the same period. Eagle Ford, Permian, and Appalachia rig counts declined 22%, 15%, and 17%, respectively.

The rig count in the Bakken at the end of September was unchanged from the year prior at 53. While not impressive at first glance, the total U.S. rig count declined nearly 20% over the same period. Eagle Ford, Permian, and Appalachia rig counts declined 22%, 15%, and 17%, respectively.

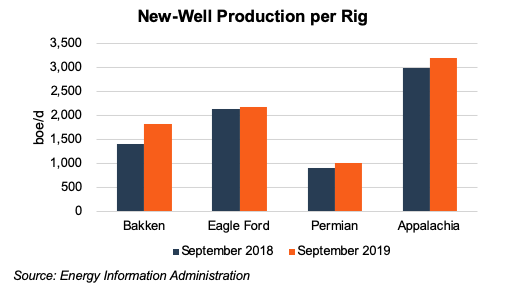

The Bakken has also seen the biggest gain in new-well production per rig relative to our other coverage basins. While this metric doesn’t cover the full life cycle of a well, it is a signal of the increasing efficiency of operators in the area. New well production per rig in the Bakken increased 29% on a year-over-year basis through September, compared to increases of 2%, 12%, and 7% in the Eagle Ford, Permian, and Appalachia, respectively.

The Bakken has also seen the biggest gain in new-well production per rig relative to our other coverage basins. While this metric doesn’t cover the full life cycle of a well, it is a signal of the increasing efficiency of operators in the area. New well production per rig in the Bakken increased 29% on a year-over-year basis through September, compared to increases of 2%, 12%, and 7% in the Eagle Ford, Permian, and Appalachia, respectively.

Financial Performance

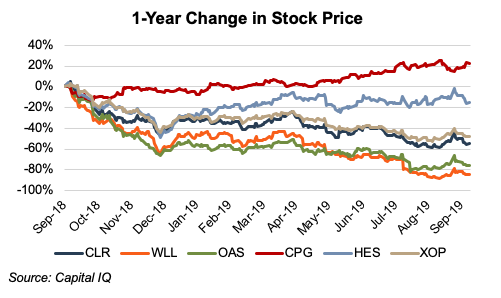

Bakken E&P operator financial performance was a mixed bag over the past year. Canada’s Crescent Point Energy (CPG) was the only positive performer of the Bakken-focused operators, up 23% year-over-year through September. While down 16%, Hess outperformed the broader S&P Oil & Gas Exploration & Production Index (XOP). However, this was likely attributable (at least in part) to positive developments out of Guyana, where Hess has a 30% interest in the massive Stabroek block. The Stabroek block is one of the largest offshore oil discoveries in the past decade, with more than 6 billion boe of discovered, recoverable resource.

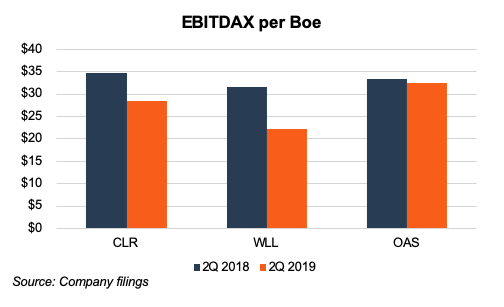

Continental, Whiting, and Oasis all unperformed the broader E&P index during the past year, with Whiting down a notable 85%. Oasis is funding its Permian development program with cash flows generated from its Bakken position, a strategy that has fallen out of favor with investors who now seek capital discipline and free cash flow generation. Whiting is down largely on concerns regarding leverage and inventory life. All three saw margin compression, with Whiting’s EBITDAX per boe down nearly 30% year-over-year.

Continental, Whiting, and Oasis all unperformed the broader E&P index during the past year, with Whiting down a notable 85%. Oasis is funding its Permian development program with cash flows generated from its Bakken position, a strategy that has fallen out of favor with investors who now seek capital discipline and free cash flow generation. Whiting is down largely on concerns regarding leverage and inventory life. All three saw margin compression, with Whiting’s EBITDAX per boe down nearly 30% year-over-year.

Despite this financial performance, the Bakken hasn’t been impacted by the recent batch of bankruptcies that have afflicted the Mid-Con (Alta Mesa, White Star), Eagle Ford (Sanchez, EP Energy), and even the Permian (Halcon). However, Whiting did announce a major restructuring in which it will terminate 254 positions (around one-third of the company’s workforce). As a result, the company anticipates approximately $50 million in annual savings.

Despite this financial performance, the Bakken hasn’t been impacted by the recent batch of bankruptcies that have afflicted the Mid-Con (Alta Mesa, White Star), Eagle Ford (Sanchez, EP Energy), and even the Permian (Halcon). However, Whiting did announce a major restructuring in which it will terminate 254 positions (around one-third of the company’s workforce). As a result, the company anticipates approximately $50 million in annual savings.

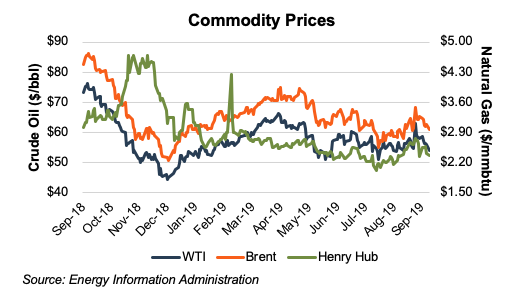

Commodity Prices Largely Unchanged in Aftermath of Saudi Attack

On September 14, a missile attack on Saudi Arabian oil production facilities took out 5.7 million barrels a day of production, amounting to about 5% of global production. Both WTI and Brent crude prices surged more than 10% in the immediate aftermath of the attack.

However, the price reaction was short-lived, as the Saudis were able to bring 2 million bbl/d of production back online within days, with the remainder expected to be back online within weeks. WTI and Brent prices ended September lower than on the day prior to the attack.

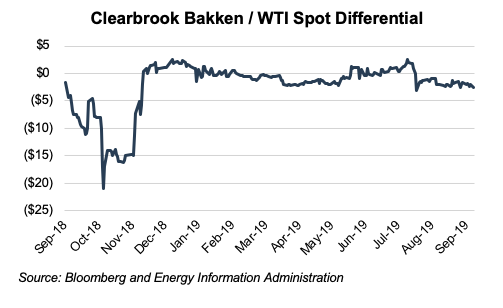

Realized pricing in the Bakken has improved markedly relative to last fall, when a combination of Midwest refinery turnarounds and a glut of Canadian production sent the Clearbrook Bakken / WTI differential to more than $20/bbl. At the end of September, the differential stood at approximately $2.50/bbl. While thinly traded, basis futures indicate expected differentials of $2.50 to $4.30/bbl over the next several years.

However, the price reaction was short-lived, as the Saudis were able to bring 2 million bbl/d of production back online within days, with the remainder expected to be back online within weeks. WTI and Brent prices ended September lower than on the day prior to the attack.

Realized pricing in the Bakken has improved markedly relative to last fall, when a combination of Midwest refinery turnarounds and a glut of Canadian production sent the Clearbrook Bakken / WTI differential to more than $20/bbl. At the end of September, the differential stood at approximately $2.50/bbl. While thinly traded, basis futures indicate expected differentials of $2.50 to $4.30/bbl over the next several years.

Infrastructure Issues

The Dakota Access Pipeline largely alleviated crude takeaway constraints out of the basin. And with a proposed expansion of the pipeline, the announced Liberty Pipeline, and excess crude-by-rail capacity, E&P operators likely won’t have issues getting crude to end markets.

However, both Whiting and Oasis indicated that issues with natural gas processing infrastructure adversely impacted performance during the quarter.

In the Q2 earnings call, Whiting CEO Brad Holly stated,

To minimize flaring, we are producing some wells at constrained oil rates, while we focus on increasing gas capture through the installation of mobile combustion units, building out gathering systems, and completing our ray gas processing plant. Constraints also impacted the pace of planned operating activity.

Oasis CEO Tommy Nusz put a finer point on his commentary, specifically stating that downtime at the company’s Wild Basin gas complex reduced 2Q19 production by 3,000 boe/d.

These constraints should moderate, though, as additional natural gas infrastructure comes online in late 2019 and early 2020.

MLP Simplification Trend Continues

The recent trend of MLP simplifications, driven in part by tax reform, FERC policy changes, cost of capital considerations, and a desire to reach a broader investor base, continues. Hess Midstream Partners (HESM) announced that it is acquiring Hess Infrastructure Partners (HIP) in a $6.2 billion transaction. HIP owns HESM’s General Partner (GP) units and Incentive Distribution Rights (IDRs), as well as an 80% interest in HESM’s oil and gas midstream assets. Unlike most simplifications that have occurred once GP/IDR distributions are “high in the splits” (with the GP/IDR holder typically taking 50% of incremental distributions above a certain threshold), HESM was only at the 25% split level.

Fellow Bakken midstream operator Oasis Midstream Partners remains on a rapidly shortening list of MLPs that still have IDRs.

Conclusion

Now that the Bakken’s crude infrastructure issues have been (somewhat) resolved, the basin has seemed to take a backseat to other areas in terms of news coverage and investor attention. While the Bakken hasn’t kept up with the Permian’s growth, its static (rather than declining) rig count, higher oil to gas ratio, and sufficient crude takeaway capacity bode well for the basin relative to its domestic counterparts.

We have assisted many clients with various valuation needs in the upstream oil and gas space in both conventional and unconventional plays in North America, and around the world. Contact a Mercer Capital professional to discuss your needs in confidence and learn more about how we can help you succeed.